March

... • Ten years ago, if the country thought it important enough to protect any single category against belt-tightening in the long run - say military or social security or taxes – it would have been arithmetically possible, by making the cuts elsewhere. • But we no longer have the luxury of such choice ...

... • Ten years ago, if the country thought it important enough to protect any single category against belt-tightening in the long run - say military or social security or taxes – it would have been arithmetically possible, by making the cuts elsewhere. • But we no longer have the luxury of such choice ...

Macroeconomics

... therefore do not affect AE or Y. Give a reason why such cuts would also reduce GDP. 2. Given that S = -120 + .1(Y-T), and IM = 10 + .1Y, I = 105, EX = 25, G = T = 150: a) Calculate the expenditure-multiplier in this economy. b) What is equilibrium income in this economy? c) If full employment requir ...

... therefore do not affect AE or Y. Give a reason why such cuts would also reduce GDP. 2. Given that S = -120 + .1(Y-T), and IM = 10 + .1Y, I = 105, EX = 25, G = T = 150: a) Calculate the expenditure-multiplier in this economy. b) What is equilibrium income in this economy? c) If full employment requir ...

INSTITUTE OF ACTUARIES OF INDIA EXAMINATIONS 29 October 2007

... A. crowding out which tend to increase the effectiveness of fiscal policy B. crowding out which tend to decrease the effectiveness of fiscal policy C. policy lags which tend to increase the effectiveness of fiscal policy D. policy lags which tend to decrease the effectiveness of fiscal policy ...

... A. crowding out which tend to increase the effectiveness of fiscal policy B. crowding out which tend to decrease the effectiveness of fiscal policy C. policy lags which tend to increase the effectiveness of fiscal policy D. policy lags which tend to decrease the effectiveness of fiscal policy ...

Fiscal Policy - Eusay Economics

... • The multiplier effect in fiscal policy states that for every one dollar change in taxing or government spending, it will create a greater change in the national income, either increasing or decreasing. ...

... • The multiplier effect in fiscal policy states that for every one dollar change in taxing or government spending, it will create a greater change in the national income, either increasing or decreasing. ...

PDF Download

... ideas in the United States and elsewhere and not because of new evidence that it has become more effective or timely than in the past. Sure, Milton Friedman (1966) did say “in one sense, we are all Keynesians now”; but the remainder of his statement was “in another, nobody is any longer a Keynesian” ...

... ideas in the United States and elsewhere and not because of new evidence that it has become more effective or timely than in the past. Sure, Milton Friedman (1966) did say “in one sense, we are all Keynesians now”; but the remainder of his statement was “in another, nobody is any longer a Keynesian” ...

Can we say that there is sustainable growth in Brazil?

... Expansion of Social Protection Programmes o Social Protection as social insurance: dual welfare system: formal/urban versus informal/rural sector workers o Incipient SP for informal workers (authoritarian regime to 1988 Constitution: rural pension and non-contributory pension (from Funrural to unive ...

... Expansion of Social Protection Programmes o Social Protection as social insurance: dual welfare system: formal/urban versus informal/rural sector workers o Incipient SP for informal workers (authoritarian regime to 1988 Constitution: rural pension and non-contributory pension (from Funrural to unive ...

1. a. Suppose a government decides to reduce spending and (lump

... 6. According to the model developed in Chapter 3, when government spending increases and taxes increase by an equal amount: A) consumption and investment both increase. B) consumption and investment both decrease. C) consumption increases and investment decreases. D) consumption decreases and invest ...

... 6. According to the model developed in Chapter 3, when government spending increases and taxes increase by an equal amount: A) consumption and investment both increase. B) consumption and investment both decrease. C) consumption increases and investment decreases. D) consumption decreases and invest ...

A Household Understanding of the Economic Crisis

... kinds of economic study: macro-economics Let’s start by establishing some economic and micro-economics. The study of microprinciples that are specific to a household. If economics is the study of a single enterprise, our household encounters difficult economic whereas the study of an entire economy ...

... kinds of economic study: macro-economics Let’s start by establishing some economic and micro-economics. The study of microprinciples that are specific to a household. If economics is the study of a single enterprise, our household encounters difficult economic whereas the study of an entire economy ...

NAmerica 2 - Where We Stand

... A. USA: population = 312,955,819 (2/3/12 @ 7:11 AM); urbanization = 75% B. characteristics of a postindustrial society 1. economic sectors: a. extractive (2%); manufacturing (18%); service (80%) b. information: 65% today 2. change of technology use from fabricating to processing C. locational forces ...

... A. USA: population = 312,955,819 (2/3/12 @ 7:11 AM); urbanization = 75% B. characteristics of a postindustrial society 1. economic sectors: a. extractive (2%); manufacturing (18%); service (80%) b. information: 65% today 2. change of technology use from fabricating to processing C. locational forces ...

The Aggregate Economy

... • Disposable income is the income available after taxes. • All income can either be spent or saved. • The higher your income the more you spend and save and vice versa. • Taxes come out of personal income (personal income – taxes = disposable income = spending + saving) • An increase in taxes reduce ...

... • Disposable income is the income available after taxes. • All income can either be spent or saved. • The higher your income the more you spend and save and vice versa. • Taxes come out of personal income (personal income – taxes = disposable income = spending + saving) • An increase in taxes reduce ...

Sections 3 & 4

... _____ the use of taxes, government transfers, or government purchases of goods and services to stabilize the economy. _____ fiscal policy that increases aggregate demand by increasing government purchases, decreasing taxes, or increasing transfers. _____ exists when aggregate output is above potenti ...

... _____ the use of taxes, government transfers, or government purchases of goods and services to stabilize the economy. _____ fiscal policy that increases aggregate demand by increasing government purchases, decreasing taxes, or increasing transfers. _____ exists when aggregate output is above potenti ...

Economic History of the US

... J.M. Keynes said… …the cause of the GD was the collapse of private investment spending (i.e. demand) …and consumption spending to a lesser extent (i.e. also demand) Investment spending almost entirely discretionary In fact, private investment fell by 88.5%, from $16.2 billion in 1929, to $ ...

... J.M. Keynes said… …the cause of the GD was the collapse of private investment spending (i.e. demand) …and consumption spending to a lesser extent (i.e. also demand) Investment spending almost entirely discretionary In fact, private investment fell by 88.5%, from $16.2 billion in 1929, to $ ...

B200 TUTORIAL WEEK ONE

... Monetarists believe that control of the money supply is key to price stability, economic growth and full employment. A set of views concerning the determination of national income and monetary economic. It focus on the supply of goods and demand for money as the primary means by which economic activ ...

... Monetarists believe that control of the money supply is key to price stability, economic growth and full employment. A set of views concerning the determination of national income and monetary economic. It focus on the supply of goods and demand for money as the primary means by which economic activ ...

Overview of the SUST

... French language community, Brussels region and 3 smaller governments within Brussels. ...

... French language community, Brussels region and 3 smaller governments within Brussels. ...

Aggregate Expenditure

... trillion, sales revenues at investment goods manufacturers (Boeing, Westinghouse, Cincinnati Milacron) will increase by $0.5 trillion ...

... trillion, sales revenues at investment goods manufacturers (Boeing, Westinghouse, Cincinnati Milacron) will increase by $0.5 trillion ...

Demand for Loans Real Interest Rate

... B) Unemployment decreases with an increase in inflation C) Increased automation will lead to lower levels of structural unemployment in the long-run. D) Changes in the composition of the overall demand for labor tend to be deflationary in the long-run. E) The natural rate of unemployment is independ ...

... B) Unemployment decreases with an increase in inflation C) Increased automation will lead to lower levels of structural unemployment in the long-run. D) Changes in the composition of the overall demand for labor tend to be deflationary in the long-run. E) The natural rate of unemployment is independ ...

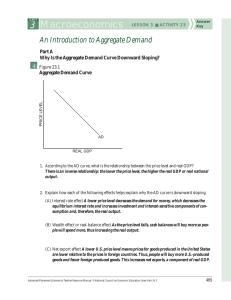

3 Macroeconomics LESSON 3 s ACTIVITY 23

... 1. According to the AD curve, what is the relationship between the price level and real GDP? There is an inverse relationship: the lower the price level, the higher the real GDP or real national output. ...

... 1. According to the AD curve, what is the relationship between the price level and real GDP? There is an inverse relationship: the lower the price level, the higher the real GDP or real national output. ...

Public Expenditure Analysis and Management

... case for intervention • If taxation or borrowing depresses private production or investment, it would offset some or all of the benefit • Session by Dr. Tanzi will discuss how forces other than economics have influenced public spending and the role of the state, for better and for worse ...

... case for intervention • If taxation or borrowing depresses private production or investment, it would offset some or all of the benefit • Session by Dr. Tanzi will discuss how forces other than economics have influenced public spending and the role of the state, for better and for worse ...

ch9-1

... tax revenue and government spending. The budget surplus is the difference between tax revenue and government spending when tax revenue exceeds government spending. The budget deficit is the difference between tax revenue and government spending when government spending exceeds tax revenue. ...

... tax revenue and government spending. The budget surplus is the difference between tax revenue and government spending when tax revenue exceeds government spending. The budget deficit is the difference between tax revenue and government spending when government spending exceeds tax revenue. ...

Chapter 11 Slides PPT

... (1) AE = C + I + G + X – M. (2) C = a + b(Yd) (consumption function) (3) Yd = Y – T (definition) (4) C = a + b(Y – T) (substitute (3) into (2)) (5) T = Ta + tY (This is new. Tax equation, taxes depend on Y. Ta is autonomous taxes, not related to income) (6) C = a + b(Y – (Ta + tY)) (substitute (5) i ...

... (1) AE = C + I + G + X – M. (2) C = a + b(Yd) (consumption function) (3) Yd = Y – T (definition) (4) C = a + b(Y – T) (substitute (3) into (2)) (5) T = Ta + tY (This is new. Tax equation, taxes depend on Y. Ta is autonomous taxes, not related to income) (6) C = a + b(Y – (Ta + tY)) (substitute (5) i ...