Using Derivatives to Manage Interest Rate Risk Derivatives A

... Positions require a deposit equivalent to a performance bond ...

... Positions require a deposit equivalent to a performance bond ...

Using Derivatives to Manage Interest Rate Risk

... Positions require a deposit equivalent to a performance bond ...

... Positions require a deposit equivalent to a performance bond ...

Hedging with Interest-Rate Forward Contracts

... that it specifies that a financial instrument must be delivered by one party to another on a stated future date. However, it differs from an interest-rate forward contract in several ways that overcome some of the liquidity and default problems of forward markets. To understand what financial future ...

... that it specifies that a financial instrument must be delivered by one party to another on a stated future date. However, it differs from an interest-rate forward contract in several ways that overcome some of the liquidity and default problems of forward markets. To understand what financial future ...

ETF Strategists: The Next Generation of Asset Allocation

... 4. How is the strategy implemented? What investment instruments are used, and how much does the portfolio change over time? For example, can the portfolio go from being fully invested to all cash, or are moves more measured in approach? Portfolio turnover is also an important strategy question, pa ...

... 4. How is the strategy implemented? What investment instruments are used, and how much does the portfolio change over time? For example, can the portfolio go from being fully invested to all cash, or are moves more measured in approach? Portfolio turnover is also an important strategy question, pa ...

hedging through invoice currency

... known, sell the currency forward, when the quantity is unknown , buy a put option on the currency. 3. When the quantity of foreign currency cash flow is partially known and partially uncertain , use a forward contract to hedge the known portion and an option to hedge the maximum value of the uncerta ...

... known, sell the currency forward, when the quantity is unknown , buy a put option on the currency. 3. When the quantity of foreign currency cash flow is partially known and partially uncertain , use a forward contract to hedge the known portion and an option to hedge the maximum value of the uncerta ...

Chapter 305 British Pound Sterling/Japanese Yen (GBP/JPY) Cross

... British Pound Sterling/Japanese Yen (GBP/JPY) Cross Rate Futures ...

... British Pound Sterling/Japanese Yen (GBP/JPY) Cross Rate Futures ...

a. a contract that involves a long position only. b. a

... a. European options are traded in Europe as well as in America b. The intrinsic value reflects the option's potential appreciation c. Out-of-the-money for a call means that the stock price is less than the exercising price d. Option prices almost always exceed intrinsic values ...

... a. European options are traded in Europe as well as in America b. The intrinsic value reflects the option's potential appreciation c. Out-of-the-money for a call means that the stock price is less than the exercising price d. Option prices almost always exceed intrinsic values ...

ch20 - Csulb.edu

... The Treynor measure relates return to systematic risk, as measured by the security (or portfolio) beta. It is an appropriate measure for both single securities as well as for portfolios. ...

... The Treynor measure relates return to systematic risk, as measured by the security (or portfolio) beta. It is an appropriate measure for both single securities as well as for portfolios. ...

FAQ Power Exchange - Tata Power Trading Company Ltd.

... All purchase bids and sale offers are aggregated in the unconstrained scenario. The aggregate supply and demand curves are drawn on Price-Quantity axes. The intersection point of the two curves gives Market Clearing Price (MCP) and Market Clearing Volume (MCV) corresponding to price and quantity of ...

... All purchase bids and sale offers are aggregated in the unconstrained scenario. The aggregate supply and demand curves are drawn on Price-Quantity axes. The intersection point of the two curves gives Market Clearing Price (MCP) and Market Clearing Volume (MCV) corresponding to price and quantity of ...

HullFund8eCh03ProblemSolutions

... A trader owns 55,000 units of a particular asset and decides to hedge the value of her position with futures contracts on another related asset. Each futures contract is on 5,000 units. The spot price of the asset that is owned is $28 and the standard deviation of the change in this price over the l ...

... A trader owns 55,000 units of a particular asset and decides to hedge the value of her position with futures contracts on another related asset. Each futures contract is on 5,000 units. The spot price of the asset that is owned is $28 and the standard deviation of the change in this price over the l ...

Download attachment

... Hedge funds can take advantage of these insurance mechanisms to reduce their volatility and enhance their potential. Those with proper risk management can provide reasonable upside performance but lose less on the downside compared with conventional portfolio managers. As well as buying stocks they ...

... Hedge funds can take advantage of these insurance mechanisms to reduce their volatility and enhance their potential. Those with proper risk management can provide reasonable upside performance but lose less on the downside compared with conventional portfolio managers. As well as buying stocks they ...

Chapter 3 Function of Financial Markets Financial Intermediaries

... legal obligation of one party to transfer something of value – usually money – to another party at some future date, under certain conditions, such as stocks, loans, or insurance. ...

... legal obligation of one party to transfer something of value – usually money – to another party at some future date, under certain conditions, such as stocks, loans, or insurance. ...

Information regarding characteristics and risks associated with

... company may wish to alter the nominal price, for example because the share’s market price has risen sharply. By dividing each share into two or more parts, a process known as a split, the nominal price and the market price is lowered proportionately. The shareholders’ assets, however, remain the sam ...

... company may wish to alter the nominal price, for example because the share’s market price has risen sharply. By dividing each share into two or more parts, a process known as a split, the nominal price and the market price is lowered proportionately. The shareholders’ assets, however, remain the sam ...

Standard Life MyFolio Market Funds

... balanced combination of portfolios. This robust structure forms the basis from which all portfolios are built and provides a consistency across the range. Advisers looking to combine different styles for clients within the MyFolio range can do so knowing the portfolio will have the same underlying c ...

... balanced combination of portfolios. This robust structure forms the basis from which all portfolios are built and provides a consistency across the range. Advisers looking to combine different styles for clients within the MyFolio range can do so knowing the portfolio will have the same underlying c ...

exam1

... consolidated entities as a whole. c. The transaction meets certain tests as a foreign currency hedge. d. There are no conditions in which transactions between related parties can be accounted for as a hedge under SFAS 133. 25. (03 Points) Suppose General Electric uses the U.S. dollar as its function ...

... consolidated entities as a whole. c. The transaction meets certain tests as a foreign currency hedge. d. There are no conditions in which transactions between related parties can be accounted for as a hedge under SFAS 133. 25. (03 Points) Suppose General Electric uses the U.S. dollar as its function ...

- Advisor To Client

... To make it easier for you to prepare meeting materials, we’ve developed these slides about the 5 types of hedge funds. The presentation is in a Word file to make it simpler to customize content to meet your clients’ information needs. ...

... To make it easier for you to prepare meeting materials, we’ve developed these slides about the 5 types of hedge funds. The presentation is in a Word file to make it simpler to customize content to meet your clients’ information needs. ...

Liquidity risk and positive feedback

... I make this distinction between normal and abnormal conditions because I view market-makers as providers of immediacy; i.e. market-makers provide immediate temporary liquidity to the market to absorb short-term order imbalances which they believe will disappear when the other side of the market eve ...

... I make this distinction between normal and abnormal conditions because I view market-makers as providers of immediacy; i.e. market-makers provide immediate temporary liquidity to the market to absorb short-term order imbalances which they believe will disappear when the other side of the market eve ...

Document

... purchase of interest rate futures contracts. If the forecast is correct, the profits on the hedge will help to offset the losses in the cash market. ...

... purchase of interest rate futures contracts. If the forecast is correct, the profits on the hedge will help to offset the losses in the cash market. ...

Risk, Return, and Discount Rates

... How should the discount rate change in the NPV calculation if the cash flows are not riskless? The question, as we said, is more easily answered from the “other side.” How must the return on an asset change so you will be happy to own it if it is a risky rather than a riskless asset? – Risk averse i ...

... How should the discount rate change in the NPV calculation if the cash flows are not riskless? The question, as we said, is more easily answered from the “other side.” How must the return on an asset change so you will be happy to own it if it is a risky rather than a riskless asset? – Risk averse i ...

Regulatory Circular RG02-39 (RG02

... Since January 31, 2001, the Chicago Mercantile Exchange (CME) has employed special “fair value”1 settlement procedures for domestic stock index futures and options on the last business day of each month. On these days, the CME calculates the daily settlement price for its domestic stock index future ...

... Since January 31, 2001, the Chicago Mercantile Exchange (CME) has employed special “fair value”1 settlement procedures for domestic stock index futures and options on the last business day of each month. On these days, the CME calculates the daily settlement price for its domestic stock index future ...

Presentation - NCDEX Institute of Commodity Markets and Research

... Upward movement in world prices were clearly passed through in domestic prices, downward movements were not ...

... Upward movement in world prices were clearly passed through in domestic prices, downward movements were not ...

Financial Markets

... Construction of Market-ValueIndex Market-value-weighted index is prepared by: The prices of stocks in the index are multiplied by their respective number of shares outstanding They are added up in order to arrive at a figure equal to the aggregate market value for that day This figure is th ...

... Construction of Market-ValueIndex Market-value-weighted index is prepared by: The prices of stocks in the index are multiplied by their respective number of shares outstanding They are added up in order to arrive at a figure equal to the aggregate market value for that day This figure is th ...

CHAPTER 5 THE FOREIGN EXCHANGE MARKET

... what the dm/ cross rate is, and you know dm2/US$ and .55/US$ ...

... what the dm/ cross rate is, and you know dm2/US$ and .55/US$ ...

Asian Total Return Bond Fund

... (or distribution). Bonds with high probability of default are excluded from the calculation. The running yield does not reflect the total return over the life of the bond and takes no account of reinvestment risk (the uncertainty about the rate at which future cash flows can be reinvested) or the fa ...

... (or distribution). Bonds with high probability of default are excluded from the calculation. The running yield does not reflect the total return over the life of the bond and takes no account of reinvestment risk (the uncertainty about the rate at which future cash flows can be reinvested) or the fa ...

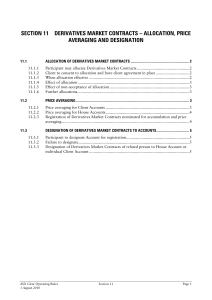

ASX Clear Section 11 - Derivatives Market Contracts – Allocation

... Participant may allocate Derivatives Market Contracts If a Derivatives Market Contract is reported to ASX Clear for registration in the name of a Participant (the “First Participant”), the First Participant may, before the Derivatives Market Contract is registered, allocate the contract to another P ...

... Participant may allocate Derivatives Market Contracts If a Derivatives Market Contract is reported to ASX Clear for registration in the name of a Participant (the “First Participant”), the First Participant may, before the Derivatives Market Contract is registered, allocate the contract to another P ...