CHAPTER 02 AA Accounting for Business

... The four financial statements and their purposes are: 1. Income statement — describes a company’s revenues and expenses along with the resulting net income or loss over a period of time due to earnings activities. 2. Statement of retained earnings— explains changes in equity from net income (or loss ...

... The four financial statements and their purposes are: 1. Income statement — describes a company’s revenues and expenses along with the resulting net income or loss over a period of time due to earnings activities. 2. Statement of retained earnings— explains changes in equity from net income (or loss ...

2015 President`s Letter - Constellation Software, Inc.

... some third party add-on product businesses that might sell well into their installed base. We have tended to be more sceptical of such cross-selling synergies, perhaps because the investment decision-making has not historically been at the BU manager level. A lesson from JKHY, is that we may have be ...

... some third party add-on product businesses that might sell well into their installed base. We have tended to be more sceptical of such cross-selling synergies, perhaps because the investment decision-making has not historically been at the BU manager level. A lesson from JKHY, is that we may have be ...

Background - Gunderson Dettmer

... Therefore, the valuation of the Common Stock is critical. If Section 409A applies to an option, then the terms of the option must limit exercises to certain times or window periods specified at the time of grant.2 Otherwise, the optionee is taxable at the end of each year in which an increment of th ...

... Therefore, the valuation of the Common Stock is critical. If Section 409A applies to an option, then the terms of the option must limit exercises to certain times or window periods specified at the time of grant.2 Otherwise, the optionee is taxable at the end of each year in which an increment of th ...

control premiums and the eeeectiveness oe corporate governance

... But this method of evaluating corporate governance systems clearly has limitations. One concem is the possibility that companies that choose to have multiple classes of stock are fundamentally different from other publicly traded companies in those countries. But perhaps even more limiting is the fa ...

... But this method of evaluating corporate governance systems clearly has limitations. One concem is the possibility that companies that choose to have multiple classes of stock are fundamentally different from other publicly traded companies in those countries. But perhaps even more limiting is the fa ...

The Use of Financial Ratios in Predicting Corporate Failure in Sri

... business. M. Cash flow from operations to current liabilities (CFFOCL) Operating cash flow is a measure of how much cash a company has on hand, while current liabilities show expenses it must pay in the near future. The operating cash flow ratio thus shows a company's ability to meet these liabiliti ...

... business. M. Cash flow from operations to current liabilities (CFFOCL) Operating cash flow is a measure of how much cash a company has on hand, while current liabilities show expenses it must pay in the near future. The operating cash flow ratio thus shows a company's ability to meet these liabiliti ...

Portfolio Adjustment Costs and Asset Price Volatility with

... costs generate a wedge between buying and selling prices, i.e. the buyer has to pay more for the asset and the seller receives less, thus decreasing the incentive to trade on markets with transaction costs. In general, these studies find that transaction costs have only a limited effect on asset pri ...

... costs generate a wedge between buying and selling prices, i.e. the buyer has to pay more for the asset and the seller receives less, thus decreasing the incentive to trade on markets with transaction costs. In general, these studies find that transaction costs have only a limited effect on asset pri ...

New York REIT, Inc. (Form: DFAN14A, Received: 10

... Partners, L.P. (“Winthrop”), have delivered to New York REIT, Inc. (NYSE: NYRT) (the “Company”) a proposal to be appointed as the replacement advisor for the Company in connection with the Company’s proposed plan of liquidation. WW Investors’ proposal is to manage the Company during its proposed liq ...

... Partners, L.P. (“Winthrop”), have delivered to New York REIT, Inc. (NYSE: NYRT) (the “Company”) a proposal to be appointed as the replacement advisor for the Company in connection with the Company’s proposed plan of liquidation. WW Investors’ proposal is to manage the Company during its proposed liq ...

Form 51-102F1 KOKOMO ENTERPRISES INC. Forward

... concessions and Arqueana’s real estate (“Arqueana’s Assets”). Pursuant to the LOI, the parties have agreed to enter into a Definitive Property Option Agreement within a period of 60 business days whereby the Company shall have the right to acquire up to a 75% right, title and interest in Arqueana’s ...

... concessions and Arqueana’s real estate (“Arqueana’s Assets”). Pursuant to the LOI, the parties have agreed to enter into a Definitive Property Option Agreement within a period of 60 business days whereby the Company shall have the right to acquire up to a 75% right, title and interest in Arqueana’s ...

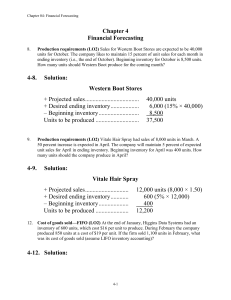

Chapter 4

... The firm is expecting a 20 percent increase in sales next year, and management is concerned about the company's need for external funds. The increase in sales is expected to be carried out without any expansion of fixed assets, but rather through more efficient asset utilization in the existing stor ...

... The firm is expecting a 20 percent increase in sales next year, and management is concerned about the company's need for external funds. The increase in sales is expected to be carried out without any expansion of fixed assets, but rather through more efficient asset utilization in the existing stor ...

Ch_2

... • Refers to the ease and quickness with which assets can be converted to cash—without a significant loss in value • Current assets are the most liquid. • Some fixed assets are intangible. • The more liquid a firm’s assets, the less likely the firm is to experience problems meeting short-term obligat ...

... • Refers to the ease and quickness with which assets can be converted to cash—without a significant loss in value • Current assets are the most liquid. • Some fixed assets are intangible. • The more liquid a firm’s assets, the less likely the firm is to experience problems meeting short-term obligat ...

M1 TSE Natural Resources Chapter 3 (Market Economies)

... When turning to market economies, we have to consider systems of more or less decentralized decisions made by individual agents over time. As is well known, the time dimension of the decision problems faced by the agents, firms or resource consumers, may produce coordination difficulties to the real ...

... When turning to market economies, we have to consider systems of more or less decentralized decisions made by individual agents over time. As is well known, the time dimension of the decision problems faced by the agents, firms or resource consumers, may produce coordination difficulties to the real ...

Corporate Payout Policy and Product Market Competition

... dividends and repurchase shares to mitigate the potential agency costs generated by the lack of competitive pressure from the product market. ...

... dividends and repurchase shares to mitigate the potential agency costs generated by the lack of competitive pressure from the product market. ...

North American Architectural Coatings: The End

... allow PPG to compete much more effectively with Sherwin-Williams. The acquisition also appears timely, with recent data pointing to a steady recovery building in the North American housing market. For Akzo Nobel, the divestiture unloads an unprofitable business and provides capital that can be alloc ...

... allow PPG to compete much more effectively with Sherwin-Williams. The acquisition also appears timely, with recent data pointing to a steady recovery building in the North American housing market. For Akzo Nobel, the divestiture unloads an unprofitable business and provides capital that can be alloc ...

BIOPHARMX CORPORATION Related Party Transactions Policy As

... required to be reported in the Company’s proxy statement under Item 402 of Regulation S-K; c. Any transaction with another company at which a Related Person’s only relationship is as an employee (other than an executive officer), director or beneficial owner of less than 10% of that company’s shares ...

... required to be reported in the Company’s proxy statement under Item 402 of Regulation S-K; c. Any transaction with another company at which a Related Person’s only relationship is as an employee (other than an executive officer), director or beneficial owner of less than 10% of that company’s shares ...

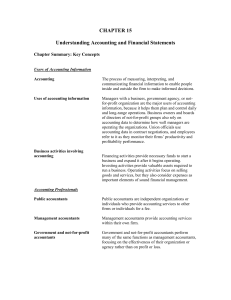

CHAPTER 15 Understanding Accounting and Financial

... The statement of owners’ equity shows the components of the change in owners’ equity from the end of the prior year to the end of the current year. ...

... The statement of owners’ equity shows the components of the change in owners’ equity from the end of the prior year to the end of the current year. ...

Chap 18 - CSUN.edu

... • Printing and clerical costs • Legal and accounting fees • Promotional costs Share issue costs reduce net proceeds from selling shares, resulting in a lower amount of additional paid-in capital. ...

... • Printing and clerical costs • Legal and accounting fees • Promotional costs Share issue costs reduce net proceeds from selling shares, resulting in a lower amount of additional paid-in capital. ...

Chapter Summary (continued) Purchases returns and allowances

... © 2006 The McGraw-Hill Companies, Inc., All Rights Reserved. ...

... © 2006 The McGraw-Hill Companies, Inc., All Rights Reserved. ...

Real Industry, Inc. (Form: 8-K, Received: 07/15/2015

... statements about the Company’s long-term investment decisions, further acquisitions, potential de-leveraging and expansion and business strategies; anticipated growth opportunities; the amount of capital-raising necessary to achieve those strategies; utilization of federal net operating loss tax car ...

... statements about the Company’s long-term investment decisions, further acquisitions, potential de-leveraging and expansion and business strategies; anticipated growth opportunities; the amount of capital-raising necessary to achieve those strategies; utilization of federal net operating loss tax car ...

Report of the Executive Board

... Report of the Executive Board Report of the Executive Board on Items 6 and 7 of the Agenda pursuant to §§ 203 Para. 2 in conjunction with § 186 Para. 4 Sentence 2 Stock Corporation Act (AktG) (in conjunction with Article 9 Para. 1 Letter c) ii) of the SE Regulation) The company most recently adopted ...

... Report of the Executive Board Report of the Executive Board on Items 6 and 7 of the Agenda pursuant to §§ 203 Para. 2 in conjunction with § 186 Para. 4 Sentence 2 Stock Corporation Act (AktG) (in conjunction with Article 9 Para. 1 Letter c) ii) of the SE Regulation) The company most recently adopted ...

1 VALUING PRIVATE FIRMS So far in this book, we

... whereas if we choose to value the firm, we discount cashflows at the cost of capital. While the fundamental definitions of these costs have not changed, the process of estimating them may have to be changed given the special circumstances surrounding private firms. Cost of Equity In assessing the co ...

... whereas if we choose to value the firm, we discount cashflows at the cost of capital. While the fundamental definitions of these costs have not changed, the process of estimating them may have to be changed given the special circumstances surrounding private firms. Cost of Equity In assessing the co ...

Chapter 13

... price of the stock in the “buying range.” Basically, the company cuts the stock price and you get more shares, but retain the same total investment. Stock repurchases -- companies buying back their own stock. Each stockholder owns a larger proportion of the firm. Prentice-Hall, Inc. ...

... price of the stock in the “buying range.” Basically, the company cuts the stock price and you get more shares, but retain the same total investment. Stock repurchases -- companies buying back their own stock. Each stockholder owns a larger proportion of the firm. Prentice-Hall, Inc. ...

Draft Explanatory Memorandum - GST financial

... limited to $50 (one-eleventh of $550) for the first instalment, in the period she actually pays the instalment. Had Melissa been accounting for GST on a non-cash basis she would have been able to claim input tax credit of $300 (one-eleventh of $3,300) in the tax period in which she provided any of t ...

... limited to $50 (one-eleventh of $550) for the first instalment, in the period she actually pays the instalment. Had Melissa been accounting for GST on a non-cash basis she would have been able to claim input tax credit of $300 (one-eleventh of $3,300) in the tax period in which she provided any of t ...

Strategic Management-An Introduction [ppt]

... as to achieve better performance and a competitive advantage for their organization. An organization is said to have competitive advantage if its profitability is higher than the average profitability for all companies in its industry. Strategic management can also be defined as a bundle of decision ...

... as to achieve better performance and a competitive advantage for their organization. An organization is said to have competitive advantage if its profitability is higher than the average profitability for all companies in its industry. Strategic management can also be defined as a bundle of decision ...

IEC ELECTRONICS CORP (Form: DEFA14A

... below per Exchange Act Rules 14a-6(i)(1) and 0-11 (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth th ...

... below per Exchange Act Rules 14a-6(i)(1) and 0-11 (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth th ...

![Strategic Management-An Introduction [ppt]](http://s1.studyres.com/store/data/002368178_1-4d6f847ca530194c6f58dbc984404e70-300x300.png)