AMP Capital Derivatives Risk Statement

... Operational risk is defined as the risk of loss resulting from inadequate or failed internal processes, people and systems, or from external events. AMP Capital has an operational risk framework which outlines the procedures to be adopted by the business in managing operational risk. The framework c ...

... Operational risk is defined as the risk of loss resulting from inadequate or failed internal processes, people and systems, or from external events. AMP Capital has an operational risk framework which outlines the procedures to be adopted by the business in managing operational risk. The framework c ...

Cash Is KIng, and There`s no heIr To The Throne

... terms (operating cash flow) making a loss. In August 2010 the company surprised the market by announcing a change in its accounting policies: rather than account for revenue on a percentage of completion basis, ie book revenue associated with a turbine as they build it, they would book revenue only ...

... terms (operating cash flow) making a loss. In August 2010 the company surprised the market by announcing a change in its accounting policies: rather than account for revenue on a percentage of completion basis, ie book revenue associated with a turbine as they build it, they would book revenue only ...

Calvert High Yield Bond Fund

... may be magnified in a rising interest rate environment or other circumstances where investor redemptions from fixed-income mutual funds may be higher than normal, causing increased supply in the market due to selling activity. The secondary market for municipal obligations also tends to be less well ...

... may be magnified in a rising interest rate environment or other circumstances where investor redemptions from fixed-income mutual funds may be higher than normal, causing increased supply in the market due to selling activity. The secondary market for municipal obligations also tends to be less well ...

Estimating Equity Risk Premiums Report

... The historical equity risk premium (ERP), also referred to as the realized ERP, ex post ERP or the excess return, can be defined as the return of a stock market index minus the risk free return calculated as an annual percent over some historical period. The term ex ante ERP (or just ERP) will be us ...

... The historical equity risk premium (ERP), also referred to as the realized ERP, ex post ERP or the excess return, can be defined as the return of a stock market index minus the risk free return calculated as an annual percent over some historical period. The term ex ante ERP (or just ERP) will be us ...

risks associated with financial instruments (glossary)

... Non-systematic risk refers to risks that can be mitigated through diversification. It is also called unique, diversifiable, firm-specific, or industryspecific risk. Investors can mitigate this type of risk by constructing portfolios in an intelligent way. The two examples below illustrate simple div ...

... Non-systematic risk refers to risks that can be mitigated through diversification. It is also called unique, diversifiable, firm-specific, or industryspecific risk. Investors can mitigate this type of risk by constructing portfolios in an intelligent way. The two examples below illustrate simple div ...

Capital raising in Australia

... In most jurisdictions initial public offerings (IPOs) virtually ground to a halt through the second half of 2008 and the first half of 2009, before picking up towards the end of 2009 as some confidence returned to markets and risk appetite started to recover. Secondary capital raisings continued to ...

... In most jurisdictions initial public offerings (IPOs) virtually ground to a halt through the second half of 2008 and the first half of 2009, before picking up towards the end of 2009 as some confidence returned to markets and risk appetite started to recover. Secondary capital raisings continued to ...

OPTIMAL CAPITAL STRUCTURE

... Market value of debt and equity. In a perpetuity, the debt’s market value (line 11) is equal to the annual interest payments, divided by the required return on debt (I/Kd). Likewise, equity’s market value (line 12) is equal to the dividends divided by the required return to equity (Div/Ke). The mark ...

... Market value of debt and equity. In a perpetuity, the debt’s market value (line 11) is equal to the annual interest payments, divided by the required return on debt (I/Kd). Likewise, equity’s market value (line 12) is equal to the dividends divided by the required return to equity (Div/Ke). The mark ...

Foreign Institutional Investors and Corporate Governance in

... this movement are institutional investors, both domestic and foreign. Many initiatives have been launched to encourage and convince institutional investors to play a more active role. However, not enough is known about how institutional investors utilize CG in their investment decisions, in particul ...

... this movement are institutional investors, both domestic and foreign. Many initiatives have been launched to encourage and convince institutional investors to play a more active role. However, not enough is known about how institutional investors utilize CG in their investment decisions, in particul ...

Does Financial Constraint Affect Shareholder Taxes and the

... 2000, among others, segregate firms based on whether they pay dividends. They report that the benefits of the TRA cut in capital gains taxes fell disproportionately on nondividend-paying firms. They interpret this finding as evidence that TRA affected the equity markets because its capital gains tax ...

... 2000, among others, segregate firms based on whether they pay dividends. They report that the benefits of the TRA cut in capital gains taxes fell disproportionately on nondividend-paying firms. They interpret this finding as evidence that TRA affected the equity markets because its capital gains tax ...

May 15, 2017 Basel Committee on Banking Supervision Bank for

... The Second Consultation likewise lacks clarity as to the appropriate treatment of regulated stock and bond funds in a framework designed to identify entities whose weakness or failure could prompt a bank sponsor to step in. On the one hand, the Committee correctly recognizes variable NAV funds as “c ...

... The Second Consultation likewise lacks clarity as to the appropriate treatment of regulated stock and bond funds in a framework designed to identify entities whose weakness or failure could prompt a bank sponsor to step in. On the one hand, the Committee correctly recognizes variable NAV funds as “c ...

NBER WORKING PAPER SERIES COST OF EQUITY CAPITAL?

... To capture different tax sensitivity of investor ownership to shareholder taxes, we construct proxies for the percentage of investor ownership of a stock (individual investors and institutional investors) using data on shares outstanding and shares owned by different types of institutional investors ...

... To capture different tax sensitivity of investor ownership to shareholder taxes, we construct proxies for the percentage of investor ownership of a stock (individual investors and institutional investors) using data on shares outstanding and shares owned by different types of institutional investors ...

Interest Tax Shield Benefit

... • Other Benefits Because managers must make these interest and principal payments or face the prospect of bankruptcy, not making the payments can destroy a manager’s career. Debt can be used to limit the ability of bad managers to waste the stockholders’ money on things such as fancy jet aircraft, p ...

... • Other Benefits Because managers must make these interest and principal payments or face the prospect of bankruptcy, not making the payments can destroy a manager’s career. Debt can be used to limit the ability of bad managers to waste the stockholders’ money on things such as fancy jet aircraft, p ...

the Building Capital Markets progress report

... Government directly provides to businesses seeking capital. The Government must also continue to review the assets on its balance sheet to ensure that Crown capital works efficiently for New Zealanders. The Government Share Offers and the Future Investment Fund are a major component of this. ...

... Government directly provides to businesses seeking capital. The Government must also continue to review the assets on its balance sheet to ensure that Crown capital works efficiently for New Zealanders. The Government Share Offers and the Future Investment Fund are a major component of this. ...

Hedge Funds and Governance Targets

... stock had at least one buyer that day, Carl Icahn, who purchased one million shares. He continued buying over the next six weeks, investing $307 million and finally revealing himself as the owner of 6.8% of the company in a Securities and Exchange Commission (SEC) 13D filing. He simultaneously denou ...

... stock had at least one buyer that day, Carl Icahn, who purchased one million shares. He continued buying over the next six weeks, investing $307 million and finally revealing himself as the owner of 6.8% of the company in a Securities and Exchange Commission (SEC) 13D filing. He simultaneously denou ...

The Cost of Capital for Alternative Investments

... With a complete state-contingent description of an investable risk-matched alternative to the aggregate hedge fund universe, we can determine the rate of return that an investor would require as a function of his risk aversion and the underlying return distributions of other asset classes, all of w ...

... With a complete state-contingent description of an investable risk-matched alternative to the aggregate hedge fund universe, we can determine the rate of return that an investor would require as a function of his risk aversion and the underlying return distributions of other asset classes, all of w ...

fund accounting training

... Since endowment principals are generally kept in perpetuity, cash gifts are generally invested in long‐term instruments. When non‐cash instruments such as stocks or bonds are donated to establish an endowment, the asset is valued at market value as of the gift date. Income earned on endowments i ...

... Since endowment principals are generally kept in perpetuity, cash gifts are generally invested in long‐term instruments. When non‐cash instruments such as stocks or bonds are donated to establish an endowment, the asset is valued at market value as of the gift date. Income earned on endowments i ...

the role of pension funds in financing green growth

... issuance, other development banks have become involved (EIB, ADB) and the US government has introduced interesting initiatives. Other more exotic green financial vehicles have also been launched – with mixed success. Green infrastructure funds are also likely to be an important way for pension funds ...

... issuance, other development banks have become involved (EIB, ADB) and the US government has introduced interesting initiatives. Other more exotic green financial vehicles have also been launched – with mixed success. Green infrastructure funds are also likely to be an important way for pension funds ...

The Evolution of Quantitative Investment Strategies

... CAPM. While Bill Sharpe’s name is most prominently associated with the development of the CAPM, a few other economists independently derived similar models more or less contemporaneously. The CAPM starts with the premise that all securities are exposed to fluctuations in the overall market. A securi ...

... CAPM. While Bill Sharpe’s name is most prominently associated with the development of the CAPM, a few other economists independently derived similar models more or less contemporaneously. The CAPM starts with the premise that all securities are exposed to fluctuations in the overall market. A securi ...

wiiw FDI Database – detailed description (June 2015)

... The main difference between the two presentational styles (A/L and DP) stems from the treatment of ‘reverse investments’, i.e. receivables of a foreign subsidiary vis-à-vis the parent (in the reporting country). According to the assets/liabilities concept, these receivables are added to the payables ...

... The main difference between the two presentational styles (A/L and DP) stems from the treatment of ‘reverse investments’, i.e. receivables of a foreign subsidiary vis-à-vis the parent (in the reporting country). According to the assets/liabilities concept, these receivables are added to the payables ...

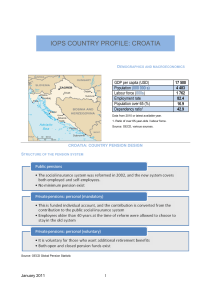

IOPS COUNTRY PROFILE: CROATIA

... Benefits Benefits are paid as annuities. Member may not withdraw their benefits until they reach the age of 50. MARKET INFORMATION Personal mandatory Mandatory funds are managed by mandatory pension fund management companies (OMFs), which can only manage one mandatory fund each. By law, these funds ...

... Benefits Benefits are paid as annuities. Member may not withdraw their benefits until they reach the age of 50. MARKET INFORMATION Personal mandatory Mandatory funds are managed by mandatory pension fund management companies (OMFs), which can only manage one mandatory fund each. By law, these funds ...

Firm Value

... But, if RC issues $500,000 of debt, the value of all of the firm’s securities must increase by the value of the tax shield. This means, in a world with taxes, the value of a firm increases with debt: ...

... But, if RC issues $500,000 of debt, the value of all of the firm’s securities must increase by the value of the tax shield. This means, in a world with taxes, the value of a firm increases with debt: ...

NBER WORKING THEY WANT TO REDUCE HOUSING EQUITY Steven

... and the housing equity that is chosen when a move occurs. The results are based on the decisions of the Retirement History Survey sample between 1969 and 1919. Relative to the potential gains from a reallocation of wealth between housing equity and other assets, transaction costs are very ...

... and the housing equity that is chosen when a move occurs. The results are based on the decisions of the Retirement History Survey sample between 1969 and 1919. Relative to the potential gains from a reallocation of wealth between housing equity and other assets, transaction costs are very ...

GOVERNMENT SHAREHOLDING AND FINANCIAL HEALTH OF

... conflict of interest may increase when shareholding control (or concentration) is in the hands of the government. (Laffont & Tirole, 1991; D’Acunto, 2012). Such conflicts can have a particularly negative effect on the performance of companies if institutional investors are not active (Gilson & Gordo ...

... conflict of interest may increase when shareholding control (or concentration) is in the hands of the government. (Laffont & Tirole, 1991; D’Acunto, 2012). Such conflicts can have a particularly negative effect on the performance of companies if institutional investors are not active (Gilson & Gordo ...

V7-Mutual Fund year book

... We are pleased to release the third edition of The CRISIL Mutual Fund Year Book, a one-stop insight on the mutual fund industry. This is in line with our objective of making markets function better and improving connect with retail investors. 2012 was a turnaround year for the Indian capital markets ...

... We are pleased to release the third edition of The CRISIL Mutual Fund Year Book, a one-stop insight on the mutual fund industry. This is in line with our objective of making markets function better and improving connect with retail investors. 2012 was a turnaround year for the Indian capital markets ...

Chapter 9 : Finance: Acquiring and Using Funds to Maximize Value

... taxes owed to the government. Other funds are used to finance major long-term investments, such as the purchase of plant and equipment or the launch of a new product line. And, of course, firms need some funds to pay a return to the owners for their investment in the company. Companies also have a v ...

... taxes owed to the government. Other funds are used to finance major long-term investments, such as the purchase of plant and equipment or the launch of a new product line. And, of course, firms need some funds to pay a return to the owners for their investment in the company. Companies also have a v ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.