Practice Test - MDC Faculty Web Pages

... A) An improvement in technology shifts the long-run aggregate supply curve to the right. B) A decrease in inflationary expectations shifts the short-run aggregate supply curve to the left. C) As business expectations become more negative, the short-run aggregate supply curve shifts to the right. D) ...

... A) An improvement in technology shifts the long-run aggregate supply curve to the right. B) A decrease in inflationary expectations shifts the short-run aggregate supply curve to the left. C) As business expectations become more negative, the short-run aggregate supply curve shifts to the right. D) ...

2011 - Harvard Kennedy School

... Reagan’s policy: sharp tax cuts (& rise in defense spending) The claim: budget surpluses would result. The reality: record deficits that added to the national debt ...

... Reagan’s policy: sharp tax cuts (& rise in defense spending) The claim: budget surpluses would result. The reality: record deficits that added to the national debt ...

Raffles Junior College

... S-side policy refers to measures intended to boost Aggregate Supply rather than Aggregate Demand. Evidence of this can be seen in the components of the Resilience Package eg enhancing business cash-flow and competitiveness via stimulating bank lending and announcing corporate tax cuts from 2010 and ...

... S-side policy refers to measures intended to boost Aggregate Supply rather than Aggregate Demand. Evidence of this can be seen in the components of the Resilience Package eg enhancing business cash-flow and competitiveness via stimulating bank lending and announcing corporate tax cuts from 2010 and ...

Theories of U.S. Economic Policy Economic policy refers to the

... rates of inflation, which are most often caused by increases or decreases in the money supply. In 1979, the Federal Reserve (the central banking system of the United States) announced that it would adopt a monetarism policy to stabilize the economy. The result was a deep recession in the early 1980s ...

... rates of inflation, which are most often caused by increases or decreases in the money supply. In 1979, the Federal Reserve (the central banking system of the United States) announced that it would adopt a monetarism policy to stabilize the economy. The result was a deep recession in the early 1980s ...

Chapter 25

... workers to administer government programs; government investment spending includes buying military equipment and building roads. Many other examples are possible. Government spending on health programs is an investment in human capital. This is truer for spending on health programs for the young rat ...

... workers to administer government programs; government investment spending includes buying military equipment and building roads. Many other examples are possible. Government spending on health programs is an investment in human capital. This is truer for spending on health programs for the young rat ...

Fiscal multipliers in downturns and the effects of Eurozone

... of multiplier. The reference specification for a particular multiplier is then a cumulative multiplier value (CUM) from a general public spending impulse (SPEND) taking place in average economic circumstances (RAV). If the multiplier stems from a VAR model with Blanchard-Perotti identification (BP), w ...

... of multiplier. The reference specification for a particular multiplier is then a cumulative multiplier value (CUM) from a general public spending impulse (SPEND) taking place in average economic circumstances (RAV). If the multiplier stems from a VAR model with Blanchard-Perotti identification (BP), w ...

Agricultural Economics 430 - Department of Agricultural Economics

... If a recessionary gap exists, the government should consider adopting expansionary monetary (lowering interest rates by expanding money supply) and/or fiscal policy (cut taxes or increase government spending). If a inflationary gap exists, the government should consider adopting contractionary monet ...

... If a recessionary gap exists, the government should consider adopting expansionary monetary (lowering interest rates by expanding money supply) and/or fiscal policy (cut taxes or increase government spending). If a inflationary gap exists, the government should consider adopting contractionary monet ...

The State of the Global Economy: an Agenda for Job Creation

... Savings today translates into spending tomorrow; if future periods demand constrained, increases income in future; expectation of that leads to more consumption today: with rational expectations, multipliers are larger ...

... Savings today translates into spending tomorrow; if future periods demand constrained, increases income in future; expectation of that leads to more consumption today: with rational expectations, multipliers are larger ...

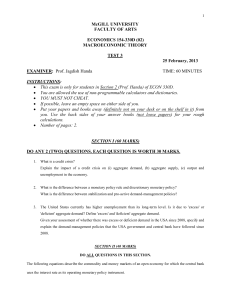

doc Test 3 (Midterm) 2013

... The United States currently has higher unemployment than its long-term level. Is it due to 'excess' or 'deficient' aggregate demand? Define 'excess' and 'deficient' aggregate demand. Given your assessment of whether there was excess or deficient demand in the USA since 2008, specify and explain the ...

... The United States currently has higher unemployment than its long-term level. Is it due to 'excess' or 'deficient' aggregate demand? Define 'excess' and 'deficient' aggregate demand. Given your assessment of whether there was excess or deficient demand in the USA since 2008, specify and explain the ...

Australia`s economy drifts towards disaster with no

... “businesses and individuals – not government – are the true creators of wealth and employment”, to quote from that document. If possible, the task of stabilising the economy should fall primarily to monetary policy, through the actions of the Reserve Bank. It’s a “hands off” approach, relying on the ...

... “businesses and individuals – not government – are the true creators of wealth and employment”, to quote from that document. If possible, the task of stabilising the economy should fall primarily to monetary policy, through the actions of the Reserve Bank. It’s a “hands off” approach, relying on the ...

Document

... things equal, the government’s budget surplus will rise either if real GDP is growing or if Macroland is using contractionary fiscal policy. When the economy grows, tax revenue rises and government transfers fall, leading to an increase in the government’s budget surplus. However, if the governmen ...

... things equal, the government’s budget surplus will rise either if real GDP is growing or if Macroland is using contractionary fiscal policy. When the economy grows, tax revenue rises and government transfers fall, leading to an increase in the government’s budget surplus. However, if the governmen ...

CH 18-Monetary and Fiscal Policy

... More income = greater demand for money. Less money available to lend. Higher r required for equilibrium ...

... More income = greater demand for money. Less money available to lend. Higher r required for equilibrium ...

Assume you are Dr. I.O. Many Bucks (Government`s Doc)

... One measure of good “health” is if the economy is growing. The government statistic (vital sign) that best measures economic growth is….. GDP----Gross Domestic Product ...

... One measure of good “health” is if the economy is growing. The government statistic (vital sign) that best measures economic growth is….. GDP----Gross Domestic Product ...

Comments on Fatas: Automatic Stablizers

... • Antonio’s work on size of government is important – larger government reduces volatility unless government is source of instability (although recent paper by Debrun et al provides some contradictory evidence) • Antonio recognizes – tradeoff between stabilization and other issues – equity and effic ...

... • Antonio’s work on size of government is important – larger government reduces volatility unless government is source of instability (although recent paper by Debrun et al provides some contradictory evidence) • Antonio recognizes – tradeoff between stabilization and other issues – equity and effic ...

Multiplier

... 3. Formulation of Economic Policies The government can decide upon the amount of investment to be injected into the economy to reduce unemployment. The multiplier theory helps the government in formulating an appropriate employment policy during depression. During depression, Government’s public wo ...

... 3. Formulation of Economic Policies The government can decide upon the amount of investment to be injected into the economy to reduce unemployment. The multiplier theory helps the government in formulating an appropriate employment policy during depression. During depression, Government’s public wo ...

Fiscal Policy, Deficits, and Debt

... • Removes impact of built-in stabilizers • Size of deficit/surplus if the economy is at full-employment for the year • Cyclically adjusted budget only changes when government changes fiscal policy LO3 ...

... • Removes impact of built-in stabilizers • Size of deficit/surplus if the economy is at full-employment for the year • Cyclically adjusted budget only changes when government changes fiscal policy LO3 ...

Contraction

... A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators. A recession begins when the economy reaches a peak of activity and ends when the economy reaches its tro ...

... A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators. A recession begins when the economy reaches a peak of activity and ends when the economy reaches its tro ...

Korea`s Public Finance and its Role in the

... • Resource allocation: The emphasis was placed on promoting the economic growth with large spending on education, infrastructure, and other public goods. • Income distribution: After the crisis, spending on social protection is increasing rapidly, and is expected to increase further in coming years. ...

... • Resource allocation: The emphasis was placed on promoting the economic growth with large spending on education, infrastructure, and other public goods. • Income distribution: After the crisis, spending on social protection is increasing rapidly, and is expected to increase further in coming years. ...

Paul Johnson`s Opening remarks

... The OBR’s economic forecasts are noticeably more upbeat than the Bank of England’s. Earlier this month the Bank projected growth of 1.4, 1.5 and 1.6% in 2017, 2018 and 2019 respectively. The OBR’s projections are for growth of 1.4, 1.7 and 2.1%. That’s quite a big difference. Overall the Bank foreca ...

... The OBR’s economic forecasts are noticeably more upbeat than the Bank of England’s. Earlier this month the Bank projected growth of 1.4, 1.5 and 1.6% in 2017, 2018 and 2019 respectively. The OBR’s projections are for growth of 1.4, 1.7 and 2.1%. That’s quite a big difference. Overall the Bank foreca ...

SU14_2630_Study Guid..

... 37. What is the difference between gross and net public debt? Gross public debt includes the total amount owed to all holders of government securities. Net public debt is equal to gross public debt minus intragovernmental debt (the amount owed to holders of public securities outside of the governmen ...

... 37. What is the difference between gross and net public debt? Gross public debt includes the total amount owed to all holders of government securities. Net public debt is equal to gross public debt minus intragovernmental debt (the amount owed to holders of public securities outside of the governmen ...

Diploma Macro Paper 2

... the unique combination of Y and i that satisfies equilibrium in both markets. ...

... the unique combination of Y and i that satisfies equilibrium in both markets. ...

Expanding or Curtailing Government Spending

... the role of government spending in promoting growth? ...

... the role of government spending in promoting growth? ...