Enc. 5 for Treasury Management Strategy and Prudential Limits

... These are Money Market Funds which maintain a stable price of £1 per share when investors redeem or purchase shares which means that that any investment will not fluctuate in value. Corporate Bonds: ...

... These are Money Market Funds which maintain a stable price of £1 per share when investors redeem or purchase shares which means that that any investment will not fluctuate in value. Corporate Bonds: ...

Document

... difficult to reconcile the strictures of a monetary union with the absence of fiscal transfers. An example will clarify this last point. A number of European countries – including France, Italy and Portugal – suffer from a competitiveness gap against Germany. To take the example of Italy, it may tak ...

... difficult to reconcile the strictures of a monetary union with the absence of fiscal transfers. An example will clarify this last point. A number of European countries – including France, Italy and Portugal – suffer from a competitiveness gap against Germany. To take the example of Italy, it may tak ...

Laying the foundations for future prosperity: the longer term

... Of course, initiatives to encourage self-funding of retirement are not without cost to the budget. Most individuals are presently able to access superannuation concessions, a full or part pension and/or other concessions as well as generous taxation arrangements. These concessions will become increa ...

... Of course, initiatives to encourage self-funding of retirement are not without cost to the budget. Most individuals are presently able to access superannuation concessions, a full or part pension and/or other concessions as well as generous taxation arrangements. These concessions will become increa ...

School Funding Sources - Friess Lake School District

... To further clarify this statement, if state aid is reduced, the lost revenue must be made up with the tax levy. However, a district’s revenue limit can be increased beyond the limit in a few instances such as: when new costs occur when a district attaches new property or when the district is require ...

... To further clarify this statement, if state aid is reduced, the lost revenue must be made up with the tax levy. However, a district’s revenue limit can be increased beyond the limit in a few instances such as: when new costs occur when a district attaches new property or when the district is require ...

Fiscal Policy

... 1. Disincentives of Tax Cuts. Increasing Taxes to reduce AD may cause disincentives to work, if this occurs there will be a fall in productivity and AS could fall. However higher taxes do not necessarily reduce incentives to work if the income effect dominates. 2. Side Effects on Public Spending. Re ...

... 1. Disincentives of Tax Cuts. Increasing Taxes to reduce AD may cause disincentives to work, if this occurs there will be a fall in productivity and AS could fall. However higher taxes do not necessarily reduce incentives to work if the income effect dominates. 2. Side Effects on Public Spending. Re ...

Chapter 12, 13, and 14

... If Bob loses his job at the GM plant because car manufacturing is slow due to a downturn in the economy, you can conclude that he is ...

... If Bob loses his job at the GM plant because car manufacturing is slow due to a downturn in the economy, you can conclude that he is ...

How 401(k) Plans Make Recessions Worse

... and 401(k) type plan – a defined contribution (DC) plan. Most workers with DB plans also have a DC plan. Most workers with DC plans do not have a DB plans. One reason why Social Security works as an automatic stabilizer is because it is big. Social Security is a universal defined benefit plan (93 pe ...

... and 401(k) type plan – a defined contribution (DC) plan. Most workers with DB plans also have a DC plan. Most workers with DC plans do not have a DB plans. One reason why Social Security works as an automatic stabilizer is because it is big. Social Security is a universal defined benefit plan (93 pe ...

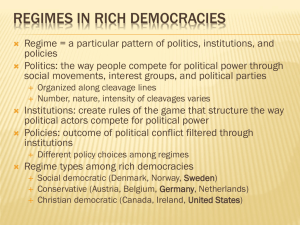

Regimes in rich democracies

... Creates a floor under which poor cannot fall Private to public spending devoted to welfare high (citizens pay larger proportion of cost of day care, health care, retirement) ...

... Creates a floor under which poor cannot fall Private to public spending devoted to welfare high (citizens pay larger proportion of cost of day care, health care, retirement) ...

Saving

... • Psychologists suggest individual self-control may be too weak to produce rational outcomes • Devices to support savings – Make savings automatic and withdrawals costly • Easy borrowing supports high levels of current spending ...

... • Psychologists suggest individual self-control may be too weak to produce rational outcomes • Devices to support savings – Make savings automatic and withdrawals costly • Easy borrowing supports high levels of current spending ...

Chapter 10

... IV. Another solution to layoffs (unemployment) in a recession, and the resulting lost output: The share economy. Wages are partially tied to profits. A majority of worker salaries would be stable, in economist Martin Weitzman’s proposal, while 15-20% would be variable and directly tied to the profi ...

... IV. Another solution to layoffs (unemployment) in a recession, and the resulting lost output: The share economy. Wages are partially tied to profits. A majority of worker salaries would be stable, in economist Martin Weitzman’s proposal, while 15-20% would be variable and directly tied to the profi ...

group insurance fna - Chambre de la sécurité financière

... DETERMINE IF THE CLIENT’S NEEDS HAVE CHANGED ...

... DETERMINE IF THE CLIENT’S NEEDS HAVE CHANGED ...

National Municipal Bonds Tax Free Yield Calculator

... can be made. Neither the information nor any opinion that may be expressed constitutes a solicitation for the purchase or sale of any security referred to herein. For certain Investors, the income from municipal bonds designated AMT may be subject to the Alternative Minimum Tax. Discount bonds may b ...

... can be made. Neither the information nor any opinion that may be expressed constitutes a solicitation for the purchase or sale of any security referred to herein. For certain Investors, the income from municipal bonds designated AMT may be subject to the Alternative Minimum Tax. Discount bonds may b ...

MANDATORYHWKTST3

... 33. Which of the following correctly explains the crowding-out effect? a. An increase in government expenditures => leads to more bonds bought by Gov’t => which increases demand of loanable funds => which leads to higher interest rates b. An increase in government expenditures => leads to more bonds ...

... 33. Which of the following correctly explains the crowding-out effect? a. An increase in government expenditures => leads to more bonds bought by Gov’t => which increases demand of loanable funds => which leads to higher interest rates b. An increase in government expenditures => leads to more bonds ...

(GDP) Per Capita

... In PEDs, the ratio is approaching 1:1 (one car per person, etc…) In PINGs, these products do not play a role in the daily lives of most people ...

... In PEDs, the ratio is approaching 1:1 (one car per person, etc…) In PINGs, these products do not play a role in the daily lives of most people ...

Homework Assignment 1

... They will earn labor income, wtLt, and private non-labor income, Πt. They pay a proportional tax rate, τ, on all private income and receive a subsidy S from the government regardless of how much they work. The budget constraint is C (1 ) wt TIME lst t St on all private incom ...

... They will earn labor income, wtLt, and private non-labor income, Πt. They pay a proportional tax rate, τ, on all private income and receive a subsidy S from the government regardless of how much they work. The budget constraint is C (1 ) wt TIME lst t St on all private incom ...

Document

... will lead to a shift to the left in the AD curve. • 3. Government spending in aggregate demand does not include payment by the government for which there is no corresponding output (transfer payment). • 4. Government spending is influence by political decisions of the government of the day. ...

... will lead to a shift to the left in the AD curve. • 3. Government spending in aggregate demand does not include payment by the government for which there is no corresponding output (transfer payment). • 4. Government spending is influence by political decisions of the government of the day. ...

To read the entire viewpoint, click here!

... normalcy will ultimately lead to even higher stock prices. Contrary to popular opinion, we think Fed policy is now a negative for investment success. Finally, and this is the most sinister of our theories, the Fed may be very complicit in a transfer of wealth from savers to borrowers. And who are th ...

... normalcy will ultimately lead to even higher stock prices. Contrary to popular opinion, we think Fed policy is now a negative for investment success. Finally, and this is the most sinister of our theories, the Fed may be very complicit in a transfer of wealth from savers to borrowers. And who are th ...

14.02 Macroeconomics May 18, 2006 Practice Question: Mundell-Fleming Model Managing Vermont’s Economy

... Y U S : Real GDP of the US T : Vermont’s Taxes i : Vermont’s nominal interest rate iU S : Nominal interest rate of the US E : VT$ in terms of US$ E e : Expected future VT$ in terms of US$ M : Vermont’s stock of money in circulation The only trading partner of Vermont is the US. Please note that the ...

... Y U S : Real GDP of the US T : Vermont’s Taxes i : Vermont’s nominal interest rate iU S : Nominal interest rate of the US E : VT$ in terms of US$ E e : Expected future VT$ in terms of US$ M : Vermont’s stock of money in circulation The only trading partner of Vermont is the US. Please note that the ...

Module Fiscal Policy and the Multiplier

... • Example: Same $50 billion given to HH is subject to MPC ratios $50 billion x MPC .5= 25 billion to re-spend $25 billion x 2 multiplier= $ 50 Billion Increase in GDP ...

... • Example: Same $50 billion given to HH is subject to MPC ratios $50 billion x MPC .5= 25 billion to re-spend $25 billion x 2 multiplier= $ 50 Billion Increase in GDP ...

Economics 259 Final Exam Fall 2014 Name: Before beginning the

... valued below the higher minimum wage. This policy change is likely to increase the measured unemployment rate. 22.c. Frictional unemployment will be reduced if workers with obsolete skills receive training that prepares them for available jobs. This policy change is intended to reduce the measured r ...

... valued below the higher minimum wage. This policy change is likely to increase the measured unemployment rate. 22.c. Frictional unemployment will be reduced if workers with obsolete skills receive training that prepares them for available jobs. This policy change is intended to reduce the measured r ...

14.02 Macroeconomics May 18, 2006 Practice Question: Mundell-Fleming Model Managing Vermont’s Economy

... rates. Because GDP decreases, money demand decreases. Vermont’s households reduce their money holdings by exchanging VT$ for bonds. Increasing demand for VT$-denominated bonds tends to increase bond prices and thus reduces the interest rate. By the UIP, the interest rate cannot change under fixed ex ...

... rates. Because GDP decreases, money demand decreases. Vermont’s households reduce their money holdings by exchanging VT$ for bonds. Increasing demand for VT$-denominated bonds tends to increase bond prices and thus reduces the interest rate. By the UIP, the interest rate cannot change under fixed ex ...

Econ 201 Intermediate Macroeconomics

... is ambiguous. Thinking in terms of the money market equilibrium, the increase in the nominal money supply tends to reduce the nominal interest rate, but the increase in nominal money demand (because of the increase in output) tends to increase the nominal interest rate. d. Output is higher than in F ...

... is ambiguous. Thinking in terms of the money market equilibrium, the increase in the nominal money supply tends to reduce the nominal interest rate, but the increase in nominal money demand (because of the increase in output) tends to increase the nominal interest rate. d. Output is higher than in F ...

Aegon Americas fact sheet

... • Transamerica provides a wide range of life insurance, long-term savings, pensions, accident & health, and investment products in the United States and Latin America. • The company uses a variety of distribution channels to help customers access its products and services in the way they prefer – ...

... • Transamerica provides a wide range of life insurance, long-term savings, pensions, accident & health, and investment products in the United States and Latin America. • The company uses a variety of distribution channels to help customers access its products and services in the way they prefer – ...

Testimony of Martin Feldstein Professor of Economics

... While lower income households may eventually spend a higher portion of their tax rebates, those with higher incomes may respond to the legislation more rapidly, using credit cards or available savings to spend their tax rebates even before they receive the cash. The total size of the package should ...

... While lower income households may eventually spend a higher portion of their tax rebates, those with higher incomes may respond to the legislation more rapidly, using credit cards or available savings to spend their tax rebates even before they receive the cash. The total size of the package should ...

Investment Outlook

... know, the neutral or natural rate of interest is not a new concept. Irving Fisher back in early 20th century hypothesized that while neutral nominal policy rates could go up or down depending on inflation and cyclical growth rates, that the real natural rate of interest was relatively constant. I th ...

... know, the neutral or natural rate of interest is not a new concept. Irving Fisher back in early 20th century hypothesized that while neutral nominal policy rates could go up or down depending on inflation and cyclical growth rates, that the real natural rate of interest was relatively constant. I th ...