discount rates

... Survivorship Bias: Using historical data from the U.S. equity markets over the twentieth century does create a sampling bias. After all, the US economy and equity markets were among the most successful of the global economies that you could have invested in early in the ...

... Survivorship Bias: Using historical data from the U.S. equity markets over the twentieth century does create a sampling bias. After all, the US economy and equity markets were among the most successful of the global economies that you could have invested in early in the ...

Rede ning Financial Constraints: a Text-Based

... investment and issuance policies manage their investment and issuance policies differently. Equity focused constrained firms (and, more so, private placement constrained firms) most severely curtail their R&D, capital expenditures, and equity issues following negative shocks. In contrast, debt focus ...

... investment and issuance policies manage their investment and issuance policies differently. Equity focused constrained firms (and, more so, private placement constrained firms) most severely curtail their R&D, capital expenditures, and equity issues following negative shocks. In contrast, debt focus ...

NBER WORKING PAPER SERIES JUNIOR IS RICH: BEQUESTS AS CONSUMPTION George Constantinides

... earlier. In the third and final period of their lives, as elderly, they consume out of their pension income and savings and themselves leave the residual as a bequest of securities, the value of which is modeled as directly providing them utility. We further refine the behavior of the elderly in a n ...

... earlier. In the third and final period of their lives, as elderly, they consume out of their pension income and savings and themselves leave the residual as a bequest of securities, the value of which is modeled as directly providing them utility. We further refine the behavior of the elderly in a n ...

SME Access to External Finance BIS ECONOMICS PAPER NO. 16 JANUARY 2012

... Debt financing gap for businesses lacking track record and collateral.................................9 Equity Gap for high growth potential SMEs..........................................................................9 A financing gap also exists in the supply of growth capital.................... ...

... Debt financing gap for businesses lacking track record and collateral.................................9 Equity Gap for high growth potential SMEs..........................................................................9 A financing gap also exists in the supply of growth capital.................... ...

NI/Sales ROA

... • Know how to compute and interpret important financial ratios • Be able to develop a financial plan using the percentage of sales approach • Understand how capital structure and dividend policies affect a firm’s ability to grow • Relate corporate loan criteria to personal loan ...

... • Know how to compute and interpret important financial ratios • Be able to develop a financial plan using the percentage of sales approach • Understand how capital structure and dividend policies affect a firm’s ability to grow • Relate corporate loan criteria to personal loan ...

The Changing Chemistry Between Hedge Funds and Investors

... more than HNWIs, who see return enhancement as a greater driver for hedge fund investment. Increasingly, the drive for yield in the era of low interest rates is leading institutional firms into more diverse strategies, so investing in hedge funds has become relatively mainstream. For fund managers, ...

... more than HNWIs, who see return enhancement as a greater driver for hedge fund investment. Increasingly, the drive for yield in the era of low interest rates is leading institutional firms into more diverse strategies, so investing in hedge funds has become relatively mainstream. For fund managers, ...

Leveraged and Inverse ETFs(Slides)

... effects of compounding, so that their risk profiles differ significantly vis-à-vis traditional ETFs Investors should be aware that leveraged and inverse ETFs do not seek to provide returns which are the 2x multiple or -1x inverse of a given index for periods longer than a day. These funds are not s ...

... effects of compounding, so that their risk profiles differ significantly vis-à-vis traditional ETFs Investors should be aware that leveraged and inverse ETFs do not seek to provide returns which are the 2x multiple or -1x inverse of a given index for periods longer than a day. These funds are not s ...

NBER WORKING PAPER SERIES PRIVATE PENSIONS INFLATION Martin Feldstein

... 1 The inflation-induced growth of the assets of pension funds would also be reduced to the extent that households save less in response to the lower real yield on saving or divert saving into nonportfolio assets like housing and land. 2 Joseph Stiglitz (1973) develops an analysis which shows that un ...

... 1 The inflation-induced growth of the assets of pension funds would also be reduced to the extent that households save less in response to the lower real yield on saving or divert saving into nonportfolio assets like housing and land. 2 Joseph Stiglitz (1973) develops an analysis which shows that un ...

Corporate capital structure choice: does

... want to remark that a significant influence of CEO gender on the corporate capital structure may give additional insights for the corporate governance field. A manager’s gender is not a factor that should influence the amount of company’s borrowings and, thus, the riskiness of employed capital. Firs ...

... want to remark that a significant influence of CEO gender on the corporate capital structure may give additional insights for the corporate governance field. A manager’s gender is not a factor that should influence the amount of company’s borrowings and, thus, the riskiness of employed capital. Firs ...

1 - Certified Financial Analyst

... Another recognised authority in this market is the GSE through its regulations aimed at safeguarding the interest of investors. It is also considered as a self-regulatory organisation since its rules and regulations guide its members with regards to transactions conducted on and off the exchange. I ...

... Another recognised authority in this market is the GSE through its regulations aimed at safeguarding the interest of investors. It is also considered as a self-regulatory organisation since its rules and regulations guide its members with regards to transactions conducted on and off the exchange. I ...

Portfolio Optimisation - Hearthstone Investments

... reflects the fact that if Gilts are not held to redemption, their prices and yields can fluctuate wildly. Cash does, however, prove to be markedly less volatile than all other asset classes, as would be expected. Commercial property, meanwhile, shows broadly the same volatility as the residential ma ...

... reflects the fact that if Gilts are not held to redemption, their prices and yields can fluctuate wildly. Cash does, however, prove to be markedly less volatile than all other asset classes, as would be expected. Commercial property, meanwhile, shows broadly the same volatility as the residential ma ...

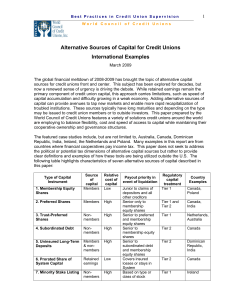

Alternative Sources of Capital for Credit Unions

... benchmark rate index. Dividends will be paid only if the UCBs capital to assets ratio is above minimum regulatory requirement and such payment does not result in the capital ratio falling below the minimum regulatory requirement. Preference shares cannot be issued with a put option—investors don’t ...

... benchmark rate index. Dividends will be paid only if the UCBs capital to assets ratio is above minimum regulatory requirement and such payment does not result in the capital ratio falling below the minimum regulatory requirement. Preference shares cannot be issued with a put option—investors don’t ...

Large Cap Growth - Dahab Associates, Inc.

... box cell blank if you are unable to provide the statistic. o Any compliance related disclosures may be placed in the footer of the page, but without superscripts. ...

... box cell blank if you are unable to provide the statistic. o Any compliance related disclosures may be placed in the footer of the page, but without superscripts. ...

Investment Strategy Statement

... receives proper advice from internal and external advisers with the requisite knowledge and skills. In addition the Pensions Committee undertakes training on a regular basis and this will include on training and information sessions on matters of social, environmental and corporate governance. The F ...

... receives proper advice from internal and external advisers with the requisite knowledge and skills. In addition the Pensions Committee undertakes training on a regular basis and this will include on training and information sessions on matters of social, environmental and corporate governance. The F ...

Draft: May 30, 2004 preliminary & incomplete

... The tension between the financial frictions and moral hazard approaches to explain Sudden Stops and their proposals for price guarantees captures an important tradeoff that ex ante price guarantees create. On one hand, ex-ante price guarantees hold the promise of endowing IFOs with an effective poli ...

... The tension between the financial frictions and moral hazard approaches to explain Sudden Stops and their proposals for price guarantees captures an important tradeoff that ex ante price guarantees create. On one hand, ex-ante price guarantees hold the promise of endowing IFOs with an effective poli ...

Overvalued Equity and Financing Decisions

... investment opportunities, or managerial effectiveness. So, using q or market-tobook, it is not possible to distinguish misvaluation from other rational effects.1 Furthermore, Tobin’s q is a measure of total firm valuation; to measure the firm’s access to cheap equity capital, we need a measure of eq ...

... investment opportunities, or managerial effectiveness. So, using q or market-tobook, it is not possible to distinguish misvaluation from other rational effects.1 Furthermore, Tobin’s q is a measure of total firm valuation; to measure the firm’s access to cheap equity capital, we need a measure of eq ...

Efficient Bailouts? - Federal Reserve Bank of Minneapolis

... In the aftermath of the 2008-2009 financial crisis, a heated debate on the desirability of bailouts has taken center stage in discussions of financial regulatory reform. Many argue that bailouts are often necessary to prevent a complete meltdown of the financial sector, which would otherwise bring a ...

... In the aftermath of the 2008-2009 financial crisis, a heated debate on the desirability of bailouts has taken center stage in discussions of financial regulatory reform. Many argue that bailouts are often necessary to prevent a complete meltdown of the financial sector, which would otherwise bring a ...

An Investigation into the Impact of Debt Financing

... that a firm chooses does not affect its value, that is, whether the firm uses more of debt than equity or either 100% debt or 100% equity, the value will not be affected except for the deductibility of interest payments when calculating taxable income. The theory therefore assumes that a firm’s valu ...

... that a firm chooses does not affect its value, that is, whether the firm uses more of debt than equity or either 100% debt or 100% equity, the value will not be affected except for the deductibility of interest payments when calculating taxable income. The theory therefore assumes that a firm’s valu ...

SUMMARY PROSPECTUS Tortoise North American Pipeline Fund

... As with all funds, a shareholder of the Fund is subject to the risk that his or her investment could lose money. The principal risks affecting shareholders’ investments in the Fund are set forth below. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the FDIC or an ...

... As with all funds, a shareholder of the Fund is subject to the risk that his or her investment could lose money. The principal risks affecting shareholders’ investments in the Fund are set forth below. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the FDIC or an ...

NBER WORKING PAPER SERIES TAXES, LEVERAGE AND THE NATIONAL RETURN ON OUTBOUND

... obtained by using foreign debt. The present paper presents a framework for calculating these two effects and uses the framework to estimate the effect on U.S. national income of a marginal ...

... obtained by using foreign debt. The present paper presents a framework for calculating these two effects and uses the framework to estimate the effect on U.S. national income of a marginal ...

Infrastructure Investments - ForUM for Utvikling og Miljø

... development and economic growth. It is widely acknowledged that improvements in both economic and social infrastructure foster a country’s competitiveness and boosts its GDP, also improving the economic growth outlook. While certain social aspects of infrastructure development are harder to quantify ...

... development and economic growth. It is widely acknowledged that improvements in both economic and social infrastructure foster a country’s competitiveness and boosts its GDP, also improving the economic growth outlook. While certain social aspects of infrastructure development are harder to quantify ...

Data Definitions

... The percentage of days fund traded at a Premium to NAV, over the previous rolling three years. NII Coverage The current net investment income per share for the fund dividend by the appropriate dividend per share for the fund (NOT just income only, but the full dividend amount). If the fund pays a mo ...

... The percentage of days fund traded at a Premium to NAV, over the previous rolling three years. NII Coverage The current net investment income per share for the fund dividend by the appropriate dividend per share for the fund (NOT just income only, but the full dividend amount). If the fund pays a mo ...

Reflections on Recent Target Date Glide-Path

... beneficial because many individual investors lack the knowledge, willingness, or time to develop and maintain a retirement investing plan on their own. By design, these products serve a mass audience—they are not tailored to each individual investor. While individually tailored investment strategies ...

... beneficial because many individual investors lack the knowledge, willingness, or time to develop and maintain a retirement investing plan on their own. By design, these products serve a mass audience—they are not tailored to each individual investor. While individually tailored investment strategies ...

Reporting Form SRF 530.0 Investments

... The asset class types are: cash, fixed income, equity, property, infrastructure, commodities and ‘other’. The asset domicile types are: Australia domicile, international domicile and ‘not applicable’. Where the domicile is not known, report domicile type as ‘not applicable’. The asset listing types ...

... The asset class types are: cash, fixed income, equity, property, infrastructure, commodities and ‘other’. The asset domicile types are: Australia domicile, international domicile and ‘not applicable’. Where the domicile is not known, report domicile type as ‘not applicable’. The asset listing types ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.