View

... in which these definitions can become blurred. While we understand that no standard can cover all potential situations, we offer two examples to illustrate our concern about the completeness of these definitions or whether additional guidance to address transactions that may have attributes of sever ...

... in which these definitions can become blurred. While we understand that no standard can cover all potential situations, we offer two examples to illustrate our concern about the completeness of these definitions or whether additional guidance to address transactions that may have attributes of sever ...

The Scope of Business Today - University of Hawaii at Hilo

... Smaller, less developed countries – Any company with 100 or fewer employees ...

... Smaller, less developed countries – Any company with 100 or fewer employees ...

TYPES OF MERGERS LONG-FORM FREEZEOUT MERGER

... leveraged recapitalization: change of capital structure, usually substitute debt for equity, eg take on significant debt with purpose of either paying large cash dividend to shareholders or repurchasing shares SHARE REPURCHASE (“GREENMAIL”) ...

... leveraged recapitalization: change of capital structure, usually substitute debt for equity, eg take on significant debt with purpose of either paying large cash dividend to shareholders or repurchasing shares SHARE REPURCHASE (“GREENMAIL”) ...

Customers benefit from the merger

... For seller, watch for inconsistency between antitrust clearance conditions and generally worded conditions on “absence of litigation” or “no contravention of law” ...

... For seller, watch for inconsistency between antitrust clearance conditions and generally worded conditions on “absence of litigation” or “no contravention of law” ...

Topic 4 – Why do share prices fluctuate?

... in term deposits. This might feel safer, but inflation is the real enemy here which can decimate the spending power of your savings over time. Remove the need to time the market The price you pay for shares, property, bonds and currencies has a big impact on your future returns. However, trying to p ...

... in term deposits. This might feel safer, but inflation is the real enemy here which can decimate the spending power of your savings over time. Remove the need to time the market The price you pay for shares, property, bonds and currencies has a big impact on your future returns. However, trying to p ...

Companies and their products

... of the products, or actually owns the company. These are known as Parent Companies, and will be KEY to the Stock Market. Write down Parent Companies & Ticker Symbol (if traded). ...

... of the products, or actually owns the company. These are known as Parent Companies, and will be KEY to the Stock Market. Write down Parent Companies & Ticker Symbol (if traded). ...

Case 1

... bought and sold. The prices of these shares will be determined by demand and supply. A public limited company must hold an annual shareholders’ meeting. Private limited companies. Private limited companies cannot offer their shares publicly. Shares have to be sold privately. This makes it more diffi ...

... bought and sold. The prices of these shares will be determined by demand and supply. A public limited company must hold an annual shareholders’ meeting. Private limited companies. Private limited companies cannot offer their shares publicly. Shares have to be sold privately. This makes it more diffi ...

Written exam 2008 spring

... a) When are the P/S-ratio better to use than the P/E-ratio? When the company has has negative earnings b) When is the relative valuation approach easiest to use? • This approach is easiest to use when: – There are a large number of assets comparable to the one being valued – These assets are priced ...

... a) When are the P/S-ratio better to use than the P/E-ratio? When the company has has negative earnings b) When is the relative valuation approach easiest to use? • This approach is easiest to use when: – There are a large number of assets comparable to the one being valued – These assets are priced ...

Industrial Expansion after the Civil War

... • Firms could also grow large to increase monopoly power. (Ability to set price above marginal cost) • Firms could also achieve power to set price above marginal cost through price fixing agreements. – If there are no economies of scale this would be cheaper than increasing firm size either through ...

... • Firms could also grow large to increase monopoly power. (Ability to set price above marginal cost) • Firms could also achieve power to set price above marginal cost through price fixing agreements. – If there are no economies of scale this would be cheaper than increasing firm size either through ...

Easing Creeping Acquisition Norm

... Therefore, while the SEBI has given the window to promoters to consolidate their shareholding beyond 55%, it has, by subjecting consolidation beyond 55% strictly to open market purchases, tried to ensure that such consolidation does not block the retail shareholders window to exit. In an exclusive i ...

... Therefore, while the SEBI has given the window to promoters to consolidate their shareholding beyond 55%, it has, by subjecting consolidation beyond 55% strictly to open market purchases, tried to ensure that such consolidation does not block the retail shareholders window to exit. In an exclusive i ...

View Abstract

... The North American electricity and gas utility industries are experiencing another wave of significant merger and acquisition (M&A) activity, driven in the short term by high stock prices and valuable financial currency. Over the longer term, the need to reduce costs and improve access to large amou ...

... The North American electricity and gas utility industries are experiencing another wave of significant merger and acquisition (M&A) activity, driven in the short term by high stock prices and valuable financial currency. Over the longer term, the need to reduce costs and improve access to large amou ...

A. Returns to targets

... affect the outcome of the takeover bid. If the bid is going to succeed, no stockholder will sell unless he is offered at least the post-takeover value of his stock. Consequently, the raider cannot purchase a share unless he pays at least what the share is worth to him if the bid succeeds. The idea b ...

... affect the outcome of the takeover bid. If the bid is going to succeed, no stockholder will sell unless he is offered at least the post-takeover value of his stock. Consequently, the raider cannot purchase a share unless he pays at least what the share is worth to him if the bid succeeds. The idea b ...

Growth of Firms - GillmonBusinessStudies

... Advantages • It reduces competition, thus increases market share • Increase in market power • It has greater control on prices to make more profit • Gain new ideas from the other business • As its scale of operations is greater, it may experience economies of scale (decrease in average costs=effici ...

... Advantages • It reduces competition, thus increases market share • Increase in market power • It has greater control on prices to make more profit • Gain new ideas from the other business • As its scale of operations is greater, it may experience economies of scale (decrease in average costs=effici ...

Dr. John*s Products, Ltd. Case Study

... Patent will not prevent other companies from developing similar tooth brushes since the patent is specific to angles and motions ...

... Patent will not prevent other companies from developing similar tooth brushes since the patent is specific to angles and motions ...

Chapter 5 The Free Enterprise System

... trademark A word, name, symbol, sound, brand name, brand mark, trade name, trade character, color, or a combination of these elements that identifies a good or service and cannot be used by anyone but the owner because it is registered with the federal government and has legal protection. (p. 114) c ...

... trademark A word, name, symbol, sound, brand name, brand mark, trade name, trade character, color, or a combination of these elements that identifies a good or service and cannot be used by anyone but the owner because it is registered with the federal government and has legal protection. (p. 114) c ...

International Financial Management

... of a hostile takeover for inefficient companies, the linkage between executive compensation and share price performance, and institutional investors' activism. c. US corporate governance is market, arm's-length transaction oriented, while Japan's corporate governance is bank, close ...

... of a hostile takeover for inefficient companies, the linkage between executive compensation and share price performance, and institutional investors' activism. c. US corporate governance is market, arm's-length transaction oriented, while Japan's corporate governance is bank, close ...

Corporate Financing

... M & A means a change in management, and also is usually accompanied with an Increased Indebtedness(D/E ratio): Debts have become even more important in corporate financing. ...

... M & A means a change in management, and also is usually accompanied with an Increased Indebtedness(D/E ratio): Debts have become even more important in corporate financing. ...

Advanced Accounting by Hoyle et al, 6th Edition

... The Consolidation Worksheet 1. Parent prepares the allocation of the FV, including calculation of gain or goodwill. 2. The financial information for Parent and Sub are recorded in the first two columns of the worksheet (with Sub’s prior revenue and expense already closed). 3. Remove the Sub’s equity ...

... The Consolidation Worksheet 1. Parent prepares the allocation of the FV, including calculation of gain or goodwill. 2. The financial information for Parent and Sub are recorded in the first two columns of the worksheet (with Sub’s prior revenue and expense already closed). 3. Remove the Sub’s equity ...

Chapter 11: Structuring the Deal--Payment and Legal Considerations

... The chapter also will address the interrelatedness of payment, legal, and tax forms by illustrating how decisions made in one area affect other aspects of the overall deal structure. The focus in this chapter is on the form of payment, form of acquisition, and alternative forms of legal structures i ...

... The chapter also will address the interrelatedness of payment, legal, and tax forms by illustrating how decisions made in one area affect other aspects of the overall deal structure. The focus in this chapter is on the form of payment, form of acquisition, and alternative forms of legal structures i ...

Gains From Acquisitions

... A second way to acquire another firm is to simply purchase the firm’s voting stock in exchange for cash, shares of stock, or other securities. A tender offer (ie. public offer to buy shares) is made by one firm directly to the shareholders of another firm. If the shareholders choose to accept the of ...

... A second way to acquire another firm is to simply purchase the firm’s voting stock in exchange for cash, shares of stock, or other securities. A tender offer (ie. public offer to buy shares) is made by one firm directly to the shareholders of another firm. If the shareholders choose to accept the of ...

1 REVISION 2 I WHAT ARE THE OPPOSITES? income

... 4. L__________ means that a company has enough cash or assets that can easily be turned into cash to cover its liabilities. 5. C_______ o________ include purchases of fixed and financial assets, running expenses, interest payments, taxation and payment of dividends. 6. Listed companies have to a____ ...

... 4. L__________ means that a company has enough cash or assets that can easily be turned into cash to cover its liabilities. 5. C_______ o________ include purchases of fixed and financial assets, running expenses, interest payments, taxation and payment of dividends. 6. Listed companies have to a____ ...

CHAPTER 7 STRATEGIC ACQUISITION AND

... Two firms agree to integrate their operations on a relatively co-equal basis ...

... Two firms agree to integrate their operations on a relatively co-equal basis ...

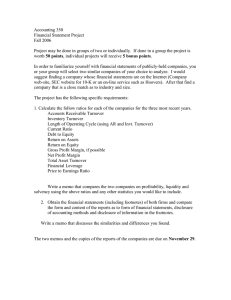

Accounting 350 Financial Statement Project Fall 2006

... Project may be done in groups of two or individually. If done in a group the project is worth 50 points, individual projects will receive 5 bonus points. In order to familiarize yourself with financial statements of publicly-held companies, you or your group will select two similar companies of your ...

... Project may be done in groups of two or individually. If done in a group the project is worth 50 points, individual projects will receive 5 bonus points. In order to familiarize yourself with financial statements of publicly-held companies, you or your group will select two similar companies of your ...

Bucharest-Dec9-Presentazione EIBA panel COST

... Emerging market firms’ international experience and home-country characteristics are key determinants of acquisition behavior Better CSAs, broader and diverse sources of knowledge positively ...

... Emerging market firms’ international experience and home-country characteristics are key determinants of acquisition behavior Better CSAs, broader and diverse sources of knowledge positively ...

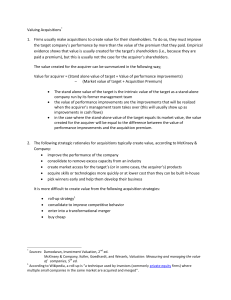

Valuing Acquisitions* 1. Firms usually make acquisitions to create

... share (higher growth), or longer high growth period. McKinsey & Company find that companies are better at estimating cost savings than revenue enhancements. Financial synergies can come from an increase in debt capacity, tax benefits, and mergers between firms with excess cash (low growth opportunit ...

... share (higher growth), or longer high growth period. McKinsey & Company find that companies are better at estimating cost savings than revenue enhancements. Financial synergies can come from an increase in debt capacity, tax benefits, and mergers between firms with excess cash (low growth opportunit ...