BT Smaller Companies Fund

... Performance returns are calculated net of ICR (Management Fees) and pre tax. Past performance is not a reliable indicator of future performance, the value of your investment can go up and down. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Tota ...

... Performance returns are calculated net of ICR (Management Fees) and pre tax. Past performance is not a reliable indicator of future performance, the value of your investment can go up and down. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Tota ...

Investment Update February 2011

... We estimate that the Australian Enhanced Income Fund’s total return will be approximately 13.0% per annum over the next 12 months and beyond. Our estimates are based on an average credit term of the Fund, assumes no defaults on coupon and principal payments and that discounts (i.e the difference bet ...

... We estimate that the Australian Enhanced Income Fund’s total return will be approximately 13.0% per annum over the next 12 months and beyond. Our estimates are based on an average credit term of the Fund, assumes no defaults on coupon and principal payments and that discounts (i.e the difference bet ...

What Is a Reasonable Rate of Return?

... much you want to have saved by a future date, your figure is stated in terms of today’s dollars. Due to inflation over the years, that amount will not have the same purchasing ...

... much you want to have saved by a future date, your figure is stated in terms of today’s dollars. Due to inflation over the years, that amount will not have the same purchasing ...

productivity improvements, investment and the rate of

... dollar should rise, and with it the profitability of tradable goods production in Russia. Unfortunately, the real exchange rate of an economy responds to many different forces so one cannot say for sure that one particular causal chain will dominate at any given moment. For example, all observers of ...

... dollar should rise, and with it the profitability of tradable goods production in Russia. Unfortunately, the real exchange rate of an economy responds to many different forces so one cannot say for sure that one particular causal chain will dominate at any given moment. For example, all observers of ...

A Conservative, Value-Oriented Investment

... Mr. Goldblum: OK, so it’s an interesting time in the markets. I’ve heard a lot of folks are still on the sidelines, they’re still nervous about the market, they’re still unsure about what the future holds. Clearly with our Federal Reserve printing money like crazy and the economy not growing well, a ...

... Mr. Goldblum: OK, so it’s an interesting time in the markets. I’ve heard a lot of folks are still on the sidelines, they’re still nervous about the market, they’re still unsure about what the future holds. Clearly with our Federal Reserve printing money like crazy and the economy not growing well, a ...

Identify the right investments

... An index tracker fund tracks a stock market index. Having decided which recognised market index is most appropriate for the tracker fund, the manager (often a computer rather than a person) will invest in such a way as to replicate the make-up of that index. In times of good stock market performance ...

... An index tracker fund tracks a stock market index. Having decided which recognised market index is most appropriate for the tracker fund, the manager (often a computer rather than a person) will invest in such a way as to replicate the make-up of that index. In times of good stock market performance ...

Answers to Concepts Review and Critical Thinking Questions

... projects. In addition, institutions may be better able to implement effective monitoring mechanisms on managers than can individual owners, given an institutions’ deeper resources and experiences with their own management. The increase in institutional ownership of stock in the United States and the ...

... projects. In addition, institutions may be better able to implement effective monitoring mechanisms on managers than can individual owners, given an institutions’ deeper resources and experiences with their own management. The increase in institutional ownership of stock in the United States and the ...

Capital Budgeting for Small Businesses

... expenses—have been applied within the small business environment. Bhandari [2] suggests that discounted payback has the simplicity required by small businesses while acknowledging their emphasis on liquidity. From a theoretical perspective discounted payback is an improvement over the standard payba ...

... expenses—have been applied within the small business environment. Bhandari [2] suggests that discounted payback has the simplicity required by small businesses while acknowledging their emphasis on liquidity. From a theoretical perspective discounted payback is an improvement over the standard payba ...

Chapter 1 Simple and compound interest

... period of 5 years. Which of the following investments would be best for him? A 6.7% p.a. simple interest B 6.75% p.a. compound interest with yearly rests C 6.5% p.a. compound interest with quarterly rests D 6.25% p.a. compound interest with monthly rests E 6% compound interest with daily rests. ...

... period of 5 years. Which of the following investments would be best for him? A 6.7% p.a. simple interest B 6.75% p.a. compound interest with yearly rests C 6.5% p.a. compound interest with quarterly rests D 6.25% p.a. compound interest with monthly rests E 6% compound interest with daily rests. ...

1 - JustAnswer.de

... a.) Due, but not payable for more than one year b.) Due and receivable within one year c.) Due, but not receivable for more than one year d.) Due and payable within one year 2.) 2.) Notes may be issued a.) To creditors to temporarily satisfy an account payable created earlier b.) When borrowing mone ...

... a.) Due, but not payable for more than one year b.) Due and receivable within one year c.) Due, but not receivable for more than one year d.) Due and payable within one year 2.) 2.) Notes may be issued a.) To creditors to temporarily satisfy an account payable created earlier b.) When borrowing mone ...

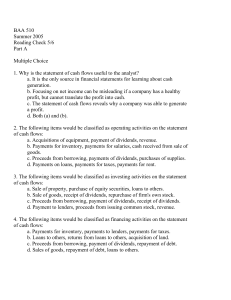

Quiz Part A

... 6. What is implied if the accounts receivable account has increased? a. Cash flow from operating activities is greater relative to net income. b. Cash flow from operating activities is less relative to net income. c. The firm's sales have increased relative to the prior year. d. None of the above. 7 ...

... 6. What is implied if the accounts receivable account has increased? a. Cash flow from operating activities is greater relative to net income. b. Cash flow from operating activities is less relative to net income. c. The firm's sales have increased relative to the prior year. d. None of the above. 7 ...

Instructions: Exercises for seminar no. 1, 7 Sept.

... Show that under some assumptions, the interest rates on two risk free bonds must be the same. 1(b) Assume that the binomial share and option model is valid: Consider a share which for sure does not pay any dividend in the periods we focus on. All agents know that if the share price at time t is S, t ...

... Show that under some assumptions, the interest rates on two risk free bonds must be the same. 1(b) Assume that the binomial share and option model is valid: Consider a share which for sure does not pay any dividend in the periods we focus on. All agents know that if the share price at time t is S, t ...

UK life insurers can help boost infrastructure

... long term illiquid assets — have long been attracted to investing in infrastructure. And in recent years persistently low interest rates have made infrastructure potentially even more attractive as insurers intensify the search for good returns for customers. The appetite is certainly there. And so, ...

... long term illiquid assets — have long been attracted to investing in infrastructure. And in recent years persistently low interest rates have made infrastructure potentially even more attractive as insurers intensify the search for good returns for customers. The appetite is certainly there. And so, ...

The Importance of Risk Adjusted Returns

... Important notes - please read: The past is not an indication to future performance. The value of investments and any income they produce can go down as well as up and you may not get back the full amount invested. The stockmarket should not be considered as a suitable place for short-term investment ...

... Important notes - please read: The past is not an indication to future performance. The value of investments and any income they produce can go down as well as up and you may not get back the full amount invested. The stockmarket should not be considered as a suitable place for short-term investment ...

Document

... This relationship links interest rates of two countries with spot and future exchange rates. It was made popular in 1920s by economists such as John M. Keynes. The theory underlying this relationship says that premium or discount of one currency against another should reflect interest rate different ...

... This relationship links interest rates of two countries with spot and future exchange rates. It was made popular in 1920s by economists such as John M. Keynes. The theory underlying this relationship says that premium or discount of one currency against another should reflect interest rate different ...

FUSION Income | US Dollar - Capital International Group

... The information contained herein is believed to be correct, but its accuracy cannot be guaranteed. Performance is calculated based on the average actual performance of Fusion portfolios. Model performance has been used prior to 2007. Individual Fusion portfolios may vary significantly from the avera ...

... The information contained herein is believed to be correct, but its accuracy cannot be guaranteed. Performance is calculated based on the average actual performance of Fusion portfolios. Model performance has been used prior to 2007. Individual Fusion portfolios may vary significantly from the avera ...

Creating a Dynamic DCF Analysis: A Detailed Excel Approach

... potential dynamic model. This paper addresses the issue that the DCF is conducted under uncertainty and as such, the estimated future cash flows need to reflect deviations over the time horizon. A Monte Carlo Simulation (MCS) is utilized to account for changes in both the growth rate (g) in the free ...

... potential dynamic model. This paper addresses the issue that the DCF is conducted under uncertainty and as such, the estimated future cash flows need to reflect deviations over the time horizon. A Monte Carlo Simulation (MCS) is utilized to account for changes in both the growth rate (g) in the free ...