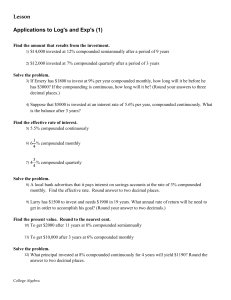

Lesson Applications to Log`s and Exp`s (1)

... 3) If Emery has $1800 to invest at 9% per year compounded monthly, how long will it be before he has $3000? If the compounding is continuous, how long will it be? (Round your answers to three decimal places.) ...

... 3) If Emery has $1800 to invest at 9% per year compounded monthly, how long will it be before he has $3000? If the compounding is continuous, how long will it be? (Round your answers to three decimal places.) ...

PAGE 1 UNITED STATES SECURITIES AND EXCHANGE

... Management's Discussion and Analysis of Financial Condition and Results of Operations Railway operating expenses after March 31, 1993, do not include the operating expenses of the partnership and include only those transportation operating expenses for rail service provided to TCSC. Casualties and o ...

... Management's Discussion and Analysis of Financial Condition and Results of Operations Railway operating expenses after March 31, 1993, do not include the operating expenses of the partnership and include only those transportation operating expenses for rail service provided to TCSC. Casualties and o ...

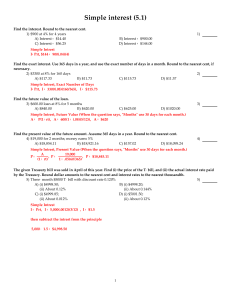

Simple interest (5.1)

... The given Treasury bill was sold in April of this year. Find (i) the price of the T-bill, and (ii) the actual interest rate paid by the Treasury. Round dollar amounts to the nearest cent and interest rates to the nearest thousandth. 5) Three-month $5000 T-bill with discount rate 0.120% ...

... The given Treasury bill was sold in April of this year. Find (i) the price of the T-bill, and (ii) the actual interest rate paid by the Treasury. Round dollar amounts to the nearest cent and interest rates to the nearest thousandth. 5) Three-month $5000 T-bill with discount rate 0.120% ...

$doc.title

... Amongst many new changes, we began to look at our investment allocations in finer, more sophisticated ways. We implemented a top down investment approach headed by our chief economist. We organized ourselves into industry and stock coverage groups which fostered deeper and broader analysis of our ho ...

... Amongst many new changes, we began to look at our investment allocations in finer, more sophisticated ways. We implemented a top down investment approach headed by our chief economist. We organized ourselves into industry and stock coverage groups which fostered deeper and broader analysis of our ho ...

PDF

... increasing (Figure 1). However, as anyone who lived through 1980s farm crisis can attest, farmland values are not guaranteed to increase forever, and a number of conditions could lead to a decrease in agricultural land values. The literature demonstrates that farmland values are determined by a comp ...

... increasing (Figure 1). However, as anyone who lived through 1980s farm crisis can attest, farmland values are not guaranteed to increase forever, and a number of conditions could lead to a decrease in agricultural land values. The literature demonstrates that farmland values are determined by a comp ...

International Fixed Interest Fund

... Other management and administration charges Total performance based fees ...

... Other management and administration charges Total performance based fees ...

smart beta in the limelight

... Investors in securities essentially take two forms of risk: systematic factor risk and idiosyncratic security-specific risk. It is the former that can be isolated and targeted in specific investment strategies. While some individual factors have shown persistence and produced positive returns over t ...

... Investors in securities essentially take two forms of risk: systematic factor risk and idiosyncratic security-specific risk. It is the former that can be isolated and targeted in specific investment strategies. While some individual factors have shown persistence and produced positive returns over t ...

Calculate - LessonPaths

... This lesson will help you refresh your skills using exponents. Many financial equations rely on exponents to show compounding and growth. 1. A business acquaintance promises to deliver a $20 bill to you one year from today. How much should you be willing to pay today for this promise? 2. What is the ...

... This lesson will help you refresh your skills using exponents. Many financial equations rely on exponents to show compounding and growth. 1. A business acquaintance promises to deliver a $20 bill to you one year from today. How much should you be willing to pay today for this promise? 2. What is the ...

Market Value of the Firm, Market Value of Equity

... Keywords: Maximum profit, Maximum value of the firm, Capital structure, Equity premium 1. Introduction What is the primary goal for a business? There are many answers for this question. For examples, maximum profit, maximum market value of the firm, maximum market value of equity, maximum return rat ...

... Keywords: Maximum profit, Maximum value of the firm, Capital structure, Equity premium 1. Introduction What is the primary goal for a business? There are many answers for this question. For examples, maximum profit, maximum market value of the firm, maximum market value of equity, maximum return rat ...

Presentation

... 70% as progressivity increases, and greater progressivity could enable investors to 19 shed all or almost all equity risk. ...

... 70% as progressivity increases, and greater progressivity could enable investors to 19 shed all or almost all equity risk. ...

Chapter 1 1 2

... flows means that the denominator, but not the numerator, rises with inflation, and this lowers the calculated NPV. ...

... flows means that the denominator, but not the numerator, rises with inflation, and this lowers the calculated NPV. ...

Risk Management - Spears School of Business

... • Unlike return, variance of a portfolio is also related to correlations. So if these correlations different from ONE, then there can be some risk saving! ...

... • Unlike return, variance of a portfolio is also related to correlations. So if these correlations different from ONE, then there can be some risk saving! ...

Document

... • Deferred Tax Liability - balance sheet account showing future additional income taxes • Deferred Tax Asset - balance sheet account showing the amount by which future income taxes will be reduced ...

... • Deferred Tax Liability - balance sheet account showing future additional income taxes • Deferred Tax Asset - balance sheet account showing the amount by which future income taxes will be reduced ...

Managing the IT Portfolio - MIT SeeIT Project

... on-line tracking, customer calls to its call center cost UPS around $2 each and sometimes required two follow-on calls within UPS to locate the package with a total cost of $6. Each tracking query now costs UPS a few cents and during the Christmas rush period there can be 6 million tracking requests ...

... on-line tracking, customer calls to its call center cost UPS around $2 each and sometimes required two follow-on calls within UPS to locate the package with a total cost of $6. Each tracking query now costs UPS a few cents and during the Christmas rush period there can be 6 million tracking requests ...

Prospective Interest Rate Differential and Currency Returns

... information on currency market returns, we use a parsimonious model to decompose the pricing kernel to price government bonds. In the model, the dynamics of the short rate and bond returns contain the same persistence parameter, thereby allowing us to exploit the panel of bond returns in addition to ...

... information on currency market returns, we use a parsimonious model to decompose the pricing kernel to price government bonds. In the model, the dynamics of the short rate and bond returns contain the same persistence parameter, thereby allowing us to exploit the panel of bond returns in addition to ...

Equity Income and Dividend Growth Strategies

... bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury bills are certificates reflecting short-term (less than one year) obligations of the U.S. government. Diversification does not guarantee a profit nor protect against loss. Dividends ...

... bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury bills are certificates reflecting short-term (less than one year) obligations of the U.S. government. Diversification does not guarantee a profit nor protect against loss. Dividends ...

Finance 419

... historical average market return to get the market-risk-premium. The MRP estimate should be based on the difference between the historical average of the market return and the historical average return on the risk-free bond. The current risk-free rate is used for the standalone Rf if the SML equ ...

... historical average market return to get the market-risk-premium. The MRP estimate should be based on the difference between the historical average of the market return and the historical average return on the risk-free bond. The current risk-free rate is used for the standalone Rf if the SML equ ...

q. are you the same charles e. olson whose direct testimony

... December 9, 1970, 44 FPC 1556 at 1570. Not only does it provide so wide a range as to be entitled to little weight, as is the case in this proceeding, but we are persuaded that to the extent it may be based upon circular reasoning, it should be tested in its end result by the application of other ev ...

... December 9, 1970, 44 FPC 1556 at 1570. Not only does it provide so wide a range as to be entitled to little weight, as is the case in this proceeding, but we are persuaded that to the extent it may be based upon circular reasoning, it should be tested in its end result by the application of other ev ...

Chapter 19

... • Additional current assets are needed during the “peak” time • The level of current assets will decrease as sales occur ...

... • Additional current assets are needed during the “peak” time • The level of current assets will decrease as sales occur ...

Document

... In the 1970s, the Strategic Planning Institute collected data on the performance of business units at its subscribers.http://www.inc.com/encyclopedia/ profit-impact-of-market-strategies-pims.html The resulting Profit Impact of Market Strategyhttp://pimsonline.com/ (PIMS) model was very influential w ...

... In the 1970s, the Strategic Planning Institute collected data on the performance of business units at its subscribers.http://www.inc.com/encyclopedia/ profit-impact-of-market-strategies-pims.html The resulting Profit Impact of Market Strategyhttp://pimsonline.com/ (PIMS) model was very influential w ...

Download Full Article

... Since the calculated value of Chi-Square (27.7598) is less than the table value (40.113) as shown in table 8.4(b), null hypothesis is accepted. It is therefore, concluded that there is no significant relationship between the return on net worth of (AXIS, ICICI, KVB, SIB) private sectors banks in ind ...

... Since the calculated value of Chi-Square (27.7598) is less than the table value (40.113) as shown in table 8.4(b), null hypothesis is accepted. It is therefore, concluded that there is no significant relationship between the return on net worth of (AXIS, ICICI, KVB, SIB) private sectors banks in ind ...

FM11 Ch 09 Instructors Manual

... short-term interest-bearing debt on a permanent basis. New bonds would be privately placed with no flotation cost. 3. The current price of the firm's 10 percent, $100 par value, quarterly dividend, perpetual preferred stock is $113.10. Harry Davis would incur flotation costs of $2.00 per share on a ...

... short-term interest-bearing debt on a permanent basis. New bonds would be privately placed with no flotation cost. 3. The current price of the firm's 10 percent, $100 par value, quarterly dividend, perpetual preferred stock is $113.10. Harry Davis would incur flotation costs of $2.00 per share on a ...