Causes of Macro Instability

... • Government interference is the problem • Equation of exchange MV = PQ • Stable velocity • Monetary causes of instability • Inappropriate monetary policy LO1 ...

... • Government interference is the problem • Equation of exchange MV = PQ • Stable velocity • Monetary causes of instability • Inappropriate monetary policy LO1 ...

1 - UCSB Economics

... In January, 1999 each national currency was redefined as a fixed number of euros. No physical euros yet, but euros are used for electronic transactions and accounting purposes: stock and bond trades denominated entirely in euros, all transactions between banks, bank customers can write checks in eur ...

... In January, 1999 each national currency was redefined as a fixed number of euros. No physical euros yet, but euros are used for electronic transactions and accounting purposes: stock and bond trades denominated entirely in euros, all transactions between banks, bank customers can write checks in eur ...

http://socrates

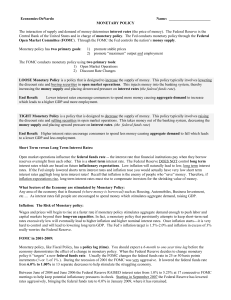

... interest rates which are based on future inflationary expectations. Low inflation will naturally lead to low, long term interest rates. If the Fed simply lowered shorts term interest rates and inflation rose you would actually have very low short term interest rates and high long term interest rates ...

... interest rates which are based on future inflationary expectations. Low inflation will naturally lead to low, long term interest rates. If the Fed simply lowered shorts term interest rates and inflation rose you would actually have very low short term interest rates and high long term interest rates ...

Document

... would cut the money supply and force the Fed to stick to a fixed money supply growth rate. In the short run, the unemployment rate will rise, but in the long-run, it selfcorrects to the natural rate. ...

... would cut the money supply and force the Fed to stick to a fixed money supply growth rate. In the short run, the unemployment rate will rise, but in the long-run, it selfcorrects to the natural rate. ...

Final Exam Cram Assignment

... The label in your jeans says that they were made in a Latin American country. This is probably because the jeans manufacturing company wanted to locate its plant closer to raw materials. ...

... The label in your jeans says that they were made in a Latin American country. This is probably because the jeans manufacturing company wanted to locate its plant closer to raw materials. ...

Solutions to Problems - Pearson Higher Education

... A credible announced inflation reduction from the Reserve Bank would reduce inflationary expectations little or no unemployment. 5c. In figure 2 nominal wages increased because employers and workers anticipated an expansion of aggregate demand from AD to EAD at current interest rates. The Reserve Ba ...

... A credible announced inflation reduction from the Reserve Bank would reduce inflationary expectations little or no unemployment. 5c. In figure 2 nominal wages increased because employers and workers anticipated an expansion of aggregate demand from AD to EAD at current interest rates. The Reserve Ba ...

Final Exam Cram Assignment

... When a good’s price is lower, people will buy more of it. d. Services are of interest in the same way that goods are. 15. When prices rise, which of the following happens to income? a. It goes down. c. It rises to meet prices. b. It buys less. d. It is used to buy different things. 16. Which of the ...

... When a good’s price is lower, people will buy more of it. d. Services are of interest in the same way that goods are. 15. When prices rise, which of the following happens to income? a. It goes down. c. It rises to meet prices. b. It buys less. d. It is used to buy different things. 16. Which of the ...

1) Gross domestic product is calculated by summing up A) the total

... A) Empirical evidence shows workers and firms have rational expectations. B) Contracts with workers and suppliers may hinder firms' abilities to adjust to price changes. C) Wages and prices may not adjust rapidly enough to keep the short-run Phillips curve vertical. D) Individuals may not be able to ...

... A) Empirical evidence shows workers and firms have rational expectations. B) Contracts with workers and suppliers may hinder firms' abilities to adjust to price changes. C) Wages and prices may not adjust rapidly enough to keep the short-run Phillips curve vertical. D) Individuals may not be able to ...

AN ECONOMIC ANALYSIS OF THE DETERMINANTS OF

... The objective of this study is to examine the determinants of inflation using the data from 1990 to 2010. The Ordinary Least Square (OLS) method has been used to explain the relationships. The empirical results show that money supply, one year lagged value of interest rate positively and significant ...

... The objective of this study is to examine the determinants of inflation using the data from 1990 to 2010. The Ordinary Least Square (OLS) method has been used to explain the relationships. The empirical results show that money supply, one year lagged value of interest rate positively and significant ...

San Diego Community Leaders’ Luncheon

... process by which labor’s share of income returns to more normal levels, hence unthreatening from an inflation standpoint. As we assess the likely behaviour of wage pressures going forward, we must also factor in the influence of slack in labor and product markets. The decline in the unemployment ra ...

... process by which labor’s share of income returns to more normal levels, hence unthreatening from an inflation standpoint. As we assess the likely behaviour of wage pressures going forward, we must also factor in the influence of slack in labor and product markets. The decline in the unemployment ra ...

Intro_To_Inflation_and Unemployment

... • The Consumer Price Index (CPI), often known as "the cost of living," is the most widely cited index. • Nominal values can be deflated by the CPI in order to estimate real changes. ...

... • The Consumer Price Index (CPI), often known as "the cost of living," is the most widely cited index. • Nominal values can be deflated by the CPI in order to estimate real changes. ...

Portland Community Leaders’ Luncheon

... recover from the 2001 recession, but mostly catching up in 2004 and early 2005 as economic growth picked up noticeably in the state. As of early this year, home prices in the Portland area were up 12 percent over a year earlier, only a bit below the national pace of 12½ percent. More recently, I’ve ...

... recover from the 2001 recession, but mostly catching up in 2004 and early 2005 as economic growth picked up noticeably in the state. As of early this year, home prices in the Portland area were up 12 percent over a year earlier, only a bit below the national pace of 12½ percent. More recently, I’ve ...

Has the resurgence of Keynesianism already peaked?

... of what demand-management policy could achieve, should not be forgotten. If central banks disregard the lags of one to two years and more with which monetary policy measures produce their effect, they risk underestimating the dynamics of inflationary developments and exiting too late from expansiona ...

... of what demand-management policy could achieve, should not be forgotten. If central banks disregard the lags of one to two years and more with which monetary policy measures produce their effect, they risk underestimating the dynamics of inflationary developments and exiting too late from expansiona ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research Volume Title: Analysis of Inflation: 1965–1974

... 1974 and, to some extent, its interrelationship with inflation in other countries. The period covered is one during which Federal deficits grew and rates of monetary growth were high. There was also an exceptional variety of developments of the kind that are frequently considered in the analysis of ...

... 1974 and, to some extent, its interrelationship with inflation in other countries. The period covered is one during which Federal deficits grew and rates of monetary growth were high. There was also an exceptional variety of developments of the kind that are frequently considered in the analysis of ...

Solutions to Problems

... The money multiplier is the ratio of the money supply to the monetary base, which equals $330 billion divided by $45 billion, which equals 7.33. MS = MB x mm = 1 x 7.33 =$7.33b ...

... The money multiplier is the ratio of the money supply to the monetary base, which equals $330 billion divided by $45 billion, which equals 7.33. MS = MB x mm = 1 x 7.33 =$7.33b ...

Food inflation rears its ugly head - Malaysian Institute of Accountants

... 0% (i.e. a negative inflation rate). While inflation reduces the real value of money over time, deflation, conversely, increases the real value of money. This allows one to buy more goods with the same amount of money at a later time. Under normal circumstances, ...

... 0% (i.e. a negative inflation rate). While inflation reduces the real value of money over time, deflation, conversely, increases the real value of money. This allows one to buy more goods with the same amount of money at a later time. Under normal circumstances, ...

International Economic Integration

... to appreciate, through trade Therefore, countries may wish or need to cooperate on exchange rates Currency unions Case in point: Europe’s single currency ...

... to appreciate, through trade Therefore, countries may wish or need to cooperate on exchange rates Currency unions Case in point: Europe’s single currency ...

Inflation

In economics, inflation is a sustained increase in the general price level of goods and services in an economy over a period of time.When the price level rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy. A chief measure of price inflation is the inflation rate, the annualized percentage change in a general price index (normally the consumer price index) over time. The opposite of inflation is deflation.Inflation affects an economy in various ways, both positive and negative. Negative effects of inflation include an increase in the opportunity cost of holding money, uncertainty over future inflation which may discourage investment and savings, and if inflation were rapid enough, shortages of goods as consumers begin hoarding out of concern that prices will increase in the future.Inflation also has positive effects: Fundamentally, inflation gives everyone an incentive to spend and invest, because if they don't, their money will be worth less in the future. This increase in spending and investment can benefit the economy. However it may also lead to sub-optimal use of resources. Inflation reduces the real burden of debt, both public and private. If you have a fixed-rate mortgage on your house, your salary is likely to increase over time due to wage inflation, but your mortgage payment will stay the same. Over time, your mortgage payment will become a smaller percentage of your earnings, which means that you will have more money to spend. Inflation keeps nominal interest rates above zero, so that central banks can reduce interest rates, when necessary, to stimulate the economy. Inflation reduces unemployment to the extent that unemployment is caused by nominal wage rigidity. When demand for labor falls but nominal wages do not, as typically occurs during a recession, the supply and demand for labor cannot reach equilibrium, and unemployment results. By reducing the real value of a given nominal wage, inflation increases the demand for labor, and therefore reduces unemployment.Economists generally believe that high rates of inflation and hyperinflation are caused by an excessive growth of the money supply. However, money supply growth does not necessarily cause inflation. Some economists maintain that under the conditions of a liquidity trap, large monetary injections are like ""pushing on a string"". Views on which factors determine low to moderate rates of inflation are more varied. Low or moderate inflation may be attributed to fluctuations in real demand for goods and services, or changes in available supplies such as during scarcities. However, the consensus view is that a long sustained period of inflation is caused by money supply growing faster than the rate of economic growth.Today, most economists favor a low and steady rate of inflation. Low (as opposed to zero or negative) inflation reduces the severity of economic recessions by enabling the labor market to adjust more quickly in a downturn, and reduces the risk that a liquidity trap prevents monetary policy from stabilizing the economy. The task of keeping the rate of inflation low and stable is usually given to monetary authorities. Generally, these monetary authorities are the central banks that control monetary policy through the setting of interest rates, through open market operations, and through the setting of banking reserve requirements.