The influence of monetary on aggregate demand (short run)

... According to the theory of liquidity preference, the interest rate adjusts to bring the quantity of money supplied and the quantity of money demanded into balance. If the interest rate is above the equilibrium level (such as at r1), the quantity of money people want to hold (Md1) is less than the qu ...

... According to the theory of liquidity preference, the interest rate adjusts to bring the quantity of money supplied and the quantity of money demanded into balance. If the interest rate is above the equilibrium level (such as at r1), the quantity of money people want to hold (Md1) is less than the qu ...

chap 9 & 10

... Our model, as formulated, does not tell us the order in which variables move—we just infer that the economy moves from one equilibrium to another (after a shock). Here are some thoughts on timing: ...

... Our model, as formulated, does not tell us the order in which variables move—we just infer that the economy moves from one equilibrium to another (after a shock). Here are some thoughts on timing: ...

"Great Inflation" Lessons for Monetary Policy

... monetary regimes since the Civil War (1861-1865), the Great Inflation coincided with the complete severance of any link between money and a commodity base, such as gold or silver, which had for centuries provided a strong nominal anchor and thus stabilised inflation expectations: “In earlier periods ...

... monetary regimes since the Civil War (1861-1865), the Great Inflation coincided with the complete severance of any link between money and a commodity base, such as gold or silver, which had for centuries provided a strong nominal anchor and thus stabilised inflation expectations: “In earlier periods ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research Volume Title: Inflation: Causes and Effects

... capital gains or losses on corporate stock in 1973. While the sample is anonymous, it is the kind of scientific sample that can be used to make accurate estimates of national totals. The results of this analysis were quite astounding. In 1973, individuals paid tax on $4.6 billion of capital gains on ...

... capital gains or losses on corporate stock in 1973. While the sample is anonymous, it is the kind of scientific sample that can be used to make accurate estimates of national totals. The results of this analysis were quite astounding. In 1973, individuals paid tax on $4.6 billion of capital gains on ...

Central bank monitoring – December 2015

... year from the ECB, EB members met frequently with members of the private sector days, or even hours, before monetary policy meetings. Riskbank deputy governor suggests improvements to inflation targeting In his December speech, Riksbank deputy governor Per Janssen proposed two changes to the impleme ...

... year from the ECB, EB members met frequently with members of the private sector days, or even hours, before monetary policy meetings. Riskbank deputy governor suggests improvements to inflation targeting In his December speech, Riksbank deputy governor Per Janssen proposed two changes to the impleme ...

Fiscal and Monetary Policies Interrelation and Inflation over the

... Darby (1985) contradicted Sargent and Wallace (hereafter SW) (1981) view that monetary policy cannot be manipulated independently when tax rates and government expenditure are fixed. Darby maintained that government can, at least in the United States, independently manipulate “all three instruments, ...

... Darby (1985) contradicted Sargent and Wallace (hereafter SW) (1981) view that monetary policy cannot be manipulated independently when tax rates and government expenditure are fixed. Darby maintained that government can, at least in the United States, independently manipulate “all three instruments, ...

CRS Report for Congress

... time the additional reserves were supplied to the banks, making it unprofitable for banks to lend them out. If the banks have little incentive to lend out the additional reserves, the money supply will not increase, interest rates will not fall, and aggregate demand will not be stimulated. Such a si ...

... time the additional reserves were supplied to the banks, making it unprofitable for banks to lend them out. If the banks have little incentive to lend out the additional reserves, the money supply will not increase, interest rates will not fall, and aggregate demand will not be stimulated. Such a si ...

The Aggregate Demand Curve

... Any non-price-level change that increases aggregate spending (on domestic goods) shifts AD to the right. Any non-price-level change that decreases aggregate spending (on domestic goods) shifts AD to the left. ...

... Any non-price-level change that increases aggregate spending (on domestic goods) shifts AD to the right. Any non-price-level change that decreases aggregate spending (on domestic goods) shifts AD to the left. ...

Economics 101 Name

... Treasury Bill: a short-term (one year or less) IOU of the United States government Treasury Note: IOU of the U.S. government die in more than 1 year but less than 10 years; Treasury Bond: IOU of the U.S, government due in 10 years or more Mutual Fund: pools the savings of large numbers of people and ...

... Treasury Bill: a short-term (one year or less) IOU of the United States government Treasury Note: IOU of the U.S. government die in more than 1 year but less than 10 years; Treasury Bond: IOU of the U.S, government due in 10 years or more Mutual Fund: pools the savings of large numbers of people and ...

Chapter 25 - uob.edu.bh

... 1. From the equation of exchange aggregate spending, P Y equals $2,000 billion (= MV = 400 5). The aggregate demand curve on the graph should show that, when P = 0.5, Y = 4,000; when P = 1, Y = 2,000; and when P = 2, Y = 1,000. If the money supply falls to $50 billion, the aggregate demand curve s ...

... 1. From the equation of exchange aggregate spending, P Y equals $2,000 billion (= MV = 400 5). The aggregate demand curve on the graph should show that, when P = 0.5, Y = 4,000; when P = 1, Y = 2,000; and when P = 2, Y = 1,000. If the money supply falls to $50 billion, the aggregate demand curve s ...

Document

... adjust within a country. For instance, in Brazil, which has had a history of high and variable inflation, almost all wage and price contracts have been indexed, meaning they automatically adjust to any changes in inflation. As a result, you would expect wages within such a country to adjust much mor ...

... adjust within a country. For instance, in Brazil, which has had a history of high and variable inflation, almost all wage and price contracts have been indexed, meaning they automatically adjust to any changes in inflation. As a result, you would expect wages within such a country to adjust much mor ...

NBER WORKING PAPER SERIES MODIGLIANIESQUE MACRO MODELS Stanley Fischer Working Paper No. 1797

... 1944 and 1963 versions and the standard textbook model in using separate equilibrium conditions for the goods market, the asset markets, and the labor market. ...

... 1944 and 1963 versions and the standard textbook model in using separate equilibrium conditions for the goods market, the asset markets, and the labor market. ...

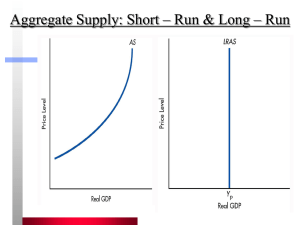

Chapter 14: Aggregate Demand and Supply

... Listen to the Ask the Instructor Video Clip” titled “Can the Aggregate Supply Curve Take on Different Shapes?” You will learn the conditions that determine the three ranges of the aggregate supply curve. ...

... Listen to the Ask the Instructor Video Clip” titled “Can the Aggregate Supply Curve Take on Different Shapes?” You will learn the conditions that determine the three ranges of the aggregate supply curve. ...

Chapter 14: Aggregate Demand and Supply

... Listen to the Ask the Instructor Video Clip” titled “Can the Aggregate Supply Curve Take on Different Shapes?” You will learn the conditions that determine the three ranges of the aggregate supply curve. ...

... Listen to the Ask the Instructor Video Clip” titled “Can the Aggregate Supply Curve Take on Different Shapes?” You will learn the conditions that determine the three ranges of the aggregate supply curve. ...

Fina 353-Lecture Slide Week 8

... Movements along the aggregate supply curves – If output prices change but input prices do not, we have a movement along the SAS curve. – If both output and input prices change at the same rate, then we have a movement along the LAS curve. Shifts of aggregate supply curves When anything other than a ...

... Movements along the aggregate supply curves – If output prices change but input prices do not, we have a movement along the SAS curve. – If both output and input prices change at the same rate, then we have a movement along the LAS curve. Shifts of aggregate supply curves When anything other than a ...

chapter overview

... igniting fear that cost-push inflation and inflation would occur. It didn’t for several reasons. 1. The adverse shock was offset by positive supply shocks such as increased productivity. 2. Oil prices and consumption have declined in relative importance to the overall price level and production of t ...

... igniting fear that cost-push inflation and inflation would occur. It didn’t for several reasons. 1. The adverse shock was offset by positive supply shocks such as increased productivity. 2. Oil prices and consumption have declined in relative importance to the overall price level and production of t ...

Aggregate Demand and Aggregate Supply

... • The ratio of the final shift in aggregate demand to the initial shift in aggregate demand is known as the multiplier. • The logic of the multiplier goes back to Keynes. He believed that as government spending increases and the aggregate demand curve shifts to the right, output will subsequently in ...

... • The ratio of the final shift in aggregate demand to the initial shift in aggregate demand is known as the multiplier. • The logic of the multiplier goes back to Keynes. He believed that as government spending increases and the aggregate demand curve shifts to the right, output will subsequently in ...

Worker Insecurity and US Macroeconomic Performance

... Where w is the rate of growth of nominal wages, p and p are the actual and expected rates of inflation respectively, q is the rate of growth of productivity, a is a distributed lag of past rates of growth of the real wage, and τ represents the rate of growth of the gross markup (the ratio of price t ...

... Where w is the rate of growth of nominal wages, p and p are the actual and expected rates of inflation respectively, q is the rate of growth of productivity, a is a distributed lag of past rates of growth of the real wage, and τ represents the rate of growth of the gross markup (the ratio of price t ...

Inflation

In economics, inflation is a sustained increase in the general price level of goods and services in an economy over a period of time.When the price level rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy. A chief measure of price inflation is the inflation rate, the annualized percentage change in a general price index (normally the consumer price index) over time. The opposite of inflation is deflation.Inflation affects an economy in various ways, both positive and negative. Negative effects of inflation include an increase in the opportunity cost of holding money, uncertainty over future inflation which may discourage investment and savings, and if inflation were rapid enough, shortages of goods as consumers begin hoarding out of concern that prices will increase in the future.Inflation also has positive effects: Fundamentally, inflation gives everyone an incentive to spend and invest, because if they don't, their money will be worth less in the future. This increase in spending and investment can benefit the economy. However it may also lead to sub-optimal use of resources. Inflation reduces the real burden of debt, both public and private. If you have a fixed-rate mortgage on your house, your salary is likely to increase over time due to wage inflation, but your mortgage payment will stay the same. Over time, your mortgage payment will become a smaller percentage of your earnings, which means that you will have more money to spend. Inflation keeps nominal interest rates above zero, so that central banks can reduce interest rates, when necessary, to stimulate the economy. Inflation reduces unemployment to the extent that unemployment is caused by nominal wage rigidity. When demand for labor falls but nominal wages do not, as typically occurs during a recession, the supply and demand for labor cannot reach equilibrium, and unemployment results. By reducing the real value of a given nominal wage, inflation increases the demand for labor, and therefore reduces unemployment.Economists generally believe that high rates of inflation and hyperinflation are caused by an excessive growth of the money supply. However, money supply growth does not necessarily cause inflation. Some economists maintain that under the conditions of a liquidity trap, large monetary injections are like ""pushing on a string"". Views on which factors determine low to moderate rates of inflation are more varied. Low or moderate inflation may be attributed to fluctuations in real demand for goods and services, or changes in available supplies such as during scarcities. However, the consensus view is that a long sustained period of inflation is caused by money supply growing faster than the rate of economic growth.Today, most economists favor a low and steady rate of inflation. Low (as opposed to zero or negative) inflation reduces the severity of economic recessions by enabling the labor market to adjust more quickly in a downturn, and reduces the risk that a liquidity trap prevents monetary policy from stabilizing the economy. The task of keeping the rate of inflation low and stable is usually given to monetary authorities. Generally, these monetary authorities are the central banks that control monetary policy through the setting of interest rates, through open market operations, and through the setting of banking reserve requirements.