12 January 2016 Real income of households increased by 2.7

... 7. Average monthly income from employment is defined as wages and salaries for the national economy (D.11) in average per month divided by the number of employees (full-time equivalent). The wages and salaries indicator includes all income from employment, namely in cash as well as in kind (employee ...

... 7. Average monthly income from employment is defined as wages and salaries for the national economy (D.11) in average per month divided by the number of employees (full-time equivalent). The wages and salaries indicator includes all income from employment, namely in cash as well as in kind (employee ...

Macro3 Summary and Teaching Tips

... As in Macro2 the student sets government spending, taxes, and the money supply. As in Macro2 fiscal policy results reflect crowding out effects. Crowding out is more severe in this module than in Macro2, with an effective multiplier result of about .02. This is only partly due to the choice of the m ...

... As in Macro2 the student sets government spending, taxes, and the money supply. As in Macro2 fiscal policy results reflect crowding out effects. Crowding out is more severe in this module than in Macro2, with an effective multiplier result of about .02. This is only partly due to the choice of the m ...

Contractual Savings and Financial Markets

... The impact on the bond market is stronger in countries with a bank based financial system The impact of contractual savings institutions on securities market is not the consequence of a joint determination of both contractual savings institutions and financial markets by other slow-moving characteri ...

... The impact on the bond market is stronger in countries with a bank based financial system The impact of contractual savings institutions on securities market is not the consequence of a joint determination of both contractual savings institutions and financial markets by other slow-moving characteri ...

Topic Note-3

... does not invest any further, EPS is expected to remain constant at this level. However, starting next year, the firm has the chance to invest $3 per share a year in developing a newly discovered geothermal steam source for electricity generation. Each investment is expected generate a perpetual 20 % ...

... does not invest any further, EPS is expected to remain constant at this level. However, starting next year, the firm has the chance to invest $3 per share a year in developing a newly discovered geothermal steam source for electricity generation. Each investment is expected generate a perpetual 20 % ...

Midterm

... of the distribution, and your conclusions. Unless otherwise mentioned, all hypothesis tests should be performed at the 95% level of confidence. Partial credit will be given only if work is shown. The number of points each problem is worth appears in parenthesis. ...

... of the distribution, and your conclusions. Unless otherwise mentioned, all hypothesis tests should be performed at the 95% level of confidence. Partial credit will be given only if work is shown. The number of points each problem is worth appears in parenthesis. ...

Front of House Supervisor Responsible to: House Manager Place of

... You will be auto-enrolled into a workplace pension scheme operated by NOW Pensions at the statutory level (these contributions are postponed during the probationary period but there is an option for you to “opt in” at this stage if you chose to do so). Alternatively on completion of your probationar ...

... You will be auto-enrolled into a workplace pension scheme operated by NOW Pensions at the statutory level (these contributions are postponed during the probationary period but there is an option for you to “opt in” at this stage if you chose to do so). Alternatively on completion of your probationar ...

ECONOMICS - TerpConnect

... • Properly targeted tax cuts (such as capital gains or corporate profit)can increase the rate of economic growth but force us to either redistribute the tax burden or cut government programs ...

... • Properly targeted tax cuts (such as capital gains or corporate profit)can increase the rate of economic growth but force us to either redistribute the tax burden or cut government programs ...

PDF Download

... Whereas the seasonally adjusted unemployment rate for the 12 euroarea countries stabilised at 8.8% in April, it edged up slightly to 8.1% in the entire EU-15 group. The lowest rates were registered in Luxembourg (3.5%), the Netherlands (3.7%), Austria (4.3%), Ireland (4.6%), and Denmark (5.1%). Spai ...

... Whereas the seasonally adjusted unemployment rate for the 12 euroarea countries stabilised at 8.8% in April, it edged up slightly to 8.1% in the entire EU-15 group. The lowest rates were registered in Luxembourg (3.5%), the Netherlands (3.7%), Austria (4.3%), Ireland (4.6%), and Denmark (5.1%). Spai ...

Costa_Rica_en.pdf

... another increase in the fiscal deficit as a proportion of GDP. Monetary and exchange-rate policies in 2010 continued to aim for a transition towards a flexible exchange rate and inflation targeting, while also pursuing the process to keep inflation down that was begun in 2009. (a) Fiscal policy The ...

... another increase in the fiscal deficit as a proportion of GDP. Monetary and exchange-rate policies in 2010 continued to aim for a transition towards a flexible exchange rate and inflation targeting, while also pursuing the process to keep inflation down that was begun in 2009. (a) Fiscal policy The ...

2 Macroeconomics LESSON 2 s ACTIVITY 11

... Which of the following are included and which are excluded in calculating GDP? Explain your decisions. 1. A monthly check received by an economics student who has been granted a government scholarship Excluded: transfer payment from government to an individual 2. A farmer’s purchase of a new tractor ...

... Which of the following are included and which are excluded in calculating GDP? Explain your decisions. 1. A monthly check received by an economics student who has been granted a government scholarship Excluded: transfer payment from government to an individual 2. A farmer’s purchase of a new tractor ...

Fiscal Policy

... • Congress must be careful with the amount of taxes/spending adjusted, as it could create a multiplying (“snowball”) effect: – If the gov’t puts $10 billion into the economy, that money will affect GDP more than $10 bill. It may affect by $10.5 or even $12 billion, depending on responsiveness of eco ...

... • Congress must be careful with the amount of taxes/spending adjusted, as it could create a multiplying (“snowball”) effect: – If the gov’t puts $10 billion into the economy, that money will affect GDP more than $10 bill. It may affect by $10.5 or even $12 billion, depending on responsiveness of eco ...

Slide 1

... Natural Rate of Unemployment Hypothesis • The natural rate of output and employment “ground out” by the equilibrium in goods, labour and money markets (Friedman (1968)) • The economies converges to the natural rate in the long run. • Nothing in the economy guarantees that actual output and employme ...

... Natural Rate of Unemployment Hypothesis • The natural rate of output and employment “ground out” by the equilibrium in goods, labour and money markets (Friedman (1968)) • The economies converges to the natural rate in the long run. • Nothing in the economy guarantees that actual output and employme ...

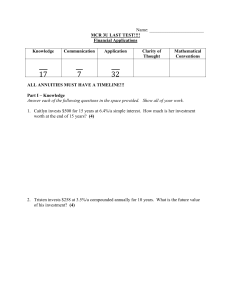

Test Chapter 8 Spring `14

... years, the interest rate changes to 9%/a compounded semi-annually. Calculate the value of the investment two years after this change. (7) ...

... years, the interest rate changes to 9%/a compounded semi-annually. Calculate the value of the investment two years after this change. (7) ...

DISCUSSION by David Vavra

... Should really a high interest rate differential imply higher flows? Exchange rate depreciation reducing flows? Nominal vs real rates of return ...

... Should really a high interest rate differential imply higher flows? Exchange rate depreciation reducing flows? Nominal vs real rates of return ...

Review of retirement income stream regulation

... Further, the Institute recommends that members should be limited from having the ability to effectively take 100 per cent of their benefits as either a lump sum or as one off pension payment. Whilst extensive legislation exists to regulate how much, and the manner in which Australians contribute to ...

... Further, the Institute recommends that members should be limited from having the ability to effectively take 100 per cent of their benefits as either a lump sum or as one off pension payment. Whilst extensive legislation exists to regulate how much, and the manner in which Australians contribute to ...

COVENANT UNIVERSITY NIGERIA TUTORIAL KIT OMEGA

... probability of living up to later old ages. At this stage, the country need not to allocate a larger percentage of her budget on recurrent expenditures, but rather on long-term investments that will help to develop the country and improve the standard of living of the people. When this window of opp ...

... probability of living up to later old ages. At this stage, the country need not to allocate a larger percentage of her budget on recurrent expenditures, but rather on long-term investments that will help to develop the country and improve the standard of living of the people. When this window of opp ...

Document

... Changes in Exchange Rates • Exchange rates (e) are a function of the supply and demand for currency. – An increase in the supply of a currency will decrease the exchange rate of a currency – A decrease in supply of a currency will increase the exchange rate of a currency – An increase in demand for ...

... Changes in Exchange Rates • Exchange rates (e) are a function of the supply and demand for currency. – An increase in the supply of a currency will decrease the exchange rate of a currency – A decrease in supply of a currency will increase the exchange rate of a currency – An increase in demand for ...

STEP TWO:

... you receive at the bank (which also offers lower risk). If the return from this company is higher than at the bank, then we have a better quality investment. Interest Cover - this is one of the most important ratios to consider financial risk. Interest cover should at least be above three times cove ...

... you receive at the bank (which also offers lower risk). If the return from this company is higher than at the bank, then we have a better quality investment. Interest Cover - this is one of the most important ratios to consider financial risk. Interest cover should at least be above three times cove ...

A 200

... Which of the following best explains why many United States economists support free international trade? a. Workers who lose their jobs can collect unemployment compensation. b. It is more important to reduce world inflation than to reduce United States unemployment. c. Workers are not affected; onl ...

... Which of the following best explains why many United States economists support free international trade? a. Workers who lose their jobs can collect unemployment compensation. b. It is more important to reduce world inflation than to reduce United States unemployment. c. Workers are not affected; onl ...

12-1

... • Social Security is the largest federal plan. • Social Security is a “pay-as-you-go” system. ...

... • Social Security is the largest federal plan. • Social Security is a “pay-as-you-go” system. ...

Examples of Level II exam item set questions

... create shareholder value. Price Objective & Risk We are reiterating our Buy recommendation on SKATE with a 12-month price objective of $45. This assumes that SKATE trades at 16.0X our 2010 estimated EPS of $2.25 and 17.3X our 2011 estimated EPS of $2.60. Risks to our price objective include: a slowd ...

... create shareholder value. Price Objective & Risk We are reiterating our Buy recommendation on SKATE with a 12-month price objective of $45. This assumes that SKATE trades at 16.0X our 2010 estimated EPS of $2.25 and 17.3X our 2011 estimated EPS of $2.60. Risks to our price objective include: a slowd ...

Practice Final

... C. When internally held debt is repaid, it decreases national wealth D. When externally held debt is repaid, it increases national wealth 42. The ____________ argument about the twin deficits says budget deficits ____________ the trade deficit A. Traditional; are caused by B. Traditional; are not ca ...

... C. When internally held debt is repaid, it decreases national wealth D. When externally held debt is repaid, it increases national wealth 42. The ____________ argument about the twin deficits says budget deficits ____________ the trade deficit A. Traditional; are caused by B. Traditional; are not ca ...

US GDP Review -- Consumer, Where Art Thou?

... Uncle Sam himself does not create income -- he borrows cash from current bondholders and future taxpayers. Not the stuff that seems deserving of a 760x multiple. Inflation was non-existent in the second quarter, with the GDP deflator flat and taking the YoY trend down to 1.5% from 1.9% in the first ...

... Uncle Sam himself does not create income -- he borrows cash from current bondholders and future taxpayers. Not the stuff that seems deserving of a 760x multiple. Inflation was non-existent in the second quarter, with the GDP deflator flat and taking the YoY trend down to 1.5% from 1.9% in the first ...

problem set 5 - Shepherd Webpages

... Expansionary fiscal policy (increase government spending and/or decrease taxes), other things constant, will increase the interest rate. To bring the interest rate back down to i1, the Fed can implement an expansionary monetary policy. i ...

... Expansionary fiscal policy (increase government spending and/or decrease taxes), other things constant, will increase the interest rate. To bring the interest rate back down to i1, the Fed can implement an expansionary monetary policy. i ...

The 4% Withdrawal Rule—Have Planners Been Wrong?

... recommends a 30-year strategy of withdrawing 4% (pre-tax) of the value of the initial portfolio of investments each year, with annual increases by amounts based on actual inflation rates. Bengen assumed a portfolio of 50% to 75% stocks and back-tested the rule using overlapping 30-year time periods. ...

... recommends a 30-year strategy of withdrawing 4% (pre-tax) of the value of the initial portfolio of investments each year, with annual increases by amounts based on actual inflation rates. Bengen assumed a portfolio of 50% to 75% stocks and back-tested the rule using overlapping 30-year time periods. ...