Zero Unemployment2 - Understanding Economy

... Easy money spurs prices higher, which can make business impossible as money loses its value. ...

... Easy money spurs prices higher, which can make business impossible as money loses its value. ...

Answer Key - Dasha Safonova

... B. Malthus suggested that in the long run, income levels will grow exponentially C. Malthus suggested that in the long run, income levels will stay at subsistence 10. Which of the following statements illustrates frictional unemployment? A. Robin is quitting his current job to find another that has ...

... B. Malthus suggested that in the long run, income levels will grow exponentially C. Malthus suggested that in the long run, income levels will stay at subsistence 10. Which of the following statements illustrates frictional unemployment? A. Robin is quitting his current job to find another that has ...

2015 Intergenerational Report - Institute of Actuaries of Australia

... population. Comparing cohorts and their context can reveal significant discrepancies in areas, such as, accumulation of wealth, income trends and expenditure habits. It is important that the trends of past generations are not assumed to continue in younger cohorts when we can foresee they are likely ...

... population. Comparing cohorts and their context can reveal significant discrepancies in areas, such as, accumulation of wealth, income trends and expenditure habits. It is important that the trends of past generations are not assumed to continue in younger cohorts when we can foresee they are likely ...

The Art and Science of Economics

... Thus, we can say that for a given price level, and assuming that consumption varies with income ...

... Thus, we can say that for a given price level, and assuming that consumption varies with income ...

Borrowing, Depreciation, Taxes in Cash Flow Problems

... Sell it after a year and get $106, buy the basket of goods at then-current cost of $103, we will have $3 left over. So after factoring in inflation, our $100 bond will earn us $3 in net income; a real interest rate of 3%. ...

... Sell it after a year and get $106, buy the basket of goods at then-current cost of $103, we will have $3 left over. So after factoring in inflation, our $100 bond will earn us $3 in net income; a real interest rate of 3%. ...

(1) Main Economic Developments

... no longer be regarded as representing the Bank's policy stance because the only role it plays is as the upper limit of the uncollateralized overnight call rate, which is currently the Bank's operating target for money market operations or the policy interest rate. Before 1994, when interest rates we ...

... no longer be regarded as representing the Bank's policy stance because the only role it plays is as the upper limit of the uncollateralized overnight call rate, which is currently the Bank's operating target for money market operations or the policy interest rate. Before 1994, when interest rates we ...

supply side ppt

... Provision of job information Support for adolescent industries All of the above interventionist policies are known as ...

... Provision of job information Support for adolescent industries All of the above interventionist policies are known as ...

Chapter 10 Federal Reserve System

... bonds have a face value bonds pay a fixed interest payment each year (coupon pmt) bond prices are determined by the relationship between current interest rates and the bond’s rate ...

... bonds have a face value bonds pay a fixed interest payment each year (coupon pmt) bond prices are determined by the relationship between current interest rates and the bond’s rate ...

S 1

... • Unlike the classical model, in the Keynesian model there is no unique level of income. – Income may be at its natural rate, above the natural rate, or below the natural rate. – Because income fluctuates, individuals’ willingness to save also changes. – Therefore, saving is assumed to be determined ...

... • Unlike the classical model, in the Keynesian model there is no unique level of income. – Income may be at its natural rate, above the natural rate, or below the natural rate. – Because income fluctuates, individuals’ willingness to save also changes. – Therefore, saving is assumed to be determined ...

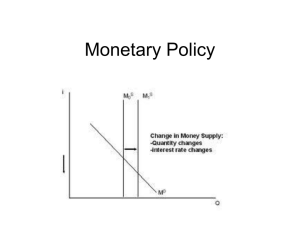

Monetary Policy

... requirements, or lowers discount rate • Real interest rates decrease • Stimulates AD (investment and consumption) • Lower interest rates lead to capital outflow, so dollar depreciates, and exports stimulated (higher AD) • Asset prices increase (housing) ...

... requirements, or lowers discount rate • Real interest rates decrease • Stimulates AD (investment and consumption) • Lower interest rates lead to capital outflow, so dollar depreciates, and exports stimulated (higher AD) • Asset prices increase (housing) ...

D and S side policies - uwcmaastricht-econ

... particular targeted rate of inflation. Examples: New Zealand (first one, 20 years ago), Australia, Canada, UK, EU, Brazil, Mexico, among others. Defined by IMF as ‘…the public announcement of medium-term numerical targets for inflation with an institutional commitment by the monetary authority to ...

... particular targeted rate of inflation. Examples: New Zealand (first one, 20 years ago), Australia, Canada, UK, EU, Brazil, Mexico, among others. Defined by IMF as ‘…the public announcement of medium-term numerical targets for inflation with an institutional commitment by the monetary authority to ...

policy brief - SIEPR - Stanford University

... slowly after that. We could raise taxes by 2 percent of GDP to pay for the benefits promised under Social Security or we could lower future benefits from their projected levels by indexing the initial benefits to wages rather than prices, as President Bush has proposed, or we could combine various a ...

... slowly after that. We could raise taxes by 2 percent of GDP to pay for the benefits promised under Social Security or we could lower future benefits from their projected levels by indexing the initial benefits to wages rather than prices, as President Bush has proposed, or we could combine various a ...

Modern macroeconomics: monetary policy

... began to raise the federal funds rate until it reached 5% by 2007. Episode 9 Great Recession in 2008, the Fed slashed interest rates 2% to nearly 0%. the economy was still deep in recession ...

... began to raise the federal funds rate until it reached 5% by 2007. Episode 9 Great Recession in 2008, the Fed slashed interest rates 2% to nearly 0%. the economy was still deep in recession ...

Back Office services - British Parking Association

... Now state running a deficit of 12% of GDP Aggregate debt rising and will hit 80% of GDP Not simply a short-term problem A bigger crisis - the costs of longer life expectancy A coalition government with no choice but to address or markets would punish. ...

... Now state running a deficit of 12% of GDP Aggregate debt rising and will hit 80% of GDP Not simply a short-term problem A bigger crisis - the costs of longer life expectancy A coalition government with no choice but to address or markets would punish. ...

Chapter 9 - Foothill College

... economy will return to, and tends to remain at in the long run. Graphically, the pure Classical theorists would have a vertical AS curve that shows the same GDP (GDP*) associated with full-employment, at each price-level in the economy. B. Keynesian Theory holds that unemployment is the normal state ...

... economy will return to, and tends to remain at in the long run. Graphically, the pure Classical theorists would have a vertical AS curve that shows the same GDP (GDP*) associated with full-employment, at each price-level in the economy. B. Keynesian Theory holds that unemployment is the normal state ...

Definitions of Various Terms Used in NHP 2008

... The gross domestic product (GDP) at market prices is the sum of gross value added by all resident producers in the economy plus any taxes and minus any subsidies that are not included in the valuation of output. GDP measures the total output of goods and services for final use occurring within the d ...

... The gross domestic product (GDP) at market prices is the sum of gross value added by all resident producers in the economy plus any taxes and minus any subsidies that are not included in the valuation of output. GDP measures the total output of goods and services for final use occurring within the d ...

Downlaod File

... d. most corporations that consistently invest in foreign short-term investments would have generated the same profits (on average) as from domestic short-term investments. __E__6. Assume that U.S. and British investors require a real return of 2%. If the nominal U.S. interest rate is 15%, and the no ...

... d. most corporations that consistently invest in foreign short-term investments would have generated the same profits (on average) as from domestic short-term investments. __E__6. Assume that U.S. and British investors require a real return of 2%. If the nominal U.S. interest rate is 15%, and the no ...

pen04Knaap-2 225520 en

... the premium base of occupational pension funds compared to their future obligations. The ratio between obligations and the premium base is about six today, but will rise in the coming decades. This makes pension funds more susceptible to risk: adverse shocks on financial markets can no longer be eas ...

... the premium base of occupational pension funds compared to their future obligations. The ratio between obligations and the premium base is about six today, but will rise in the coming decades. This makes pension funds more susceptible to risk: adverse shocks on financial markets can no longer be eas ...

White paper on minimum wage increase

... 1. A minimum wage has two opposing effects on employment: it reduces demand for new workers by raising the marginal cost of an employee and it induces additional search effort from unemployed workers. The additional search effort, however, does not overcome the higher labor costs, thereby, negativel ...

... 1. A minimum wage has two opposing effects on employment: it reduces demand for new workers by raising the marginal cost of an employee and it induces additional search effort from unemployed workers. The additional search effort, however, does not overcome the higher labor costs, thereby, negativel ...

macro 2301 test iii hccs

... 41. Consider a Keynesian transmission mechanism as we have discussed in class. If the economy has excess production capacity and unemployment, an expansionary monetary and/or fiscal policy will __________. a. Lower output and cause inflation b. Raise output without causing inflation c. Raise output ...

... 41. Consider a Keynesian transmission mechanism as we have discussed in class. If the economy has excess production capacity and unemployment, an expansionary monetary and/or fiscal policy will __________. a. Lower output and cause inflation b. Raise output without causing inflation c. Raise output ...

ECN 101 – Intermediate Macroeconomics Spring 2004 Professor

... C) Compare the business cycle behavior of these variables in the 70’s with their behavior up to the 60’s. Briefly comment on the differences you observe and the implications that these observations have for the way policy should be conducted in each period. Answer: During the 70’s inflation peaks be ...

... C) Compare the business cycle behavior of these variables in the 70’s with their behavior up to the 60’s. Briefly comment on the differences you observe and the implications that these observations have for the way policy should be conducted in each period. Answer: During the 70’s inflation peaks be ...

The Transmission Mechanism for Monetary Policy

... higher interest rates are supposed to curb increases in the general price level. Where the monetary policy instrument is market-based, for example interest rate, or the price of money, rather than an administrative instrument, as in the case of credit control, the transmission mechanism involves the ...

... higher interest rates are supposed to curb increases in the general price level. Where the monetary policy instrument is market-based, for example interest rate, or the price of money, rather than an administrative instrument, as in the case of credit control, the transmission mechanism involves the ...

Flexible hiring/firing rules Unemployment Insurance Active labour

... relative to GDP variations than other countries •Possible to sustain effective ALMP with much higher unemployment? ...

... relative to GDP variations than other countries •Possible to sustain effective ALMP with much higher unemployment? ...

Lower Returns Likely in the Years Ahead

... sustained low-inflation and low-interest-rate environment. Corporate earnings are simply worth more to an investor in a low-interest rate world. Consequently, the price/earnings ratio of the S&P 500 has risen to 18 times earnings today – a 50% valuation increase. This increased valuation priced int ...

... sustained low-inflation and low-interest-rate environment. Corporate earnings are simply worth more to an investor in a low-interest rate world. Consequently, the price/earnings ratio of the S&P 500 has risen to 18 times earnings today – a 50% valuation increase. This increased valuation priced int ...