CEO Pay and Firm Size: an Update after the Crisis

... choose to have less debt (to avoid bankruptcy costs). Then, equity is likely to be a better proxy than debt+equity for how much a CEO can impact the firm. ...

... choose to have less debt (to avoid bankruptcy costs). Then, equity is likely to be a better proxy than debt+equity for how much a CEO can impact the firm. ...

MultiFractality in Foreign Currency Markets

... Briefly, the MFMH provides a theoretical framework to account for changes from “regular” to “irregular” phases of the capital markets and vice versa. In general, these markets are characterized by investors having similar or different lengths of investment horizons. If the matching between the asset ...

... Briefly, the MFMH provides a theoretical framework to account for changes from “regular” to “irregular” phases of the capital markets and vice versa. In general, these markets are characterized by investors having similar or different lengths of investment horizons. If the matching between the asset ...

Journal of Financial Economics Momentum crashes

... the momentum premium is correlated with the strategy’s time-varying exposure to volatility risk. Using volatility index (VIX) imputed variance swap returns, we find that the momentum strategy payoff has a strong negative exposure to innovations in market variance in bear markets, but not in normal ( ...

... the momentum premium is correlated with the strategy’s time-varying exposure to volatility risk. Using volatility index (VIX) imputed variance swap returns, we find that the momentum strategy payoff has a strong negative exposure to innovations in market variance in bear markets, but not in normal ( ...

Asset Pricing with Return Asymmetries: Theory

... Most investors prefer portfolios with higher positive asymmetry, all else equal, because they occasionally pay large and positive returns. Similarly, they prefer to avoid portfolios with negative asymmetry because they sometimes fall drastically in value. Not all kinds of return asymmetry are equal ...

... Most investors prefer portfolios with higher positive asymmetry, all else equal, because they occasionally pay large and positive returns. Similarly, they prefer to avoid portfolios with negative asymmetry because they sometimes fall drastically in value. Not all kinds of return asymmetry are equal ...

The benchmark industry - Gruppe Deutsche Börse

... various benefits they are also vital for the investment industry, individual investors, corporations, governments, financial markets, and a variety of other stakeholders. Indices increase market transparency, facilitate diversification and risk management, simplify performance measurement, and suppo ...

... various benefits they are also vital for the investment industry, individual investors, corporations, governments, financial markets, and a variety of other stakeholders. Indices increase market transparency, facilitate diversification and risk management, simplify performance measurement, and suppo ...

The Impact of Auctions on Residential Sales Prices in

... Academic literature has an abundance of theoretical articles relating to auctions. Some of the comprehensive investigations of auction theory include Wilson (1977, 1992), Engelbrecht-Wiggans (1980), Milgrom and Weber (1982), McAfee and McMillan (1987) and Milgrom (1989). These studies have focused o ...

... Academic literature has an abundance of theoretical articles relating to auctions. Some of the comprehensive investigations of auction theory include Wilson (1977, 1992), Engelbrecht-Wiggans (1980), Milgrom and Weber (1982), McAfee and McMillan (1987) and Milgrom (1989). These studies have focused o ...

What Ties Return Volatilities to Price Valuations and

... unable to empirically demonstrate such a strong link between them, as evidenced in the following quote from a recent paper by Nobel prize laureate Robert Engle. “After more than 25 years of research on volatility, the central unsolved problem is the relation between the state of the economy and aggr ...

... unable to empirically demonstrate such a strong link between them, as evidenced in the following quote from a recent paper by Nobel prize laureate Robert Engle. “After more than 25 years of research on volatility, the central unsolved problem is the relation between the state of the economy and aggr ...

Investment - Cash Flow Sensitivity and Financing Constraints

... robustness checks with alternative empirical specifications. The purpose of the paper is to extend prior international studies examining the investment – cash flow relationship among group firms by focusing on one of the largest emerging markets - India. An analysis of Indian business groups can be ...

... robustness checks with alternative empirical specifications. The purpose of the paper is to extend prior international studies examining the investment – cash flow relationship among group firms by focusing on one of the largest emerging markets - India. An analysis of Indian business groups can be ...

Everything You Need to Know About Investing • 1

... by Maria Bartiromo on national TV. I got Bell’s Palsy -- which onset during a live broadcast of one of my shows caused by Lyme Disease (now cured) while I didn’t have health insurance. And I made so many stupid mistakes that I can’t even remember them all. And that’s why I wrote this book. I’ve bee ...

... by Maria Bartiromo on national TV. I got Bell’s Palsy -- which onset during a live broadcast of one of my shows caused by Lyme Disease (now cured) while I didn’t have health insurance. And I made so many stupid mistakes that I can’t even remember them all. And that’s why I wrote this book. I’ve bee ...

paper - Kellogg School of Management

... in the price level. We find that our nonparametric evidence identifies with reasonable accuracy the most plausible class of parametric models and rules out many others. There are certain advantages and also some notable pitfalls entailed with using the VIX data. High-frequency data, of course, provi ...

... in the price level. We find that our nonparametric evidence identifies with reasonable accuracy the most plausible class of parametric models and rules out many others. There are certain advantages and also some notable pitfalls entailed with using the VIX data. High-frequency data, of course, provi ...

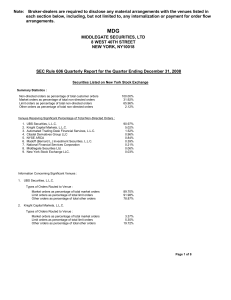

Note: Broker-dealers are required to disclose any material

... Note: Broker-dealers are required to disclose any material arrangements with the venues listed in each section below, including, but not limited to, any internalization or payment for order flow arrangements. ...

... Note: Broker-dealers are required to disclose any material arrangements with the venues listed in each section below, including, but not limited to, any internalization or payment for order flow arrangements. ...

Fifth level

... • SSFs incur lower brokerage costs than actually trading in the underlying shares. • Your initial margin earns interest for the duration of your contract. • SSFs are characteristically liquid and easily traded. • Gearing – significant returns… • JSE independently calculates and values positions ...

... • SSFs incur lower brokerage costs than actually trading in the underlying shares. • Your initial margin earns interest for the duration of your contract. • SSFs are characteristically liquid and easily traded. • Gearing – significant returns… • JSE independently calculates and values positions ...

Power Laws in the Stock Market

... were the first ones to introduce the concept of self-organized criticality to explain the behavior of their sandpile model. Soon afterwards this theory was used to justify the complexity of natural systems, including the stock market. One of the important features of a self-organized critical system ...

... were the first ones to introduce the concept of self-organized criticality to explain the behavior of their sandpile model. Soon afterwards this theory was used to justify the complexity of natural systems, including the stock market. One of the important features of a self-organized critical system ...

Page 1 of 5 Q1 2017 100.00% 95.64% 3.93% 0.43% 90.72

... publicly available quarterly reports on their order routing practices. The report provides information on the routing of “non-directed orders” – any order that the customer has not specifically instructed to be routed to a particular venue for execution. For these non-directed orders, UBS Financial ...

... publicly available quarterly reports on their order routing practices. The report provides information on the routing of “non-directed orders” – any order that the customer has not specifically instructed to be routed to a particular venue for execution. For these non-directed orders, UBS Financial ...

2010 Flash Crash

The May 6, 2010, Flash Crash also known as The Crash of 2:45, the 2010 Flash Crash or simply the Flash Crash, was a United States trillion-dollar stock market crash, which started at 2:32 and lasted for approximately 36 minutes. Stock indexes, such as the S&P 500, Dow Jones Industrial Average and Nasdaq 100, collapsed and rebounded very rapidly.The Dow Jones Industrial Average had its biggest intraday point drop (from the opening) up to that point, plunging 998.5 points (about 9%), most within minutes, only to recover a large part of the loss. It was also the second-largest intraday point swing (difference between intraday high and intraday low) up to that point, at 1,010.14 points. The prices of stocks, stock index futures, options and ETFs were volatile, thus trading volume spiked. A CFTC 2014 report described it as one of the most turbulent periods in the history of financial markets.On April 21, 2015, nearly five years after the incident, the U.S. Department of Justice laid ""22 criminal counts, including fraud and market manipulation"" against Navinder Singh Sarao, a trader. Among the charges included was the use of spoofing algorithms; just prior to the Flash Crash, he placed thousands of E-mini S&P 500 stock index futures contracts which he planned on canceling later. These orders amounting to about ""$200 million worth of bets that the market would fall"" were ""replaced or modified 19,000 times"" before they were canceled. Spoofing, layering and front-running are now banned.The Commodity Futures Trading Commission (CFTC) investigation concluded that Sarao ""was at least significantly responsible for the order imbalances"" in the derivatives market which affected stock markets and exacerbated the flash crash. Sarao began his alleged market manipulation in 2009 with commercially available trading software whose code he modified ""so he could rapidly place and cancel orders automatically."" Traders Magazine journalist, John Bates, argued that blaming a 36-year-old small-time trader who worked from his parents' modest stucco house in suburban west London for sparking a trillion-dollar stock market crash is a little bit like blaming lightning for starting a fire"" and that the investigation was lengthened because regulators used ""bicycles to try and catch Ferraris."" Furthermore, he concluded that by April 2015, traders can still manipulate and impact markets in spite of regulators and banks' new, improved monitoring of automated trade systems.As recently as May 2014, a CFTC report concluded that high-frequency traders ""did not cause the Flash Crash, but contributed to it by demanding immediacy ahead of other market participants.""Recent research shows that Flash Crashes are not isolated occurrences, but have occurred quite often over the past century. For instance, Irene Aldridge, the author of High-Frequency Trading: A Practical Guide to Algorithmic Strategies and Trading Systems, 2nd ed., Wiley & Sons, shows that Flash Crashes have been frequent and their causes predictable in market microstructure analysis.