Corporate Finance Vocabulary

... oversight. The chief executive officer (CEO) of the corporation reports to the board. The chair of the board may or may not be the CEO. The Board of Directors is typically comprised of people from both without and within the corporation. Stockholders- Owners of the corporation. Stock- Shares of owne ...

... oversight. The chief executive officer (CEO) of the corporation reports to the board. The chair of the board may or may not be the CEO. The Board of Directors is typically comprised of people from both without and within the corporation. Stockholders- Owners of the corporation. Stock- Shares of owne ...

Mergers and Acquisitions

... Reducing Capital Needs • A merger may reduce the required investment in working capital and fixed assets relative to the two firms operating separately • Firms may be able to manage existing assets more effectively under one umbrella • Some assets may be sold if they are redundant in the combined fi ...

... Reducing Capital Needs • A merger may reduce the required investment in working capital and fixed assets relative to the two firms operating separately • Firms may be able to manage existing assets more effectively under one umbrella • Some assets may be sold if they are redundant in the combined fi ...

Office of the Registrar of Joint Stock Companies and Firms 1 Kawran

... The detailed TOR will be supplied during issue of RFP ...

... The detailed TOR will be supplied during issue of RFP ...

Determining the Price - FPSS

... Money left over after all expenses are paid is earned and be kept by the owners. Ex. HMV buys the CD for $15 from the DVD manufacturer and decides to sell it for $25. The margin is (15 ÷ 25) x 100 = 60% Margin ...

... Money left over after all expenses are paid is earned and be kept by the owners. Ex. HMV buys the CD for $15 from the DVD manufacturer and decides to sell it for $25. The margin is (15 ÷ 25) x 100 = 60% Margin ...

CHAPTER 13

... A Mutual fund pools the funds of many people; the managers of the fund invest the money in a diversified portfolio of securities and try to achieve some stated objective; like long-term growth of capital or high current income or perhaps only modest current income but minimum risk. Open-end mutula f ...

... A Mutual fund pools the funds of many people; the managers of the fund invest the money in a diversified portfolio of securities and try to achieve some stated objective; like long-term growth of capital or high current income or perhaps only modest current income but minimum risk. Open-end mutula f ...

Answers to Concepts Review and Critical Thinking Questions

... firm believes that improving the safety of the product will only save $20 million in product liability claims. What should the firm do?” 11. The goal will be the same, but the best course of action toward that goal may require adjustments due different social, political, and economic climates. 12. T ...

... firm believes that improving the safety of the product will only save $20 million in product liability claims. What should the firm do?” 11. The goal will be the same, but the best course of action toward that goal may require adjustments due different social, political, and economic climates. 12. T ...

FiNaL - Mira Costa High School

... In some counties, laws require retail stores to be closed on Sundays. ...

... In some counties, laws require retail stores to be closed on Sundays. ...

Chapter 7: Principles of Asset Valuation

... Valuation Models The difficulties of finding equivalent assets Valuation models: The quantitative methods used to infer an asset’s value from information about the prices of other comparable assets and market interest rates. ...

... Valuation Models The difficulties of finding equivalent assets Valuation models: The quantitative methods used to infer an asset’s value from information about the prices of other comparable assets and market interest rates. ...

2001 Midterm (with answers)

... 2. Discuss the venture leasing industry, being sure to address the following issues: (a) the target market for venture leasing and benefits to firms using venture leasing as a source of funds; (b) innovations in venture leasing, including “financial leases for intellectual property” (FLIPS), and the ...

... 2. Discuss the venture leasing industry, being sure to address the following issues: (a) the target market for venture leasing and benefits to firms using venture leasing as a source of funds; (b) innovations in venture leasing, including “financial leases for intellectual property” (FLIPS), and the ...

Government_Intervention

... UK regulation – arguments against a “light touch” • Some firms are strategic assets for the UK economy (energy, transport, utilities) - they need to be protected • Increased risk that UK jobs will be lost • Resist takeovers by short-termist investors who don’t have the long-term interests of the bu ...

... UK regulation – arguments against a “light touch” • Some firms are strategic assets for the UK economy (energy, transport, utilities) - they need to be protected • Increased risk that UK jobs will be lost • Resist takeovers by short-termist investors who don’t have the long-term interests of the bu ...

MN50324 M and A game..

... Take-over Bids and the Freerider Problem (Grossman and Hart (1982). - Market value per share under current management = Q. - Market value per share under optimal management = V. Price per share offered by raider = P, with Q < P V. Freerider problem - If shareholder accepts offer, he gets P. If share ...

... Take-over Bids and the Freerider Problem (Grossman and Hart (1982). - Market value per share under current management = Q. - Market value per share under optimal management = V. Price per share offered by raider = P, with Q < P V. Freerider problem - If shareholder accepts offer, he gets P. If share ...

Sumitomo Corporation Announces the Exercise Price of Stock Options

... rights shall be determined by multiplying the price paid per share issuable upon the exercise of the new share acquisition rights (hereinafter “Exercise Price”) by the number of shares subject to such new share acquisition rights. The Exercise Price shall be JPY 1,124. When the Company issues new sh ...

... rights shall be determined by multiplying the price paid per share issuable upon the exercise of the new share acquisition rights (hereinafter “Exercise Price”) by the number of shares subject to such new share acquisition rights. The Exercise Price shall be JPY 1,124. When the Company issues new sh ...

True Value and the Great I Am

... market demand. As our readers know, we believed the spike had more to do with "fund flows gone wild" or the desire from many to own an asset class that was working. A few months later, oil had plunged to $90 as these emerging economies didn't seem so impervious to the economic cycle. Similarly in re ...

... market demand. As our readers know, we believed the spike had more to do with "fund flows gone wild" or the desire from many to own an asset class that was working. A few months later, oil had plunged to $90 as these emerging economies didn't seem so impervious to the economic cycle. Similarly in re ...

Venture capital, IPOs, and Seasoned Offerings

... Shelf Registration - A procedure that allows firms to file one registration statement for several issues of the same security. Private Placement - Sale of securities to a limited number of investors without a public offering. ...

... Shelf Registration - A procedure that allows firms to file one registration statement for several issues of the same security. Private Placement - Sale of securities to a limited number of investors without a public offering. ...

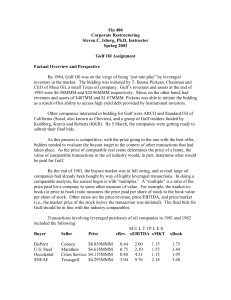

Factual Overview and Perspective

... Factual Overview and Perspective By 1984, Gulf Oil was on the verge of being “put into play” by leveraged investors in the market. The bidding was initiated by T. Boone Pickens, Chairman and CEO of Mesa Oil, a small Texas oil company. Gulf’s revenues and assets at the end of 1983 were $6.50MMM and $ ...

... Factual Overview and Perspective By 1984, Gulf Oil was on the verge of being “put into play” by leveraged investors in the market. The bidding was initiated by T. Boone Pickens, Chairman and CEO of Mesa Oil, a small Texas oil company. Gulf’s revenues and assets at the end of 1983 were $6.50MMM and $ ...

FIN432 - CSUN.edu

... a commitment to maintain a continuous primary market for listed issues. managing a syndicate for distribution on a firm-price (dealer) or best-efforts (broker) basis. helping maintain an after market for OTC issues. ...

... a commitment to maintain a continuous primary market for listed issues. managing a syndicate for distribution on a firm-price (dealer) or best-efforts (broker) basis. helping maintain an after market for OTC issues. ...

Highlights of Chapters 19, 16, 33, and 25

... Using the after-tax WACC to value a new project. If the firm is considering a project just as risky as the firm's existing assets and the firm plans to keep the same debt / equity ratio, then the firm can value the new project at the after-tax WACC. Example: Project cash flows: -$100 at t = 0, and ...

... Using the after-tax WACC to value a new project. If the firm is considering a project just as risky as the firm's existing assets and the firm plans to keep the same debt / equity ratio, then the firm can value the new project at the after-tax WACC. Example: Project cash flows: -$100 at t = 0, and ...

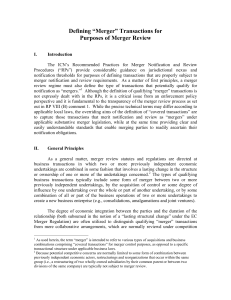

Defining “Merger” - International Competition Network

... business assets are almost universally viewed as qualifying transactions for merger review purposes. Many jurisdictions also cover asset purchases even though they may not constitute all or substantially all of the seller’s assets. Here, there is no question that there has been a change in control o ...

... business assets are almost universally viewed as qualifying transactions for merger review purposes. Many jurisdictions also cover asset purchases even though they may not constitute all or substantially all of the seller’s assets. Here, there is no question that there has been a change in control o ...

INTERPRETATION AND METHODOLOGY Financial ratios Return

... 2. The ratios are calculated using the data from the last published Audited financial reports and last paid dividend. If the companies according to the requirements of Law, are preparing consolidated financial statements, for calculation of the ratios data from the consolidated statements will be us ...

... 2. The ratios are calculated using the data from the last published Audited financial reports and last paid dividend. If the companies according to the requirements of Law, are preparing consolidated financial statements, for calculation of the ratios data from the consolidated statements will be us ...

Ch 17 Oligopoly - Intro

... Oligopolies - Characteristics • Businesses that are part of an oligopoly share some common characteristics: • They are less concentrated than in a monopoly, but more concentrated than in a competitive system. ...

... Oligopolies - Characteristics • Businesses that are part of an oligopoly share some common characteristics: • They are less concentrated than in a monopoly, but more concentrated than in a competitive system. ...

Ch 17 Oligopoly - Intro

... Oligopolies - Characteristics • Businesses that are part of an oligopoly share some common characteristics: • They are less concentrated than in a monopoly, but more concentrated than in a competitive system. ...

... Oligopolies - Characteristics • Businesses that are part of an oligopoly share some common characteristics: • They are less concentrated than in a monopoly, but more concentrated than in a competitive system. ...

item[`#file`]->filename - Open Michigan

... used in accordance with U.S. law. Copyright holders of content included in this material should contact [email protected] with any questions, corrections, or clarifications regarding the use of content. The Regents of the University of Michigan do not license the use of third party content pos ...

... used in accordance with U.S. law. Copyright holders of content included in this material should contact [email protected] with any questions, corrections, or clarifications regarding the use of content. The Regents of the University of Michigan do not license the use of third party content pos ...

A Briefing for Owners of Middle Market Companies on Private Equity

... Many owners of middle market companies are relatively unfamiliar with the workings of private equity (PE) firms, and are therefore at a disadvantage when considering how and when private equity firms might be right for the potential sale of their business. Whether or not a potential sale of the busi ...

... Many owners of middle market companies are relatively unfamiliar with the workings of private equity (PE) firms, and are therefore at a disadvantage when considering how and when private equity firms might be right for the potential sale of their business. Whether or not a potential sale of the busi ...

![item[`#file`]->filename - Open Michigan](http://s1.studyres.com/store/data/020885087_1-d710d7cc1db60d2aaa7f3f828c06596e-300x300.png)