Tutorial

... b. interest-rate effect. c. net exports effect. d. substitution effect. B. At a high price level, the demand for borrowed money increases and results in higher cost of borrowing (interest rates). Higher interest rates result in lower consumption and investment spending. ...

... b. interest-rate effect. c. net exports effect. d. substitution effect. B. At a high price level, the demand for borrowed money increases and results in higher cost of borrowing (interest rates). Higher interest rates result in lower consumption and investment spending. ...

The Great Depression Lesson 1 - Measuring the Great Depression

... shows GDP growth from 1928 through 1940, which are the years for which GDP was most below trend on the first graph. Explain that during all of these years, GDP growth was below trend. Ask the students during what years GDP growth was the lowest. (1932, 1933 and 1934) ...

... shows GDP growth from 1928 through 1940, which are the years for which GDP was most below trend on the first graph. Explain that during all of these years, GDP growth was below trend. Ask the students during what years GDP growth was the lowest. (1932, 1933 and 1934) ...

Unit 3 - Effingham County Schools

... quantity demanded for all goods/services (measured as Real GDP) in the economy at each price level (measured with a price index). ...

... quantity demanded for all goods/services (measured as Real GDP) in the economy at each price level (measured with a price index). ...

Money, inflation and interest rates

... gous out of control (hyper-inflations) are economy as money loses value so fast that people stop using money and the entire two components system a)ofthecommercial exchange, that money is supposed to facilitate, breaks down. real return The natural question then is why do governments/ central banks ...

... gous out of control (hyper-inflations) are economy as money loses value so fast that people stop using money and the entire two components system a)ofthecommercial exchange, that money is supposed to facilitate, breaks down. real return The natural question then is why do governments/ central banks ...

NBER WORKING PAPER SERIES PRIVATE PENSIONS INFLATION Martin Feldstein

... 1 The inflation-induced growth of the assets of pension funds would also be reduced to the extent that households save less in response to the lower real yield on saving or divert saving into nonportfolio assets like housing and land. 2 Joseph Stiglitz (1973) develops an analysis which shows that un ...

... 1 The inflation-induced growth of the assets of pension funds would also be reduced to the extent that households save less in response to the lower real yield on saving or divert saving into nonportfolio assets like housing and land. 2 Joseph Stiglitz (1973) develops an analysis which shows that un ...

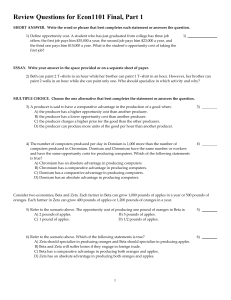

Econ 1101 Practice Questions Final Exam

... ESSAY. Write your answer in the space provided or on a separate sheet of paper. 8) What is meant by the term ʺmarginal analysisʺ? Suppose an individual has to choose between renting four apartments at different distances from his place of work. The individual has to commute to work on five days of ...

... ESSAY. Write your answer in the space provided or on a separate sheet of paper. 8) What is meant by the term ʺmarginal analysisʺ? Suppose an individual has to choose between renting four apartments at different distances from his place of work. The individual has to commute to work on five days of ...

“Debating an appropriate macroeconomic policy for South Africa`s

... It is a key contention of this paper that the primary objective of South Africa’s developmental state should be to transform the structure of opportunity in the economy. Programmes, which widen access to adequate levels of education, health care and other social services, create new opportunities an ...

... It is a key contention of this paper that the primary objective of South Africa’s developmental state should be to transform the structure of opportunity in the economy. Programmes, which widen access to adequate levels of education, health care and other social services, create new opportunities an ...

New Keynesian macroeconomics: Entry For New Palgrave

... were the time-dependant models of pricing, which focussed on the notion of staggered wage and price setting: Taylor (1979) and Calvo (1983). Indeed, these two models have become the work horses of the New Neoclassical synthesis framework. John B Taylor’s model focussed on wage-setting: the empirical ...

... were the time-dependant models of pricing, which focussed on the notion of staggered wage and price setting: Taylor (1979) and Calvo (1983). Indeed, these two models have become the work horses of the New Neoclassical synthesis framework. John B Taylor’s model focussed on wage-setting: the empirical ...

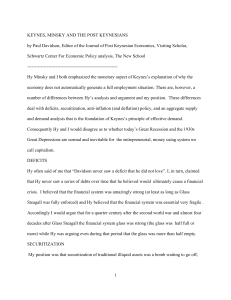

1 KEYNES, MINSKY AND THE POST KEYNESIANS by Paul

... [1] the elasticity of production associated with all liquid assets including money is zero or negligible 4 , and [2] the elasticity of substitution between all liquid assets (including money) and reproducible goods is zero or negligible 5 .. The zero elasticity of production means that when some por ...

... [1] the elasticity of production associated with all liquid assets including money is zero or negligible 4 , and [2] the elasticity of substitution between all liquid assets (including money) and reproducible goods is zero or negligible 5 .. The zero elasticity of production means that when some por ...

1960s: Experiments with Fiscal Policy

... demand initially, but the expansion and modernization of the capital stock will translate into higher productive capacity in the future. It is for this reason that so much attention in recent years has been focused on tax policies such as investment tax credits and accelerated depreciation aimed at ...

... demand initially, but the expansion and modernization of the capital stock will translate into higher productive capacity in the future. It is for this reason that so much attention in recent years has been focused on tax policies such as investment tax credits and accelerated depreciation aimed at ...

Tutorial

... 3. The real balance effect occurs because a higher price level will reduce the real value of people’s a. financial assets. b. wages. c. unpaid debt. d. physical investments. A. As the price levels increases, the dollars people receive in their paychecks and wealth are worth less. As a result, real ...

... 3. The real balance effect occurs because a higher price level will reduce the real value of people’s a. financial assets. b. wages. c. unpaid debt. d. physical investments. A. As the price levels increases, the dollars people receive in their paychecks and wealth are worth less. As a result, real ...

Mankiw 5/e Chapter 1: The Science of Macroeconomics

... …is negative: A tax increase reduces C, which reduces income. …is greater than one (in absolute value): A change in taxes has a multiplier effect on income. …is smaller than the govt spending multiplier: Consumers save the fraction (1 – MPC) of a tax cut, so the initial boost in spending from a tax ...

... …is negative: A tax increase reduces C, which reduces income. …is greater than one (in absolute value): A change in taxes has a multiplier effect on income. …is smaller than the govt spending multiplier: Consumers save the fraction (1 – MPC) of a tax cut, so the initial boost in spending from a tax ...

money supply

... • The money supply under fractional reserve banking – Rather than holding reserves that earn no interest, suppose a bank lent some of the reserves • It could do this, since the flow of money in and out of the bank is fairly predictable and only a fraction of reserves are needed to meet the need for ...

... • The money supply under fractional reserve banking – Rather than holding reserves that earn no interest, suppose a bank lent some of the reserves • It could do this, since the flow of money in and out of the bank is fairly predictable and only a fraction of reserves are needed to meet the need for ...

Parkin-Bade Chapter 21

... From a social perspective, this waste of resources is a cost of inflation. At its worse, inflation becomes hyperinflation—an inflation rate that is so rapid that workers are paid twice a day because money loses its value so quickly. © 2010 Pearson Education Canada ...

... From a social perspective, this waste of resources is a cost of inflation. At its worse, inflation becomes hyperinflation—an inflation rate that is so rapid that workers are paid twice a day because money loses its value so quickly. © 2010 Pearson Education Canada ...

Ch 5 Macroeconomics - Nine Mile Falls School District

... mortgage-backed securities began to fail. In some cases, the government rescued them; in other cases, such as Lehman Brothers, they were allowed to fail. The financial crisis had dramatic and immediate effects on the economy. The economy's total output fell at an annual rate of 3.7% in the third qua ...

... mortgage-backed securities began to fail. In some cases, the government rescued them; in other cases, such as Lehman Brothers, they were allowed to fail. The financial crisis had dramatic and immediate effects on the economy. The economy's total output fell at an annual rate of 3.7% in the third qua ...

INFLATION

... To minimize the costs of incorrectly anticipating inflation, people form rational expectations about the inflation rate. A rational expectation is one based on all relevant information and is the most accurate forecast possible, although that does not mean it is always right; to the contrary, it wil ...

... To minimize the costs of incorrectly anticipating inflation, people form rational expectations about the inflation rate. A rational expectation is one based on all relevant information and is the most accurate forecast possible, although that does not mean it is always right; to the contrary, it wil ...

Pass Workbook - University of Queensland

... 3. What are the main weaknesses of using GDP as a measure of national well-being? ...

... 3. What are the main weaknesses of using GDP as a measure of national well-being? ...

Untitled

... Of course, neutrality in this strict sense can never be achieved in the real world. In assessments of real world developments, for instanee by classical authors such as Ricardo, the criterion of neutrality therefore is used in a weaker sense; it refers to the level of output, not its composition (Hu ...

... Of course, neutrality in this strict sense can never be achieved in the real world. In assessments of real world developments, for instanee by classical authors such as Ricardo, the criterion of neutrality therefore is used in a weaker sense; it refers to the level of output, not its composition (Hu ...

Working with our basic Aggregate Demand / Supply Model

... 1. increase the wealth of people holding the fixed quantity of money, 2. lead to lower interest rates, and 3. make domestic goods cheaper relative to foreign goods. ...

... 1. increase the wealth of people holding the fixed quantity of money, 2. lead to lower interest rates, and 3. make domestic goods cheaper relative to foreign goods. ...

Case Study: Keynesians in the White House

... If government spends so much money that the resulting increase in the interest rate drives out more investment than government initially spent, the effect on the aggregate demand for goods and services could be smaller than the original government purchase. ...

... If government spends so much money that the resulting increase in the interest rate drives out more investment than government initially spent, the effect on the aggregate demand for goods and services could be smaller than the original government purchase. ...

Inflation

In economics, inflation is a sustained increase in the general price level of goods and services in an economy over a period of time.When the price level rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy. A chief measure of price inflation is the inflation rate, the annualized percentage change in a general price index (normally the consumer price index) over time. The opposite of inflation is deflation.Inflation affects an economy in various ways, both positive and negative. Negative effects of inflation include an increase in the opportunity cost of holding money, uncertainty over future inflation which may discourage investment and savings, and if inflation were rapid enough, shortages of goods as consumers begin hoarding out of concern that prices will increase in the future.Inflation also has positive effects: Fundamentally, inflation gives everyone an incentive to spend and invest, because if they don't, their money will be worth less in the future. This increase in spending and investment can benefit the economy. However it may also lead to sub-optimal use of resources. Inflation reduces the real burden of debt, both public and private. If you have a fixed-rate mortgage on your house, your salary is likely to increase over time due to wage inflation, but your mortgage payment will stay the same. Over time, your mortgage payment will become a smaller percentage of your earnings, which means that you will have more money to spend. Inflation keeps nominal interest rates above zero, so that central banks can reduce interest rates, when necessary, to stimulate the economy. Inflation reduces unemployment to the extent that unemployment is caused by nominal wage rigidity. When demand for labor falls but nominal wages do not, as typically occurs during a recession, the supply and demand for labor cannot reach equilibrium, and unemployment results. By reducing the real value of a given nominal wage, inflation increases the demand for labor, and therefore reduces unemployment.Economists generally believe that high rates of inflation and hyperinflation are caused by an excessive growth of the money supply. However, money supply growth does not necessarily cause inflation. Some economists maintain that under the conditions of a liquidity trap, large monetary injections are like ""pushing on a string"". Views on which factors determine low to moderate rates of inflation are more varied. Low or moderate inflation may be attributed to fluctuations in real demand for goods and services, or changes in available supplies such as during scarcities. However, the consensus view is that a long sustained period of inflation is caused by money supply growing faster than the rate of economic growth.Today, most economists favor a low and steady rate of inflation. Low (as opposed to zero or negative) inflation reduces the severity of economic recessions by enabling the labor market to adjust more quickly in a downturn, and reduces the risk that a liquidity trap prevents monetary policy from stabilizing the economy. The task of keeping the rate of inflation low and stable is usually given to monetary authorities. Generally, these monetary authorities are the central banks that control monetary policy through the setting of interest rates, through open market operations, and through the setting of banking reserve requirements.