IV. Economic Indicators Learning objective 5 Discuss the three

... and unemployment indicators, there are other economic indicators that can forecast changes in the economy. (See complete lecture link on page 2.Error! Bookmark not defined. of this manual.) ...

... and unemployment indicators, there are other economic indicators that can forecast changes in the economy. (See complete lecture link on page 2.Error! Bookmark not defined. of this manual.) ...

Monetary Policy

... According to the Bank, lower inflation means that lenders will accept a lower inflation premium not just on nominal interest rates but real interest rates as well, since low inflation enhances stability in financial markets. Therefore the main way the Bank believes it can reduce long-term real inter ...

... According to the Bank, lower inflation means that lenders will accept a lower inflation premium not just on nominal interest rates but real interest rates as well, since low inflation enhances stability in financial markets. Therefore the main way the Bank believes it can reduce long-term real inter ...

INSTITUTE OF ACTUARIES OF INDIA EXAMINATIONS 11 May 2015

... 30 per cent and the price of Good Y rises by 40 per cent. Which of the following statements is correct about Country A’s terms of trade? A. B. C. D. ...

... 30 per cent and the price of Good Y rises by 40 per cent. Which of the following statements is correct about Country A’s terms of trade? A. B. C. D. ...

ECON 202 - Macroeconomic Principles

... When the money supply is increased, investment spending increases, shifting the AD curve to the right Output increases and prices increase in the short run J.Jung ...

... When the money supply is increased, investment spending increases, shifting the AD curve to the right Output increases and prices increase in the short run J.Jung ...

Chapter 12 - University of Alberta

... • In the new labour contract the price expectations are revised to the new price level. • Money is not neutral in the short run but is neutral in the long run. • Wage stickiness prevents the economy from reaching its general equilibrium in the short run. ...

... • In the new labour contract the price expectations are revised to the new price level. • Money is not neutral in the short run but is neutral in the long run. • Wage stickiness prevents the economy from reaching its general equilibrium in the short run. ...

Annual Departmental Assessment Analysis Report for

... Explain Monetary and Fiscal policy and their respective influences on the business cycle. D-1. Which of the following statements is most accurate regarding fiscal policy and monetary policy? a. Fiscal policy includes changes in government spending and taxes and is controlled by the Federal Reserve. ...

... Explain Monetary and Fiscal policy and their respective influences on the business cycle. D-1. Which of the following statements is most accurate regarding fiscal policy and monetary policy? a. Fiscal policy includes changes in government spending and taxes and is controlled by the Federal Reserve. ...

DOMINICAN REPUBLIC 1. General trends The economy of the

... imports, together with significant increases in tourist arrivals, remittance flows and free zone exports, led to a reduction in the current account deficit, from 3.3% of GDP in 2014 to 1.9% in 2015. Inflation was 2.3% at the end of 2015, below the floor of the central bank’s target range (between 3. ...

... imports, together with significant increases in tourist arrivals, remittance flows and free zone exports, led to a reduction in the current account deficit, from 3.3% of GDP in 2014 to 1.9% in 2015. Inflation was 2.3% at the end of 2015, below the floor of the central bank’s target range (between 3. ...

Unit 10 : Economics - Department of Computing

... The major cause of money supply growth is increases in bank and building society lending. The ability of these institutions to create credit in the economy has been investigated previously so this should come as no great surprise. A second cause of money supply growth derives from government’s fisca ...

... The major cause of money supply growth is increases in bank and building society lending. The ability of these institutions to create credit in the economy has been investigated previously so this should come as no great surprise. A second cause of money supply growth derives from government’s fisca ...

International Institute of Economics and Finance

... representative agent framework and the overlapping-generations framework, as well as some of the standard applications to fiscal policy and social security. Students will be also familiarized with the main ideas of endogenous growth theory, ways to introduce money in dynamic optimizing macroeconomic ...

... representative agent framework and the overlapping-generations framework, as well as some of the standard applications to fiscal policy and social security. Students will be also familiarized with the main ideas of endogenous growth theory, ways to introduce money in dynamic optimizing macroeconomic ...

The Summary of the Annual Report of the Central Bank of Sri Lanka

... leading to a gradual improvement in key fiscal indicators. Accordingly, the fiscal deficit declined significantly to 5.9 per cent of GDP in 2013 from 6.5 per cent in 2012, although marginally higher than the budget estimate of 5.8 per cent. Despite the sluggish growth in revenue, fiscal consolidatio ...

... leading to a gradual improvement in key fiscal indicators. Accordingly, the fiscal deficit declined significantly to 5.9 per cent of GDP in 2013 from 6.5 per cent in 2012, although marginally higher than the budget estimate of 5.8 per cent. Despite the sluggish growth in revenue, fiscal consolidatio ...

Lecture31(Ch28)

... • First, the Fed lowers the interest rate when it shouldn’t have (the mistake Kelly McGillis warned Tom Cruise about)--this causes a boom • Then the Fed undoes the mistake by shifting monetary policy back towards a lower inflation rate • Now look at what happens over time ...

... • First, the Fed lowers the interest rate when it shouldn’t have (the mistake Kelly McGillis warned Tom Cruise about)--this causes a boom • Then the Fed undoes the mistake by shifting monetary policy back towards a lower inflation rate • Now look at what happens over time ...

Secular Stagnation

... • More than five years after the global financial crisis, • GDP growth across advanced economies is weak, • Unemployment stubbornly high • Inflation low, threatening to turn to deflation ...

... • More than five years after the global financial crisis, • GDP growth across advanced economies is weak, • Unemployment stubbornly high • Inflation low, threatening to turn to deflation ...

ch3note

... Today money consists of: Currency(Physical money): Coins and paper notes that people use. It is the money that is physically exchanged for goods and services. Deposit money: Deposits at banks and other financial institutions. These deposits can be converted into currency and made into spendable ...

... Today money consists of: Currency(Physical money): Coins and paper notes that people use. It is the money that is physically exchanged for goods and services. Deposit money: Deposits at banks and other financial institutions. These deposits can be converted into currency and made into spendable ...

The Argentine Recovery: some features and challenges Dr. P. Ruben Mercado

... However, the new “post convertibility” macro policy consisted of a few and relatively “simple” steps: 6 first devaluation then dirty float of the exchange rate allowing for a substantial real depreciation, thus switching relative prices toward the production of tradable goods; government debt renego ...

... However, the new “post convertibility” macro policy consisted of a few and relatively “simple” steps: 6 first devaluation then dirty float of the exchange rate allowing for a substantial real depreciation, thus switching relative prices toward the production of tradable goods; government debt renego ...

Unit 7: The Policy Tools

... loans in order to meet the new higher reserve requirement.7 Open market operations also control the overall money supply. It influences money and credit operations by buying and selling government securities on the open market. When interest rates are near zero and have not produced the desired econ ...

... loans in order to meet the new higher reserve requirement.7 Open market operations also control the overall money supply. It influences money and credit operations by buying and selling government securities on the open market. When interest rates are near zero and have not produced the desired econ ...

PDF Download

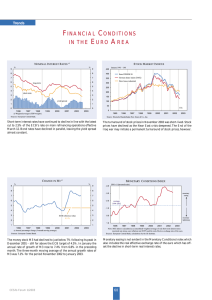

... The money stock M3 had declined to just below 7% following its peak in December 2001 – still far above the ECB target of 4.5%. In January the annual rate of growth of M3 rose to 7.4% from 6.8% in the preceding month. The three-month moving average of the annual growth rates of M3 was 7.1% for the pe ...

... The money stock M3 had declined to just below 7% following its peak in December 2001 – still far above the ECB target of 4.5%. In January the annual rate of growth of M3 rose to 7.4% from 6.8% in the preceding month. The three-month moving average of the annual growth rates of M3 was 7.1% for the pe ...

MACROECONOMICS

... We assume flexible prices, bat nominal wages are considered to be rigid Nominal wage contracts set wages for a lenghty time period The process can be modelled explicitly, but we do not do it Simply assume: wages are rigid Consequence: labor market does not clear, there is unemployment Short run and ...

... We assume flexible prices, bat nominal wages are considered to be rigid Nominal wage contracts set wages for a lenghty time period The process can be modelled explicitly, but we do not do it Simply assume: wages are rigid Consequence: labor market does not clear, there is unemployment Short run and ...

Macro 3 Exercise #2 Answers

... referred to as crowding out. Why is investment inversely related to the interest rate? The real interest rate represents a cost of business investment. Business owners and managers must usually borrow money in order to finance investment projects. Even if they do not need to borrow the real rate rep ...

... referred to as crowding out. Why is investment inversely related to the interest rate? The real interest rate represents a cost of business investment. Business owners and managers must usually borrow money in order to finance investment projects. Even if they do not need to borrow the real rate rep ...

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.Further goals of a monetary policy are usually to contribute to economic growth and stability, to lower unemployment, and to maintain predictable exchange rates with other currencies.Monetary economics provides insight into how to craft optimal monetary policy.Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.