order - TeacherWeb

... Stop-Limit Order • Instructs the broker to buy or sell when your stock hits the “stop” price, but not to pay more or accept less than the “limit price” ▫ Your trade is schedule to occur at a price between the “stop price” and the “limit price” ▫ Risk: Your trade might not be executed at all ▫ Advan ...

... Stop-Limit Order • Instructs the broker to buy or sell when your stock hits the “stop” price, but not to pay more or accept less than the “limit price” ▫ Your trade is schedule to occur at a price between the “stop price” and the “limit price” ▫ Risk: Your trade might not be executed at all ▫ Advan ...

Chapter 17: Managing Interest Rate Risk

... market. If, for instance, a corporation wants term floating-rate funds but finds that the market for its fixed-rate debt is comparatively cheaper than that for its floating-rate debt, then it can issue a fixed-rate bond and swap it into floating, for an all-in cost lower than that for a floating-rat ...

... market. If, for instance, a corporation wants term floating-rate funds but finds that the market for its fixed-rate debt is comparatively cheaper than that for its floating-rate debt, then it can issue a fixed-rate bond and swap it into floating, for an all-in cost lower than that for a floating-rat ...

F t (k)

... An Investor may call a broker and ask to “sell a particular stock short.” This means that the investor does not own shares of the stock, but wishes to sell it anyway. The investor speculates that the stock’s share price will fall and money will be made upon buying the shares back at a lower price. A ...

... An Investor may call a broker and ask to “sell a particular stock short.” This means that the investor does not own shares of the stock, but wishes to sell it anyway. The investor speculates that the stock’s share price will fall and money will be made upon buying the shares back at a lower price. A ...

The Forward Foreign Exchange Market Global

... This document does not constitute an offer, or the solicitation of an offer for the sale or purchase of any investment or security. This is a commercial communication. If you are in any doubt about the contents of this document or the investment to which this document relates you should consult a pe ...

... This document does not constitute an offer, or the solicitation of an offer for the sale or purchase of any investment or security. This is a commercial communication. If you are in any doubt about the contents of this document or the investment to which this document relates you should consult a pe ...

es220050945197.ps, page 1-3 @ Normalize_2 ( cs220050945197 )

... (a) the definitions of “advising on futures contracts” and “advising on securities” are amended so that the giving of advice by a person, who is licensed or registered for Type 9 regulated activity, solely for the purposes of carrying on securities or futures contracts management, as the case may be ...

... (a) the definitions of “advising on futures contracts” and “advising on securities” are amended so that the giving of advice by a person, who is licensed or registered for Type 9 regulated activity, solely for the purposes of carrying on securities or futures contracts management, as the case may be ...

foreign exchange market (forex)

... • the variety of factors that affect exchange rates; • the low margins of relative profit compared with other markets of fixed income. ...

... • the variety of factors that affect exchange rates; • the low margins of relative profit compared with other markets of fixed income. ...

Stable Value Option

... principal while maintaining competitive yields that generally move in the direction of prevailing market interest rates over time. Holdings in SVO are credited with a fixed rate of interest rate declared in advance. Historically, the rate of interest was subject to change every January 1st and July ...

... principal while maintaining competitive yields that generally move in the direction of prevailing market interest rates over time. Holdings in SVO are credited with a fixed rate of interest rate declared in advance. Historically, the rate of interest was subject to change every January 1st and July ...

During the application of the GBER (the Regulation) at national level

... possible to calculate precisely the gross grant equivalent of the aid ex ante without any need to undertake a risk assessment ("transparent aid"). Art. 5, par. 2 indicates the types of instruments (categories/forms of aid), which are considered to be transparent, but does not state explicitly that t ...

... possible to calculate precisely the gross grant equivalent of the aid ex ante without any need to undertake a risk assessment ("transparent aid"). Art. 5, par. 2 indicates the types of instruments (categories/forms of aid), which are considered to be transparent, but does not state explicitly that t ...

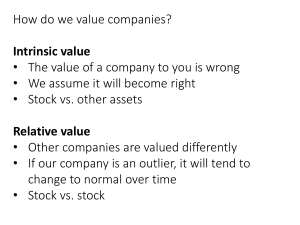

PowerPoint - Columbia University

... utility (benefit) we derive from wealth is not linear. While more wealth is always preferred, the marginal utility of wealth tends to decrease as wealth increases. Example: Most people would pay four dollar to enter into a game that pays $10 dollars if the outcome of tossing a fair coin is heads and ...

... utility (benefit) we derive from wealth is not linear. While more wealth is always preferred, the marginal utility of wealth tends to decrease as wealth increases. Example: Most people would pay four dollar to enter into a game that pays $10 dollars if the outcome of tossing a fair coin is heads and ...

12/3/15 - NBG remains NBG 12/3/15

... change its trading symbol to NBGGY, effective December 3, 2015, due to listing on an OTC market. As a result, option symbols NBG and NBG1 will also change to NBGGY and NBGG1, respectively, effective at the opening of business on December 4, 2015. Strike prices and all other option terms will not cha ...

... change its trading symbol to NBGGY, effective December 3, 2015, due to listing on an OTC market. As a result, option symbols NBG and NBG1 will also change to NBGGY and NBGG1, respectively, effective at the opening of business on December 4, 2015. Strike prices and all other option terms will not cha ...

Currency Futures Presentation January 2014

... What are Currency Futures and Options used for: Currency Future’s are used Primarily to: Hedge – Seek to reduce risk by protecting underlying portfolio/assets or hedging import/export foreign assets. It removes the risk of existing or expected currency exposure Speculate – Speculators enter into cu ...

... What are Currency Futures and Options used for: Currency Future’s are used Primarily to: Hedge – Seek to reduce risk by protecting underlying portfolio/assets or hedging import/export foreign assets. It removes the risk of existing or expected currency exposure Speculate – Speculators enter into cu ...

Currency Futures Presentation January 2014

... What are Currency Futures and Options used for: Currency Future’s are used Primarily to: Hedge – Seek to reduce risk by protecting underlying portfolio/assets or hedging import/export foreign assets. It removes the risk of existing or expected currency exposure Speculate – Speculators enter into cu ...

... What are Currency Futures and Options used for: Currency Future’s are used Primarily to: Hedge – Seek to reduce risk by protecting underlying portfolio/assets or hedging import/export foreign assets. It removes the risk of existing or expected currency exposure Speculate – Speculators enter into cu ...

Futurization of Swaps

... European energy futures contracts. So this merger is likely to be approved, possibly with conditions, by the two antitrust agencies with jurisdiction, the Department of Justice in the United States and the Competition Directorate of the European Commission. A far more interesting public policy issue ...

... European energy futures contracts. So this merger is likely to be approved, possibly with conditions, by the two antitrust agencies with jurisdiction, the Department of Justice in the United States and the Competition Directorate of the European Commission. A far more interesting public policy issue ...

Suggested Answers

... socially optimal consumption would be at the point where inverse supply equals MSB, or 8+2Q = 80-2Q so 72=4Q or Q=18. Suppliers would supply this amount at a price of 8+2Q = 8+2(18) = 44. However, consumers would only demand this amount if price were equal to P=80-Q=80-18 = 62. Therefore, the tax th ...

... socially optimal consumption would be at the point where inverse supply equals MSB, or 8+2Q = 80-2Q so 72=4Q or Q=18. Suppliers would supply this amount at a price of 8+2Q = 8+2(18) = 44. However, consumers would only demand this amount if price were equal to P=80-Q=80-18 = 62. Therefore, the tax th ...

risk management: an introduction to financial engineering

... of the S&L disaster, but the root cause was the increase in interest rate volatility. Today, financial institutions take specific steps to insulate themselves from interest rate volatility. ...

... of the S&L disaster, but the root cause was the increase in interest rate volatility. Today, financial institutions take specific steps to insulate themselves from interest rate volatility. ...

An approach on how to trade in commodities market

... You can start your investment with an amount as low as say Rs 25,000. All you need is money for margins payable upfront to exchanges through brokers. Generally commodity futures require an initial margin between 5-10% of the contract value. The exchanges levy higher additional margin in case of exc ...

... You can start your investment with an amount as low as say Rs 25,000. All you need is money for margins payable upfront to exchanges through brokers. Generally commodity futures require an initial margin between 5-10% of the contract value. The exchanges levy higher additional margin in case of exc ...

Investment products risk and fees disclosure

... notably greater movement in the price of derivative instruments. For example, price changes are often greatest in case there is little time left until the maturity of a derivative instrument (contract). This is described as leverage, which denotes that the investment into derivative instruments may ...

... notably greater movement in the price of derivative instruments. For example, price changes are often greatest in case there is little time left until the maturity of a derivative instrument (contract). This is described as leverage, which denotes that the investment into derivative instruments may ...

The Use of Derivative Financial Instruments to

... $500,000). However, what if interest rates were to rise in the subsequent quarters? This would pose a threat to the firm’s budget. The preceding example is indicative of the risk of using floating-rate or variable rate borrowing. Interest-rate risk affects fixed-rate debt, too. For example, if a fi ...

... $500,000). However, what if interest rates were to rise in the subsequent quarters? This would pose a threat to the firm’s budget. The preceding example is indicative of the risk of using floating-rate or variable rate borrowing. Interest-rate risk affects fixed-rate debt, too. For example, if a fi ...

Exploiting Inefficiencies Across Asset Classes, Globally

... First, at the underlying fund level there is the inefficiencies within the underlying asset class in which the CEF invests. The extent of these inefficiencies will vary via asset class. For example, inefficiencies are likely to be small in a US Large Cap Equity but may be much larger in say European ...

... First, at the underlying fund level there is the inefficiencies within the underlying asset class in which the CEF invests. The extent of these inefficiencies will vary via asset class. For example, inefficiencies are likely to be small in a US Large Cap Equity but may be much larger in say European ...

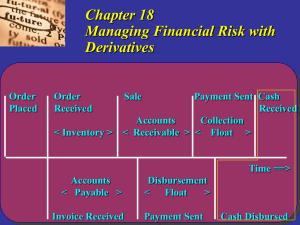

Chapter 23 Hedging with Financial Derivatives

... 38) If a firm is due to be paid in euros in two months, to hedge against exchange rate risk the firm should A) sell foreign exchange futures short. B) buy foreign exchange futures long. C) stay out of the exchange futures market. D) do none of the above. Answer: A 39) If a firm must pay for goods it ...

... 38) If a firm is due to be paid in euros in two months, to hedge against exchange rate risk the firm should A) sell foreign exchange futures short. B) buy foreign exchange futures long. C) stay out of the exchange futures market. D) do none of the above. Answer: A 39) If a firm must pay for goods it ...

Quantity Controls: Quotas

... • Graph shows us 2 transactions: • 1) Taxi Rides ($4.00 and $6.00) • 2) Medallions (the “wedge”) ...

... • Graph shows us 2 transactions: • 1) Taxi Rides ($4.00 and $6.00) • 2) Medallions (the “wedge”) ...

file_3200 - Alfa-Bank

... Construct a formula for a borrower’s ‘score’ (which determines default rate) depending on balance sheet ratios. Doesn’t suit Russia: - Lack of reliable balance sheet data (IFRS desirable), difficulty of correct factors choice - Lack of default data for calibration 2. Market bond prices as an indicat ...

... Construct a formula for a borrower’s ‘score’ (which determines default rate) depending on balance sheet ratios. Doesn’t suit Russia: - Lack of reliable balance sheet data (IFRS desirable), difficulty of correct factors choice - Lack of default data for calibration 2. Market bond prices as an indicat ...

Markets

... • Help firms and governments raise cash by selling securities • Channel funds from savers to borrowers • Provide a place where investors can act on their beliefs • Help allocate cash to where it is most productive • Help lower the cost of exchange ...

... • Help firms and governments raise cash by selling securities • Channel funds from savers to borrowers • Provide a place where investors can act on their beliefs • Help allocate cash to where it is most productive • Help lower the cost of exchange ...

PAKISTAN STOCK EXCHANGE LIMITED Stock Exchange

... This Risk Disclosure document is prescribed by the Pakistan Stock Exchange Limited (PSX) under Clause 13(1) of the Securities Broker (Licensing and Operations) Regulations, 2016. This document contains important information relating to various types of risks associated with trading and investment in ...

... This Risk Disclosure document is prescribed by the Pakistan Stock Exchange Limited (PSX) under Clause 13(1) of the Securities Broker (Licensing and Operations) Regulations, 2016. This document contains important information relating to various types of risks associated with trading and investment in ...