purpose of the report

... March 2004 is £3.4 million. Members are asked to consider whether to recommend to the Executive Board the use of the £3.4 million housing capital receipts unapplied at 31 March 2004 to part fund the secondary schools project on a “borrow and return” basis in the event of a “no vote” in the housing s ...

... March 2004 is £3.4 million. Members are asked to consider whether to recommend to the Executive Board the use of the £3.4 million housing capital receipts unapplied at 31 March 2004 to part fund the secondary schools project on a “borrow and return” basis in the event of a “no vote” in the housing s ...

Appendices - NT Treasury

... such as land and other fixed assets, which may be sold and used to repay debt, as well as its financial assets and liabilities including debtors, creditors and superannuation liabilities. Net worth also shows asset acquisitions over time, giving an indication of the extent to which borrowings are us ...

... such as land and other fixed assets, which may be sold and used to repay debt, as well as its financial assets and liabilities including debtors, creditors and superannuation liabilities. Net worth also shows asset acquisitions over time, giving an indication of the extent to which borrowings are us ...

Hanke-Guttridge Discounted Cash Flow Methodology

... measures the position and performance of a firm by recognizing economic events regardless of when cash transactions occur. The main concept is that such events are recognized by matching revenues to expenses (the matching principle) at the time in which the transaction occurs rather than when paymen ...

... measures the position and performance of a firm by recognizing economic events regardless of when cash transactions occur. The main concept is that such events are recognized by matching revenues to expenses (the matching principle) at the time in which the transaction occurs rather than when paymen ...

Document

... rate of return on capital projects as compensation for the additional risk. At the extreme, a local government could take over the ...

... rate of return on capital projects as compensation for the additional risk. At the extreme, a local government could take over the ...

GROW... - Amerisource Funding

... It can potentially be a more costly option than bank financing. Even so, factoring is only utilized if bank financing is not a viable option. Some clients have expressed a concern that factoring could be viewed negatively by their customers. However, most factoring clients simply tell their customer ...

... It can potentially be a more costly option than bank financing. Even so, factoring is only utilized if bank financing is not a viable option. Some clients have expressed a concern that factoring could be viewed negatively by their customers. However, most factoring clients simply tell their customer ...

FI3300 Corporation Finance

... bond at a price of $787.39. The face value of the bond is $1,000, and the market interest rate is 9%. What is the annual coupon rate (in percent, to 2 decimal places)? Verify that annual coupon rate = 6.69% What happens if bond pays coupon annually? Quarterly? FI 3300 - Corporate Finance Zinat Alam ...

... bond at a price of $787.39. The face value of the bond is $1,000, and the market interest rate is 9%. What is the annual coupon rate (in percent, to 2 decimal places)? Verify that annual coupon rate = 6.69% What happens if bond pays coupon annually? Quarterly? FI 3300 - Corporate Finance Zinat Alam ...

Finance Policy Supporting Organization

... measured against standard specific benchmarks. Specific total rate of return goals are expected to be met on a cumulative basis over a 3-5 year time period and shall be evaluated accordingly. Capital values do fluctuate over shorter periods and the Finance Committee recognizes that the possibility o ...

... measured against standard specific benchmarks. Specific total rate of return goals are expected to be met on a cumulative basis over a 3-5 year time period and shall be evaluated accordingly. Capital values do fluctuate over shorter periods and the Finance Committee recognizes that the possibility o ...

Lecture 4

... requirements will / must … • “Crowd out” bank lending • Reduce ROE and bank competitiveness • Raise funding costs, and hence loan rates • Distort aggregate investment ...

... requirements will / must … • “Crowd out” bank lending • Reduce ROE and bank competitiveness • Raise funding costs, and hence loan rates • Distort aggregate investment ...

Chapter 7 PPP

... Used various financial measures to assess a company’s performance, and explained how the insights derived form the basic input for the valuation process. ...

... Used various financial measures to assess a company’s performance, and explained how the insights derived form the basic input for the valuation process. ...

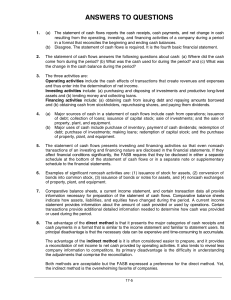

Chapter 2

... • What is the difference between book value and market value? Which should we use for decision making purposes? • What is the difference between accounting income and cash flow? Which do we need to use when making decisions? • What is the difference between average and marginal tax rates? Which shou ...

... • What is the difference between book value and market value? Which should we use for decision making purposes? • What is the difference between accounting income and cash flow? Which do we need to use when making decisions? • What is the difference between average and marginal tax rates? Which shou ...

Pindyck/Rubinfeld Microeconomics

... 15.6 Investment Decisions by Consumers 15.7 Investments in Human Capital ...

... 15.6 Investment Decisions by Consumers 15.7 Investments in Human Capital ...

determinants of capital structure of croatian enterprises before and

... issuing a sufficiently high amount of debt. The pecking order theory 4 describes the order in which firms prefer to finance firms’ future activities and growth. According to this theory, a firm will rather borrow than issue equity 5, when internal cash flow is not sufficient to fund capital expendit ...

... issuing a sufficiently high amount of debt. The pecking order theory 4 describes the order in which firms prefer to finance firms’ future activities and growth. According to this theory, a firm will rather borrow than issue equity 5, when internal cash flow is not sufficient to fund capital expendit ...