TRUE/FALSE

... 67. The words, letters or symbols that are associated with a specific company or product: 68. A situation that exists when the government spends more than it collects: 69. A sales letter written for the purpose of getting a personal interview: 70. Inspecting on wrench out of every 50 to make sure it ...

... 67. The words, letters or symbols that are associated with a specific company or product: 68. A situation that exists when the government spends more than it collects: 69. A sales letter written for the purpose of getting a personal interview: 70. Inspecting on wrench out of every 50 to make sure it ...

Credit: The Promise to Pay

... Provides information about how long it would take to pay off a loan if minimum payments are paid. Protects potential credit consumers under the age of 21, who must have a cosigner with a means to repay debt of the consumer. ...

... Provides information about how long it would take to pay off a loan if minimum payments are paid. Protects potential credit consumers under the age of 21, who must have a cosigner with a means to repay debt of the consumer. ...

9.4 Predation

... The Chicago School argues that it cannot be rational to engage in predatory (limit) pricing in order to induce exit. The arguments is that merging with the rival is a dominant strategy to realize monopoly power. For example, the predator can make an offer to the prey that would be preferred by both t ...

... The Chicago School argues that it cannot be rational to engage in predatory (limit) pricing in order to induce exit. The arguments is that merging with the rival is a dominant strategy to realize monopoly power. For example, the predator can make an offer to the prey that would be preferred by both t ...

Good Morning!

... rate five times, or a total of 1.75 percentage points, to 4.75%. The Greenspan Fed had a long tradition of moving in small increments, hoping to give officials time to assess the impact on corporate borrowing or consumer spending before moving again. Changing rates too rapidly, the theory went, risk ...

... rate five times, or a total of 1.75 percentage points, to 4.75%. The Greenspan Fed had a long tradition of moving in small increments, hoping to give officials time to assess the impact on corporate borrowing or consumer spending before moving again. Changing rates too rapidly, the theory went, risk ...

Chap 5 - TCU.edu

... For the money market fund, your holding-period return for the next year depends on the level of 30-day interest rates each month when the fund rolls over maturing securities. The one-year savings deposit offers a 7.5% holding period return for the year. If you forecast that the rate on money market ...

... For the money market fund, your holding-period return for the next year depends on the level of 30-day interest rates each month when the fund rolls over maturing securities. The one-year savings deposit offers a 7.5% holding period return for the year. If you forecast that the rate on money market ...

CHAPTER 6 ANSWERS TO "DO YOU UNDERSTAND?" TEXT

... future? How do these adjustments cause the yield curve to change? Answer: Profit-maximizing investors will shift their holdings from short-term to long-term bonds. Selling pressure drives the prices of short-term bonds down and the yields up. Buying pressure drives the prices of long-term bonds up a ...

... future? How do these adjustments cause the yield curve to change? Answer: Profit-maximizing investors will shift their holdings from short-term to long-term bonds. Selling pressure drives the prices of short-term bonds down and the yields up. Buying pressure drives the prices of long-term bonds up a ...

Adjusting the Sails: Supporting the Sustainable Growth of

... • Banks are not prohibited to lend to companies and individuals as long as: 1. They have sufficient capital to absorb any credit risk or stress conditions 2. Effective risk management frameworks are in place. • REST does not reflect any imminent vulnerability among banks with RE exposure. It forms p ...

... • Banks are not prohibited to lend to companies and individuals as long as: 1. They have sufficient capital to absorb any credit risk or stress conditions 2. Effective risk management frameworks are in place. • REST does not reflect any imminent vulnerability among banks with RE exposure. It forms p ...

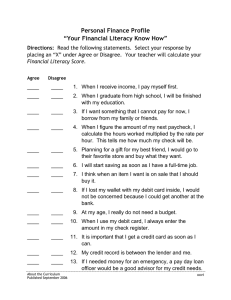

Introduction - Missouri Center for Career Education

... 12. My credit record is between the lender and me. Credit history is not only available to others but is not always accurate. ...

... 12. My credit record is between the lender and me. Credit history is not only available to others but is not always accurate. ...

Nonmonetary Effects of the Financial Crisis in the Propagation of the

... petition between the state and national banking systems for member banks also tended to keep the legal barriers to entry in banking very low.'0 In this sort of environment, a significant number of failures was to be expected and probably was even desirable. Failures due to "natural causes" (such as ...

... petition between the state and national banking systems for member banks also tended to keep the legal barriers to entry in banking very low.'0 In this sort of environment, a significant number of failures was to be expected and probably was even desirable. Failures due to "natural causes" (such as ...

Financial Development in the CIS-7 Countries

... does not appear to support the argument that banks in transition countries are likely to exploit scale economies by consolidating through mergers, i.e. by becoming bigger, since banks with ...

... does not appear to support the argument that banks in transition countries are likely to exploit scale economies by consolidating through mergers, i.e. by becoming bigger, since banks with ...

Recent developments in long-term real interest rates

... long-term yields which occurred from mid-2004 may suggest that other temporary market factors related to speculative behaviour may also have played a role. The alleged widespread use of so-called carry trades, which generate interest income as they involve borrowing at low short-term interest rates ...

... long-term yields which occurred from mid-2004 may suggest that other temporary market factors related to speculative behaviour may also have played a role. The alleged widespread use of so-called carry trades, which generate interest income as they involve borrowing at low short-term interest rates ...

General Financial Literacy

... Standard 4.2: Describe and discuss the impact of credit and debt on personal money management. 4.2.1 Discuss the purpose and role of credit and explain the value of building and maintaining a healthy c ...

... Standard 4.2: Describe and discuss the impact of credit and debt on personal money management. 4.2.1 Discuss the purpose and role of credit and explain the value of building and maintaining a healthy c ...

InterestRate assignment

... A person is purchasing an item with their credit card. Launch an input dialog window and have the user enter a short description of the item they are purchasing. Remember the JOptionPane.showInputDialog method that we used in an earlier class? Have the user input the amount of the purchase (in whole ...

... A person is purchasing an item with their credit card. Launch an input dialog window and have the user enter a short description of the item they are purchasing. Remember the JOptionPane.showInputDialog method that we used in an earlier class? Have the user input the amount of the purchase (in whole ...

Government of Pakistan

... reforms were undertaken, the contents of reform program implemented, the outcomes and lessons learnt from Pakistan’s experience. Central bank modernization was an integral part of the banking reforms and the latter could not have been successfully implemented in the absence of the former. Financial ...

... reforms were undertaken, the contents of reform program implemented, the outcomes and lessons learnt from Pakistan’s experience. Central bank modernization was an integral part of the banking reforms and the latter could not have been successfully implemented in the absence of the former. Financial ...

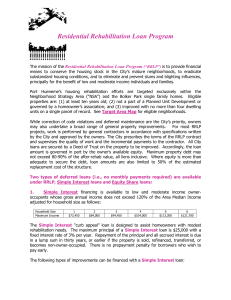

1 - City of Port Hueneme

... condition, the City will take an equity share of 20% ($40,000/$200,000 = 20%). At payoff, the property value is reestablished (by sales price or appraisal) and the borrower repays the loan principal plus 20% of the appreciation in value. Repayment is due in a lump sum in thirty years or earlier if t ...

... condition, the City will take an equity share of 20% ($40,000/$200,000 = 20%). At payoff, the property value is reestablished (by sales price or appraisal) and the borrower repays the loan principal plus 20% of the appreciation in value. Repayment is due in a lump sum in thirty years or earlier if t ...

file

... buyer; gender; credit score and history; occupation; changes in income and employment status – Location specific factors – • liquidity of housing asset;, rising/falling house prices • likelihood of becoming unemployed and finding new employment. ...

... buyer; gender; credit score and history; occupation; changes in income and employment status – Location specific factors – • liquidity of housing asset;, rising/falling house prices • likelihood of becoming unemployed and finding new employment. ...

15 The Financial Crisis and the Great Recession

... in the form of mortgages. During the mid-1990s, U.S. households borrowed an annual average of approximately $200 billion in the form of mortgages for home purchases. The figure rose abruptly to $500 billion for the period 1998–2002 and to $1 trillion from 2003 to 2006. While widespread access to cre ...

... in the form of mortgages. During the mid-1990s, U.S. households borrowed an annual average of approximately $200 billion in the form of mortgages for home purchases. The figure rose abruptly to $500 billion for the period 1998–2002 and to $1 trillion from 2003 to 2006. While widespread access to cre ...

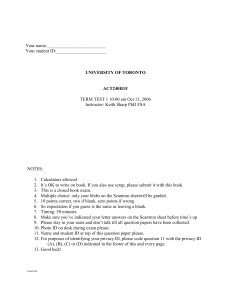

ACT 240H1F F06 Term Test 1 Privacy ID A v07

... monthly payments, starting one month from now! Or get a $X discount if you pay in a cash lump sum! The merchant is using the current market interest rate of 6% per annum compounded monthly for her calculations, and wants the same profit on a cash sale as on an ‘easy payments’ sale. Calculate X. (Not ...

... monthly payments, starting one month from now! Or get a $X discount if you pay in a cash lump sum! The merchant is using the current market interest rate of 6% per annum compounded monthly for her calculations, and wants the same profit on a cash sale as on an ‘easy payments’ sale. Calculate X. (Not ...