PRODUCTION POSSIBILITIES Unattainable Attainable & Efficient

... fixed as the price level increases or decreases ...

... fixed as the price level increases or decreases ...

Solution - Part I - Faculty Directory | Berkeley-Haas

... changing increasing inflation, and tend to fall in periods of declining expected inflation. That is, the Fisher equation which assumes that real rates stay constant, and nominal interest rates move point for point with changes in expected inflation are probably not correct. In addition, changing inf ...

... changing increasing inflation, and tend to fall in periods of declining expected inflation. That is, the Fisher equation which assumes that real rates stay constant, and nominal interest rates move point for point with changes in expected inflation are probably not correct. In addition, changing inf ...

Chapter 7

... • The LM curve represents all the points of equilibrium in the assets market. It shows the allocation between money and bonds at each different level of income and interest rates. • As income rises, the demand for money will also rise, which means for a given money supply, fewer assets are available ...

... • The LM curve represents all the points of equilibrium in the assets market. It shows the allocation between money and bonds at each different level of income and interest rates. • As income rises, the demand for money will also rise, which means for a given money supply, fewer assets are available ...

Finance and the Real Economy: Session Two

... The 2008 crisis experience of Brazil (and its current dilemma) is illustrative of this problem Recently, Brazil tried implementing a ‘transaction tax’ in order to slow speculative capital inflows ...

... The 2008 crisis experience of Brazil (and its current dilemma) is illustrative of this problem Recently, Brazil tried implementing a ‘transaction tax’ in order to slow speculative capital inflows ...

1 Macroeconomics Final Chapter 13: Fiscal policy – consists of

... Time deposits: an interest-earning deposit in a commercial bank or thrift institution that the depositor can withdraw without penalty after the end of a specific period ...

... Time deposits: an interest-earning deposit in a commercial bank or thrift institution that the depositor can withdraw without penalty after the end of a specific period ...

some questions

... can and will correct itself, while a Recessionary Gap will not (or will only correct itself very slowly and at considerable cost to the economy)? Draw diagrams and explain in words what will happen in these two cases to the price level, to the level of output, to wages and other input costs, and to ...

... can and will correct itself, while a Recessionary Gap will not (or will only correct itself very slowly and at considerable cost to the economy)? Draw diagrams and explain in words what will happen in these two cases to the price level, to the level of output, to wages and other input costs, and to ...

PDF Download

... analyse and present the information contained in the monetary aggregates in a manner that offers a coherent and credible guide for monetary policy aimed at the maintenance of price stability over the medium term (ECB, 1999c). Two characteristics of the quantitative reference value for monetary growt ...

... analyse and present the information contained in the monetary aggregates in a manner that offers a coherent and credible guide for monetary policy aimed at the maintenance of price stability over the medium term (ECB, 1999c). Two characteristics of the quantitative reference value for monetary growt ...

MANAGING THE ECONOMY WITH MONETARY POLICY

... An increase in real GDP increases the volume of expenditure, which increases the quantity of real money that people plan to hold. An increase in real GDP acts like an increase in income. Real GDP rises, people wish to hold more money. The effect is fairly strong, because the more goods and services ...

... An increase in real GDP increases the volume of expenditure, which increases the quantity of real money that people plan to hold. An increase in real GDP acts like an increase in income. Real GDP rises, people wish to hold more money. The effect is fairly strong, because the more goods and services ...

ECON 611-001 Money and Central Banking

... Brainard, W.C. and Tobin, J., "Pitfalls in Financial Model Building," AER, 1968 . Sharpe, W., "Capital Asset Prices: A Theory of Market Equilibrium Under Conditions of Risk," J. of Finance, 19, September 1964. Mossin, J., "Equilibrium in a Capital Asset Market," Econometrica, 34, 1966. Lintner, J . ...

... Brainard, W.C. and Tobin, J., "Pitfalls in Financial Model Building," AER, 1968 . Sharpe, W., "Capital Asset Prices: A Theory of Market Equilibrium Under Conditions of Risk," J. of Finance, 19, September 1964. Mossin, J., "Equilibrium in a Capital Asset Market," Econometrica, 34, 1966. Lintner, J . ...

Should Ireland have joined the euro?

... exchange rate” (Lane, 2009: 5). For a small open economy such as Ireland, exchange rate stability is extremely important and any measures to improve this are surely advantageous (Lane, 2009). The devaluation mechanism With EMU membership, countries were prepared to give up the devaluation mechanism. ...

... exchange rate” (Lane, 2009: 5). For a small open economy such as Ireland, exchange rate stability is extremely important and any measures to improve this are surely advantageous (Lane, 2009). The devaluation mechanism With EMU membership, countries were prepared to give up the devaluation mechanism. ...

Monetary Policy Decision Making at the Bank of Canada

... review the information and recommendations that they have received, exchange views, and explore any outstanding issues and differences in opinion. Further discussions are held on Tuesday, a decision is reached by consensus, and a press release is drafted and approved. Stage 5. The final stage of the ...

... review the information and recommendations that they have received, exchange views, and explore any outstanding issues and differences in opinion. Further discussions are held on Tuesday, a decision is reached by consensus, and a press release is drafted and approved. Stage 5. The final stage of the ...

What To Expect: U.S. Fiscal Policy And The Economy

... are smaller during expansions than downturns. When an economy is already at or nearing full capacity, as the U.S. is today, public funds are more likely to crowd out private investment and place greater upward pressure on prices. In other words, there is a risk that the new administration’s spending ...

... are smaller during expansions than downturns. When an economy is already at or nearing full capacity, as the U.S. is today, public funds are more likely to crowd out private investment and place greater upward pressure on prices. In other words, there is a risk that the new administration’s spending ...

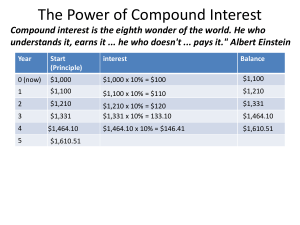

The Power of Compound Interest

... • Years to double = 72 / Interest Rate • This formula is useful for financial estimates and understanding the nature of compound interest ...

... • Years to double = 72 / Interest Rate • This formula is useful for financial estimates and understanding the nature of compound interest ...

PowerPoint (tm) presentation

... – higher education: 1.4% of GDP in the US, 3% in the EU. – R&D spending: 2.6 % of GDP in the US, 1.9 in the EU. We agree but it seems contradictory with the reduction of public spending. Many proposed reforms may have unfavourable consequences : to reduce public pensions may increase private saving ...

... – higher education: 1.4% of GDP in the US, 3% in the EU. – R&D spending: 2.6 % of GDP in the US, 1.9 in the EU. We agree but it seems contradictory with the reduction of public spending. Many proposed reforms may have unfavourable consequences : to reduce public pensions may increase private saving ...

W C B ?

... central authority should have a subsidiary function, performing only those tasks which cannot be performed effectively at a more immediate or local level”3. by direct implication, this concept implies that functions ranging from currency generation, control of interest rates and inflation, to acting ...

... central authority should have a subsidiary function, performing only those tasks which cannot be performed effectively at a more immediate or local level”3. by direct implication, this concept implies that functions ranging from currency generation, control of interest rates and inflation, to acting ...

No: 2007-05 27 February 2007 SUMMARY OF THE MONETARY POLICY COMMITTEE MEETING

... remain uncertain. Moreover, the ongoing uncertainties related to government spending constitute an upside risk to aggregate demand and inflation. 21. Waning risk appetite or a possible fluctuation in liquidity conditions in global markets continue to pose a risk against the inflation outlook. Recent ...

... remain uncertain. Moreover, the ongoing uncertainties related to government spending constitute an upside risk to aggregate demand and inflation. 21. Waning risk appetite or a possible fluctuation in liquidity conditions in global markets continue to pose a risk against the inflation outlook. Recent ...

LCcarG640_en.pdf

... In order to broaden the economic base, governments in the region pursued a strategy o f import-substitution manufacturing and diversification into tourism services from the 1960s. Since manufacturing activities were heavily protected against foreign competition, and extraregional exports had prefere ...

... In order to broaden the economic base, governments in the region pursued a strategy o f import-substitution manufacturing and diversification into tourism services from the 1960s. Since manufacturing activities were heavily protected against foreign competition, and extraregional exports had prefere ...

1 - Hong Kong Monetary Authority

... without being misunderstood: there is no doubt that the Link has been a structural factor in deflation in Hong Kong. In fact, that is precisely the point of the adjustment mechanism under the Link. But the adjustment mechanism is the vehicle for deflation, not the cause of deflation. It is the count ...

... without being misunderstood: there is no doubt that the Link has been a structural factor in deflation in Hong Kong. In fact, that is precisely the point of the adjustment mechanism under the Link. But the adjustment mechanism is the vehicle for deflation, not the cause of deflation. It is the count ...

MUSE: The Bank of Canada`s New Projection Model of the U.S.

... first equation, relates real output to the interest rate, the real effective exchange rate, and foreign activity (U.K., U.S. and Asian demand for the euro area, and euro area, U.S. and Asian demand for the United Kingdom). Aggregate supply, the second equation, is modelled using a forward-looking Ph ...

... first equation, relates real output to the interest rate, the real effective exchange rate, and foreign activity (U.K., U.S. and Asian demand for the euro area, and euro area, U.S. and Asian demand for the United Kingdom). Aggregate supply, the second equation, is modelled using a forward-looking Ph ...

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.Further goals of a monetary policy are usually to contribute to economic growth and stability, to lower unemployment, and to maintain predictable exchange rates with other currencies.Monetary economics provides insight into how to craft optimal monetary policy.Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.