Unit 3: Macroeconomics

... • A price index is a measurement that shows how the average price of a standard group of goods changes over time. It is used to compare to earlier averages to see how much prices have changed over time. • The Consumer Price Index (CPI) is a price index determined by measuring a standard group of goo ...

... • A price index is a measurement that shows how the average price of a standard group of goods changes over time. It is used to compare to earlier averages to see how much prices have changed over time. • The Consumer Price Index (CPI) is a price index determined by measuring a standard group of goo ...

FedViews

... The Survey of Professional Forecasters places the natural rate of unemployment—the lowest sustainable rate consistent with stable inflation—between 5% and 6.75%. The higher values and increased range of estimates for this rate, often called the non-accelerating inflation rate of unemployment (NAIRU) ...

... The Survey of Professional Forecasters places the natural rate of unemployment—the lowest sustainable rate consistent with stable inflation—between 5% and 6.75%. The higher values and increased range of estimates for this rate, often called the non-accelerating inflation rate of unemployment (NAIRU) ...

Chile_en.pdf

... (the main driver of growth in previous years), and a sharp fall-off in construction and machinery investment. Both factors are connected to the downgrading of expectations that began in the first quarter of 2013 as a result of rising uncertainty about future growth in the world economy and, in parti ...

... (the main driver of growth in previous years), and a sharp fall-off in construction and machinery investment. Both factors are connected to the downgrading of expectations that began in the first quarter of 2013 as a result of rising uncertainty about future growth in the world economy and, in parti ...

7.1 rise in investment demand when saving depends on interest rate

... economy over a period of time. The term "inflation" is also defined as the increases in the money supply (monetary inflation) which causes increases in the price level. Inflation can also be described as a decline in the real value of money i-e a loss of purchasing power in the medium of exchange wh ...

... economy over a period of time. The term "inflation" is also defined as the increases in the money supply (monetary inflation) which causes increases in the price level. Inflation can also be described as a decline in the real value of money i-e a loss of purchasing power in the medium of exchange wh ...

Answers to Questions in Chapter 16

... wages. For example if inflation were 10% and firms wanted to cut money wages by 5%, this would mean cutting real wages by 15%: something they would find it hard to get away with. Real wages, on the other hand frequently do fall. Because wage agreements are usually made in money terms, it only needs ...

... wages. For example if inflation were 10% and firms wanted to cut money wages by 5%, this would mean cutting real wages by 15%: something they would find it hard to get away with. Real wages, on the other hand frequently do fall. Because wage agreements are usually made in money terms, it only needs ...

ECON 404: Lecture on Deflation

... • This led to asset inflation (the “bubble economy”) in the late 1980s. Increased monetary growth led to increased bank lending, which in turn increased the demand for land, real estate, and equities. The resulting high prices for land, real estate, and equities fed back into the banking system to s ...

... • This led to asset inflation (the “bubble economy”) in the late 1980s. Increased monetary growth led to increased bank lending, which in turn increased the demand for land, real estate, and equities. The resulting high prices for land, real estate, and equities fed back into the banking system to s ...

14.02 Principles of Macroeconomics Problem Set 4 Fall 2005 ***Solutions***

... Exercise I. True/False? Explain 1) The more indexed wages are, the lower is the sacrifice ratio. True. If all wages are indexed, π te = π t . Disinflation can be obtained without any costs in terms of higher unemployment. 2) In the medium run equilibrium the economy reaches its natural inflation lev ...

... Exercise I. True/False? Explain 1) The more indexed wages are, the lower is the sacrifice ratio. True. If all wages are indexed, π te = π t . Disinflation can be obtained without any costs in terms of higher unemployment. 2) In the medium run equilibrium the economy reaches its natural inflation lev ...

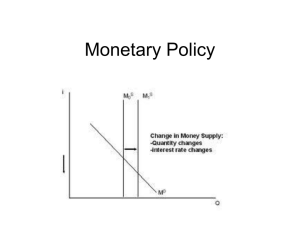

Monetary Policy

... • Fed buys bonds, lowers reserve requirements, or lowers discount rate • Real interest rates decrease • Stimulates AD (investment and consumption) • Lower interest rates lead to capital outflow, so dollar depreciates, and exports stimulated (higher AD) • Asset prices increase (housing) ...

... • Fed buys bonds, lowers reserve requirements, or lowers discount rate • Real interest rates decrease • Stimulates AD (investment and consumption) • Lower interest rates lead to capital outflow, so dollar depreciates, and exports stimulated (higher AD) • Asset prices increase (housing) ...

MACROECONOMICS AND THE GLOBAL BUSINESS ENVIRONMENT

... school, and is planning to attend State U in the fall. How should she spend her summer? ...

... school, and is planning to attend State U in the fall. How should she spend her summer? ...

Accelerated Macro Spring 2015 Solutions to HW #4 1

... For each of the following shocks, determine the effects of the policy prescribed by the Taylor Rule on the Federal Funds rate, output, and inflation. Would the policy reaction be stabilizing, destabilizing, or neutral relative to leaving the money supply unchanged after the shock? a. A temporary boo ...

... For each of the following shocks, determine the effects of the policy prescribed by the Taylor Rule on the Federal Funds rate, output, and inflation. Would the policy reaction be stabilizing, destabilizing, or neutral relative to leaving the money supply unchanged after the shock? a. A temporary boo ...

Economic Instability - Federal Reserve Bank of Dallas

... • Nominal variables are measured using current prices • Real variables have been adjusted for inflation by using prices from a base year ...

... • Nominal variables are measured using current prices • Real variables have been adjusted for inflation by using prices from a base year ...

Chapter 8

... Occurs when the number of job seekers equals the number of job vacancies It is 4% Economic Cost of Unemployment o The basic economic cost of unemployment is forgone output o When the economy fails to create enough jobs for all who are able and willing to work, potential production of goods and ...

... Occurs when the number of job seekers equals the number of job vacancies It is 4% Economic Cost of Unemployment o The basic economic cost of unemployment is forgone output o When the economy fails to create enough jobs for all who are able and willing to work, potential production of goods and ...

Inflation, Deflation, and the Phillips Curve

... the basis of mainstream macro for large open economies. ...

... the basis of mainstream macro for large open economies. ...

Business Cycle Analysis from 1945-1954

... The time period from 1945-1954 experienced three contractions lasting an average of nine and a half months and two expansions lasting three years and 3.75 years respectively. The data used to show this information include Gross Domestic Product, the Unemployment Rate and the Consumer Price Index. Th ...

... The time period from 1945-1954 experienced three contractions lasting an average of nine and a half months and two expansions lasting three years and 3.75 years respectively. The data used to show this information include Gross Domestic Product, the Unemployment Rate and the Consumer Price Index. Th ...

Economics of the Great Depression

... price level of consumer goods and services purchased by households. ...

... price level of consumer goods and services purchased by households. ...

Inflation

In economics, inflation is a sustained increase in the general price level of goods and services in an economy over a period of time.When the price level rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy. A chief measure of price inflation is the inflation rate, the annualized percentage change in a general price index (normally the consumer price index) over time. The opposite of inflation is deflation.Inflation affects an economy in various ways, both positive and negative. Negative effects of inflation include an increase in the opportunity cost of holding money, uncertainty over future inflation which may discourage investment and savings, and if inflation were rapid enough, shortages of goods as consumers begin hoarding out of concern that prices will increase in the future.Inflation also has positive effects: Fundamentally, inflation gives everyone an incentive to spend and invest, because if they don't, their money will be worth less in the future. This increase in spending and investment can benefit the economy. However it may also lead to sub-optimal use of resources. Inflation reduces the real burden of debt, both public and private. If you have a fixed-rate mortgage on your house, your salary is likely to increase over time due to wage inflation, but your mortgage payment will stay the same. Over time, your mortgage payment will become a smaller percentage of your earnings, which means that you will have more money to spend. Inflation keeps nominal interest rates above zero, so that central banks can reduce interest rates, when necessary, to stimulate the economy. Inflation reduces unemployment to the extent that unemployment is caused by nominal wage rigidity. When demand for labor falls but nominal wages do not, as typically occurs during a recession, the supply and demand for labor cannot reach equilibrium, and unemployment results. By reducing the real value of a given nominal wage, inflation increases the demand for labor, and therefore reduces unemployment.Economists generally believe that high rates of inflation and hyperinflation are caused by an excessive growth of the money supply. However, money supply growth does not necessarily cause inflation. Some economists maintain that under the conditions of a liquidity trap, large monetary injections are like ""pushing on a string"". Views on which factors determine low to moderate rates of inflation are more varied. Low or moderate inflation may be attributed to fluctuations in real demand for goods and services, or changes in available supplies such as during scarcities. However, the consensus view is that a long sustained period of inflation is caused by money supply growing faster than the rate of economic growth.Today, most economists favor a low and steady rate of inflation. Low (as opposed to zero or negative) inflation reduces the severity of economic recessions by enabling the labor market to adjust more quickly in a downturn, and reduces the risk that a liquidity trap prevents monetary policy from stabilizing the economy. The task of keeping the rate of inflation low and stable is usually given to monetary authorities. Generally, these monetary authorities are the central banks that control monetary policy through the setting of interest rates, through open market operations, and through the setting of banking reserve requirements.