PL 1 - Alvinisd.net

... wrote a paper in 1958 titled The Relation between Unemployment and the Rate of Change of Money Wage Rates in the United Kingdom, 1861-1957, which was published in the quarterly journal Economica. • In the paper Phillips describes how he observed an inverse relationship between money wage changes and ...

... wrote a paper in 1958 titled The Relation between Unemployment and the Rate of Change of Money Wage Rates in the United Kingdom, 1861-1957, which was published in the quarterly journal Economica. • In the paper Phillips describes how he observed an inverse relationship between money wage changes and ...

Parkin-Bade Chapter 21

... Others Who Want a Job These people are economically inactive, willing to work but have stopped actively looking for a job because they are not available to start a job in the next two weeks. Figure 11.4 shows that discouraged workers are a small percentage of the economically inactive. © Pearson Edu ...

... Others Who Want a Job These people are economically inactive, willing to work but have stopped actively looking for a job because they are not available to start a job in the next two weeks. Figure 11.4 shows that discouraged workers are a small percentage of the economically inactive. © Pearson Edu ...

Inflation and Economic Growth in the Philippines

... What complicates the analysis of the relation between inflation and output growth are exogenous supply shocks in the past two decades and the manner in which economic managers responded to these shocks. Policies to stabilize the economy resulted in episodes of stagflation. Inflation subsequently dec ...

... What complicates the analysis of the relation between inflation and output growth are exogenous supply shocks in the past two decades and the manner in which economic managers responded to these shocks. Policies to stabilize the economy resulted in episodes of stagflation. Inflation subsequently dec ...

Sample Final Examination

... E. an increase in technological innovations during the 1970s 29. If a country has real assets of $14 billion, financial assets of $16 billion and financial liabilities of $17 billion, then the national net worth is A. $17 billion. B. $16 billion. C. $14 billion. D. $13 billion. E. $30 billion. 30. I ...

... E. an increase in technological innovations during the 1970s 29. If a country has real assets of $14 billion, financial assets of $16 billion and financial liabilities of $17 billion, then the national net worth is A. $17 billion. B. $16 billion. C. $14 billion. D. $13 billion. E. $30 billion. 30. I ...

Document

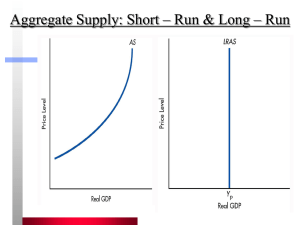

... The long-run Phillips curve shows the relationship between the inflation rate and the unemployment rate when the actual and expected inflation rates are the same. The long-run Phillips curve is vertical at the natural rate of unemployment. This is equivalent to the vertical longrun AS curve. ...

... The long-run Phillips curve shows the relationship between the inflation rate and the unemployment rate when the actual and expected inflation rates are the same. The long-run Phillips curve is vertical at the natural rate of unemployment. This is equivalent to the vertical longrun AS curve. ...

Additional Help Practice Questions for Chapter 9 Michael G. Lanyi 1

... 5. An increase in the price level might cause A) a decrease in the quantity of aggregate demand because of the substitution effect. B) an increase in the quantity of aggregate demand because of the wealth effect. C) a decrease in the quantity of aggregate demand because of the interest rate effect. ...

... 5. An increase in the price level might cause A) a decrease in the quantity of aggregate demand because of the substitution effect. B) an increase in the quantity of aggregate demand because of the wealth effect. C) a decrease in the quantity of aggregate demand because of the interest rate effect. ...

Macro Economics - e

... reduced resulting a rise in interest rate. Demand for money falls and finally inflation comes under control. In addition, the apex bank performs open market operation means it sells government bonds, commercial banks and financial institutions purchase them. Supply of money in the economy is reduced ...

... reduced resulting a rise in interest rate. Demand for money falls and finally inflation comes under control. In addition, the apex bank performs open market operation means it sells government bonds, commercial banks and financial institutions purchase them. Supply of money in the economy is reduced ...

Homework 2

... g)Suppose Pam only has offer for JOB B. The employer plans to increase Pam's salary only in order to keep up with the inflation, but does not inform Pam of this plan. So with inflation expected to be 35%, Pam gets a 35% nominal raise. Briefly explain why, when during the year Pam sees prices rising, ...

... g)Suppose Pam only has offer for JOB B. The employer plans to increase Pam's salary only in order to keep up with the inflation, but does not inform Pam of this plan. So with inflation expected to be 35%, Pam gets a 35% nominal raise. Briefly explain why, when during the year Pam sees prices rising, ...

ch28

... Sustained Inflation as a Purely Monetary Phenomenon Virtually all economists agree that an increase in the price level can be caused by anything that causes the AD curve to shift to the right or the AS curve to shift to the left. It is also generally agreed that for a sustained inflation to occur, t ...

... Sustained Inflation as a Purely Monetary Phenomenon Virtually all economists agree that an increase in the price level can be caused by anything that causes the AD curve to shift to the right or the AS curve to shift to the left. It is also generally agreed that for a sustained inflation to occur, t ...

Expectations, Taylor Rules and Liquidity Traps

... gives rise to explosive solutions. It includes the rule in a continuous-time version of the basic New-Keynesian model with an adverse natural real interest rate shock that puts the model economy into a liquidity trap, and finds that the three equilibrium paths (Christiano et al. 2011; Werning 2012; ...

... gives rise to explosive solutions. It includes the rule in a continuous-time version of the basic New-Keynesian model with an adverse natural real interest rate shock that puts the model economy into a liquidity trap, and finds that the three equilibrium paths (Christiano et al. 2011; Werning 2012; ...

Aggregate Supply and AD

... and capital constant in the short-run) higher profit margins firms want to produce more. ...

... and capital constant in the short-run) higher profit margins firms want to produce more. ...

Unemployment and Inflation

... adversely affects all individuals in the economy in the same manner. Explain that this is not the case, as inflation can aid some individuals. For example, borrowers of money are aided by unexpected inflation, since the real value of the money they repay in the future on the loans they hold has less ...

... adversely affects all individuals in the economy in the same manner. Explain that this is not the case, as inflation can aid some individuals. For example, borrowers of money are aided by unexpected inflation, since the real value of the money they repay in the future on the loans they hold has less ...

+ I(Y,i)

... In the short period, however, workers can have wrong expectations : P can differ from PE. The real wage that workers seek on the basis of wrong expectations can differ from the real wage that is set by firms while fixing the prices. ...

... In the short period, however, workers can have wrong expectations : P can differ from PE. The real wage that workers seek on the basis of wrong expectations can differ from the real wage that is set by firms while fixing the prices. ...

Week 8 Practice Quiz b Answers - The University of Chicago Booth

... the equation that defines the quantity theory of money (this should be one equation – be precise). Second, what assumptions turn the equation into the quantity theory? Again, be specific. To summarize, your answer should be one equation and at most two other sentences. %ΔM + %ΔV = %ΔY + %ΔP The quan ...

... the equation that defines the quantity theory of money (this should be one equation – be precise). Second, what assumptions turn the equation into the quantity theory? Again, be specific. To summarize, your answer should be one equation and at most two other sentences. %ΔM + %ΔV = %ΔY + %ΔP The quan ...

Teaching Intermediate Macroeconomics using the 3-Equation

... Wendy Carlin and David Soskice Much teaching of intermediate macroeconomics uses the IS-LM-AS or ADAS approach. This is far removed both from the practice of interest rate setting, inflation-targeting central banks and from the models that are taught in graduate courses. Modern monetary macroeconomi ...

... Wendy Carlin and David Soskice Much teaching of intermediate macroeconomics uses the IS-LM-AS or ADAS approach. This is far removed both from the practice of interest rate setting, inflation-targeting central banks and from the models that are taught in graduate courses. Modern monetary macroeconomi ...

Chapter 26 - Inflation and Monetary Policy

... How Ongoing Inflation Arises • As price level continued to rise in 1960s, public began to expect it to rise at a similar rate in the future • When inflation continues for some time, public develops expectations that inflation rate in the future will be similar to inflation rates of recent past • Wh ...

... How Ongoing Inflation Arises • As price level continued to rise in 1960s, public began to expect it to rise at a similar rate in the future • When inflation continues for some time, public develops expectations that inflation rate in the future will be similar to inflation rates of recent past • Wh ...

Macro Lecture 4: Aggregate Demand (AD) Curve

... Fewer goods and services purchased Summary: The real interest rate (r) affects the final goods Figure 4.6: Real interest rate and and services purchased by households and firms. When the goods and services purchased real interest rate (r): • Rises, fewer goods and services are purchased. • Falls, mo ...

... Fewer goods and services purchased Summary: The real interest rate (r) affects the final goods Figure 4.6: Real interest rate and and services purchased by households and firms. When the goods and services purchased real interest rate (r): • Rises, fewer goods and services are purchased. • Falls, mo ...

Long-Run and Short-Run Concerns: Growth, Productivity

... • Part of the reason for the upward trend in productivity is an increase in the amount of capital per worker. With more capital per worker, more output can be produced per year. • The other reason productivity has increased is that the quality of labor and capital has been increasing. ...

... • Part of the reason for the upward trend in productivity is an increase in the amount of capital per worker. With more capital per worker, more output can be produced per year. • The other reason productivity has increased is that the quality of labor and capital has been increasing. ...

Preparing for the AP Macroeconomics Test Exam Content The AP

... 5. Economic freedom – businesses, workers, consumers have a high degree of freedom in economic activities 6. Equitable distribution of income – try to minimize gap between rich and poor 7. Economic security – provide for those who are not able to earn sufficient income 8. Balance of trade – try to s ...

... 5. Economic freedom – businesses, workers, consumers have a high degree of freedom in economic activities 6. Equitable distribution of income – try to minimize gap between rich and poor 7. Economic security – provide for those who are not able to earn sufficient income 8. Balance of trade – try to s ...

Phillips curve

In economics, the Phillips curve is a historical inverse relationship between rates of unemployment and corresponding rates of inflation that result in an economy. Stated simply, decreased unemployment, (i.e., increased levels of employment) in an economy will correlate with higher rates of inflation.While there is a short run tradeoff between unemployment and inflation, it has not been observed in the long run. In 1968, Milton Friedman asserted that the Phillips Curve was only applicable in the short-run and that in the long-run, inflationary policies will not decrease unemployment. Friedman then correctly predicted that, in the upcoming years after 1968, both inflation and unemployment would increase. The long-run Phillips Curve is now seen as a vertical line at the natural rate of unemployment, where the rate of inflation has no effect on unemployment. Accordingly, the Phillips curve is now seen as too simplistic, with the unemployment rate supplanted by more accurate predictors of inflation based on velocity of money supply measures such as the MZM (""money zero maturity"") velocity, which is affected by unemployment in the short but not the long term.