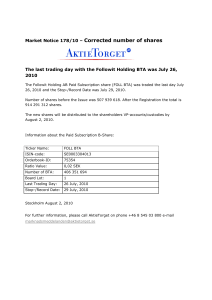

Market Notice 178/10 – Corrected number of shares

... Market Notice 178/10 – Corrected number of shares ...

... Market Notice 178/10 – Corrected number of shares ...

During the application of the GBER (the Regulation) at national level

... Regarding the application of a regional investment aid measure under the GBER, it is planned that the form of the aid will be a provision of a (real) estate/real estate right at lower prices than the market ones. Before proceeding to the approval of an investment project it is planned that an assess ...

... Regarding the application of a regional investment aid measure under the GBER, it is planned that the form of the aid will be a provision of a (real) estate/real estate right at lower prices than the market ones. Before proceeding to the approval of an investment project it is planned that an assess ...

Wolfe Wave - Forex Factory

... The "surprise" explosion in the price of gold did not come as a surprise to WolfeWave practitioners. As savvy investors know, the share prices of gold stocks often rise before the price of the metal. The above weekly chart of ASA has a beautiful WolfeWave that telegraphed the move weeks in advance ...

... The "surprise" explosion in the price of gold did not come as a surprise to WolfeWave practitioners. As savvy investors know, the share prices of gold stocks often rise before the price of the metal. The above weekly chart of ASA has a beautiful WolfeWave that telegraphed the move weeks in advance ...

ANSWER - We can offer most test bank and solution manual you need.

... Full file at http://testbankonline.eu/Test-bank-for-Fundamentals-of-Financial-Management,-ConciseEdition,-8th-Edition-by-Eugene-F.-Brigham 31. Which of the following statements is CORRECT? a. The term “IPO” stands for Introductory Price Offered, and it is the price at which shares of a new company ...

... Full file at http://testbankonline.eu/Test-bank-for-Fundamentals-of-Financial-Management,-ConciseEdition,-8th-Edition-by-Eugene-F.-Brigham 31. Which of the following statements is CORRECT? a. The term “IPO” stands for Introductory Price Offered, and it is the price at which shares of a new company ...

Hedging with Interest Rate Futures

... Liquidity breeds liquidity • Euribor Futures Contract STIR Liquidity ...

... Liquidity breeds liquidity • Euribor Futures Contract STIR Liquidity ...

chapter 10

... average period over multiple periods • Geometric average – average compound return per period over multiple periods • The geometric average will be less than the arithmetic average unless all the returns are equal • Which is better? • The arithmetic average is overly optimistic for long horizons • T ...

... average period over multiple periods • Geometric average – average compound return per period over multiple periods • The geometric average will be less than the arithmetic average unless all the returns are equal • Which is better? • The arithmetic average is overly optimistic for long horizons • T ...

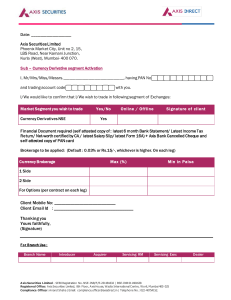

Client Email Id : Thanking you Yours faithfu

... I/We would like to confirm that I/We wish to trade in following segment of Exchanges: Market Segment you wish to trade Currency Derivatives NSE ...

... I/We would like to confirm that I/We wish to trade in following segment of Exchanges: Market Segment you wish to trade Currency Derivatives NSE ...

Algorithms for VWAP and Limit Order Trading

... – exchanges – technical analysis/indicators – algorithmic trading ...

... – exchanges – technical analysis/indicators – algorithmic trading ...

Incentive to reduce milk production – why now and why at

... Apart from the timing issue, the results of this scheme to pay for the quantities of milk not delivered (in comparison to the year before), are far from straightforward. The programme might encourage some producers to actually increase production, speculating on a positive effect on milk prices of t ...

... Apart from the timing issue, the results of this scheme to pay for the quantities of milk not delivered (in comparison to the year before), are far from straightforward. The programme might encourage some producers to actually increase production, speculating on a positive effect on milk prices of t ...

Document

... • investor keeps the account’s equity equal to or greater than a certain percentage • if not met, margin call is issued to the buyer and seller • variation margin – represents the additional deposit of cash that brings the equity up to the margin ...

... • investor keeps the account’s equity equal to or greater than a certain percentage • if not met, margin call is issued to the buyer and seller • variation margin – represents the additional deposit of cash that brings the equity up to the margin ...

Profit-oriented pricing

... 11. Law of supply and demand: Economic principle which states that the supply of a good or service will increase when demand is great and decrease when demand is low 12. Market price: Actual price that prevails in a market at any particular moment 13. Market share: An organization’s portion of the t ...

... 11. Law of supply and demand: Economic principle which states that the supply of a good or service will increase when demand is great and decrease when demand is low 12. Market price: Actual price that prevails in a market at any particular moment 13. Market share: An organization’s portion of the t ...

Securities Regulation

... • Securities professionals have special duty • Insiders should not gain personal benefit • Investors should have equal access ...

... • Securities professionals have special duty • Insiders should not gain personal benefit • Investors should have equal access ...

Volume-Synchronized Probability of Informed

... On that day, Dow Jones Industrial Average dropped sharply and caused panics in American financial markets. Latter the panics spread around the world and economic recession came. Novak and Beirlant (2006) study the crisis and prove the effectiveness of extreme value theory in predicting high volatil ...

... On that day, Dow Jones Industrial Average dropped sharply and caused panics in American financial markets. Latter the panics spread around the world and economic recession came. Novak and Beirlant (2006) study the crisis and prove the effectiveness of extreme value theory in predicting high volatil ...

FREE Manual

... We will first concentrate on a detailed discussion of the construction and strict interpretation of the Directional Day Filter. Following the section on the basics of the tool we will include a considerable number of actual price charts taken from real markets, going through extensive descriptions ...

... We will first concentrate on a detailed discussion of the construction and strict interpretation of the Directional Day Filter. Following the section on the basics of the tool we will include a considerable number of actual price charts taken from real markets, going through extensive descriptions ...

2010 Flash Crash

The May 6, 2010, Flash Crash also known as The Crash of 2:45, the 2010 Flash Crash or simply the Flash Crash, was a United States trillion-dollar stock market crash, which started at 2:32 and lasted for approximately 36 minutes. Stock indexes, such as the S&P 500, Dow Jones Industrial Average and Nasdaq 100, collapsed and rebounded very rapidly.The Dow Jones Industrial Average had its biggest intraday point drop (from the opening) up to that point, plunging 998.5 points (about 9%), most within minutes, only to recover a large part of the loss. It was also the second-largest intraday point swing (difference between intraday high and intraday low) up to that point, at 1,010.14 points. The prices of stocks, stock index futures, options and ETFs were volatile, thus trading volume spiked. A CFTC 2014 report described it as one of the most turbulent periods in the history of financial markets.On April 21, 2015, nearly five years after the incident, the U.S. Department of Justice laid ""22 criminal counts, including fraud and market manipulation"" against Navinder Singh Sarao, a trader. Among the charges included was the use of spoofing algorithms; just prior to the Flash Crash, he placed thousands of E-mini S&P 500 stock index futures contracts which he planned on canceling later. These orders amounting to about ""$200 million worth of bets that the market would fall"" were ""replaced or modified 19,000 times"" before they were canceled. Spoofing, layering and front-running are now banned.The Commodity Futures Trading Commission (CFTC) investigation concluded that Sarao ""was at least significantly responsible for the order imbalances"" in the derivatives market which affected stock markets and exacerbated the flash crash. Sarao began his alleged market manipulation in 2009 with commercially available trading software whose code he modified ""so he could rapidly place and cancel orders automatically."" Traders Magazine journalist, John Bates, argued that blaming a 36-year-old small-time trader who worked from his parents' modest stucco house in suburban west London for sparking a trillion-dollar stock market crash is a little bit like blaming lightning for starting a fire"" and that the investigation was lengthened because regulators used ""bicycles to try and catch Ferraris."" Furthermore, he concluded that by April 2015, traders can still manipulate and impact markets in spite of regulators and banks' new, improved monitoring of automated trade systems.As recently as May 2014, a CFTC report concluded that high-frequency traders ""did not cause the Flash Crash, but contributed to it by demanding immediacy ahead of other market participants.""Recent research shows that Flash Crashes are not isolated occurrences, but have occurred quite often over the past century. For instance, Irene Aldridge, the author of High-Frequency Trading: A Practical Guide to Algorithmic Strategies and Trading Systems, 2nd ed., Wiley & Sons, shows that Flash Crashes have been frequent and their causes predictable in market microstructure analysis.