Detailed analyses, figures and tables (PDF, 61 KB)

... The development of private construction and equipment investment will be hampered by the still high uncertainty about the economic outlook and the low level of capacity utilization. In addition, financial tensions will keep on weighing on the financing conditions faced by firms while credit standard ...

... The development of private construction and equipment investment will be hampered by the still high uncertainty about the economic outlook and the low level of capacity utilization. In addition, financial tensions will keep on weighing on the financing conditions faced by firms while credit standard ...

Inflation October 18

... Inflation, in the short run and when caused by changes in demand, has an inverse relationship with unemployment. If spending is rising faster than capacity to produce, unemployment is likely to be falling and demand-pull inflation increasing. If spending is rising more slowly than capacity to produc ...

... Inflation, in the short run and when caused by changes in demand, has an inverse relationship with unemployment. If spending is rising faster than capacity to produce, unemployment is likely to be falling and demand-pull inflation increasing. If spending is rising more slowly than capacity to produc ...

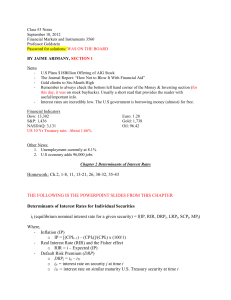

Jamie Arimany

... A rate applicable to a financial transaction that will take place in the future. Forward rates are based on the spot rate, adjusted for the cost of carry and refer to the rate that will be used to deliver a currency, bond or commodity at some future time. It may also refer to the rate fixed for a fu ...

... A rate applicable to a financial transaction that will take place in the future. Forward rates are based on the spot rate, adjusted for the cost of carry and refer to the rate that will be used to deliver a currency, bond or commodity at some future time. It may also refer to the rate fixed for a fu ...

Causes of Inflation in the Iranian Economy

... boom, the war, third oil crisis, and the economic embargo took place. Over the period of 1989-1993, when the economic reform programme was implemented, the average rates of the GDP deflator was 24.9 while the CPI inflation was exactly the same as in the pervious sub-period. The rates of inflation in ...

... boom, the war, third oil crisis, and the economic embargo took place. Over the period of 1989-1993, when the economic reform programme was implemented, the average rates of the GDP deflator was 24.9 while the CPI inflation was exactly the same as in the pervious sub-period. The rates of inflation in ...

CHAPTER OVERVIEW

... compared to the 1970s and 1980s? Explain why or why not. Changes in oil prices have a smaller impact today than in the 1970s and 1980s for several reasons. First, the beneficial effects on cost reduction of technology improvements offset higher energy costs. Second, the Federal Reserve has become be ...

... compared to the 1970s and 1980s? Explain why or why not. Changes in oil prices have a smaller impact today than in the 1970s and 1980s for several reasons. First, the beneficial effects on cost reduction of technology improvements offset higher energy costs. Second, the Federal Reserve has become be ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... function, and that tradeoffs between inflation and output that we see in the data will reflect the loss function weights. The empirical work considers whether greater openness (lighter restrictions on capital controls and trade) implies higher sacrifice ratios. It does so using disinflation episodes ...

... function, and that tradeoffs between inflation and output that we see in the data will reflect the loss function weights. The empirical work considers whether greater openness (lighter restrictions on capital controls and trade) implies higher sacrifice ratios. It does so using disinflation episodes ...

True or False

... When a business sets prices on the cost of production plus a markup, they are using what ...

... When a business sets prices on the cost of production plus a markup, they are using what ...

File

... power of money. • This decreases the quantity of expenditures • Vice Versa Example: • If the balance in your bank was $50,000, but inflation erodes your purchasing power, you will likely reduce your spending. The quantity purchased is reduced. • So…Price Level goes up, Real GDP demanded goes down. ...

... power of money. • This decreases the quantity of expenditures • Vice Versa Example: • If the balance in your bank was $50,000, but inflation erodes your purchasing power, you will likely reduce your spending. The quantity purchased is reduced. • So…Price Level goes up, Real GDP demanded goes down. ...

Private sector expectations for inflation and economic activity in the

... decline in uncertainty among forecasters regarding the average inflation rate in 2005. However, the probability distribution also points to a clear upside risk, as SPF panellists believe there is a 37.6% probability that inflation in 2005 will stand between 2.0 and 2.4%. The main risks cited by fore ...

... decline in uncertainty among forecasters regarding the average inflation rate in 2005. However, the probability distribution also points to a clear upside risk, as SPF panellists believe there is a 37.6% probability that inflation in 2005 will stand between 2.0 and 2.4%. The main risks cited by fore ...

Low and stable rate of inflation

... Q Lenders – Creditors, be they individuals, firms or governments, will also lose from inflation. This is because the money lent out to borrowers becomes worth less than before due to inflation. Q Borrowers – By contrast, borrowers tend to gain from inflation as the money they need to repay is worth ...

... Q Lenders – Creditors, be they individuals, firms or governments, will also lose from inflation. This is because the money lent out to borrowers becomes worth less than before due to inflation. Q Borrowers – By contrast, borrowers tend to gain from inflation as the money they need to repay is worth ...

Aggregate Demand and Aggregate Supply

... • Exchange rates • Dollar depreciation – rise in exports and fall in imports, AD shifts right • Dollar appreciation – fall in exports and rise in imports, AD shifts left ...

... • Exchange rates • Dollar depreciation – rise in exports and fall in imports, AD shifts right • Dollar appreciation – fall in exports and rise in imports, AD shifts left ...

error correction model of gdp and inflation based on one long

... caused by domestic money supply and price rises. In this era of globalization, the effect of economic inflation crosses borders and percolates to both developing and developed nations. Nigeria has experienced all manner of inflationary episodes – from creeping to moderate and from high to galloping ...

... caused by domestic money supply and price rises. In this era of globalization, the effect of economic inflation crosses borders and percolates to both developing and developed nations. Nigeria has experienced all manner of inflationary episodes – from creeping to moderate and from high to galloping ...

Inflation Cycles

... Aggregate demand keeps increasing and the process just described repeats indefinitely. ...

... Aggregate demand keeps increasing and the process just described repeats indefinitely. ...

IV. Marginal Rate of Substitution: Output Gap and Inflation

... supporting role in the past decade’s disinflation.” Previously, Romer (1993, 1998), and Lane (1997) show that inflation and trade liberalization are negatively, and significantly, correlated in large (flexible exchange rate) OECD economies. Gali and Monacelli, (2003) analyze the effect of exchange r ...

... supporting role in the past decade’s disinflation.” Previously, Romer (1993, 1998), and Lane (1997) show that inflation and trade liberalization are negatively, and significantly, correlated in large (flexible exchange rate) OECD economies. Gali and Monacelli, (2003) analyze the effect of exchange r ...

Quiz: Homework 14

... A. can influence aggregate demand, but it can't push the demand for housing down and, at the same time, keep the demand for everything else up. B. cannot influence aggregate demand, and it can't push the demand for housing down and, at the same time, keep the demand for everything else up. C. can i ...

... A. can influence aggregate demand, but it can't push the demand for housing down and, at the same time, keep the demand for everything else up. B. cannot influence aggregate demand, and it can't push the demand for housing down and, at the same time, keep the demand for everything else up. C. can i ...

solution 24/01/03

... iii) None is better than the other. The two are good depending on the purpose for which they are to be used. The GDP deflator is the adequate index to correct nominal figures of output, in order to isolate real growth of this output. The CPI is good to identify the evolution of the prices of the goo ...

... iii) None is better than the other. The two are good depending on the purpose for which they are to be used. The GDP deflator is the adequate index to correct nominal figures of output, in order to isolate real growth of this output. The CPI is good to identify the evolution of the prices of the goo ...

can the taylor rule be a good tool to analyse the monetary policy

... policy3. The average growth rate of consumer prices in the USA in the years 1981–1991 stood at 4.1% (OECD, 2006, Annex Table 18), whereas in the years 1984–1994 it oscillated around 3.6% (OECD, 2008, Annex Table 18). When Taylor put forward his formula, he assumed from the beginning that the monetar ...

... policy3. The average growth rate of consumer prices in the USA in the years 1981–1991 stood at 4.1% (OECD, 2006, Annex Table 18), whereas in the years 1984–1994 it oscillated around 3.6% (OECD, 2008, Annex Table 18). When Taylor put forward his formula, he assumed from the beginning that the monetar ...

Questions of Final Provide explanation of 4 out of 10 principles of

... 17. Write quantity equation. For what purpose do we use it? and explain each variable in the equation. What is velocity and how can we derive it? 18. M=100; T=100; P=50; Real GDP=200. Find transaction velocity of money and income velocity of money. 19. 1 case-The Central Bank lowers the reserve requ ...

... 17. Write quantity equation. For what purpose do we use it? and explain each variable in the equation. What is velocity and how can we derive it? 18. M=100; T=100; P=50; Real GDP=200. Find transaction velocity of money and income velocity of money. 19. 1 case-The Central Bank lowers the reserve requ ...

Policy Note 1998/7 - Levy Economics Institute of Bard College

... occurred during downturns and have resulted primarily from a combination of bad luck (crop failures, energy price shocks), perverse policy (high interest rates, which get passed along in prices), and poor sales (which induce firms to raise markups to protect revenue)-although Bureau of Labor Statist ...

... occurred during downturns and have resulted primarily from a combination of bad luck (crop failures, energy price shocks), perverse policy (high interest rates, which get passed along in prices), and poor sales (which induce firms to raise markups to protect revenue)-although Bureau of Labor Statist ...

Determinants of Inflation in Nigeria: An Empirical Analysis

... of the Naira coincides with the period of inflationary growth in Nigeria, and is an unwholesome development that has led to a drastic decline in the living standard of the average Nigerian. To measure inflation are three approaches. These are the Gross National Product (GNP) implicit deflator, the C ...

... of the Naira coincides with the period of inflationary growth in Nigeria, and is an unwholesome development that has led to a drastic decline in the living standard of the average Nigerian. To measure inflation are three approaches. These are the Gross National Product (GNP) implicit deflator, the C ...

Why has inflation in New Zealand been low?

... physical goods are also classified as non-tradables, such as cigarettes and tobacco. In this example, retail prices are heavily influenced by government regulation (taxes currently make up just under 70 percent of the price of cigarettes). Other examples of goods that are classified as non-tradables ...

... physical goods are also classified as non-tradables, such as cigarettes and tobacco. In this example, retail prices are heavily influenced by government regulation (taxes currently make up just under 70 percent of the price of cigarettes). Other examples of goods that are classified as non-tradables ...

AP Macro Review

... 10. A change in spending may generate even larger or smaller changes in real GDP. This is known as the: a) b) c) d) e) ...

... 10. A change in spending may generate even larger or smaller changes in real GDP. This is known as the: a) b) c) d) e) ...

Inflation

In economics, inflation is a sustained increase in the general price level of goods and services in an economy over a period of time.When the price level rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy. A chief measure of price inflation is the inflation rate, the annualized percentage change in a general price index (normally the consumer price index) over time. The opposite of inflation is deflation.Inflation affects an economy in various ways, both positive and negative. Negative effects of inflation include an increase in the opportunity cost of holding money, uncertainty over future inflation which may discourage investment and savings, and if inflation were rapid enough, shortages of goods as consumers begin hoarding out of concern that prices will increase in the future.Inflation also has positive effects: Fundamentally, inflation gives everyone an incentive to spend and invest, because if they don't, their money will be worth less in the future. This increase in spending and investment can benefit the economy. However it may also lead to sub-optimal use of resources. Inflation reduces the real burden of debt, both public and private. If you have a fixed-rate mortgage on your house, your salary is likely to increase over time due to wage inflation, but your mortgage payment will stay the same. Over time, your mortgage payment will become a smaller percentage of your earnings, which means that you will have more money to spend. Inflation keeps nominal interest rates above zero, so that central banks can reduce interest rates, when necessary, to stimulate the economy. Inflation reduces unemployment to the extent that unemployment is caused by nominal wage rigidity. When demand for labor falls but nominal wages do not, as typically occurs during a recession, the supply and demand for labor cannot reach equilibrium, and unemployment results. By reducing the real value of a given nominal wage, inflation increases the demand for labor, and therefore reduces unemployment.Economists generally believe that high rates of inflation and hyperinflation are caused by an excessive growth of the money supply. However, money supply growth does not necessarily cause inflation. Some economists maintain that under the conditions of a liquidity trap, large monetary injections are like ""pushing on a string"". Views on which factors determine low to moderate rates of inflation are more varied. Low or moderate inflation may be attributed to fluctuations in real demand for goods and services, or changes in available supplies such as during scarcities. However, the consensus view is that a long sustained period of inflation is caused by money supply growing faster than the rate of economic growth.Today, most economists favor a low and steady rate of inflation. Low (as opposed to zero or negative) inflation reduces the severity of economic recessions by enabling the labor market to adjust more quickly in a downturn, and reduces the risk that a liquidity trap prevents monetary policy from stabilizing the economy. The task of keeping the rate of inflation low and stable is usually given to monetary authorities. Generally, these monetary authorities are the central banks that control monetary policy through the setting of interest rates, through open market operations, and through the setting of banking reserve requirements.