MBA 661 Debate 4

... may hurt stockholders across the entire market. Finally this may also cause corporations to stop issuing stock options all together. If this were to happen, new entrepreneurial companies would have a very difficult time in attracting the most talented executives from their industries, without alread ...

... may hurt stockholders across the entire market. Finally this may also cause corporations to stop issuing stock options all together. If this were to happen, new entrepreneurial companies would have a very difficult time in attracting the most talented executives from their industries, without alread ...

Financial Value of Brands in Mergers and Acquisitions: Is Value in

... was attributed to brands with the purchase of Gillette, and at other end, less than 1.51% was attributed to the brand value in the acquisition of Latitude by Cisco Systems. What is the source of heterogeneity in the target firms’ brand value across M&As? The extant marketing literature suggests that ...

... was attributed to brands with the purchase of Gillette, and at other end, less than 1.51% was attributed to the brand value in the acquisition of Latitude by Cisco Systems. What is the source of heterogeneity in the target firms’ brand value across M&As? The extant marketing literature suggests that ...

Chapter 11 Dividend Policy

... generated from more efficient management of trade receivables, inventory, cash and ...

... generated from more efficient management of trade receivables, inventory, cash and ...

Building the Founding Team

... performance, and results over time • Sharing of the harvest – 10 – 20% of “winnings” is frequently set aside to distribute to key employees; characteristic of the most successful ...

... performance, and results over time • Sharing of the harvest – 10 – 20% of “winnings” is frequently set aside to distribute to key employees; characteristic of the most successful ...

To Our Shareholders Notice of Convocation of the 10th Ordinary

... to grow steadily as planned and have increased by 2.2 times compared to budget, in particular, because the Company received a purchase order from Eisai Korea in connection with their change of packaging facility in FY 2014, and recognized the related sales revenue originally expected in FY 2015. (ii ...

... to grow steadily as planned and have increased by 2.2 times compared to budget, in particular, because the Company received a purchase order from Eisai Korea in connection with their change of packaging facility in FY 2014, and recognized the related sales revenue originally expected in FY 2015. (ii ...

LIGHT MANAGEMENT GROUP INC (Form: DEF 14C, Received: 02

... Custodian of the Corporation and I became the sole director of the Board of Directors of the Corporation. The court charged me with powers to take control of the Corporation, assume the position of Sole director, and oversee reorganization and revitalization of the Corporation into an active corpora ...

... Custodian of the Corporation and I became the sole director of the Board of Directors of the Corporation. The court charged me with powers to take control of the Corporation, assume the position of Sole director, and oversee reorganization and revitalization of the Corporation into an active corpora ...

Capital stock

... • If a sale of treasury stock (below cost) would make this account have a debit balance, the difference is debited to Retained Earnings. • Smart Touch Learning resells an additional 200 shares of common stock for $4.50 each. Assume they were purchased at $5 and the balance in paid-in capital from tr ...

... • If a sale of treasury stock (below cost) would make this account have a debit balance, the difference is debited to Retained Earnings. • Smart Touch Learning resells an additional 200 shares of common stock for $4.50 each. Assume they were purchased at $5 and the balance in paid-in capital from tr ...

Equal opportunity rule vs. market rule in transfer of control - Hal-SHS

... US acquisitions. Unfortunately these two studies do not address the question of the possible effect of the EOR rule. ...

... US acquisitions. Unfortunately these two studies do not address the question of the possible effect of the EOR rule. ...

Chapter 5

... – Explanatory notes disclosing changes in account procedures, or significant events occurring after balance sheet dates ...

... – Explanatory notes disclosing changes in account procedures, or significant events occurring after balance sheet dates ...

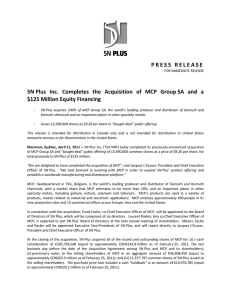

5N Plus Completes the Acquisition of MCP Group SA and a $125

... Using the closing price of 5N Plus’ shares on the Toronto Stock Exchange on Friday, February 25, 2011 ($8.00) and the Euro to Canadian noon dollar exchange rate of 1.3494 on that date, the total consideration for the acquisition of MCP is approximately €235.2 million or CDN$317.3 million. In add ...

... Using the closing price of 5N Plus’ shares on the Toronto Stock Exchange on Friday, February 25, 2011 ($8.00) and the Euro to Canadian noon dollar exchange rate of 1.3494 on that date, the total consideration for the acquisition of MCP is approximately €235.2 million or CDN$317.3 million. In add ...

Vivint Solar, Inc.

... results, levels of activity, performance or events and circumstances reflected in those statements will be achieved or will occur, and actual results could differ materially from those anticipated or implied in the forward-looking statements. Except as required by law, Vivint Solar does not undertak ...

... results, levels of activity, performance or events and circumstances reflected in those statements will be achieved or will occur, and actual results could differ materially from those anticipated or implied in the forward-looking statements. Except as required by law, Vivint Solar does not undertak ...

Yield Curve Targeting

... 1/ Policy clarity—Fed’s foray into yield curve control stemmed from unclear policy objectives ...

... 1/ Policy clarity—Fed’s foray into yield curve control stemmed from unclear policy objectives ...

Recap - VULMS.edu.pk

... • Regardless of which type of lease you choose, the future expected value of the equipment (the residual value) is considered when pricing most types of leases. The residual value is the lesson’s estimate today of the equipment's value when the lease term ends. ...

... • Regardless of which type of lease you choose, the future expected value of the equipment (the residual value) is considered when pricing most types of leases. The residual value is the lesson’s estimate today of the equipment's value when the lease term ends. ...

Trendsetter barometer® Business outlook

... trouble for insiders. US economic fundamentals remain strong, but markets and executives like predictability, and that’s not what we’ve been getting lately. In our 20 years of surveying Trendsetter executives, we’ve had lots of opportunities to see how they respond to extremes — and this is often a ...

... trouble for insiders. US economic fundamentals remain strong, but markets and executives like predictability, and that’s not what we’ve been getting lately. In our 20 years of surveying Trendsetter executives, we’ve had lots of opportunities to see how they respond to extremes — and this is often a ...

Factors to consider in a partnership or shareholders

... these types of agreements, it is recommended that any final documentation be drafted and settled by a registered legal practitioner. This guide is not intended to be exhaustive, nor complete. The following is provided for information and reference purposes only. This guide considers legislation rele ...

... these types of agreements, it is recommended that any final documentation be drafted and settled by a registered legal practitioner. This guide is not intended to be exhaustive, nor complete. The following is provided for information and reference purposes only. This guide considers legislation rele ...

DETERMINANTS OF FIRMS` BANKRUPTCY: THE CASE OF

... Next, we define independent variables – determinants of enterprise bankruptcy. We use statements of both financial position and income statement, to create these variables. Comprehensive list of variable should possess high predictive quality. After creating all variables I use the multi-period prob ...

... Next, we define independent variables – determinants of enterprise bankruptcy. We use statements of both financial position and income statement, to create these variables. Comprehensive list of variable should possess high predictive quality. After creating all variables I use the multi-period prob ...

Thrivent Investment Management Inc. Statement of Financial

... indemnifications cannot be estimated, however, the Company believes that it is unlikely it will have to make material payments under these arrangements and has not recorded a contingent liability in the financial statements for any indemnifications. The Company is involved in the normal course of bu ...

... indemnifications cannot be estimated, however, the Company believes that it is unlikely it will have to make material payments under these arrangements and has not recorded a contingent liability in the financial statements for any indemnifications. The Company is involved in the normal course of bu ...

Choices and Best Practice in Corporate Risk Management Disclosure

... their disclosure method, our investigation also attempts to evaluate, at least to some extent, the quality of the disclosure given the method selected. To this point, our inspection of 10K risk disclosures revealed a large variation in the quality of companies’ disclosures. In the next section, we b ...

... their disclosure method, our investigation also attempts to evaluate, at least to some extent, the quality of the disclosure given the method selected. To this point, our inspection of 10K risk disclosures revealed a large variation in the quality of companies’ disclosures. In the next section, we b ...

Access to finance, working capital management and company value

... capital structure, dividends or company valuation decisions. However, short-term assets and liabilities are important components of the total assets of a company and also need to be carefully analyzed. The management of these short-term assets and liabilities warrants careful analysis, considering t ...

... capital structure, dividends or company valuation decisions. However, short-term assets and liabilities are important components of the total assets of a company and also need to be carefully analyzed. The management of these short-term assets and liabilities warrants careful analysis, considering t ...

What to Know About Prime Funds

... Prime funds of the future will look and feel quite similar to today’s funds. They will continue to be subject to Rule 2a-7 and retain cash / cash equivalent accounting status. Funds that carry ratings from ratings agencies will likely continue to do so. Standard & Poor’s (S&P) has stated fund rating ...

... Prime funds of the future will look and feel quite similar to today’s funds. They will continue to be subject to Rule 2a-7 and retain cash / cash equivalent accounting status. Funds that carry ratings from ratings agencies will likely continue to do so. Standard & Poor’s (S&P) has stated fund rating ...

CanWel Building Materials Group Ltd. Consolidated Financial

... consolidated financial statements. The procedures selected depend on the auditors’ judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditors consider internal contro ...

... consolidated financial statements. The procedures selected depend on the auditors’ judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditors consider internal contro ...

Formulas Ratios and Indexes Used in Banks

... shares) at a special price. The subscription rights must be negotiable, since not every shareholder owns exacctly as many shares as are needed to purchase one or more new shares and since not every shareholder wants to exercise his subscription rights. The value of a subscription right is calculated ...

... shares) at a special price. The subscription rights must be negotiable, since not every shareholder owns exacctly as many shares as are needed to purchase one or more new shares and since not every shareholder wants to exercise his subscription rights. The value of a subscription right is calculated ...

RAIN-2013-Term

... Common Stock at any time while the Note is outstanding, at the option of the Investor. The Note will convert into that number of shares of the Company’s Common Stock equal to the quotient obtained by dividing (i) the aggregate amount of principal and accrued interest due under this Note, by (ii) the ...

... Common Stock at any time while the Note is outstanding, at the option of the Investor. The Note will convert into that number of shares of the Company’s Common Stock equal to the quotient obtained by dividing (i) the aggregate amount of principal and accrued interest due under this Note, by (ii) the ...

Introduction to Managerial Finance

... All managers in the firm, regardless of their job descriptions, work with financial personnel to justify laborpower requirements, negotiate operating budgets, deal with financial performance appraisals, and sell proposals at least partly on the basis of their financial merits. Clearly, those manager ...

... All managers in the firm, regardless of their job descriptions, work with financial personnel to justify laborpower requirements, negotiate operating budgets, deal with financial performance appraisals, and sell proposals at least partly on the basis of their financial merits. Clearly, those manager ...