download

... Components of Investment Performance • Assuming the investor has a target level of risk for the portfolio equal to T, the portion of overall performance due to risk can be ...

... Components of Investment Performance • Assuming the investor has a target level of risk for the portfolio equal to T, the portion of overall performance due to risk can be ...

The Equity Imperative - Improving Active Risk

... portfolios by significant concentration. For example, most active investors maintain at least some passive exposure in their portfolios, suggesting a segregation of assets into high and low active risk. Those that don’t, typically employ varied levels of active exposure across allocations – also ind ...

... portfolios by significant concentration. For example, most active investors maintain at least some passive exposure in their portfolios, suggesting a segregation of assets into high and low active risk. Those that don’t, typically employ varied levels of active exposure across allocations – also ind ...

KIID LU1335425580 en LU

... that the securities regimes and legal systems of the Shanghai and Hong Kong markets differ significantly. In addition, the Fund and the Custodian cannot ensure that the Fund's ownership of the Shanghai Stock Exchange securities or title thereto is assured in all circumstances. 5 Operational risks: T ...

... that the securities regimes and legal systems of the Shanghai and Hong Kong markets differ significantly. In addition, the Fund and the Custodian cannot ensure that the Fund's ownership of the Shanghai Stock Exchange securities or title thereto is assured in all circumstances. 5 Operational risks: T ...

Integrated Strategic Case Study

... and finance skills such as evaluating finance requirements from your F3 paper (‘doing accounting and finance work’) whilst taking into account the business context such as your understanding of the market environment from E3 (‘in the context of the business’). Students may then need to make decision ...

... and finance skills such as evaluating finance requirements from your F3 paper (‘doing accounting and finance work’) whilst taking into account the business context such as your understanding of the market environment from E3 (‘in the context of the business’). Students may then need to make decision ...

PDF

... In another article, Kim and Mathur examined the impact of geographical diversification on firm performance (Kim and Mathur, 2007). The author’s results suggested that geographical diversification increased operating costs but also increased return on equity and return on assets when compared to ind ...

... In another article, Kim and Mathur examined the impact of geographical diversification on firm performance (Kim and Mathur, 2007). The author’s results suggested that geographical diversification increased operating costs but also increased return on equity and return on assets when compared to ind ...

Higher Pensions and Less Risk: Innovation at Denmark`s ATP

... Overall, a risky long-term investment strategy makes little or no sense if a fund’s tolerance for a red light risk 2 is low, while the policy of indexation on the other side of the balance sheet involves expedient consumption of the reserves. The challenge is to design and implement strategies and p ...

... Overall, a risky long-term investment strategy makes little or no sense if a fund’s tolerance for a red light risk 2 is low, while the policy of indexation on the other side of the balance sheet involves expedient consumption of the reserves. The challenge is to design and implement strategies and p ...

Evaluating the Dynamic Nature of Market Risk by Todd Hubbs, Todd

... p.4) recognizes time varying risks when he states, “Many of the most dramatic price movements in the 140-year history have been associated with war and macroeconomic shocks.” We assert that the agricultural sector faces these sources of uncertainty as well as others related to general or macroeconom ...

... p.4) recognizes time varying risks when he states, “Many of the most dramatic price movements in the 140-year history have been associated with war and macroeconomic shocks.” We assert that the agricultural sector faces these sources of uncertainty as well as others related to general or macroeconom ...

Handout 3

... for an Insurance Company • The insurer's risk, as measured by its statistical distribution of outcomes, provides a meaningful yardstick that can be used to set capital needs. • A statistical measure of capital needs can be used to evaluate insurer operating strategies. ...

... for an Insurance Company • The insurer's risk, as measured by its statistical distribution of outcomes, provides a meaningful yardstick that can be used to set capital needs. • A statistical measure of capital needs can be used to evaluate insurer operating strategies. ...

Risk and Rates of Return

... well-diversified portfolio, since all investors can be well-diversified if they wish; the “market” offers no compensation for undertaking diversifiable risk … the risk that remains after diversifying is market risk, or the risk that is inherent in the market, and it can be measured as the degree to ...

... well-diversified portfolio, since all investors can be well-diversified if they wish; the “market” offers no compensation for undertaking diversifiable risk … the risk that remains after diversifying is market risk, or the risk that is inherent in the market, and it can be measured as the degree to ...

Chapter 8 - McGraw Hill Higher Education

... convertibility and taxability of various loans and securities upon their interest rates. To understand why there are so many different interest rates within the global economy. To learn how the “structure of interest rates” is built and why it changes constantly. McGraw Hill / Irwin ...

... convertibility and taxability of various loans and securities upon their interest rates. To understand why there are so many different interest rates within the global economy. To learn how the “structure of interest rates” is built and why it changes constantly. McGraw Hill / Irwin ...

The cultural revolution in risk management

... and sustaining a strong risk culture is to make explicit what is going on tacitly, to correct the negative aspects, and to enhance and entrench the strong aspects already in place... .”8 So, the challenge for financial institutions is to understand what regulators now require them to do in response ...

... and sustaining a strong risk culture is to make explicit what is going on tacitly, to correct the negative aspects, and to enhance and entrench the strong aspects already in place... .”8 So, the challenge for financial institutions is to understand what regulators now require them to do in response ...

Regulatory Developments in the FinTech Space

... third-party lending risk, the Guidance reflects the FDIC’s increasing focus on MPL activities, especially in light of recent judicial decisions.4 Comments on the Guidance are due by October 27, 2016. Overview of the Guidance In 2008, the FDIC released its Guidance for Managing Third-Party Risk focus ...

... third-party lending risk, the Guidance reflects the FDIC’s increasing focus on MPL activities, especially in light of recent judicial decisions.4 Comments on the Guidance are due by October 27, 2016. Overview of the Guidance In 2008, the FDIC released its Guidance for Managing Third-Party Risk focus ...

Challenging traditional attitudes towards investment risk and

... Savings Risk – This is the risk of not saving enough – whether that is because a client does not understand the implications of not saving enough, does not think or care about the long term, or is simply not able to put money aside. Longevity Risk – This is the risk of outliving savings. As generat ...

... Savings Risk – This is the risk of not saving enough – whether that is because a client does not understand the implications of not saving enough, does not think or care about the long term, or is simply not able to put money aside. Longevity Risk – This is the risk of outliving savings. As generat ...

Insurer solvency standards - Reserve Bank of New Zealand

... sharp focus. The ability of insurance companies to meet claims as they fall due has tremendous potential impact in such circumstances and the need for insurers to hold sufficient capital and other resources for those purposes is more visible in such difficult times. Whether in terms of meeting house ...

... sharp focus. The ability of insurance companies to meet claims as they fall due has tremendous potential impact in such circumstances and the need for insurers to hold sufficient capital and other resources for those purposes is more visible in such difficult times. Whether in terms of meeting house ...

Coherent Measures of Risk

... known, but the probabilities of the various states occurring may be unknown or not subject to common agreement. When we deal with market risk, the state of the world might be described by a list of the prices of all securities and all exchange rates, and we assume that the set of all possible such l ...

... known, but the probabilities of the various states occurring may be unknown or not subject to common agreement. When we deal with market risk, the state of the world might be described by a list of the prices of all securities and all exchange rates, and we assume that the set of all possible such l ...

View PDF - CiteSeerX

... known, but the probabilities of the various states occurring may be unknown or not subject to common agreement. When we deal with market risk, the state of the world might be described by a list of the prices of all securities and all exchange rates, and we assume that the set of all possible such l ...

... known, but the probabilities of the various states occurring may be unknown or not subject to common agreement. When we deal with market risk, the state of the world might be described by a list of the prices of all securities and all exchange rates, and we assume that the set of all possible such l ...

An Analysis of Risk Assessment Questions Based on Loss

... 1971; Pratt, 1964). Assets with a lower expected variance of returns are more preferred by investors with a higher level of risk aversion. Risk-averse investors require a greater equity premium to invest in assets where the payout is more uncertain. This insight is fundamental in modern portfolio th ...

... 1971; Pratt, 1964). Assets with a lower expected variance of returns are more preferred by investors with a higher level of risk aversion. Risk-averse investors require a greater equity premium to invest in assets where the payout is more uncertain. This insight is fundamental in modern portfolio th ...

Risk in emerging markets

... Can this performance be replicated in the coming decade? Overall, we remain optimistic about the future of the emerging-market banks, yet we also believe that they will need to adapt rapidly to a different environment. While overall growth rates are likely to slow in many markets, relatively low pen ...

... Can this performance be replicated in the coming decade? Overall, we remain optimistic about the future of the emerging-market banks, yet we also believe that they will need to adapt rapidly to a different environment. While overall growth rates are likely to slow in many markets, relatively low pen ...

risk - Harvard Kennedy School

... Lecture 25: Country Risk One lesson of portfolio diversification theory: A country borrowing too much drives up the expected rate of return it must pay. The supply of funds is not infinitely elastic. -- especially for developing countries. ...

... Lecture 25: Country Risk One lesson of portfolio diversification theory: A country borrowing too much drives up the expected rate of return it must pay. The supply of funds is not infinitely elastic. -- especially for developing countries. ...

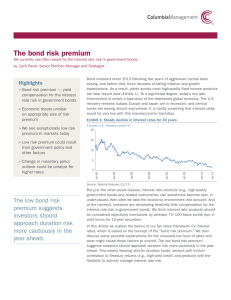

The bond risk premium

... demonstrates that prices of longer term securities will be more volatile, this does not necessarily mean they are less desirable in a portfolio. Modern asset pricing theory tells us that we should care about both a security’s volatility as well as its correlation — how it behaves relative to other a ...

... demonstrates that prices of longer term securities will be more volatile, this does not necessarily mean they are less desirable in a portfolio. Modern asset pricing theory tells us that we should care about both a security’s volatility as well as its correlation — how it behaves relative to other a ...

210115 The Dutch Pension System Chris Driessen

... Dramatic fall in interest rate have boosted pension liabilities... ...

... Dramatic fall in interest rate have boosted pension liabilities... ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... the banking licences were revoked, some of the banks had ratios of performing credits that were less than 10% of loan portfolios. In 2000 for instance, the ratio of non-performing loans to total loans of the industry had improved to 21.5% and as at the end of 2001, the ratio stood at 16.9%. In 2002, ...

... the banking licences were revoked, some of the banks had ratios of performing credits that were less than 10% of loan portfolios. In 2000 for instance, the ratio of non-performing loans to total loans of the industry had improved to 21.5% and as at the end of 2001, the ratio stood at 16.9%. In 2002, ...

Subjective Measures of Risk Aversion, Fixed Costs, and

... that if heterogeneity in risk preferences is important then empirical portfolio models should take this into account. The second motivation is that economic theory has a fair amount to say about how risk preferences should influence portfolio allocation. Having direct measures of risk preferences sh ...

... that if heterogeneity in risk preferences is important then empirical portfolio models should take this into account. The second motivation is that economic theory has a fair amount to say about how risk preferences should influence portfolio allocation. Having direct measures of risk preferences sh ...

RISK MANAGEMENT

... Policy therefore sets forth fundamental risk management principles including a risk culture and we facilitates proper judgment on the nature of risks the Bank can undertake. Comprehensive risk management requires not only detailed monitoring of each risk involved in individual operations, but also a ...

... Policy therefore sets forth fundamental risk management principles including a risk culture and we facilitates proper judgment on the nature of risks the Bank can undertake. Comprehensive risk management requires not only detailed monitoring of each risk involved in individual operations, but also a ...

Influence of macroeconomic fundamentals on country risk and

... Brazil (1999/2002) and Argentina (2001/2002). The level of country risk in these countries quickly returned to levels below 300 basis points in mid-2009. In Brazil, one of the most important emerging economies in the world, the country risk measured by JP Morgan reached its lowest historical value i ...

... Brazil (1999/2002) and Argentina (2001/2002). The level of country risk in these countries quickly returned to levels below 300 basis points in mid-2009. In Brazil, one of the most important emerging economies in the world, the country risk measured by JP Morgan reached its lowest historical value i ...

Risk

Risk is potential of losing something of value. Values (such as physical health, social status, emotional well being or financial wealth) can be gained or lost when taking risk resulting from a given action, activity and/or inaction, foreseen or unforeseen. Risk can also be defined as the intentional interaction with uncertainty. Uncertainty is a potential, unpredictable, unmeasurable and uncontrollable outcome, risk is a consequence of action taken in spite of uncertaintyRisk perception is the subjective judgment people make about the severity and/or probability of a risk, and may vary person to person. Any human endeavor carries some risk, but some are much riskier than others.