Directive 6: Market Information

... In exceptional cases for which sufficient grounds exist, market data fees may be waived for automated trading systems. This is conditional upon the participant using the price data exclusively for trading on SIX Swiss Exchange markets, confirmation of which must be provided by the compliance officer ...

... In exceptional cases for which sufficient grounds exist, market data fees may be waived for automated trading systems. This is conditional upon the participant using the price data exclusively for trading on SIX Swiss Exchange markets, confirmation of which must be provided by the compliance officer ...

Contents Stock Market Indicators Measuring market bredth Sample

... These charts are similar to bar charts, where one bar looks like the following: ...

... These charts are similar to bar charts, where one bar looks like the following: ...

Commerce and injustice

... the education standards are extremely low, the market price of human effort is close to physiological minimum. That is the logic, the "justice", of the market. Initiatives like "Fair trade", may try to push a little up the value on human effort, of course within the limits of profitability, when th ...

... the education standards are extremely low, the market price of human effort is close to physiological minimum. That is the logic, the "justice", of the market. Initiatives like "Fair trade", may try to push a little up the value on human effort, of course within the limits of profitability, when th ...

gmma relationships

... The relationship within each of these groups tells us when there is agreement on value - when they are close together - and when there is disagreement on value - when they are well spaced apart. The relationship between the two groups tells the trader about the strength of the market action. A chang ...

... The relationship within each of these groups tells us when there is agreement on value - when they are close together - and when there is disagreement on value - when they are well spaced apart. The relationship between the two groups tells the trader about the strength of the market action. A chang ...

The course presents an introduction to financial intermediation and

... trading and aims at investigating the following aspects: 1) what are banks and what do they do? 2) what are the motives for trading and how is the trading process organized? 3) how do traders (and protocols) affect market quality? The analysis of these ...

... trading and aims at investigating the following aspects: 1) what are banks and what do they do? 2) what are the motives for trading and how is the trading process organized? 3) how do traders (and protocols) affect market quality? The analysis of these ...

Inside Information and Resumption of Trading

... materials owned by Rui Hai Company* (瑞海公司) located in the area of Tianjin Port International Logistics Centre in the Binhai New Area of Tianjin (the “Accident”). The municipal committee and the municipal government of Tianjin have been coordinating the rescue and dealing with the aftermath on-site. ...

... materials owned by Rui Hai Company* (瑞海公司) located in the area of Tianjin Port International Logistics Centre in the Binhai New Area of Tianjin (the “Accident”). The municipal committee and the municipal government of Tianjin have been coordinating the rescue and dealing with the aftermath on-site. ...

Allan Thomson, CEO, Dreadnought Capital, South Africa

... The first introduction to financial markets came in early 1992 when Allan joined Rand Merchant Bank in Johannesburg, South Africa. After moving around the Bank on a trainee induction programme, Allan joined the Equities and Derivatives trading desk as a proprietary trader. Allan left Rand Merchant B ...

... The first introduction to financial markets came in early 1992 when Allan joined Rand Merchant Bank in Johannesburg, South Africa. After moving around the Bank on a trainee induction programme, Allan joined the Equities and Derivatives trading desk as a proprietary trader. Allan left Rand Merchant B ...

newsletter

... has exhibited meteoric price rises since the lows following the financial crisis. And so we find ourselves, as we did in 2008, looking back at almost six years of bull market returns, and wondering how solid the ground is beneath us. In delving beneath the market’s surface, however, there are always ...

... has exhibited meteoric price rises since the lows following the financial crisis. And so we find ourselves, as we did in 2008, looking back at almost six years of bull market returns, and wondering how solid the ground is beneath us. In delving beneath the market’s surface, however, there are always ...

memorandum - Africa Newsroom

... In accordance with the legal provisions governing the CEMAC Financial Market, the Central African Financial Market Supervisory Commission (COSUMAF), in its capacity as the authority responsible for supervising, regulating and monitoring the market, has three primary tasks. It ensures: ...

... In accordance with the legal provisions governing the CEMAC Financial Market, the Central African Financial Market Supervisory Commission (COSUMAF), in its capacity as the authority responsible for supervising, regulating and monitoring the market, has three primary tasks. It ensures: ...

Necessary Investment in Non-Domestic

... 3. No congestion: price differentials are relatively low between two markets ...

... 3. No congestion: price differentials are relatively low between two markets ...

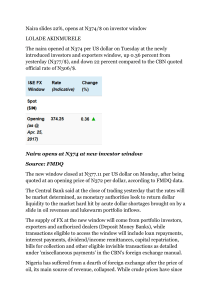

Naira opens at N374 at new investor window Source

... interest payments, dividend/income remittances, capital repatriation, bills for collection and other eligible invisible transactions as detailed under 'miscellaneous payments' in the CBN's foreign exchange manual. Nigeria has suffered from a dearth of foreign exchange after the price of oil, its mai ...

... interest payments, dividend/income remittances, capital repatriation, bills for collection and other eligible invisible transactions as detailed under 'miscellaneous payments' in the CBN's foreign exchange manual. Nigeria has suffered from a dearth of foreign exchange after the price of oil, its mai ...

Security Analysis and Portfolio Management

... A place where individuals are involved in any kind of financial transaction refers to financial market. Financial market is a platform where buyers and sellers are involved in sale and purchase of financial products like shares, mutual funds, bonds and so on. ...

... A place where individuals are involved in any kind of financial transaction refers to financial market. Financial market is a platform where buyers and sellers are involved in sale and purchase of financial products like shares, mutual funds, bonds and so on. ...

2010 Flash Crash

The May 6, 2010, Flash Crash also known as The Crash of 2:45, the 2010 Flash Crash or simply the Flash Crash, was a United States trillion-dollar stock market crash, which started at 2:32 and lasted for approximately 36 minutes. Stock indexes, such as the S&P 500, Dow Jones Industrial Average and Nasdaq 100, collapsed and rebounded very rapidly.The Dow Jones Industrial Average had its biggest intraday point drop (from the opening) up to that point, plunging 998.5 points (about 9%), most within minutes, only to recover a large part of the loss. It was also the second-largest intraday point swing (difference between intraday high and intraday low) up to that point, at 1,010.14 points. The prices of stocks, stock index futures, options and ETFs were volatile, thus trading volume spiked. A CFTC 2014 report described it as one of the most turbulent periods in the history of financial markets.On April 21, 2015, nearly five years after the incident, the U.S. Department of Justice laid ""22 criminal counts, including fraud and market manipulation"" against Navinder Singh Sarao, a trader. Among the charges included was the use of spoofing algorithms; just prior to the Flash Crash, he placed thousands of E-mini S&P 500 stock index futures contracts which he planned on canceling later. These orders amounting to about ""$200 million worth of bets that the market would fall"" were ""replaced or modified 19,000 times"" before they were canceled. Spoofing, layering and front-running are now banned.The Commodity Futures Trading Commission (CFTC) investigation concluded that Sarao ""was at least significantly responsible for the order imbalances"" in the derivatives market which affected stock markets and exacerbated the flash crash. Sarao began his alleged market manipulation in 2009 with commercially available trading software whose code he modified ""so he could rapidly place and cancel orders automatically."" Traders Magazine journalist, John Bates, argued that blaming a 36-year-old small-time trader who worked from his parents' modest stucco house in suburban west London for sparking a trillion-dollar stock market crash is a little bit like blaming lightning for starting a fire"" and that the investigation was lengthened because regulators used ""bicycles to try and catch Ferraris."" Furthermore, he concluded that by April 2015, traders can still manipulate and impact markets in spite of regulators and banks' new, improved monitoring of automated trade systems.As recently as May 2014, a CFTC report concluded that high-frequency traders ""did not cause the Flash Crash, but contributed to it by demanding immediacy ahead of other market participants.""Recent research shows that Flash Crashes are not isolated occurrences, but have occurred quite often over the past century. For instance, Irene Aldridge, the author of High-Frequency Trading: A Practical Guide to Algorithmic Strategies and Trading Systems, 2nd ed., Wiley & Sons, shows that Flash Crashes have been frequent and their causes predictable in market microstructure analysis.