The impact of high and growing government debt - ECB

... threshold would have a negative effect on economic growth. Confidence intervals for the debt turning point suggest that the negative growth effect of high debt may start already from levels of around 70-80% of GDP, which calls for even more prudent indebtedness policies. We also find evidence that t ...

... threshold would have a negative effect on economic growth. Confidence intervals for the debt turning point suggest that the negative growth effect of high debt may start already from levels of around 70-80% of GDP, which calls for even more prudent indebtedness policies. We also find evidence that t ...

Power Point: Equilibrium and Multiplier

... gapFirms when trying to hire workers Equilibrium GDP is who already have higher than Fulla job GDP Employment ...

... gapFirms when trying to hire workers Equilibrium GDP is who already have higher than Fulla job GDP Employment ...

Austerity in 2009-2013

... purely by the need to reduce excessive deficits and not as a response to the state of the economic cycle. The second challenge was to isolate the effect of fiscal policy from many other intervening factors like devaluations, monetary policy, labor and product market reforms etc. This earlier literat ...

... purely by the need to reduce excessive deficits and not as a response to the state of the economic cycle. The second challenge was to isolate the effect of fiscal policy from many other intervening factors like devaluations, monetary policy, labor and product market reforms etc. This earlier literat ...

Mutal Funds - BYU Personal Finance

... D. Understand how to Calculate Mutual Fund Returns • How do you make money with mutual funds? • Capital gains (i.e. appreciation market value) • Capital gains are the best type of earnings as capital gains at the share level are not taxed until you sell your mutual fund shares. You decide when to s ...

... D. Understand how to Calculate Mutual Fund Returns • How do you make money with mutual funds? • Capital gains (i.e. appreciation market value) • Capital gains are the best type of earnings as capital gains at the share level are not taxed until you sell your mutual fund shares. You decide when to s ...

Sample

... 11) Over the past half-century, government transfer payments have increased. As a result ________. A) interest payments on government debt have declined B) government expenditures have become a larger portion of GDP C) the volatility of investment expenditures has declined D) net exports have been p ...

... 11) Over the past half-century, government transfer payments have increased. As a result ________. A) interest payments on government debt have declined B) government expenditures have become a larger portion of GDP C) the volatility of investment expenditures has declined D) net exports have been p ...

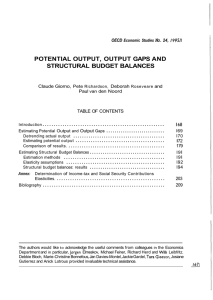

Potential output, output gaps and structural budget balances

... Such a specification allows estimated trend growth to change between cycles, but not within each cycle. While in theory this method is straightforward, in practice determining where the peaks in the cycle occur is more complicated, using the residuals obtained by regressing GDP on a time trend in an ...

... Such a specification allows estimated trend growth to change between cycles, but not within each cycle. While in theory this method is straightforward, in practice determining where the peaks in the cycle occur is more complicated, using the residuals obtained by regressing GDP on a time trend in an ...

Guide to Private Equity and Venture Capital for

... Over the last 15 years, the private equity and venture capital industry has grown and matured substantially to become an established part of many institutional investors’ portfolios, with pension funds among some of the most active investors in this type of fund. Invest Europe’s data shows that almo ...

... Over the last 15 years, the private equity and venture capital industry has grown and matured substantially to become an established part of many institutional investors’ portfolios, with pension funds among some of the most active investors in this type of fund. Invest Europe’s data shows that almo ...

A Dynamic Model of Aggregate Demand and Aggregate Supply

... aggregate supply (DAD-DAS) gives us more insight into how the economy behaves in the short run. • This theory determines both real GDP (Y) and the inflation rate (π) • This theory is dynamic in the sense that the outcome in one period affects the outcome in the next period – like the Solow-Swan mode ...

... aggregate supply (DAD-DAS) gives us more insight into how the economy behaves in the short run. • This theory determines both real GDP (Y) and the inflation rate (π) • This theory is dynamic in the sense that the outcome in one period affects the outcome in the next period – like the Solow-Swan mode ...

Measuring Ireland's Progress 2011 (PDF 1,359KB)

... Ireland was the fifth most expensive EU state in 2011, after Denmark, Sweden, Finland and Luxembourg with prices 17% above the EU average. However this represents a considerable improvement on 2008 when Irish prices were the second highest in the EU, at 30% above the EU average. After three successi ...

... Ireland was the fifth most expensive EU state in 2011, after Denmark, Sweden, Finland and Luxembourg with prices 17% above the EU average. However this represents a considerable improvement on 2008 when Irish prices were the second highest in the EU, at 30% above the EU average. After three successi ...

CONNECTICUT WATER SERVICE INC / CT (Form

... Diluted Basic Earnings per Share Dilutive Effect of Unexercised Stock Options Diluted Earnings per Share ...

... Diluted Basic Earnings per Share Dilutive Effect of Unexercised Stock Options Diluted Earnings per Share ...

Macro Sample Questions All Chapters McConnell 20 edition TO

... use its resources more efficiently than the data in the table now indicate. C. allocate its available resources most efficiently among alternative uses. D. achieve the full employment of available resources. Which of the following is assumed in constructing a typical production possibilities curve ...

... use its resources more efficiently than the data in the table now indicate. C. allocate its available resources most efficiently among alternative uses. D. achieve the full employment of available resources. Which of the following is assumed in constructing a typical production possibilities curve ...

Belize PER - Inter-American Development Bank

... and put forward a set of recommendations on how to improve efficiency in this sector. A final section summarizes the major findings and recommendations of the report. These include strengthening the preparation of the budget through improved estimation procedures based on detailed actual information ...

... and put forward a set of recommendations on how to improve efficiency in this sector. A final section summarizes the major findings and recommendations of the report. These include strengthening the preparation of the budget through improved estimation procedures based on detailed actual information ...

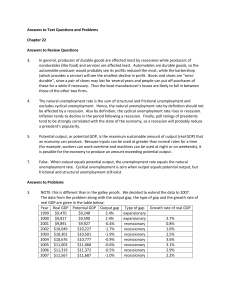

Answers to Text Questions and Problems Chapter 22 Answers to

... run, leading to increased output and employment, but it may also raise real interest rates if it reduces national saving (by increasing the government’s budget deficit without an offsetting increase in private saving). The increased interest rates may reduce capital investment and long-run growth of ...

... run, leading to increased output and employment, but it may also raise real interest rates if it reduces national saving (by increasing the government’s budget deficit without an offsetting increase in private saving). The increased interest rates may reduce capital investment and long-run growth of ...

SFYP Mid-Term Review 2014 Final_29_03-2015

... not a mean achievement. It is expected that GDP growth rate will pick up in the coming years. However, we have to put special emphasis in attracting private investment in the economy underpinned by the infrastructure development under public sector investment programme. Some shortfall in domestic em ...

... not a mean achievement. It is expected that GDP growth rate will pick up in the coming years. However, we have to put special emphasis in attracting private investment in the economy underpinned by the infrastructure development under public sector investment programme. Some shortfall in domestic em ...

KEYNESIAN MULTIPLIER EFFECTS

... We can plug the appropriate number into the Government Spending Multiplier and come up with a useful number. ...

... We can plug the appropriate number into the Government Spending Multiplier and come up with a useful number. ...

Sample Chapter 2 (PDF, 28 Pages

... Business Cycle Council list of recessions was published more than two years after the end of the last recession, and we do not know how long its delay in announcing future recessions and expansions will be. In the United States the delays are substantial. For example, the announcement that the most ...

... Business Cycle Council list of recessions was published more than two years after the end of the last recession, and we do not know how long its delay in announcing future recessions and expansions will be. In the United States the delays are substantial. For example, the announcement that the most ...

the impact of real exchange rate volatility on

... determined whether exchange rates in Kenya were affected by the monetary policy and if these effects were transitory or permanent. Ndung’u (1999) was based on the premise that the choice of the exchange rate regime is determined by various factors such as the objective of the policy makers, sources ...

... determined whether exchange rates in Kenya were affected by the monetary policy and if these effects were transitory or permanent. Ndung’u (1999) was based on the premise that the choice of the exchange rate regime is determined by various factors such as the objective of the policy makers, sources ...

fiscal multipliers in recession and expansion

... first in the SVAR, we could then estimate directly from the ...

... first in the SVAR, we could then estimate directly from the ...

PPF Long-Term Funding Strategy Update

... 6.3.1 As well as assuming that future realisations of CPI will on average be lower than RPI, we also assume that market-implied levels of inflation will be lower for CPI than for RPI. Or to express this another way, we assume that CPI-linked investments will have higher real yields than otherwise eq ...

... 6.3.1 As well as assuming that future realisations of CPI will on average be lower than RPI, we also assume that market-implied levels of inflation will be lower for CPI than for RPI. Or to express this another way, we assume that CPI-linked investments will have higher real yields than otherwise eq ...

Hourly Employee Engagement and Reward Systems

... It allows the organization to acquire fully trained workers and therefore reduces the internal training costs. It enables the organization to hire and utilize those individuals that seek this type of employment relationship due to personal preferences, family commitments, educational activities that ...

... It allows the organization to acquire fully trained workers and therefore reduces the internal training costs. It enables the organization to hire and utilize those individuals that seek this type of employment relationship due to personal preferences, family commitments, educational activities that ...

Benchmarks as Limits to Arbitrage: Understanding the Low

... with a leverage constraint cause institutional investors to pass up the superior risk–return tradeoff of low-volatility portfolios; we also examined the appropriateness of a leverage constraint assumption. Rather than being a stabilizing force on prices, the typical institutional contract for delega ...

... with a leverage constraint cause institutional investors to pass up the superior risk–return tradeoff of low-volatility portfolios; we also examined the appropriateness of a leverage constraint assumption. Rather than being a stabilizing force on prices, the typical institutional contract for delega ...

ExamView - CH 28 sample test questions.tst

... a. occurs in the United States during each business cycle. b. occurs only in theory, never in reality. c. has never occurred in the United States. d. happens in all countries at some time during their business cycle. e. is a period of time when inflation exceeds 20 percent per year. ____ 58. In the ...

... a. occurs in the United States during each business cycle. b. occurs only in theory, never in reality. c. has never occurred in the United States. d. happens in all countries at some time during their business cycle. e. is a period of time when inflation exceeds 20 percent per year. ____ 58. In the ...

Waco MSA Economic Forecast for 2011 by Tom Kelly, Director

... statewide losses, but the loss of high tech jobs impacted metro areas such as Austin more severely than the local economy. During the 2007 recession the loss of jobs statewide and in the Waco MSA lagged the loss of jobs nationwide and again was less severe in Waco than the state average. In 2008, T ...

... statewide losses, but the loss of high tech jobs impacted metro areas such as Austin more severely than the local economy. During the 2007 recession the loss of jobs statewide and in the Waco MSA lagged the loss of jobs nationwide and again was less severe in Waco than the state average. In 2008, T ...