NBER WORKING PAPER SERIES Stanley Fischer Working Paper 12426

... which the Central Bureau of Statistics does not regard as very reliable – is available about monthly unemployment rates, with a 2-month lag. The basic problem here is the small size of the sample. A concurrent index of economic activity is published by the Bank monthly, as is a related private secto ...

... which the Central Bureau of Statistics does not regard as very reliable – is available about monthly unemployment rates, with a 2-month lag. The basic problem here is the small size of the sample. A concurrent index of economic activity is published by the Bank monthly, as is a related private secto ...

Shifts of the Short-Run Aggregate Supply Curve

... Fiscal policy affects aggregate demand directly through government purchases and indirectly through changes in taxes or government transfers that affect consumer spending. Monetary policy affects aggregate demand indirectly through changes in the interest rate that affect consumer and investment s ...

... Fiscal policy affects aggregate demand directly through government purchases and indirectly through changes in taxes or government transfers that affect consumer spending. Monetary policy affects aggregate demand indirectly through changes in the interest rate that affect consumer and investment s ...

Price Level

... – Borrowers and lenders must form expectations about what prices will be in the future before they agree to lend and borrow. – In the macroeconomy, individuals form expectations about the price level (inflation later on). • Workers form Pe when negotiating form nominal wages (W). • Business form Pe ...

... – Borrowers and lenders must form expectations about what prices will be in the future before they agree to lend and borrow. – In the macroeconomy, individuals form expectations about the price level (inflation later on). • Workers form Pe when negotiating form nominal wages (W). • Business form Pe ...

Aggregate Demand and Supply

... – Borrowers and lenders must form expectations about what prices will be in the future before they agree to lend and borrow. – In the macroeconomy, individuals form expectations about the price level (inflation later on). • Workers form Pe when negotiating form nominal wages (W). • Business form Pe ...

... – Borrowers and lenders must form expectations about what prices will be in the future before they agree to lend and borrow. – In the macroeconomy, individuals form expectations about the price level (inflation later on). • Workers form Pe when negotiating form nominal wages (W). • Business form Pe ...

Inflation: Islamic and Conventional Economic Systems: Evidence

... According to monetarists led by Milton Friedman, inflation is only a monetary phenomenon. When money supply increases, people have more money than they desire. They, consequently, spend the extra money. Since goods and services are constant the prices will go up. It is also possible for the consumer ...

... According to monetarists led by Milton Friedman, inflation is only a monetary phenomenon. When money supply increases, people have more money than they desire. They, consequently, spend the extra money. Since goods and services are constant the prices will go up. It is also possible for the consumer ...

cm24e perfect competition

... constructed to show how a price system allocates scarce resources economists were concerned with its allocative properties not with its descriptive realism. Because all models are simplifications of the very complex systems that we are modeling, the appropriate criterion to apply to this model is no ...

... constructed to show how a price system allocates scarce resources economists were concerned with its allocative properties not with its descriptive realism. Because all models are simplifications of the very complex systems that we are modeling, the appropriate criterion to apply to this model is no ...

Estimating New-Keynesian Phillips Curves: A Full Information

... if the model is severely misspecified and the measurement errors are non-normally distributed, which are common arguments against the use of FIML (see e.g. Tauchen, 1986). The last part of the paper estimates a version of the macroeconomic model used in the simulations with FIML on exactly the same ...

... if the model is severely misspecified and the measurement errors are non-normally distributed, which are common arguments against the use of FIML (see e.g. Tauchen, 1986). The last part of the paper estimates a version of the macroeconomic model used in the simulations with FIML on exactly the same ...

Factors determining price developments

... Why can central banks influence (ex ante) real interest rates? The role of “sticky” prices Borrowing and investment decisions by households and firms greatly depend on the real interest rate. For example, the ex ante real interest rate is the real return which a financial asset is expected to delive ...

... Why can central banks influence (ex ante) real interest rates? The role of “sticky” prices Borrowing and investment decisions by households and firms greatly depend on the real interest rate. For example, the ex ante real interest rate is the real return which a financial asset is expected to delive ...

Principles of Economics, Case and Fair,9e

... Sustained Inflation as a Purely Monetary Phenomenon Virtually all economists agree that an increase in the price level can be caused by anything that causes the AD curve to shift to the right or the AS curve to shift to the left. It is also generally agreed that for a sustained inflation to occur, t ...

... Sustained Inflation as a Purely Monetary Phenomenon Virtually all economists agree that an increase in the price level can be caused by anything that causes the AD curve to shift to the right or the AS curve to shift to the left. It is also generally agreed that for a sustained inflation to occur, t ...

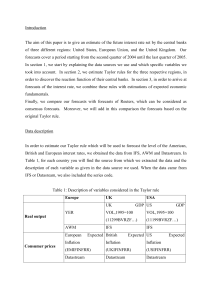

Data description

... As we can see from this table, the expected inflation and the lagged interest rate are highly significant and their coefficients have a positive sign. The fact that the relative current output gap is not significant could be due to two reasons. First of all, we could argue that this is due to our sm ...

... As we can see from this table, the expected inflation and the lagged interest rate are highly significant and their coefficients have a positive sign. The fact that the relative current output gap is not significant could be due to two reasons. First of all, we could argue that this is due to our sm ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research Volume Title: Inflation: Causes and Effects

... However, the inflation rate was more variable during the seventies than in the period since the mid-fifties. From the viewpoint of an individual entering a nominal contract, the payoff of which is specified in dollars, it is the price level that determines the real value of the outcome. Uncertainty ...

... However, the inflation rate was more variable during the seventies than in the period since the mid-fifties. From the viewpoint of an individual entering a nominal contract, the payoff of which is specified in dollars, it is the price level that determines the real value of the outcome. Uncertainty ...

Chapter22

... produced rises. From a firm’s total cost, two related measures of cost are derived. Average total cost divided by the quantity of output. Marginal cost is the amount by which total cost rises if output increases by 1 unit. When analyzing firm behavior, it is often useful to graph average total cost ...

... produced rises. From a firm’s total cost, two related measures of cost are derived. Average total cost divided by the quantity of output. Marginal cost is the amount by which total cost rises if output increases by 1 unit. When analyzing firm behavior, it is often useful to graph average total cost ...

Aggregate Demand and Aggregate Supply

... • The ratio of the final shift in aggregate demand to the initial shift in aggregate demand is known as the multiplier. • The logic of the multiplier goes back to Keynes. He believed that as government spending increases and the aggregate demand curve shifts to the right, output will subsequently in ...

... • The ratio of the final shift in aggregate demand to the initial shift in aggregate demand is known as the multiplier. • The logic of the multiplier goes back to Keynes. He believed that as government spending increases and the aggregate demand curve shifts to the right, output will subsequently in ...

Aggregate Demand I: Building the IS

... • Keynesians argued that the tax cuts boosted demand, which led to higher production and falling unemployment • Supply-siders argued that demand had nothing to do with it. The tax cuts gave people the incentive to work harder. So, L increased. Therefore, Y = F(K, L) also increased. – Personally, I f ...

... • Keynesians argued that the tax cuts boosted demand, which led to higher production and falling unemployment • Supply-siders argued that demand had nothing to do with it. The tax cuts gave people the incentive to work harder. So, L increased. Therefore, Y = F(K, L) also increased. – Personally, I f ...

esp01-molana 221832 en

... in the industrialised countries and provide indisputable evidence regarding the way in which labour productivity has changed over the last few decades. Recent examples include Disney, et al. (2000), Barnes and Haskel (2000), Marini and Scaramozzino (2000), Bart van Ark et al. (2000) and Salai-Marti ...

... in the industrialised countries and provide indisputable evidence regarding the way in which labour productivity has changed over the last few decades. Recent examples include Disney, et al. (2000), Barnes and Haskel (2000), Marini and Scaramozzino (2000), Bart van Ark et al. (2000) and Salai-Marti ...

Principles of Economics, Case and Fair,9e

... Sustained Inflation as a Purely Monetary Phenomenon Virtually all economists agree that an increase in the price level can be caused by anything that causes the AD curve to shift to the right or the AS curve to shift to the left. It is also generally agreed that for a sustained inflation to occur, t ...

... Sustained Inflation as a Purely Monetary Phenomenon Virtually all economists agree that an increase in the price level can be caused by anything that causes the AD curve to shift to the right or the AS curve to shift to the left. It is also generally agreed that for a sustained inflation to occur, t ...

Answers to Questions: Chapter 4

... 14. If the Fed is not worried about inflation but is concerned that unemployment is too high, it is likely to take actions to ensure that the tax cut has its maximum impact on output. The Fed is likely to increase the money supply to prevent any rise in the interest rate that would otherwise result ...

... 14. If the Fed is not worried about inflation but is concerned that unemployment is too high, it is likely to take actions to ensure that the tax cut has its maximum impact on output. The Fed is likely to increase the money supply to prevent any rise in the interest rate that would otherwise result ...

GDP

... Okun’s Law: When unemployment rises 1 percent above the natural rate, GDP falls by about 2 percent ...

... Okun’s Law: When unemployment rises 1 percent above the natural rate, GDP falls by about 2 percent ...

Phillips curve

In economics, the Phillips curve is a historical inverse relationship between rates of unemployment and corresponding rates of inflation that result in an economy. Stated simply, decreased unemployment, (i.e., increased levels of employment) in an economy will correlate with higher rates of inflation.While there is a short run tradeoff between unemployment and inflation, it has not been observed in the long run. In 1968, Milton Friedman asserted that the Phillips Curve was only applicable in the short-run and that in the long-run, inflationary policies will not decrease unemployment. Friedman then correctly predicted that, in the upcoming years after 1968, both inflation and unemployment would increase. The long-run Phillips Curve is now seen as a vertical line at the natural rate of unemployment, where the rate of inflation has no effect on unemployment. Accordingly, the Phillips curve is now seen as too simplistic, with the unemployment rate supplanted by more accurate predictors of inflation based on velocity of money supply measures such as the MZM (""money zero maturity"") velocity, which is affected by unemployment in the short but not the long term.