SKI160217 Risk Adjusted TSR Methodology

... political) and non-systemic risk (e.g. management skills and judgement). If we can adjust for the systemic risk, then the variability in adjusted returns should be more strongly related to management performance. TSR (share price appreciation + dividends), though commonly used to benchmark longterm ...

... political) and non-systemic risk (e.g. management skills and judgement). If we can adjust for the systemic risk, then the variability in adjusted returns should be more strongly related to management performance. TSR (share price appreciation + dividends), though commonly used to benchmark longterm ...

Do large cash holdings and low leverage always

... Modification of the ex ante overinvestment measure.” ...

... Modification of the ex ante overinvestment measure.” ...

Econ 181 Midterm

... increased, which was accompanied with increased current account deficits. Using the identity CA = Private Saving - I - (G – T), one can see that if private savings and I are constants, an increase in the deficit, namely an increase in (G – T), necessarily increases the CA deficits by the same magnit ...

... increased, which was accompanied with increased current account deficits. Using the identity CA = Private Saving - I - (G – T), one can see that if private savings and I are constants, an increase in the deficit, namely an increase in (G – T), necessarily increases the CA deficits by the same magnit ...

chapter 5 - BYU Marriott School

... decline in the standard deviation from 18.9% to 17.5%. Since both mean return and standard deviation fall, it is not yet clear whether the move is beneficial. The disadvantage of the shift is apparent from the fact that, if my client is willing to accept an expected return on his total portfolio of ...

... decline in the standard deviation from 18.9% to 17.5%. Since both mean return and standard deviation fall, it is not yet clear whether the move is beneficial. The disadvantage of the shift is apparent from the fact that, if my client is willing to accept an expected return on his total portfolio of ...

Investment Objective - Marmot Library Network Information Center

... preservation of principal should not be imposed on each individual investment. To achieve a favorable long term, real rate of return. To reduce risk by diversifying markets, fund managers and maturities. ...

... preservation of principal should not be imposed on each individual investment. To achieve a favorable long term, real rate of return. To reduce risk by diversifying markets, fund managers and maturities. ...

ASB Investment Funds World Fixed Interest Fund Update

... The risk indicator is rated from 1 (low) to 7 (high). The rating reflects how much the value of the fund’s assets goes up and down. A higher risk generally means higher potential returns over time, but more ups and downs along the way. To help you clarify your own attitude to risk, you can seek fina ...

... The risk indicator is rated from 1 (low) to 7 (high). The rating reflects how much the value of the fund’s assets goes up and down. A higher risk generally means higher potential returns over time, but more ups and downs along the way. To help you clarify your own attitude to risk, you can seek fina ...

Test Bank for Quiz-2 FINA252 Financial Management

... An examination of the sources and uses of funds statement is part of: a forecasting techniques a funds flow analysis a ratio analysis calculations for preparing the balance sheet. ...

... An examination of the sources and uses of funds statement is part of: a forecasting techniques a funds flow analysis a ratio analysis calculations for preparing the balance sheet. ...

Federal Reserve Raises Interest Rates

... securities. This has led many income-starved investors to reach for yield, taking on additional risk. The Fed’s increase in the Federal Funds rate may push up interest rates across the yield curve. Since 1994 there have been only three periods of increasing Federal Funds rates. Each of these periods ...

... securities. This has led many income-starved investors to reach for yield, taking on additional risk. The Fed’s increase in the Federal Funds rate may push up interest rates across the yield curve. Since 1994 there have been only three periods of increasing Federal Funds rates. Each of these periods ...

the Treasury Management Strategy Statement 2017/18

... incurring losses from defaults and the risk of receiving unsuitably low investment income. Where balances are expected to be invested for more than one year, the Council will aim to achieve a total return that is equal or higher than the prevailing rate of inflation, in order to maintain the spendin ...

... incurring losses from defaults and the risk of receiving unsuitably low investment income. Where balances are expected to be invested for more than one year, the Council will aim to achieve a total return that is equal or higher than the prevailing rate of inflation, in order to maintain the spendin ...

Chapter 13 - Corporate Financing and Market Efficiency (pages 321

... choices will have no affect on the value of the firm since all have a zero NPV. Example. A project requires a time zero investment of $100 and produces an expected cash flow of $110 in one year. The opportunity cost of capital is 7% and the project NPV is $2.80. The firm has two financing choices fo ...

... choices will have no affect on the value of the firm since all have a zero NPV. Example. A project requires a time zero investment of $100 and produces an expected cash flow of $110 in one year. The opportunity cost of capital is 7% and the project NPV is $2.80. The firm has two financing choices fo ...

Analysis of IDC EMEA Top 10 announcement (prelim)

... Corporate Counsel needs to be included earlier in the decisionmaking process, but must change their “image” to be accepted earlier in the process. Otherwise, they will beg for forgiveness rather than ask for permission. Your legal job is to mitigate risk, which can be value producing activity. Howev ...

... Corporate Counsel needs to be included earlier in the decisionmaking process, but must change their “image” to be accepted earlier in the process. Otherwise, they will beg for forgiveness rather than ask for permission. Your legal job is to mitigate risk, which can be value producing activity. Howev ...

Investment Update - Australia Post Superannuation Scheme

... markets. This is because the formula used to calculate your superannuation benefit is based on your Final Average Salary and years of service and does not incorporate investment returns or values. The investment risk (i.e. the risk of low, variable or negative investment returns) is borne by your em ...

... markets. This is because the formula used to calculate your superannuation benefit is based on your Final Average Salary and years of service and does not incorporate investment returns or values. The investment risk (i.e. the risk of low, variable or negative investment returns) is borne by your em ...

Chapters 1 and 2

... c. KNOWN RECONTRACTING COSTS -- future input costs are part of the present value of expected cash flows. The existence of future and forward markets in inputs can help lock-in future input costs. H. Goals in the Public Sector and the Not-For-Profit (NFP) Enterprise 1. NFP organizations such as perfo ...

... c. KNOWN RECONTRACTING COSTS -- future input costs are part of the present value of expected cash flows. The existence of future and forward markets in inputs can help lock-in future input costs. H. Goals in the Public Sector and the Not-For-Profit (NFP) Enterprise 1. NFP organizations such as perfo ...

A Framework for the use of Discount Rates in Actuarial Work

... after 20 years. c) It gives no information on what the potential shortfall might become if the investment strategy does not go to plan. Of course ‘b)’ and ‘c)’ above can be partly addressed by further more sophisticated budgeting calculations (looking at different possible investment returns and the ...

... after 20 years. c) It gives no information on what the potential shortfall might become if the investment strategy does not go to plan. Of course ‘b)’ and ‘c)’ above can be partly addressed by further more sophisticated budgeting calculations (looking at different possible investment returns and the ...

The Public Market Equivalent and Private Equity Performance

... privately-held companies, without quoted market valuations, and hence they have no regularly quoted month-to-month or quarter-to-quarter market returns. This raises the general problem of evaluating performance based on cash flows alone. A natural starting point is to calculate the internal rate of ...

... privately-held companies, without quoted market valuations, and hence they have no regularly quoted month-to-month or quarter-to-quarter market returns. This raises the general problem of evaluating performance based on cash flows alone. A natural starting point is to calculate the internal rate of ...

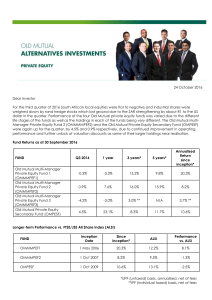

24 October 2016 Dear Investor For the third quarter of 2016 South

... pullback, the fund is up 13.2% per year over the last three years and has been a superb creator of wealth for investors by outperforming inflation by 14.1% per annum since inception in May 2006. OMMMPEF1 has made four cash distribution to date. As investors have had the benefit of receiving cash pro ...

... pullback, the fund is up 13.2% per year over the last three years and has been a superb creator of wealth for investors by outperforming inflation by 14.1% per annum since inception in May 2006. OMMMPEF1 has made four cash distribution to date. As investors have had the benefit of receiving cash pro ...

Click here to free sample

... a. Provide an analysis of the U.S. balance of payments. b. Provide an analysis of the British balance of payments. c. Provide an analysis of the French balance of payments. d. Provide a brief analysis of the Japanese balance of payments. e. Provide a brief analysis of the German balance of payments. ...

... a. Provide an analysis of the U.S. balance of payments. b. Provide an analysis of the British balance of payments. c. Provide an analysis of the French balance of payments. d. Provide a brief analysis of the Japanese balance of payments. e. Provide a brief analysis of the German balance of payments. ...