Shree Gurukripa`s Institute of Management, chennai CA CPT

... Direct taxes contributed 7% of the GDP in 2012-13. Ratio of share of Direct and Indirect taxes = 39:61 (2012–13) ...

... Direct taxes contributed 7% of the GDP in 2012-13. Ratio of share of Direct and Indirect taxes = 39:61 (2012–13) ...

Speech in Stockholm

... 1. Single worker with average earnings. 2. The implicit tax rate on continued work refers to an "early retirement route". The latter is modelled as the unemployment benefits / assistance pathway into retirement with the exception of Ireland, where the modelling refers to the pre-retirement allowance ...

... 1. Single worker with average earnings. 2. The implicit tax rate on continued work refers to an "early retirement route". The latter is modelled as the unemployment benefits / assistance pathway into retirement with the exception of Ireland, where the modelling refers to the pre-retirement allowance ...

PDF Download

... pensions funds seriously undermines trust in the government’s respect for private property. That trust could be maintained if a pension reform led to accumulated wealth handled as private property shrinking, and savings managed by the state growing, provided that the changes were based on the princi ...

... pensions funds seriously undermines trust in the government’s respect for private property. That trust could be maintained if a pension reform led to accumulated wealth handled as private property shrinking, and savings managed by the state growing, provided that the changes were based on the princi ...

PowerPoint-presentation

... The measures start to have an effect. A slow recovery in the global economy started between the second and fourth quarters of 2009. Fiscal policy became increasingly expansive as a result of automatic stabilisers and stimulus measures. The economy made the clearest recovery in Asia, partly as a cons ...

... The measures start to have an effect. A slow recovery in the global economy started between the second and fourth quarters of 2009. Fiscal policy became increasingly expansive as a result of automatic stabilisers and stimulus measures. The economy made the clearest recovery in Asia, partly as a cons ...

Chapter 8 - Pearsoned.co.uk

... additional £10 billion would need to be injected into the economy to bring actual national income up to full-employment national income. In other words, the E line only needs to be raised by £10 billion to yield an increase in national income of £50 billion. (The gap is defined as the amount that th ...

... additional £10 billion would need to be injected into the economy to bring actual national income up to full-employment national income. In other words, the E line only needs to be raised by £10 billion to yield an increase in national income of £50 billion. (The gap is defined as the amount that th ...

Tanzania issues 2016/17 budget

... The Finance Bill 2016 has not been made public yet. According to the budget, the Government revenue estimates for 2016/17 are TZS29.53 trillion of which TZS18.46 trillion are internally sourced (tax and non-tax revenue) representing 62.3% of the GDP. The projected internal revenue TZS15.11 trillion ...

... The Finance Bill 2016 has not been made public yet. According to the budget, the Government revenue estimates for 2016/17 are TZS29.53 trillion of which TZS18.46 trillion are internally sourced (tax and non-tax revenue) representing 62.3% of the GDP. The projected internal revenue TZS15.11 trillion ...

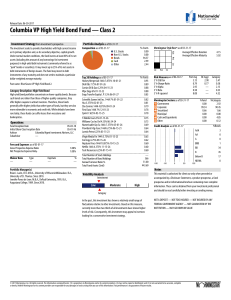

Columbia VP High Yield Bond Fund — Class 2

... Columbia VP High Yield Bond Fund — Class 2 Investment Strategy from investment’s prospectus The investment seeks to provide shareholders with high current income as its primary objective and, as its secondary objective, capital growth. Under normal market conditions, the fund invests at least 80% of ...

... Columbia VP High Yield Bond Fund — Class 2 Investment Strategy from investment’s prospectus The investment seeks to provide shareholders with high current income as its primary objective and, as its secondary objective, capital growth. Under normal market conditions, the fund invests at least 80% of ...

Higher Pensions and Less Risk: Innovation at Denmark`s ATP

... nominal with future indexation depending on the current financial situation of the fund. A World Bank working paper on ATP (Vittas, 2008) describes ATP as “effectively operating a hybrid scheme with elements from both defined contribution and defined benefit plans.” 1 Appendix 1 provides more detail ...

... nominal with future indexation depending on the current financial situation of the fund. A World Bank working paper on ATP (Vittas, 2008) describes ATP as “effectively operating a hybrid scheme with elements from both defined contribution and defined benefit plans.” 1 Appendix 1 provides more detail ...

NOTES ON NOMINAL WAGES AND EMPLOYMENT Paul Krugman

... price level increases the demand for money, which drives up interest rates, which reduces desired spending. (In terms of IS-LM analysis, higher P leads to lower M/P which shifts LM left.) But in liquidity trap conditions, the interest rate isn’t affected at the margin by either the supply or the dem ...

... price level increases the demand for money, which drives up interest rates, which reduces desired spending. (In terms of IS-LM analysis, higher P leads to lower M/P which shifts LM left.) But in liquidity trap conditions, the interest rate isn’t affected at the margin by either the supply or the dem ...

Rate Hike Probability

... A key input into deciding how to position a portfolio is, of course, the future direction of interest rates. Given the recent low interest rate environment, market participants have been anticipating an increase in rates. However, the precise timing of such increase is much debated. The following ar ...

... A key input into deciding how to position a portfolio is, of course, the future direction of interest rates. Given the recent low interest rate environment, market participants have been anticipating an increase in rates. However, the precise timing of such increase is much debated. The following ar ...

National Recovery Plan 2011-2014 Brochure

... Specific expenditure measures announced in Budget 2011 include… • 4% reduction in working age rates of social welfare payments • Reduction in child benefit rates • Additional 15,000 activation places and supports for the unemployed • Maximum salary rate introduced for public sector • Public service ...

... Specific expenditure measures announced in Budget 2011 include… • 4% reduction in working age rates of social welfare payments • Reduction in child benefit rates • Additional 15,000 activation places and supports for the unemployed • Maximum salary rate introduced for public sector • Public service ...

PDF Download

... demand pressures, fiscal policy remained expansionary in 2010. To be sure, the recorded primary surplus of the consolidated public sector improved slightly (to 2.8 percent of GDP) and the overall deficit narrowed correspondingly (Figure 1), but the improvement was more than accounted for by the proc ...

... demand pressures, fiscal policy remained expansionary in 2010. To be sure, the recorded primary surplus of the consolidated public sector improved slightly (to 2.8 percent of GDP) and the overall deficit narrowed correspondingly (Figure 1), but the improvement was more than accounted for by the proc ...

EC 102 Fall 2007 – Homework #5

... b) Determine the money multiplier. How much does Mr. Bauer’s deposit increase the money supply (ignore the later effects of Mr. Bond’s borrowing)? ...

... b) Determine the money multiplier. How much does Mr. Bauer’s deposit increase the money supply (ignore the later effects of Mr. Bond’s borrowing)? ...

Answers to Questions in Chapter 23

... Answers to questions in Economics by Sloman and Norris 39% higher relative to US national income than it really is in purchasing terms. 549 Why would banks not be prepared to offer a forward exchange rate to a firm for, say, five years' time? It would involve too much risk. The longer the time pe ...

... Answers to questions in Economics by Sloman and Norris 39% higher relative to US national income than it really is in purchasing terms. 549 Why would banks not be prepared to offer a forward exchange rate to a firm for, say, five years' time? It would involve too much risk. The longer the time pe ...

Bank of Canada - McGraw Hill Higher Education

... is as safe for them to invest in the other country as in their own. Therefore, even the smallest difference in interest rates would cause money to flood out of the country with the lower rate. This being the case, if the major country lowers its interest rate for example, then the other country must ...

... is as safe for them to invest in the other country as in their own. Therefore, even the smallest difference in interest rates would cause money to flood out of the country with the lower rate. This being the case, if the major country lowers its interest rate for example, then the other country must ...

`COMMENTARAO` IN “THE TELEGRAPH”, March 20 2012

... improve production and lower costs, as has happened with captive mines in the private sector. It would have been better if Coal India merely held ownership of mines and leased them for operation to the private sector, and a Coal regulator determined coal prices. There is little to stimulate FDI in t ...

... improve production and lower costs, as has happened with captive mines in the private sector. It would have been better if Coal India merely held ownership of mines and leased them for operation to the private sector, and a Coal regulator determined coal prices. There is little to stimulate FDI in t ...

Reserve Uncertainty and the Supply of International Credit

... Better institutions are associated with less volatile f s. Better institutions are associated with a higher growth rate. The quality of institutions variable “soaks” the explanatory power from the volatility of selffinancing ratios, but leaving intact the positive convex effect of self-financing rat ...

... Better institutions are associated with less volatile f s. Better institutions are associated with a higher growth rate. The quality of institutions variable “soaks” the explanatory power from the volatility of selffinancing ratios, but leaving intact the positive convex effect of self-financing rat ...

Accelerating Deflation and Monetary Policy (MAR/03)

... eliminating deflation, then the more powerful “negative interest rate policy” is n e c e s s a r y. B a l a n c e s o f f i n a n c i a l a s s e t s w h o s e p r i n c i p a l s a r e g u a r a n t e e d b y t h e government such as cash, yen deposits, government bonds, government-backed bonds, lo ...

... eliminating deflation, then the more powerful “negative interest rate policy” is n e c e s s a r y. B a l a n c e s o f f i n a n c i a l a s s e t s w h o s e p r i n c i p a l s a r e g u a r a n t e e d b y t h e government such as cash, yen deposits, government bonds, government-backed bonds, lo ...

The Return of Saving Martin Feldstein

... investors diversified their investments by moving into the U.S. market because they thought the potential equity returns in the United States were favorable in comparison to the risks. Now, in contrast, the flow of equity investment to the United States is very small—often less than the equity investm ...

... investors diversified their investments by moving into the U.S. market because they thought the potential equity returns in the United States were favorable in comparison to the risks. Now, in contrast, the flow of equity investment to the United States is very small—often less than the equity investm ...

SU14_2630_Study Guid..

... Security, Medicare/Medicaid, and Interest Payments are expected to increase dramatically. 40. Currently, approximately 33% of the federal U.S. budget is ‘discretionary’. If fiscal policy is not changed, it is projected that 0% of the federal U.S. budget will be discretionary by 2030. 41. What could ...

... Security, Medicare/Medicaid, and Interest Payments are expected to increase dramatically. 40. Currently, approximately 33% of the federal U.S. budget is ‘discretionary’. If fiscal policy is not changed, it is projected that 0% of the federal U.S. budget will be discretionary by 2030. 41. What could ...

Homework 3

... a. Calculate, the profit maximizing level of capital when the tax wedge is zero and the level of output that could be produced with that amount of capital. Calculate the level of profit (Hint: The profit is the level of output minus costs. Costs are equal to the product of the cost of capital and th ...

... a. Calculate, the profit maximizing level of capital when the tax wedge is zero and the level of output that could be produced with that amount of capital. Calculate the level of profit (Hint: The profit is the level of output minus costs. Costs are equal to the product of the cost of capital and th ...