WHAT is your INVESTMENT PROFILE?

... Spreading your money across the major asset classes (stocks, bonds, and stable value/cash) can help you weather the ups and downs of the market. That’s because asset classes tend to perform differently at any given time. You may go even further by dividing your money among investment categories with ...

... Spreading your money across the major asset classes (stocks, bonds, and stable value/cash) can help you weather the ups and downs of the market. That’s because asset classes tend to perform differently at any given time. You may go even further by dividing your money among investment categories with ...

About Our Private Investment Benchmarks

... impact on the index’s return. By pointing out trends in the largest vintages, the commentaries help inform investors about what is having the most influence on the index at a given point in time. 9. What does it mean that “vintage year fund-level returns are shown net of fees, expenses and carried i ...

... impact on the index’s return. By pointing out trends in the largest vintages, the commentaries help inform investors about what is having the most influence on the index at a given point in time. 9. What does it mean that “vintage year fund-level returns are shown net of fees, expenses and carried i ...

Assignment-77 - The complete management portal

... 56) If the company buys the raw material from the suppliers on credit basis, it is termed as=> Trade Credit ** 57) Discounted Payback period is an improvement over the pay back period method as it considers=> time value of money *** 58) Advantage of term loan from the company's point of view is=> In ...

... 56) If the company buys the raw material from the suppliers on credit basis, it is termed as=> Trade Credit ** 57) Discounted Payback period is an improvement over the pay back period method as it considers=> time value of money *** 58) Advantage of term loan from the company's point of view is=> In ...

Cash Flow

... 8.8 Cash Flow Statements On completion, the student should: • Understand the importance of cash flow statements/data • Be able to explain the difference between profit and cash • Be able to identify and treat items not involving the movement of cash • Be able to identify and classify the sources of ...

... 8.8 Cash Flow Statements On completion, the student should: • Understand the importance of cash flow statements/data • Be able to explain the difference between profit and cash • Be able to identify and treat items not involving the movement of cash • Be able to identify and classify the sources of ...

CIS September 2011 Exam Diet Examination Paper 2.1:

... A. Holding all else constant, the further out the cash flow of an investment, the lower the NPV will be. B. Holding all else constant, if a project has nothing but positive future cash flows, then its NPV will be positive as well. C. Holding all else constant, the NPV will increase as the discount r ...

... A. Holding all else constant, the further out the cash flow of an investment, the lower the NPV will be. B. Holding all else constant, if a project has nothing but positive future cash flows, then its NPV will be positive as well. C. Holding all else constant, the NPV will increase as the discount r ...

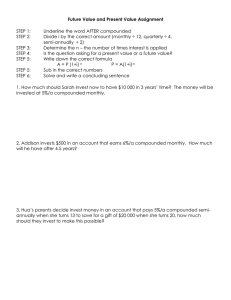

Future Value and Present Value Assignment

... Future Value and Present Value Assignment STEP 1: STEP 2: STEP 3: STEP 4: STEP 5: STEP 5: STEP 6: ...

... Future Value and Present Value Assignment STEP 1: STEP 2: STEP 3: STEP 4: STEP 5: STEP 5: STEP 6: ...

Final accounts of non trading organisation

... Income shown by income and expenditure Add income o/s at the beginning of year Add income recived in advance at the end of year Less income received in adv.at the beginning of year less income o/s at the end of year. ...

... Income shown by income and expenditure Add income o/s at the beginning of year Add income recived in advance at the end of year Less income received in adv.at the beginning of year less income o/s at the end of year. ...

Lecture Presentation to accompany Investment Analysis & Portfolio

... Borrowing requires fixed payments which must be paid ahead of payments to stockholders. The use of debt increases uncertainty of stockholder income and causes an increase in the stock’s risk premium. ...

... Borrowing requires fixed payments which must be paid ahead of payments to stockholders. The use of debt increases uncertainty of stockholder income and causes an increase in the stock’s risk premium. ...

Multiple Choice Questions

... (b) a shift in neither the saving nor the investment curve. (c) a leftward shift in the saving curve, but no shift in the investment curve. (d) no shift in the saving curve, but a rightward shift in the investment curve. An invention that raises the future marginal product of capital would cause an ...

... (b) a shift in neither the saving nor the investment curve. (c) a leftward shift in the saving curve, but no shift in the investment curve. (d) no shift in the saving curve, but a rightward shift in the investment curve. An invention that raises the future marginal product of capital would cause an ...

TCP Capital Corp. Receives Investment Grade Ratings from

... TCP Capital Corp. (NASDAQ: TCPC) is a specialty finance company focused on performing credit lending to middle-market companies as well as small businesses. TCPC lends primarily to companies with established market positions, strong regional or national operations, differentiated products and servic ...

... TCP Capital Corp. (NASDAQ: TCPC) is a specialty finance company focused on performing credit lending to middle-market companies as well as small businesses. TCPC lends primarily to companies with established market positions, strong regional or national operations, differentiated products and servic ...

Risk-adjusted pricing: Risk-neutral, real

... The two approaches in Illustration 1 and 2 could potentially produce the same result. When that happens, the adjustment for both market and non-market risks in realworld pricing is exactly the same as the adjustment that the market would require to achieve a market-consistent price. However, they do ...

... The two approaches in Illustration 1 and 2 could potentially produce the same result. When that happens, the adjustment for both market and non-market risks in realworld pricing is exactly the same as the adjustment that the market would require to achieve a market-consistent price. However, they do ...

Forecasting Interest Rates

... Current and Future consumption can be found by inserting the above restriction into the wealth constraint ...

... Current and Future consumption can be found by inserting the above restriction into the wealth constraint ...

Investment - McGraw Hill Higher Education

... Even if they are investing their own money they need to make this comparison. • Spending money on investment has opportunity costs. • Foregone alternative could be putting the funds in a safe money market fund. The ERP of investing has to be higher than the opportunity cost (potential interest). ...

... Even if they are investing their own money they need to make this comparison. • Spending money on investment has opportunity costs. • Foregone alternative could be putting the funds in a safe money market fund. The ERP of investing has to be higher than the opportunity cost (potential interest). ...

Cash Is KIng, and There`s no heIr To The Throne

... Vestas was reporting P/L profits (here defined as net income + D&A) of over €800m while in cash terms (operating cash flow) making a loss. In August 2010 the company surprised the market by announcing a change in its accounting policies: rather than account for revenue on a percentage of completion ...

... Vestas was reporting P/L profits (here defined as net income + D&A) of over €800m while in cash terms (operating cash flow) making a loss. In August 2010 the company surprised the market by announcing a change in its accounting policies: rather than account for revenue on a percentage of completion ...

PPT

... The drop in its stock price has pushed the market debt to capital ratio to 83.18%. Concurrently, the beta of the stock, estimated using the unlevered beta of 0.82 for the restaurant industry and the current market debt to equity ratio has risen to 3.46. The high default risk in the firm has caused t ...

... The drop in its stock price has pushed the market debt to capital ratio to 83.18%. Concurrently, the beta of the stock, estimated using the unlevered beta of 0.82 for the restaurant industry and the current market debt to equity ratio has risen to 3.46. The high default risk in the firm has caused t ...

On the Significance of the Investment Chapter of the Energy Charter

... • Japan is Party to 21 IIAs (only signed 2 IIAs). → ECT is Very Valuable for Japan. • The Investment Chapter of the ECT only Covers Energy Field. • How shall we Assess such Coverage? ...

... • Japan is Party to 21 IIAs (only signed 2 IIAs). → ECT is Very Valuable for Japan. • The Investment Chapter of the ECT only Covers Energy Field. • How shall we Assess such Coverage? ...

The Optimal Rotation Period 01 Renewable Resources

... In industry, the period to which quantities like profit or costs refer is open. The figures are related to the chosen time span that can be a day, a week, a month or a year. Likewise, in a timber company, cultivation will usually be shaped as woodland with a mixed age structure. Trees are cut when t ...

... In industry, the period to which quantities like profit or costs refer is open. The figures are related to the chosen time span that can be a day, a week, a month or a year. Likewise, in a timber company, cultivation will usually be shaped as woodland with a mixed age structure. Trees are cut when t ...

Delay SocialSecurity :Funding the Incom e Gap with a Rev ers e M

... Security or IRA withdrawals are added on top, and her California tax rate is 9%+. Her investments are only in an IRA. (A taxable account was used if there were extra dollars left after RMDs in any years and was available for spending later). o The tax-free RM proceeds would not have been as big an a ...

... Security or IRA withdrawals are added on top, and her California tax rate is 9%+. Her investments are only in an IRA. (A taxable account was used if there were extra dollars left after RMDs in any years and was available for spending later). o The tax-free RM proceeds would not have been as big an a ...

How Could ECB-Fed Divergence Affect LIBOR? - Blog

... impact on LIBOR. However, the negative rates on short-term euro-denominated securities created by the ECB’s quantitative easing program are likely to increase demand f or similar maturity, dollar-denominated investments as the Fed raises rates. Zane Brown is a Lord Abbett Partner and F ...

... impact on LIBOR. However, the negative rates on short-term euro-denominated securities created by the ECB’s quantitative easing program are likely to increase demand f or similar maturity, dollar-denominated investments as the Fed raises rates. Zane Brown is a Lord Abbett Partner and F ...

Document

... More beneficial for small number of larger deposits Evaluation involves comparison of costs versus benefits of faster collection ...

... More beneficial for small number of larger deposits Evaluation involves comparison of costs versus benefits of faster collection ...