Interest Rates and Aggregate Corporate Investment

... Jorgenson in 1963 that draws its fundamentals from the maximisation of utility and wealth over time for a firm (Eklund, 2013). The production function and profit function is optimized in order to maximise the discount flow of all future profits (Jorgenson 1963). In the neoclassical model adjustment ...

... Jorgenson in 1963 that draws its fundamentals from the maximisation of utility and wealth over time for a firm (Eklund, 2013). The production function and profit function is optimized in order to maximise the discount flow of all future profits (Jorgenson 1963). In the neoclassical model adjustment ...

Chapter 14. Investment and asset prices

... firm’s profits consist of dividends that it will pay out plus its retained earnings, which it can invest – This is called the uses of profits, the sources being sales minus costs ...

... firm’s profits consist of dividends that it will pay out plus its retained earnings, which it can invest – This is called the uses of profits, the sources being sales minus costs ...

Corporate Finance

... This represents a valuation indicator for the overall company and not just equity. It is more appropriate for comparing companies that have different capital structures since EBITDA is a pre-interest measure of ...

... This represents a valuation indicator for the overall company and not just equity. It is more appropriate for comparing companies that have different capital structures since EBITDA is a pre-interest measure of ...

Capital Structure: Basic Concepts

... Some of the increase in equity risk and return is offset by the interest tax shield RS = R0 + (B/S)×(1-TC)×(R0 - RB) RB is the interest rate (cost of debt) RS is the return on equity (cost of equity) R0 is the return on unlevered equity (cost of capital) B is the value of debt S is the value of leve ...

... Some of the increase in equity risk and return is offset by the interest tax shield RS = R0 + (B/S)×(1-TC)×(R0 - RB) RB is the interest rate (cost of debt) RS is the return on equity (cost of equity) R0 is the return on unlevered equity (cost of capital) B is the value of debt S is the value of leve ...

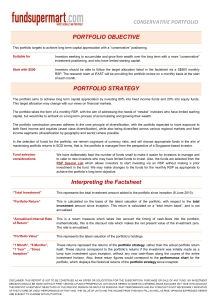

portfolio objective

... The portfolio takes the form of a monthly RSP, with the aim of addressing the needs of “newbie” investors who have limited starting capital, but would like to embark on a long term process of accumulating and growing their wealth. The portfolio construction process adheres to the core principle of d ...

... The portfolio takes the form of a monthly RSP, with the aim of addressing the needs of “newbie” investors who have limited starting capital, but would like to embark on a long term process of accumulating and growing their wealth. The portfolio construction process adheres to the core principle of d ...

FIN 534 FIN534 Quiz 9 - Welcome to homeworks.16mb.com!

... cash budget. If a firm has a relatively aggressive current asset financing policy vis-à-vis other firms in its industry, then its current ratio will probably be relatively high. 2 points Question 9 1. Which of the following statements is CORRECT? Answer Under normal conditions, a firm’s expected RO ...

... cash budget. If a firm has a relatively aggressive current asset financing policy vis-à-vis other firms in its industry, then its current ratio will probably be relatively high. 2 points Question 9 1. Which of the following statements is CORRECT? Answer Under normal conditions, a firm’s expected RO ...

Return of Premium Term

... a provision for an unusual pattern of guaranteed cash surrender values. An unusual pattern is considered when the change in cash surrender values is greater than 110 percent of the premium paid in the period plus 110 percent of the valuation interest rate on the prior cash value plus premium. The re ...

... a provision for an unusual pattern of guaranteed cash surrender values. An unusual pattern is considered when the change in cash surrender values is greater than 110 percent of the premium paid in the period plus 110 percent of the valuation interest rate on the prior cash value plus premium. The re ...

Nº 227 - Instituto de Economía - Pontificia Universidad Católica de

... uncertain but highly correlated over time, then the distant future should be discounted at lower rates than suggested by the current rate. Still another rationale for declining discount rates is provided by Weitzman (2001), who argues that "... even if every individual believes in a constant discoun ...

... uncertain but highly correlated over time, then the distant future should be discounted at lower rates than suggested by the current rate. Still another rationale for declining discount rates is provided by Weitzman (2001), who argues that "... even if every individual believes in a constant discoun ...

File

... Tonya took out a loan to help pay for her house. She borrowed $30,000 for 15 years at a yearly simple interest rate of 5%. How much interest will she end up paying the bank? The formula for computing simple interest is shown below, where p is the principal (starting) amount, r is the interest rate ( ...

... Tonya took out a loan to help pay for her house. She borrowed $30,000 for 15 years at a yearly simple interest rate of 5%. How much interest will she end up paying the bank? The formula for computing simple interest is shown below, where p is the principal (starting) amount, r is the interest rate ( ...

CUSTOMER_CODE SMUDE DIVISION_CODE SMUDE

... maximization has been criticized on many accounts: •The concept of profit lacks clarity. What does profit mean? •In these sense, profit is neither defined precisely nor correctly. It creates unnecessary conflicts regarding the earning habits of the business concern. Differences in interpretation of ...

... maximization has been criticized on many accounts: •The concept of profit lacks clarity. What does profit mean? •In these sense, profit is neither defined precisely nor correctly. It creates unnecessary conflicts regarding the earning habits of the business concern. Differences in interpretation of ...

International Macro

... changes in monetary policy Since expenditure is more sensitive to monetary policy, AD curve is flatter. Output will be less sensitive to changes in fiscal policy or other forms of demand changes. ...

... changes in monetary policy Since expenditure is more sensitive to monetary policy, AD curve is flatter. Output will be less sensitive to changes in fiscal policy or other forms of demand changes. ...

Topic 1 : Saving and Investment

... must be below potential investment I¯ = sȲ + B̄(higher output will also improve the government budget position by increasing tax revenues). It is therefore not the case by identity that actual savings and investment equal potential savings and investment. It is also, as we have seen, not the case b ...

... must be below potential investment I¯ = sȲ + B̄(higher output will also improve the government budget position by increasing tax revenues). It is therefore not the case by identity that actual savings and investment equal potential savings and investment. It is also, as we have seen, not the case b ...

Capital Structure

... rs = r0 + (B / SL) (r0 - rB) rB is the interest rate (cost of debt) rs is the return on (levered) equity (cost of equity) r0 is the return on unlevered equity (cost of capital) B is the value of debt SL is the value of levered equity ...

... rs = r0 + (B / SL) (r0 - rB) rB is the interest rate (cost of debt) rs is the return on (levered) equity (cost of equity) r0 is the return on unlevered equity (cost of capital) B is the value of debt SL is the value of levered equity ...

Present Values, Investment Returns and Discount Rates

... The concept of present value lies at the heart of finance in general and actuarial science in particular. The importance of the concept is universally recognized. Present values of various cash flows are extensively utilized in the pricing of financial instruments, funding of financial commitments, ...

... The concept of present value lies at the heart of finance in general and actuarial science in particular. The importance of the concept is universally recognized. Present values of various cash flows are extensively utilized in the pricing of financial instruments, funding of financial commitments, ...

Cash Flow IN Sources of Cash Flow in

... minus what a company owes OR What your business is worth at book value (not market value) ...

... minus what a company owes OR What your business is worth at book value (not market value) ...

AS 13 - CAalley.com

... Interest, dividends and rentals receivables in connection with an investment are generally regarded as income, being the return on the investment. However, in some circumstances, such inflows represent a recovery of cost and do not form part of income. For example, when unpaid interest has accrued b ...

... Interest, dividends and rentals receivables in connection with an investment are generally regarded as income, being the return on the investment. However, in some circumstances, such inflows represent a recovery of cost and do not form part of income. For example, when unpaid interest has accrued b ...

Access the Investor Brochure

... 3. CION may fund its cash distributions to shareholders from any sources of funds available to it, including offering proceeds, borrowings, net investment income from operations, capital gains proceeds from the sale of assets, non-capital gains proceeds from the sale of assets, dividends or other d ...

... 3. CION may fund its cash distributions to shareholders from any sources of funds available to it, including offering proceeds, borrowings, net investment income from operations, capital gains proceeds from the sale of assets, non-capital gains proceeds from the sale of assets, dividends or other d ...

Finance 534 week 10 quiz 9 Question 1 Which of the following

... Depreciation is included in the estimate of cash flows (Cash flow = Net income + Depreciation), hence depreciation is set forth on a separate line in the cash budget. If cash inflows from collections occur in equal daily amounts but most payments must be made on the 10th of each month, then a regul ...

... Depreciation is included in the estimate of cash flows (Cash flow = Net income + Depreciation), hence depreciation is set forth on a separate line in the cash budget. If cash inflows from collections occur in equal daily amounts but most payments must be made on the 10th of each month, then a regul ...

Sample Questions Conceptual

... although all capital budgeting decisions are ultimately made at the home office using the firm's overall WACC. Just recently, they discovered the divisions have significantly different risks. Which of the following is also likely to be true? A) The divisions are being rewarded for decreasing their r ...

... although all capital budgeting decisions are ultimately made at the home office using the firm's overall WACC. Just recently, they discovered the divisions have significantly different risks. Which of the following is also likely to be true? A) The divisions are being rewarded for decreasing their r ...

Sample Questions

... although all capital budgeting decisions are ultimately made at the home office using the firm's overall WACC. Just recently, they discovered the divisions have significantly different risks. Which of the following is also likely to be true? A) The divisions are being rewarded for decreasing their r ...

... although all capital budgeting decisions are ultimately made at the home office using the firm's overall WACC. Just recently, they discovered the divisions have significantly different risks. Which of the following is also likely to be true? A) The divisions are being rewarded for decreasing their r ...