Comomentum: Inferring Arbitrage Activity from Return

... capital that has already been deployed in the strategy. An unanchored, positive-feedback trading strategy like momentum is thus the most likely place where arbitrage activity can be destabilizing when trading becomes too crowded (Stein, 2009).8 Since Stein’s theory predicts that arbitrageurs will be ...

... capital that has already been deployed in the strategy. An unanchored, positive-feedback trading strategy like momentum is thus the most likely place where arbitrage activity can be destabilizing when trading becomes too crowded (Stein, 2009).8 Since Stein’s theory predicts that arbitrageurs will be ...

The Information Content of the NCREIF Index

... and Webb (1993) conduct vector autoregression (VAR) analyses and Granger causality tests using data from 1978 to 1990. They find an intertemporal relation between REIT returns and unsecuritized real estate returns, as well as a significant Granger causality of REIT returns to most of real estate ind ...

... and Webb (1993) conduct vector autoregression (VAR) analyses and Granger causality tests using data from 1978 to 1990. They find an intertemporal relation between REIT returns and unsecuritized real estate returns, as well as a significant Granger causality of REIT returns to most of real estate ind ...

The Effects of Uncertainty Shocks on the Labor Market: A Search

... returns from early commitment against the benefits from waiting for more information. Increased uncertainty about future returns increase the value of waiting for more information, thus dampening investment and economic activity. More recently, a rapidly growing strand of literature explicitly moti ...

... returns from early commitment against the benefits from waiting for more information. Increased uncertainty about future returns increase the value of waiting for more information, thus dampening investment and economic activity. More recently, a rapidly growing strand of literature explicitly moti ...

Changes in Twelfth District Local Banking Market Structure during a

... that have high profits, and entry tends to decrease market concentration.6 Amel and Liang (1990) offer a related model of the long-run change in concentration as a negative function of the difference between current concentration and the longrun equilibrium level of concentration. Partial adjustment ...

... that have high profits, and entry tends to decrease market concentration.6 Amel and Liang (1990) offer a related model of the long-run change in concentration as a negative function of the difference between current concentration and the longrun equilibrium level of concentration. Partial adjustment ...

The Relation between information in option prices and short term

... when the total value of a levered firm falls the value of its equity becomes a smaller share of the total. Since equity bears the full risk of the firm the percentage volatility of equity should rise. Even if a firm is not financially levered with debt this may occur if the firm has fixed commitment ...

... when the total value of a levered firm falls the value of its equity becomes a smaller share of the total. Since equity bears the full risk of the firm the percentage volatility of equity should rise. Even if a firm is not financially levered with debt this may occur if the firm has fixed commitment ...

Option pricing with discrete dividends

... This is, however, an arbitrage opportunity! The arbitrage occurs because the RGW model is mis-specified, in that the dynamics of the stock price process depends on the timing of the dividend. Similar examples have been discussed by Beneder and Vorst (2001) and Frishling (2002). This is not just an e ...

... This is, however, an arbitrage opportunity! The arbitrage occurs because the RGW model is mis-specified, in that the dynamics of the stock price process depends on the timing of the dividend. Similar examples have been discussed by Beneder and Vorst (2001) and Frishling (2002). This is not just an e ...

Market Returns without Downside Risk Or The Difference Between

... – Market Neutral (low absolute risk, high returns with good ...

... – Market Neutral (low absolute risk, high returns with good ...

Asset market participation and portfolio choice over the life-cycle

... failure to find evidence of rebalancing in the risky share. Third, evidence so far is based primarily on household surveys which are notoriously subject to measurement problems. Most importantly, measurement and reporting errors are likely to be correlated with age, hiding age patterns when present ...

... failure to find evidence of rebalancing in the risky share. Third, evidence so far is based primarily on household surveys which are notoriously subject to measurement problems. Most importantly, measurement and reporting errors are likely to be correlated with age, hiding age patterns when present ...

Night Trading: Lower Risk But Higher Returns? by Marie

... United States for the past year and holding them overnight-only for the next year yields an annual return of 40.43%. By contrast, stocks in the bottom decile of past overnight returns underperform overnight with a -17.08% return. Sorting stocks by quartiles of past overnight returns, the same patter ...

... United States for the past year and holding them overnight-only for the next year yields an annual return of 40.43%. By contrast, stocks in the bottom decile of past overnight returns underperform overnight with a -17.08% return. Sorting stocks by quartiles of past overnight returns, the same patter ...

Spatial competition among multi

... to the seminal work of Hotelling (1929). Despite its long history, it is surprising how little attention has been paid to study competition among firms who can set up multiple stores.1 The literature on spatial competition that allows firms to choose ...

... to the seminal work of Hotelling (1929). Despite its long history, it is surprising how little attention has been paid to study competition among firms who can set up multiple stores.1 The literature on spatial competition that allows firms to choose ...

Stop-loss orders and price cascades in currency markets

... Though the paper interprets unusual exchange rate behavior near round numbers as the response to clusters of stop-loss and take-profit orders, statistical analysis cannot prove that the connection is causal. To evaluate whether some other factor might explain the unusual behavior, the paper closely ...

... Though the paper interprets unusual exchange rate behavior near round numbers as the response to clusters of stop-loss and take-profit orders, statistical analysis cannot prove that the connection is causal. To evaluate whether some other factor might explain the unusual behavior, the paper closely ...

stop-loss orders and price cascades in currency markets

... Though the paper interprets unusual exchange rate behavior near round numbers as the response to clusters of stop-loss and take-profit orders, statistical analysis cannot prove that the connection is causal. To evaluate whether some other factor might explain the unusual behavior, the paper closely ...

... Though the paper interprets unusual exchange rate behavior near round numbers as the response to clusters of stop-loss and take-profit orders, statistical analysis cannot prove that the connection is causal. To evaluate whether some other factor might explain the unusual behavior, the paper closely ...

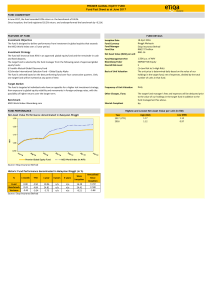

Etiqa Insurance Berhad Overall Risk Level Basis of Unit Valuation

... The fund is selected based on the best performing fund over four consecutive quarters. Only one target fund will be invested at any point of time. Target Market The fund is targeted at individuals who have an appetite for a higher risk investment strategy, from exposure to global equity volatility a ...

... The fund is selected based on the best performing fund over four consecutive quarters. Only one target fund will be invested at any point of time. Target Market The fund is targeted at individuals who have an appetite for a higher risk investment strategy, from exposure to global equity volatility a ...

Warrant price = Intrinsic value + time value

... One of the fundamental advantages of buying a warrant as a opposed to buying the underlying asset directly resides in the leverage effect. In an investor believes that the price of a specific asset will rise, he can increase his exposure by purchasing call warrants instead of direct investing in the ...

... One of the fundamental advantages of buying a warrant as a opposed to buying the underlying asset directly resides in the leverage effect. In an investor believes that the price of a specific asset will rise, he can increase his exposure by purchasing call warrants instead of direct investing in the ...

Stock Price Volatility and the Equity Premium

... setting is still imperfectly understood. First, as Grossman and Shiller (1981) and others have argued, stock returns appear to be too volatile given the relatively smooth process for aggregate dividends and consumption. Over the period 1871-1996 the standard deviation of real annual continuously com ...

... setting is still imperfectly understood. First, as Grossman and Shiller (1981) and others have argued, stock returns appear to be too volatile given the relatively smooth process for aggregate dividends and consumption. Over the period 1871-1996 the standard deviation of real annual continuously com ...

2010 Flash Crash

The May 6, 2010, Flash Crash also known as The Crash of 2:45, the 2010 Flash Crash or simply the Flash Crash, was a United States trillion-dollar stock market crash, which started at 2:32 and lasted for approximately 36 minutes. Stock indexes, such as the S&P 500, Dow Jones Industrial Average and Nasdaq 100, collapsed and rebounded very rapidly.The Dow Jones Industrial Average had its biggest intraday point drop (from the opening) up to that point, plunging 998.5 points (about 9%), most within minutes, only to recover a large part of the loss. It was also the second-largest intraday point swing (difference between intraday high and intraday low) up to that point, at 1,010.14 points. The prices of stocks, stock index futures, options and ETFs were volatile, thus trading volume spiked. A CFTC 2014 report described it as one of the most turbulent periods in the history of financial markets.On April 21, 2015, nearly five years after the incident, the U.S. Department of Justice laid ""22 criminal counts, including fraud and market manipulation"" against Navinder Singh Sarao, a trader. Among the charges included was the use of spoofing algorithms; just prior to the Flash Crash, he placed thousands of E-mini S&P 500 stock index futures contracts which he planned on canceling later. These orders amounting to about ""$200 million worth of bets that the market would fall"" were ""replaced or modified 19,000 times"" before they were canceled. Spoofing, layering and front-running are now banned.The Commodity Futures Trading Commission (CFTC) investigation concluded that Sarao ""was at least significantly responsible for the order imbalances"" in the derivatives market which affected stock markets and exacerbated the flash crash. Sarao began his alleged market manipulation in 2009 with commercially available trading software whose code he modified ""so he could rapidly place and cancel orders automatically."" Traders Magazine journalist, John Bates, argued that blaming a 36-year-old small-time trader who worked from his parents' modest stucco house in suburban west London for sparking a trillion-dollar stock market crash is a little bit like blaming lightning for starting a fire"" and that the investigation was lengthened because regulators used ""bicycles to try and catch Ferraris."" Furthermore, he concluded that by April 2015, traders can still manipulate and impact markets in spite of regulators and banks' new, improved monitoring of automated trade systems.As recently as May 2014, a CFTC report concluded that high-frequency traders ""did not cause the Flash Crash, but contributed to it by demanding immediacy ahead of other market participants.""Recent research shows that Flash Crashes are not isolated occurrences, but have occurred quite often over the past century. For instance, Irene Aldridge, the author of High-Frequency Trading: A Practical Guide to Algorithmic Strategies and Trading Systems, 2nd ed., Wiley & Sons, shows that Flash Crashes have been frequent and their causes predictable in market microstructure analysis.