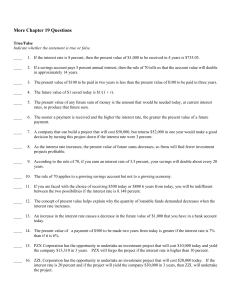

More Finance Questions

... ____ 23. Historically the return on stocks has been higher than the return on bonds. In part this reflects the higher risk from holding stock. ____ 24. Risk-averse persons will take no risks. ____ 25. The market for insurance is one example of reducing risk by using diversification. ____ 26. A perso ...

... ____ 23. Historically the return on stocks has been higher than the return on bonds. In part this reflects the higher risk from holding stock. ____ 24. Risk-averse persons will take no risks. ____ 25. The market for insurance is one example of reducing risk by using diversification. ____ 26. A perso ...

Risk measures and robust optimization problems

... This property allows to decentralize the management of risk arising from a collection of different positions: If separate risk limits are given to different “desks”, then the risk of the aggregate position is bounded by the sum of the individual risk limits. In many situations, however, risk may gro ...

... This property allows to decentralize the management of risk arising from a collection of different positions: If separate risk limits are given to different “desks”, then the risk of the aggregate position is bounded by the sum of the individual risk limits. In many situations, however, risk may gro ...

Basel III Pillar 3 Regulatory Capital Disclosure Report 12.31.15

... “estimates,” “will,” “should,” “may” or words of similar meaning, but these words are not the exclusive means of identifying forward-looking statements. Forward-looking statements are based on management’s current expectations and assumptions, and are subject to inherent uncertainties, risks and cha ...

... “estimates,” “will,” “should,” “may” or words of similar meaning, but these words are not the exclusive means of identifying forward-looking statements. Forward-looking statements are based on management’s current expectations and assumptions, and are subject to inherent uncertainties, risks and cha ...

Managerial risk preference and its influencing factors: analysis of

... In 2015, the total revenue of national SOEs was RMB 45.47 trillion, down by 5.4%; total profit was RMB 2.3 trillion, down by 6.7%.3 Investigations showed that a large number of ‘‘zombie firms’’ comprise large SOEs, typified by discontinuation, semi-cut, continued loss, insolvency, and operations mai ...

... In 2015, the total revenue of national SOEs was RMB 45.47 trillion, down by 5.4%; total profit was RMB 2.3 trillion, down by 6.7%.3 Investigations showed that a large number of ‘‘zombie firms’’ comprise large SOEs, typified by discontinuation, semi-cut, continued loss, insolvency, and operations mai ...

Markowitz and the Expanding Definition of Risk: Applications of Multi

... Capital Asset Pricing Model (CAPM) held that investors are compensated for bearing not only total risk, but also rather market risk, or systematic risk, as measured by a stock’s beta. Investors are not compensated for bearing stock-specific risk, which can be diversified away in a portfolio context. ...

... Capital Asset Pricing Model (CAPM) held that investors are compensated for bearing not only total risk, but also rather market risk, or systematic risk, as measured by a stock’s beta. Investors are not compensated for bearing stock-specific risk, which can be diversified away in a portfolio context. ...

Success and Risk Factors in the Pre

... account can be divided into network, financial, and ecological approaches. In network approaches the emphasis is on relationships between people. Ties can differ in diversity and emotional strength. Diversity of ties means that one knows people that do not know each other. Emotional strength can vary ...

... account can be divided into network, financial, and ecological approaches. In network approaches the emphasis is on relationships between people. Ties can differ in diversity and emotional strength. Diversity of ties means that one knows people that do not know each other. Emotional strength can vary ...

NBER WORKING PAPER SERIES NEW FRAMEWORK FOR MEASURING AND MANAGING MACROFINANCIAL

... example, the economic balance sheet of the banking sector has assets consisting of corporate loans (default-free debt minus the value of a put option). The banking sector also includes contingent liabilities (implicit put options) from the government as an asset, which is an obligation (short put op ...

... example, the economic balance sheet of the banking sector has assets consisting of corporate loans (default-free debt minus the value of a put option). The banking sector also includes contingent liabilities (implicit put options) from the government as an asset, which is an obligation (short put op ...

Tendency to Choose Big Audit Firms: Case of Indonesia

... because the brand name auditors have greater resources with better quality to execute more complex audit procedures. Becker et al. (1998) find that discretionary accruals are higher for companies audited by small audit firms or non-brand name auditors. The existence of higher discretionary accruals ...

... because the brand name auditors have greater resources with better quality to execute more complex audit procedures. Becker et al. (1998) find that discretionary accruals are higher for companies audited by small audit firms or non-brand name auditors. The existence of higher discretionary accruals ...

Spring 2013 Advanced Portfolio Management Solutions

... Identify and describe four factors that affect the risk objectives and risk tolerance of the employees’ DB pension plan. Commentary on Question: The question requires candidate to identify and describe only four factors; additional credit is not given for more than four factors. The model solution b ...

... Identify and describe four factors that affect the risk objectives and risk tolerance of the employees’ DB pension plan. Commentary on Question: The question requires candidate to identify and describe only four factors; additional credit is not given for more than four factors. The model solution b ...

New Framework for Measuring and Managing Macrofinancial Risk and Financial Stability

... example, the economic balance sheet of the banking sector has assets consisting of corporate loans (default-free debt minus the value of a put option). The banking sector also includes contingent liabilities (implicit put options) from the government as an asset, which is an obligation (short put op ...

... example, the economic balance sheet of the banking sector has assets consisting of corporate loans (default-free debt minus the value of a put option). The banking sector also includes contingent liabilities (implicit put options) from the government as an asset, which is an obligation (short put op ...

Reflections on Recent Target Date Glide-Path

... real annuity that is not actually available to most retirement plan participants (and likely would not be purchased by them anyway based on the low adoption rates of those annuity products that are available) is not the primary measure against which we evaluate glidepath efficacy. ...

... real annuity that is not actually available to most retirement plan participants (and likely would not be purchased by them anyway based on the low adoption rates of those annuity products that are available) is not the primary measure against which we evaluate glidepath efficacy. ...

Heterogeneous Risk Preferences in Financial Markets

... differ in their risk aversion parameter, their rate of time preference, and their beliefs. However, they focus on issues of long run survival and price. I build on their results by studying how changes in the distribution of preferences effect the short run dynamics of the model, while focusing on a ...

... differ in their risk aversion parameter, their rate of time preference, and their beliefs. However, they focus on issues of long run survival and price. I build on their results by studying how changes in the distribution of preferences effect the short run dynamics of the model, while focusing on a ...

Capital efficiency and optimization Measured steps to achieve return

... profitability effect Indian banks have traditionally established profitability management frameworks based on the conventional Fund Transfer Pricing (‘FTP’) methodologies, which considers either the historic cost of funds or the marginal cost of funds to determine the return on equity (‘ROE’) for ea ...

... profitability effect Indian banks have traditionally established profitability management frameworks based on the conventional Fund Transfer Pricing (‘FTP’) methodologies, which considers either the historic cost of funds or the marginal cost of funds to determine the return on equity (‘ROE’) for ea ...

Deconstructing Equity: Public Ownership, Agency Costs, and

... marketplace, reflected the absence of low-cost means to transfer-and market participants who could be paid to bear-only a portion of that risk. In complete capital markets, private owners can purchase risk bearing and liquidity in discrete slices. And if risk management and liquidity are available b ...

... marketplace, reflected the absence of low-cost means to transfer-and market participants who could be paid to bear-only a portion of that risk. In complete capital markets, private owners can purchase risk bearing and liquidity in discrete slices. And if risk management and liquidity are available b ...

NBER WORKING PAPER SERIES UNINSURED IDIOSYNCRATIC INVESTMENT RISK AND AGGREGATE SAVING George-Marios Angeletos

... Stacchetti (2000). In these models, investment risk is known to have a positive effect on savings and growth when the elasticity of intertemporal substitution is less than one, but this is only because the income share of capital is one.3 In the benchmark model, the entire capital stock is held in pr ...

... Stacchetti (2000). In these models, investment risk is known to have a positive effect on savings and growth when the elasticity of intertemporal substitution is less than one, but this is only because the income share of capital is one.3 In the benchmark model, the entire capital stock is held in pr ...

intermediate-financial-management-10th-edition

... the market risk of a stock (beta), and it specifies the relationship between risk as measured by beta and the required rate of return on a stock. Its principal developers (Sharpe and Markowitz) won the Nobel Prize in 1990 for their work. The key assumptions are spelled out in Chapter 3, but they inc ...

... the market risk of a stock (beta), and it specifies the relationship between risk as measured by beta and the required rate of return on a stock. Its principal developers (Sharpe and Markowitz) won the Nobel Prize in 1990 for their work. The key assumptions are spelled out in Chapter 3, but they inc ...

Report on Internal Control 2013 - Autorité de contrôle prudentiel et

... institutions can, for the last time (financial year 2014), produce their reports on internal control according to the Regulation 97-02 of 21 February 1997 as amended (repealed by the above-mentioned order). Consequently, the references given below are from the Regulation 97-02 of 21 February 1997 as ...

... institutions can, for the last time (financial year 2014), produce their reports on internal control according to the Regulation 97-02 of 21 February 1997 as amended (repealed by the above-mentioned order). Consequently, the references given below are from the Regulation 97-02 of 21 February 1997 as ...

Tail Risk Hedging: A Roadmap for Asset Owners

... With a working definition of tail risk in hand, an asset owner must decide on the degree of hedging desired. Is the hedge to be placed at the single instrument level (e.g., too much Microsoft exposure), theme/sector level (e.g., too much exposure to tech), ...

... With a working definition of tail risk in hand, an asset owner must decide on the degree of hedging desired. Is the hedge to be placed at the single instrument level (e.g., too much Microsoft exposure), theme/sector level (e.g., too much exposure to tech), ...

here - CLS Blue Sky Blog

... cause damage to the economy as a whole and the types of regulation that can lessen the risk of such damage occurring. Amici have studied the causes and consequences of the global financial crisis of 2008 and have made recommendations to policymakers concerning measures that will both reduce the risk ...

... cause damage to the economy as a whole and the types of regulation that can lessen the risk of such damage occurring. Amici have studied the causes and consequences of the global financial crisis of 2008 and have made recommendations to policymakers concerning measures that will both reduce the risk ...

Financial cycle

... Shin (2010) argues that increased systemic risk from interconnectedness of banks is a corollary of excessive asset growth and a macroprudential policy framework must therefore address excessive asset dynamics and fragility of bank liabilities. • In a growth phase of the financial cycle, rapid credit ...

... Shin (2010) argues that increased systemic risk from interconnectedness of banks is a corollary of excessive asset growth and a macroprudential policy framework must therefore address excessive asset dynamics and fragility of bank liabilities. • In a growth phase of the financial cycle, rapid credit ...

Backtesting Value-at-Risk based on Tail Losses Woon K. Wong

... measure. More importantly, for a portfolio with elliptically distributed returns, VaR is subadditive and thus a coherent risk measure; see for example Embrechts et al. (1999) and Szegö (2002). In practice, risk management process is about communicating effectively various aspects of risks and reduci ...

... measure. More importantly, for a portfolio with elliptically distributed returns, VaR is subadditive and thus a coherent risk measure; see for example Embrechts et al. (1999) and Szegö (2002). In practice, risk management process is about communicating effectively various aspects of risks and reduci ...

Morningstar`s 2016 Fundamentals for Investors

... There’s a reason that investors tend to only hear about 3 Look, but don’t stare. “looming” market doom or “imminent” market growth. While it’s important for investors to know the While many news outlets have incentive to draw performance of their accounts, short-term market fluctuviewer attention wi ...

... There’s a reason that investors tend to only hear about 3 Look, but don’t stare. “looming” market doom or “imminent” market growth. While it’s important for investors to know the While many news outlets have incentive to draw performance of their accounts, short-term market fluctuviewer attention wi ...

Alternative Risk Transfer, The Convergence of the Insurance and

... with stagnant capacity of reinsurers while primary insurance industries faced increased demand for risk coverage, insurers turned to the capital markets to supplement their reinsurance needs. Although the ILS market was created by insurers looking for alternatives to reinsurance, it has since been f ...

... with stagnant capacity of reinsurers while primary insurance industries faced increased demand for risk coverage, insurers turned to the capital markets to supplement their reinsurance needs. Although the ILS market was created by insurers looking for alternatives to reinsurance, it has since been f ...

Asset Pricing Theory with an Imprecise Information Set

... In the spirit of Merton (1973), we derive an intertemporal asset-pricing model that examines the pricing of risk associated with imprecise accounting information. We model the impact of imprecise information on asset returns with an Ornstein-Uhlenbeck meanreverting process under which the informati ...

... In the spirit of Merton (1973), we derive an intertemporal asset-pricing model that examines the pricing of risk associated with imprecise accounting information. We model the impact of imprecise information on asset returns with an Ornstein-Uhlenbeck meanreverting process under which the informati ...

International Interbank Borrowing During the Global Crisis

... within the cluster. In the context of the global crisis, U.K. banks could pull back from other borrowers if there is a crisis in Ireland (Figure 1a). This paper argues that similar indirect effects could arise in lending clusters. It is not uncommon for large borrowers to depend on several major cre ...

... within the cluster. In the context of the global crisis, U.K. banks could pull back from other borrowers if there is a crisis in Ireland (Figure 1a). This paper argues that similar indirect effects could arise in lending clusters. It is not uncommon for large borrowers to depend on several major cre ...

Risk

Risk is potential of losing something of value. Values (such as physical health, social status, emotional well being or financial wealth) can be gained or lost when taking risk resulting from a given action, activity and/or inaction, foreseen or unforeseen. Risk can also be defined as the intentional interaction with uncertainty. Uncertainty is a potential, unpredictable, unmeasurable and uncontrollable outcome, risk is a consequence of action taken in spite of uncertaintyRisk perception is the subjective judgment people make about the severity and/or probability of a risk, and may vary person to person. Any human endeavor carries some risk, but some are much riskier than others.