Mankiw 5e Chapter 4

... A. people start spending too much money. B. firms demand higher and higher prices for their goods. C. governments are forced to print money to finance their spending. D. fiscal deficits are small. ...

... A. people start spending too much money. B. firms demand higher and higher prices for their goods. C. governments are forced to print money to finance their spending. D. fiscal deficits are small. ...

Essays on Dynamic Macroeconomics - Institute for International

... - mainly taxes - can account for the discrepancy in labor supply between Sweden and the U.S. Moreover, even though the elasticity of labor supply is rather low for individual households, labor taxes are estimated to be associated with considerable output losses. I also show that policy can account f ...

... - mainly taxes - can account for the discrepancy in labor supply between Sweden and the U.S. Moreover, even though the elasticity of labor supply is rather low for individual households, labor taxes are estimated to be associated with considerable output losses. I also show that policy can account f ...

Taxes and the Economy: An Economic Thomas L. Hungerford

... Income tax rates have been at the center of recent policy debates over taxes. Some policymakers have argued that raising tax rates, especially on higher income taxpayers, to increase tax revenues is part of the solution for long-term debt reduction. For example, the Senate recently passed the Middle ...

... Income tax rates have been at the center of recent policy debates over taxes. Some policymakers have argued that raising tax rates, especially on higher income taxpayers, to increase tax revenues is part of the solution for long-term debt reduction. For example, the Senate recently passed the Middle ...

PDF

... expenses (Nickerson et al., 2012). In recent years, farmland values have increased at record rates in a number of areas throughout the country (Duffy, 2011). The rapid appreciation has garnered the attention of investors outside of the traditional agricultural sector (Ifft & Kuethe, 2011). Todd H. K ...

... expenses (Nickerson et al., 2012). In recent years, farmland values have increased at record rates in a number of areas throughout the country (Duffy, 2011). The rapid appreciation has garnered the attention of investors outside of the traditional agricultural sector (Ifft & Kuethe, 2011). Todd H. K ...

Unemployment and Economic Recovery

... picks up is that some firms may have underutilized labor. Laying off workers when times are bad and rehiring them as conditions improve has costs. Therefore, up to a point, firms may be willing to pay for more workers than they need to satisfy the depressed demand for their goods and services. As a ...

... picks up is that some firms may have underutilized labor. Laying off workers when times are bad and rehiring them as conditions improve has costs. Therefore, up to a point, firms may be willing to pay for more workers than they need to satisfy the depressed demand for their goods and services. As a ...

Taxes and the Economy: An Economic Thomas L. Hungerford

... Income tax rates have been at the center of recent policy debates over taxes. Some policymakers have argued that raising tax rates, especially on higher income taxpayers, to increase tax revenues is part of the solution for long-term debt reduction. For example, the Senate recently passed the Middle ...

... Income tax rates have been at the center of recent policy debates over taxes. Some policymakers have argued that raising tax rates, especially on higher income taxpayers, to increase tax revenues is part of the solution for long-term debt reduction. For example, the Senate recently passed the Middle ...

7 The Anatomy of Inflation and Unemployment

... The natural rate of unemployment is determined by a number of factors, some which affect the duration of unemploymentthe average length of time person remains out of workand others which affect the frequency of unemploymentthe average number of times in a given period that workers become unemploy ...

... The natural rate of unemployment is determined by a number of factors, some which affect the duration of unemploymentthe average length of time person remains out of workand others which affect the frequency of unemploymentthe average number of times in a given period that workers become unemploy ...

The U.S. economy to 2010

... Consumer durable goods. Consumer spending on longlasting items, such as motor vehicles, personal computers, and household furnishings, is highly cyclical. During the past two decades, particularly in the 1990s, the U.S. economy experienced the most sustained spending on big-ticket items ever, bringi ...

... Consumer durable goods. Consumer spending on longlasting items, such as motor vehicles, personal computers, and household furnishings, is highly cyclical. During the past two decades, particularly in the 1990s, the U.S. economy experienced the most sustained spending on big-ticket items ever, bringi ...

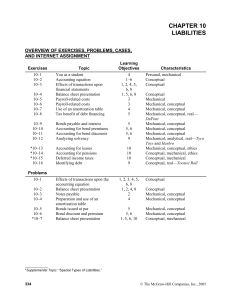

Internet Assignment

... capital—that is, applying leverage. In essence, if you can borrow money at a relatively low rate and invest it at a significantly higher one, you will benefit from doing so. But some businesses have borrowed such large amounts—and at such high interest rates—that they have been unable to earn enough ...

... capital—that is, applying leverage. In essence, if you can borrow money at a relatively low rate and invest it at a significantly higher one, you will benefit from doing so. But some businesses have borrowed such large amounts—and at such high interest rates—that they have been unable to earn enough ...

Stability Programme - European Commission

... This Stability Programme outlines France's fiscal strategy for the period 2016-2019. It presents the macroeconomic scenario adopted by the government and sets out its main objectives - getting the French economy back on track and continuing its fiscal consolidation efforts. In 2015, France exceeded ...

... This Stability Programme outlines France's fiscal strategy for the period 2016-2019. It presents the macroeconomic scenario adopted by the government and sets out its main objectives - getting the French economy back on track and continuing its fiscal consolidation efforts. In 2015, France exceeded ...

Section 1 - Practising Law Institute

... Funding and Deductibility of Contributions to a VEBA. VEBAs can use a variety of methods for recording and applying amounts contributed and held under the VEBA. For example, a VEBA can have a defined contribution feature whereby an employer and a union agree that an increment of each employee’s comp ...

... Funding and Deductibility of Contributions to a VEBA. VEBAs can use a variety of methods for recording and applying amounts contributed and held under the VEBA. For example, a VEBA can have a defined contribution feature whereby an employer and a union agree that an increment of each employee’s comp ...

An Introduction to the Federal Reserve System

... country well. And there is no conflict, most of the time and especially now, between pursing both pieces of this.” “I am committed to achieving both parts of our dual mandate—helping the economy return to full employment and returning inflation to 2 percent, while ensuring that it does not run persi ...

... country well. And there is no conflict, most of the time and especially now, between pursing both pieces of this.” “I am committed to achieving both parts of our dual mandate—helping the economy return to full employment and returning inflation to 2 percent, while ensuring that it does not run persi ...

Inflacja - E-SGH

... 1970s: unemployment rate and the inflation rate>10% (UK). Effects of the supply shock: oil prices tripled, rising the price level, 1973-74). Short run Phillips curve shifted up, equilibrium point E much higher on LRPC than in 1960. Two possible reactions of government: a) increase of M (easy monetar ...

... 1970s: unemployment rate and the inflation rate>10% (UK). Effects of the supply shock: oil prices tripled, rising the price level, 1973-74). Short run Phillips curve shifted up, equilibrium point E much higher on LRPC than in 1960. Two possible reactions of government: a) increase of M (easy monetar ...

Submission to Committee for Social Development

... the intention is that both members of a couple must be above qualifying age for a couple for state pension to be paid otherwise couples must claim Universal Credit. With pension age being equalized for men and women by April 2018 this means that one member of a couple could be well above pensionable ...

... the intention is that both members of a couple must be above qualifying age for a couple for state pension to be paid otherwise couples must claim Universal Credit. With pension age being equalized for men and women by April 2018 this means that one member of a couple could be well above pensionable ...

The Government and Fiscal Policy

... → Inventories will be lower than planned → A rise in output As Y rises → creation of more employment → more income will be generated → causing a second-round increase in consumption Familiar multiplier in action ...

... → Inventories will be lower than planned → A rise in output As Y rises → creation of more employment → more income will be generated → causing a second-round increase in consumption Familiar multiplier in action ...

The Graduate Backpack

... ⧁ Male 40 anb with a 4 year diploma and gross income in all cases R204 000 pa (R17 000 pm). ⧁ All premium calculations are based on the following: ...

... ⧁ Male 40 anb with a 4 year diploma and gross income in all cases R204 000 pa (R17 000 pm). ⧁ All premium calculations are based on the following: ...

Regulatory Capital Requirements under FTK and

... In the Netherlands, it is obligatory to participate in a pension scheme in case it is provided by the employer. Since employees are obliged to invest part of their salary in a pension scheme, it is important that there is good supervision. The legislation for pension funds is embedded in the Financi ...

... In the Netherlands, it is obligatory to participate in a pension scheme in case it is provided by the employer. Since employees are obliged to invest part of their salary in a pension scheme, it is important that there is good supervision. The legislation for pension funds is embedded in the Financi ...

How Homeowners Choose between Fixed and Adjustable Rate

... households with co-borrowers, married couples, and limited expected housing tenures were found to have the greatest probability of taking out ARM. In general, they found that borrower characteristics do not significantly influence the choice. Despite the vast amount of literature dealing with housin ...

... households with co-borrowers, married couples, and limited expected housing tenures were found to have the greatest probability of taking out ARM. In general, they found that borrower characteristics do not significantly influence the choice. Despite the vast amount of literature dealing with housin ...

Assessing Discount Rate for a Project Financed Entirely with Equity

... with a stable rate, for a very long time. Two-stage model separates the time interval into two periods: for the first period, we are not able to forecast stable income streams, while in the second period cash flows will enhance at a constant sustainable rate. The three-stage model establishes three ...

... with a stable rate, for a very long time. Two-stage model separates the time interval into two periods: for the first period, we are not able to forecast stable income streams, while in the second period cash flows will enhance at a constant sustainable rate. The three-stage model establishes three ...

Marxist Crisis Theory and the Severity of the Current Economic Crisis

... 1982 (U.S. Bureau of Labor Statistics, 2009). This resulted from intentional government policy, as the Federal Reserve applied very tight monetary policy which drove interest rates over 20%, aiming at destroying labor's bargaining power, stopping inflation, and driving up the international value of ...

... 1982 (U.S. Bureau of Labor Statistics, 2009). This resulted from intentional government policy, as the Federal Reserve applied very tight monetary policy which drove interest rates over 20%, aiming at destroying labor's bargaining power, stopping inflation, and driving up the international value of ...

Perverse Fiscal Consolidation by D. Mario Nuti Sapienza University

... “employable”, pulling down the growth path of potential output (Vianello 2005). “An insufficient demand protracted over time unavoidably generates a slowdown in the formation of new productive capacity and therefore of potential income” (ibidem). Discouraged workers will stop looking for work and th ...

... “employable”, pulling down the growth path of potential output (Vianello 2005). “An insufficient demand protracted over time unavoidably generates a slowdown in the formation of new productive capacity and therefore of potential income” (ibidem). Discouraged workers will stop looking for work and th ...

Real Interest Rates, Saving and Investment

... Saving might also be a®ected by government spending and ¯scal policy. Government spending consists of purchases of goods and services and transfer payments. Blanchard (1985) showed that both the level and expected changes of government spending might a®ect aggregate demand. The e®ect of a change in ...

... Saving might also be a®ected by government spending and ¯scal policy. Government spending consists of purchases of goods and services and transfer payments. Blanchard (1985) showed that both the level and expected changes of government spending might a®ect aggregate demand. The e®ect of a change in ...

Chapter 13

... If AD now decreases back to AD0, equilibrium real GDP decreases again to $9 trillion, the full employment level. If AD decreases further to AD2, equilibrium real GDP decreases to $8 trillion and the economy is in a recession, with equilibrium real GDP below full employment. If AD increases again to ...

... If AD now decreases back to AD0, equilibrium real GDP decreases again to $9 trillion, the full employment level. If AD decreases further to AD2, equilibrium real GDP decreases to $8 trillion and the economy is in a recession, with equilibrium real GDP below full employment. If AD increases again to ...