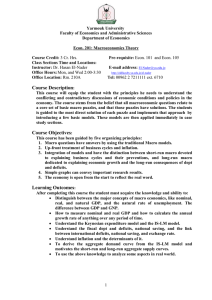

Yarmouk University Economics 200

... How to measure nominal and real GDP and how to calculate the annual growth rate of anything over any period of time. Understand the Keynesian expenditure model and the IS-LM model. Understand the fiscal dept and deficits, national saving, and the link between international deficits, national s ...

... How to measure nominal and real GDP and how to calculate the annual growth rate of anything over any period of time. Understand the Keynesian expenditure model and the IS-LM model. Understand the fiscal dept and deficits, national saving, and the link between international deficits, national s ...

Lecture Notes Chapter 6

... some base period Most widely used measure of the price level in United States Designed to track price paid by typical consumer Compiled and reported by Bureau of Labor Statistics (BLS) Two problems must be solved before we even begin Must decide which goods and services should be included in a ...

... some base period Most widely used measure of the price level in United States Designed to track price paid by typical consumer Compiled and reported by Bureau of Labor Statistics (BLS) Two problems must be solved before we even begin Must decide which goods and services should be included in a ...

No: 2011 -24 Meeting Date: July 21, 2011

... still persist. Especially, mounting problems regarding sovereign debt of the euro area peripheral economies have increased the downside risks on the global economy. The Committee members indicated that it would be appropriate to narrow the interest corridor gradually should the sovereign debt proble ...

... still persist. Especially, mounting problems regarding sovereign debt of the euro area peripheral economies have increased the downside risks on the global economy. The Committee members indicated that it would be appropriate to narrow the interest corridor gradually should the sovereign debt proble ...

Inaugural Economic Outlook Conference Central Washington University Ellensburg, Washington

... As a result of these uncertainties, the Fed has taken a fairly cautious approach in reacting to indications of higher future inflation—especially since actual inflation has been so well-behaved. ...

... As a result of these uncertainties, the Fed has taken a fairly cautious approach in reacting to indications of higher future inflation—especially since actual inflation has been so well-behaved. ...

FedViews

... Several factors, including strong dollar appreciation and falling gasoline prices, continue to weigh down headline personal consumption expenditures (PCE) price inflation, which rose only 0.1% at an annual rate in the twelve months through April. Core PCE inflation, which removes volatile food and e ...

... Several factors, including strong dollar appreciation and falling gasoline prices, continue to weigh down headline personal consumption expenditures (PCE) price inflation, which rose only 0.1% at an annual rate in the twelve months through April. Core PCE inflation, which removes volatile food and e ...

Chapter 26 Key Question Solutions

... There is a pre-Christmas spurt in production and sales and a January slackening. This normal seasonal variation does not signal boom or recession. From decade to decade, the long-term trend (the secular trend) of the U.S. economy has been upward. A period of no GDP growth thus does not mean all is n ...

... There is a pre-Christmas spurt in production and sales and a January slackening. This normal seasonal variation does not signal boom or recession. From decade to decade, the long-term trend (the secular trend) of the U.S. economy has been upward. A period of no GDP growth thus does not mean all is n ...

The Economic Theories all in one

... • If there is equilibrium in the money market, then the quantity of money supplied is equal to the quantity of money demanded. When M is taken to be the quantity of money demanded, this equality would make the quantity of money demanded dependent on nominal GDP, but not the interest rate. • The dem ...

... • If there is equilibrium in the money market, then the quantity of money supplied is equal to the quantity of money demanded. When M is taken to be the quantity of money demanded, this equality would make the quantity of money demanded dependent on nominal GDP, but not the interest rate. • The dem ...

Graphing Symbols

... Common Macro Graphing Symbols: McConnell and Brue (15th): And Vocabulary for AP Macroeconomics Symbol: Meaning: C consumption Savings savings (use “S” for individual product Supply) Y/FE Income or Full Employment Income on AD/AS graph P price Q quantity (individual products or aggregate q. of GDP) P ...

... Common Macro Graphing Symbols: McConnell and Brue (15th): And Vocabulary for AP Macroeconomics Symbol: Meaning: C consumption Savings savings (use “S” for individual product Supply) Y/FE Income or Full Employment Income on AD/AS graph P price Q quantity (individual products or aggregate q. of GDP) P ...

Macroeconomics: BSc Year One The Monetarist View of Interest

... This process, however, generates inflation, which may become expected as before, leading to no short-term benefits. Also, the IS curve will shift up, because P& e ¹ 0 , leading to a higher interest rate. The long run effect is the opposite of the short run effect in terms of interest rates, but infl ...

... This process, however, generates inflation, which may become expected as before, leading to no short-term benefits. Also, the IS curve will shift up, because P& e ¹ 0 , leading to a higher interest rate. The long run effect is the opposite of the short run effect in terms of interest rates, but infl ...

Economic Indicators PowerPoint

... durable goods such as washing machines. Decreases in interest rates encourage businesses to take out loans to construct more buildings. To fight unemployment, the government decides to hire more people to work in national parks. Tax cuts to businesses give businesses incentives to buy more computers ...

... durable goods such as washing machines. Decreases in interest rates encourage businesses to take out loans to construct more buildings. To fight unemployment, the government decides to hire more people to work in national parks. Tax cuts to businesses give businesses incentives to buy more computers ...

DATA WAREHOUSES

... Apply Statistical Regression Incorporate Findings in Report Intended for Your Peers at the bank ...

... Apply Statistical Regression Incorporate Findings in Report Intended for Your Peers at the bank ...

Chapter 29: Inflation and Its Relationship to Unemployment and

... b. Since the exchange rate was fixed, any differential in inflation rates between the two countries could not be offset a change in the exchange rate. The fact that goods in dollar equivalent pesos in Argentina were higher than in NYC suggests that the Argentinean inflation rate remained greater tha ...

... b. Since the exchange rate was fixed, any differential in inflation rates between the two countries could not be offset a change in the exchange rate. The fact that goods in dollar equivalent pesos in Argentina were higher than in NYC suggests that the Argentinean inflation rate remained greater tha ...

Sample questions

... to unexpected shocks. Proponents of this type of monetary policy assume that the economy, if left on its own, will move smoothly along the long run trend of growth in full employment output. Discretionary policy enables the government to smooth short run business cycle fluctuations around the long r ...

... to unexpected shocks. Proponents of this type of monetary policy assume that the economy, if left on its own, will move smoothly along the long run trend of growth in full employment output. Discretionary policy enables the government to smooth short run business cycle fluctuations around the long r ...

Name:

... How does the Bureau of Labor Statistics (BLS) calculate the rate of inflation from one year to the next? What effect does inflation have on the purchasing power of a dollar? How does it explain differences between nominal and real interest rates? How does deflation differ from inflation? Answer: The ...

... How does the Bureau of Labor Statistics (BLS) calculate the rate of inflation from one year to the next? What effect does inflation have on the purchasing power of a dollar? How does it explain differences between nominal and real interest rates? How does deflation differ from inflation? Answer: The ...

Business Cycle

... Monetarists believe that such effects are temporary and that appropriate monetary policy will dampen economic cycles Automatic stabilizers (taxes and transfer payments such as unemployment benefits) tend to increase deficits during recessions and decrease deficits during expansions Goals of fi ...

... Monetarists believe that such effects are temporary and that appropriate monetary policy will dampen economic cycles Automatic stabilizers (taxes and transfer payments such as unemployment benefits) tend to increase deficits during recessions and decrease deficits during expansions Goals of fi ...

AP Macro Problem Set #3 Total: ______/55

... c. If someone told you that the nominal GDP increased by 4% in 2004 explain why you would need two additional pieces of information to conclude that the standard of living for the typical person also increased by 4%. ( ____/5) 2. (_____/10 Points) Unemployment a. Define and give examples of the thre ...

... c. If someone told you that the nominal GDP increased by 4% in 2004 explain why you would need two additional pieces of information to conclude that the standard of living for the typical person also increased by 4%. ( ____/5) 2. (_____/10 Points) Unemployment a. Define and give examples of the thre ...

1) - Georgia State University

... a decrease in the rate of inflation c) inflation being unchanged d) inflation and currency exchange value are not related ...

... a decrease in the rate of inflation c) inflation being unchanged d) inflation and currency exchange value are not related ...

File

... People on fixed incomes are hurt, because their buying power is reduced by inflation. The only exception is if they have a COLA (Cost of Living Adjustment) which keeps up with the inflation rate. ...

... People on fixed incomes are hurt, because their buying power is reduced by inflation. The only exception is if they have a COLA (Cost of Living Adjustment) which keeps up with the inflation rate. ...

Inflation

In economics, inflation is a sustained increase in the general price level of goods and services in an economy over a period of time.When the price level rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy. A chief measure of price inflation is the inflation rate, the annualized percentage change in a general price index (normally the consumer price index) over time. The opposite of inflation is deflation.Inflation affects an economy in various ways, both positive and negative. Negative effects of inflation include an increase in the opportunity cost of holding money, uncertainty over future inflation which may discourage investment and savings, and if inflation were rapid enough, shortages of goods as consumers begin hoarding out of concern that prices will increase in the future.Inflation also has positive effects: Fundamentally, inflation gives everyone an incentive to spend and invest, because if they don't, their money will be worth less in the future. This increase in spending and investment can benefit the economy. However it may also lead to sub-optimal use of resources. Inflation reduces the real burden of debt, both public and private. If you have a fixed-rate mortgage on your house, your salary is likely to increase over time due to wage inflation, but your mortgage payment will stay the same. Over time, your mortgage payment will become a smaller percentage of your earnings, which means that you will have more money to spend. Inflation keeps nominal interest rates above zero, so that central banks can reduce interest rates, when necessary, to stimulate the economy. Inflation reduces unemployment to the extent that unemployment is caused by nominal wage rigidity. When demand for labor falls but nominal wages do not, as typically occurs during a recession, the supply and demand for labor cannot reach equilibrium, and unemployment results. By reducing the real value of a given nominal wage, inflation increases the demand for labor, and therefore reduces unemployment.Economists generally believe that high rates of inflation and hyperinflation are caused by an excessive growth of the money supply. However, money supply growth does not necessarily cause inflation. Some economists maintain that under the conditions of a liquidity trap, large monetary injections are like ""pushing on a string"". Views on which factors determine low to moderate rates of inflation are more varied. Low or moderate inflation may be attributed to fluctuations in real demand for goods and services, or changes in available supplies such as during scarcities. However, the consensus view is that a long sustained period of inflation is caused by money supply growing faster than the rate of economic growth.Today, most economists favor a low and steady rate of inflation. Low (as opposed to zero or negative) inflation reduces the severity of economic recessions by enabling the labor market to adjust more quickly in a downturn, and reduces the risk that a liquidity trap prevents monetary policy from stabilizing the economy. The task of keeping the rate of inflation low and stable is usually given to monetary authorities. Generally, these monetary authorities are the central banks that control monetary policy through the setting of interest rates, through open market operations, and through the setting of banking reserve requirements.