The Proper Use of Risk Measures in Portfolio Theory

... different investors adopt different investment strategies in seeking to realize their investment objectives. In some sense risk itself is a subjective concept and this is probably the main characteristic of risk. Thus, even if we can identify some desirable features of an investment risk measure, pr ...

... different investors adopt different investment strategies in seeking to realize their investment objectives. In some sense risk itself is a subjective concept and this is probably the main characteristic of risk. Thus, even if we can identify some desirable features of an investment risk measure, pr ...

Estimating the country risk premium in emerging markets: the case

... Estimation of the cost of capital investment in a developed market is different than it is in emerging markets. As Estrada (2001) notes – defining the risk, determining the factors that influence the return on equity is complicated enough in developed countries but much more difficult in emerging mark ...

... Estimation of the cost of capital investment in a developed market is different than it is in emerging markets. As Estrada (2001) notes – defining the risk, determining the factors that influence the return on equity is complicated enough in developed countries but much more difficult in emerging mark ...

Global Risk Aversion, Contagion or Fundamentals?

... costs. This could also lead to an increase in rollover risk, as debt might have to be refinanced at unusually high cost or, in extreme cases, cannot be rolled over at all. Large increase in government funding costs can thus cause real economic losses, in addition to the purely financial effects of h ...

... costs. This could also lead to an increase in rollover risk, as debt might have to be refinanced at unusually high cost or, in extreme cases, cannot be rolled over at all. Large increase in government funding costs can thus cause real economic losses, in addition to the purely financial effects of h ...

Everything You Wanted to Know about Credit Default Swaps-

... was quoted in a recent Washington Post series as telling an SEC roundtable: "The regulatory black hole for credit-default swaps is one of the most significant issues we are confronting in the current credit crisis . . . and requires immediate legislative action. . . . The over-the-counter credit-def ...

... was quoted in a recent Washington Post series as telling an SEC roundtable: "The regulatory black hole for credit-default swaps is one of the most significant issues we are confronting in the current credit crisis . . . and requires immediate legislative action. . . . The over-the-counter credit-def ...

http://www.econstor.eu/bitstream/10419/89039/1/IDB-WP-276.pdf

... possibility of failure of individual institutions is a necessary part of a healthy financial sector. 2 It is often commented that the Basel standards have stressed microeconomic or individual institution risks. The standards neither consider how risks might develop within financial institutions nor ...

... possibility of failure of individual institutions is a necessary part of a healthy financial sector. 2 It is often commented that the Basel standards have stressed microeconomic or individual institution risks. The standards neither consider how risks might develop within financial institutions nor ...

Quantitative modeling of operational risk losses when combining

... log-normality assumption. Instead, we propose semi-parametric models that are much more flexible and that are much more suitable in this context than the normal distribution assumption Sparse data, underreporting, and extreme values are three fundamental reasons for operational risk being extremely ...

... log-normality assumption. Instead, we propose semi-parametric models that are much more flexible and that are much more suitable in this context than the normal distribution assumption Sparse data, underreporting, and extreme values are three fundamental reasons for operational risk being extremely ...

an exploratory study of Italian listed state

... part of accountability. It is understandable in the wake of corporate catastrophes that there has been a growing amount of literature on the subject of risk management in general, while less attention has been given to risk disclosure in the public sector. In particular there is very little literatu ...

... part of accountability. It is understandable in the wake of corporate catastrophes that there has been a growing amount of literature on the subject of risk management in general, while less attention has been given to risk disclosure in the public sector. In particular there is very little literatu ...

The 1/N investment strategy is optimal under high

... an agent is faced with a sufficiently high degree of model uncertainty in the form of ambiguous loss distributions. More specifically, we use a classical risk minimization framework to show that, for a broad class of risk measures, as the uncertainty concerning the probabilistic model increases, the o ...

... an agent is faced with a sufficiently high degree of model uncertainty in the form of ambiguous loss distributions. More specifically, we use a classical risk minimization framework to show that, for a broad class of risk measures, as the uncertainty concerning the probabilistic model increases, the o ...

New risks. New insights.

... Risk. It comes in many forms. To some, it’s volatility of returns. To others, it’s simply losing money — either ...

... Risk. It comes in many forms. To some, it’s volatility of returns. To others, it’s simply losing money — either ...

Reviewing Systemic Risk in the Insurance Industry

... become insolvent but few consumers have been left without support in their time of need, and insurance has not been the driver behind broader crises. The system is not perfect and can always be improved, but this paper will argue that an overhaul is not needed, and that some changes being suggeste ...

... become insolvent but few consumers have been left without support in their time of need, and insurance has not been the driver behind broader crises. The system is not perfect and can always be improved, but this paper will argue that an overhaul is not needed, and that some changes being suggeste ...

V. The Culture of Risk and Regulation

... Modernity is characterized by the emergence of new forms of risk. Businesses have looked to financial markets to solve real problems by financial means, which has led to a massive commodification of risk and the development of a whole new range of financial products enabling the pricing and trading ...

... Modernity is characterized by the emergence of new forms of risk. Businesses have looked to financial markets to solve real problems by financial means, which has led to a massive commodification of risk and the development of a whole new range of financial products enabling the pricing and trading ...

Introducing Expected Returns into Risk Parity

... wishes to hold over a long period (typically 10 to 30 years). Risk parity portfolios based on the volatility risk measure define well-diversified strategic portfolios. The use of a standard deviation-based risk measure allows the risk premiums of the different asset classes to be taken into account. ...

... wishes to hold over a long period (typically 10 to 30 years). Risk parity portfolios based on the volatility risk measure define well-diversified strategic portfolios. The use of a standard deviation-based risk measure allows the risk premiums of the different asset classes to be taken into account. ...

SM_Ch06

... the probability that the auditee's system of internal control will fail to detect material misstatements, provided any enter the accounting system in the first place. Detection risk: the probability that audit procedures will fail to find material misstatements, provided any have entered the system ...

... the probability that the auditee's system of internal control will fail to detect material misstatements, provided any enter the accounting system in the first place. Detection risk: the probability that audit procedures will fail to find material misstatements, provided any have entered the system ...

Revisiting the Role of Insurance Company ALM

... Reporting Standards (IFRS) accounting regimes. This means that fixed income assets are held on the balance sheet at their market value, but the difference between market value and amortized cost flows through equity on the balance sheet. This is referred to as AOCI. Each quarter, assets are evaluate ...

... Reporting Standards (IFRS) accounting regimes. This means that fixed income assets are held on the balance sheet at their market value, but the difference between market value and amortized cost flows through equity on the balance sheet. This is referred to as AOCI. Each quarter, assets are evaluate ...

Developing a strong risk appetite program

... improve results, reduce inconsistencies, and minimize organizational tensions. • Result rationalization. It would be naive to believe the process described above will produce consistent results in all cases. After all, there is a natural and healthy tension between growth and risk management. As a ...

... improve results, reduce inconsistencies, and minimize organizational tensions. • Result rationalization. It would be naive to believe the process described above will produce consistent results in all cases. After all, there is a natural and healthy tension between growth and risk management. As a ...

Jeremy Siegel, Rob Arnott and Other Experts Forecast Equity Returns

... offer new ones, and turn the resulting discussion into a book, which has now been published by the CFA Institute’s Research Foundation under the title, Rethinking the Equity Risk Premium. It is available as a free download, or for purchase in hard copy format at a low price, here. The estimates were ...

... offer new ones, and turn the resulting discussion into a book, which has now been published by the CFA Institute’s Research Foundation under the title, Rethinking the Equity Risk Premium. It is available as a free download, or for purchase in hard copy format at a low price, here. The estimates were ...

What is a realistic aversion to risk for real

... income, it is clear that the present value of labor income (the human wealth) can be added to the definition of agent’s investment wealth. Even though these assumptions are not fully realistic, it appears plausible that a significant portion of, or some form of certainty equivalent of personal wealt ...

... income, it is clear that the present value of labor income (the human wealth) can be added to the definition of agent’s investment wealth. Even though these assumptions are not fully realistic, it appears plausible that a significant portion of, or some form of certainty equivalent of personal wealt ...

Complete Article - Society of Actuaries

... Significant changes in the insurance and financial markets are giving increasing attention to the need for developing a standard framework for risk management. Today’s competitive and investment oriented marketplace requires from insurance directors to use all the advantages of investing risk capita ...

... Significant changes in the insurance and financial markets are giving increasing attention to the need for developing a standard framework for risk management. Today’s competitive and investment oriented marketplace requires from insurance directors to use all the advantages of investing risk capita ...

INVESTMENT PORTFOLIO OPTIMIZATION BY

... in the allocation of existing and new types of financial assets or changing the investment manager, which affects exposure to the systematic and non-systematic risk, well known as beta and alpha coefficients, with the ultimate goal of achieving a better relationship between portfolio risk and return ...

... in the allocation of existing and new types of financial assets or changing the investment manager, which affects exposure to the systematic and non-systematic risk, well known as beta and alpha coefficients, with the ultimate goal of achieving a better relationship between portfolio risk and return ...

Deflation Risk

... financial markets or in the macroeconomy in general. Focusing first on the pricing of deflation risk, we find that the ratio of the risk-neutral probability of deflation to the objective probability of deflation is on the order of three to one. This ratio is very similar to that of other types of tail ris ...

... financial markets or in the macroeconomy in general. Focusing first on the pricing of deflation risk, we find that the ratio of the risk-neutral probability of deflation to the objective probability of deflation is on the order of three to one. This ratio is very similar to that of other types of tail ris ...

Religious Activity, Risk Taking Preferences, and Financial Behaviour

... II.1. Institutional background information ...

... II.1. Institutional background information ...

chapter 10: arbitrage pricing theory and multifactor models of risk

... The sensitivity of the payoff of this portfolio to the market factor is zero because the exposures of the positive alpha and negative alpha stocks cancel out. (Notice that the terms involving RM sum to zero.) Thus, the systematic component of total risk is also zero. The variance of the analyst’s pr ...

... The sensitivity of the payoff of this portfolio to the market factor is zero because the exposures of the positive alpha and negative alpha stocks cancel out. (Notice that the terms involving RM sum to zero.) Thus, the systematic component of total risk is also zero. The variance of the analyst’s pr ...

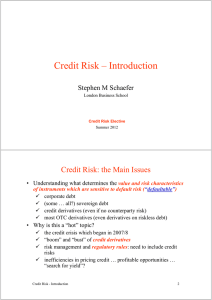

Credit Risk – Introduction

... year or more. They address the possibility that a financial obligation will not be honored as promised. Such ratings use Moody’s Global Scale and reflect both the likelihood of default and any financial loss suffered in the event of default. Source: Moody’s Ratings Symbols & Definitions, April 2012 ...

... year or more. They address the possibility that a financial obligation will not be honored as promised. Such ratings use Moody’s Global Scale and reflect both the likelihood of default and any financial loss suffered in the event of default. Source: Moody’s Ratings Symbols & Definitions, April 2012 ...

Risk

Risk is potential of losing something of value. Values (such as physical health, social status, emotional well being or financial wealth) can be gained or lost when taking risk resulting from a given action, activity and/or inaction, foreseen or unforeseen. Risk can also be defined as the intentional interaction with uncertainty. Uncertainty is a potential, unpredictable, unmeasurable and uncontrollable outcome, risk is a consequence of action taken in spite of uncertaintyRisk perception is the subjective judgment people make about the severity and/or probability of a risk, and may vary person to person. Any human endeavor carries some risk, but some are much riskier than others.