the wizard of bubbleland

... dealer hedges his balance sheet against any changes in interest rates. Dealers use the repo market to finance their cash market positions. The key advantage of the repo market as a funding mechanism is its flexibility: dealers who are uncertain how long they will need to maintain a position or a hed ...

... dealer hedges his balance sheet against any changes in interest rates. Dealers use the repo market to finance their cash market positions. The key advantage of the repo market as a funding mechanism is its flexibility: dealers who are uncertain how long they will need to maintain a position or a hed ...

Dollarization in El Salvador

... Lower Country Risk Premiums Lower transaction costs between former currency & the US dollar • Gains in policy credibility • Encourages competition – Boosts productivity & innovation ...

... Lower Country Risk Premiums Lower transaction costs between former currency & the US dollar • Gains in policy credibility • Encourages competition – Boosts productivity & innovation ...

Potentials and limits of monetary policy to boost growth and

... Different versions of monetarism point towards excess liquidity, the risk of high and hyperinflation and misallocation of capital. The argument of fiscal profligacy (‘moral hazard’) if the ECB purchases government bonds on the secondary market is very popular among the opponents of doing quantitativ ...

... Different versions of monetarism point towards excess liquidity, the risk of high and hyperinflation and misallocation of capital. The argument of fiscal profligacy (‘moral hazard’) if the ECB purchases government bonds on the secondary market is very popular among the opponents of doing quantitativ ...

Learnings from the Global Financial Crisis

... possible. The New Zealand and Australian Reserve Banks, for example, cut policy rates by 575 and 425 basis points respectively between July 2008 and April 2009. Crisis then brought opportunities. Monetary policy researchers had always wondered what might happen if price inflation and interest rates ...

... possible. The New Zealand and Australian Reserve Banks, for example, cut policy rates by 575 and 425 basis points respectively between July 2008 and April 2009. Crisis then brought opportunities. Monetary policy researchers had always wondered what might happen if price inflation and interest rates ...

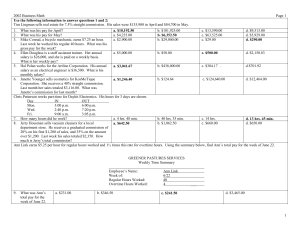

Day IN OUT

... Use the following information to answer questions 24 and 25: On July 5, Lucy Schamburgh had a balance of $594.62 in her savings account. On that day she deposited $240 and the teller also credited $9.28 in interest to her account. 24. What is her new balance? 25. On July 15, she deposited checks for ...

... Use the following information to answer questions 24 and 25: On July 5, Lucy Schamburgh had a balance of $594.62 in her savings account. On that day she deposited $240 and the teller also credited $9.28 in interest to her account. 24. What is her new balance? 25. On July 15, she deposited checks for ...

Defensive open market operations

... reserves and the monetary base expand dollar-for-dollar, but the money supply is not directly or immediately affected. This happens when banks initiate the multiple deposit-expansion process by making loans and buying securities. ...

... reserves and the monetary base expand dollar-for-dollar, but the money supply is not directly or immediately affected. This happens when banks initiate the multiple deposit-expansion process by making loans and buying securities. ...

Q3 - Trivant

... The issue proceeds are being used to buy back stock, retire higher-cost debt, finance acquisitions, and/or fund daily operations. No matter the use of the proceeds, the end result is a higher company earnings per share (EPS). A higher EPS usually translates to a higher future stock price. As long as ...

... The issue proceeds are being used to buy back stock, retire higher-cost debt, finance acquisitions, and/or fund daily operations. No matter the use of the proceeds, the end result is a higher company earnings per share (EPS). A higher EPS usually translates to a higher future stock price. As long as ...

homework 3

... A. demand for real money balances. B. ex post real interest rate. C. nominal interest rate. D. current price level. Answer: B 18. An increase in the expected rate of inflation will: A. lower the demand for real balances because the real interest rate will rise. B. lower demand for real balances beca ...

... A. demand for real money balances. B. ex post real interest rate. C. nominal interest rate. D. current price level. Answer: B 18. An increase in the expected rate of inflation will: A. lower the demand for real balances because the real interest rate will rise. B. lower demand for real balances beca ...

Institute of Actuaries of India MARKING SCHEDULE October 2009 EXAMINATION

... a. According to the model, the short rate can take negative values, which is not realistic. b. However, the probability of negative rates occurring is quite low. c. Negative rates are more likely to occur for medium terms than for long or short. d. The yield curve slopes upwards. e. The standard dev ...

... a. According to the model, the short rate can take negative values, which is not realistic. b. However, the probability of negative rates occurring is quite low. c. Negative rates are more likely to occur for medium terms than for long or short. d. The yield curve slopes upwards. e. The standard dev ...

Presentation - Keith Rankin

... • C behaviour relates to individuals (the financial and trading decision-makers), rather than to the countries as a whole. – Possibly the largest credit balances belong to C individuals who reside in D countries. – Rebalancing reduces the real values of financial assets (IOU credits; historical clai ...

... • C behaviour relates to individuals (the financial and trading decision-makers), rather than to the countries as a whole. – Possibly the largest credit balances belong to C individuals who reside in D countries. – Rebalancing reduces the real values of financial assets (IOU credits; historical clai ...

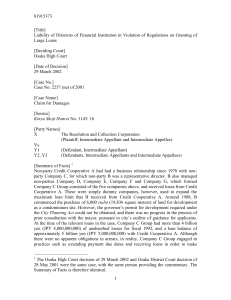

English

... 6(1) of the then Act on Financing Business by Cooperative Associations, and Article 13 of the Banking Act applied mutatis mutandis under the Act on Financing Business by Cooperative Associations, a credit cooperative could not extend loans to an individual in an amount in excess of 20% of the total ...

... 6(1) of the then Act on Financing Business by Cooperative Associations, and Article 13 of the Banking Act applied mutatis mutandis under the Act on Financing Business by Cooperative Associations, a credit cooperative could not extend loans to an individual in an amount in excess of 20% of the total ...

38 - VU LMS

... • SBP does not fix any maximum/minimum mark-up rate to be charged on agricultural loans. Banks’ mark-up is based on their cost structure and risk profile of the borrowers and the sector. However, for benchmarking, Karachi inter-bank Offered Rate (KIBOR) is used by banks for the purpose. ...

... • SBP does not fix any maximum/minimum mark-up rate to be charged on agricultural loans. Banks’ mark-up is based on their cost structure and risk profile of the borrowers and the sector. However, for benchmarking, Karachi inter-bank Offered Rate (KIBOR) is used by banks for the purpose. ...

Monetarist’s take on Fiscal Policy

... iff rises to id provided the Fed adds $5b to reserves by issuing $5b in discount loans. The equilibrium quantity of reserves increases to $32b. ...

... iff rises to id provided the Fed adds $5b to reserves by issuing $5b in discount loans. The equilibrium quantity of reserves increases to $32b. ...

The Monetary Transmission Mechanism No. 06‐1 Peter N. Ireland

... that is below the market rate on other highly liquid assets such as short‐term government bonds, then private agents’ demand for real base money M/P can be described as a decreasing function of the short‐term nominal interest rate i: M/P = L(i). This function L summarize ...

... that is below the market rate on other highly liquid assets such as short‐term government bonds, then private agents’ demand for real base money M/P can be described as a decreasing function of the short‐term nominal interest rate i: M/P = L(i). This function L summarize ...

Horizon Community Credit Union Selects Fidelity Information

... industries. FIS’ software processes nearly 50 percent of all U. S. residential mortgages, it has processing and technology relationships with 45 of the top 50 U.S. banks and more than 2,800 small and mid-sized U.S. financial institutions and it has clients in more than 50 countries who rely on its p ...

... industries. FIS’ software processes nearly 50 percent of all U. S. residential mortgages, it has processing and technology relationships with 45 of the top 50 U.S. banks and more than 2,800 small and mid-sized U.S. financial institutions and it has clients in more than 50 countries who rely on its p ...

Liquidity Markets Overview

... With the ongoing challenges to robustly create jobs and the structural difficulties in the jobs market that point toward some stagnation, perhaps the biggest reason the Fed has its foot off the monetary brake is the financial/sovereign debt situation in the Eurozone. The lower chart displays the y ...

... With the ongoing challenges to robustly create jobs and the structural difficulties in the jobs market that point toward some stagnation, perhaps the biggest reason the Fed has its foot off the monetary brake is the financial/sovereign debt situation in the Eurozone. The lower chart displays the y ...

Global Financial Instability: Framework, Events, Issues

... Financial markets perform the essential function of channeling funds to those individuals or firms that have productive investment opportunities. ...

... Financial markets perform the essential function of channeling funds to those individuals or firms that have productive investment opportunities. ...

financial services - Xavier Institute of Management

... non-farm enterprises, and landless workers • Small, medium and large size of holdings • Different cropping pattern • Variety of non-farm enterprises ...

... non-farm enterprises, and landless workers • Small, medium and large size of holdings • Different cropping pattern • Variety of non-farm enterprises ...

Development of Benchmarks and Regulatory Commissions

... bulk supplier of power. . At present the bulk supply business of APTRANSCO is transferred to the distribution companies – a move from single buyer model to multibuyer model. ...

... bulk supplier of power. . At present the bulk supply business of APTRANSCO is transferred to the distribution companies – a move from single buyer model to multibuyer model. ...

Hong Kong dollar exchange rate

... deposits from customers, amounts due to banks, negotiable certificates of deposit and other debt instruments, and Hong Kong dollar non-interest bearing demand deposits on the books of banks. Data from retail banks, which account for about 90% of the total customers’ deposits in the banking sector, a ...

... deposits from customers, amounts due to banks, negotiable certificates of deposit and other debt instruments, and Hong Kong dollar non-interest bearing demand deposits on the books of banks. Data from retail banks, which account for about 90% of the total customers’ deposits in the banking sector, a ...