Fiscal Consolidation - wimdreesstichting.nl

... growth and economic stability in the UK. • Tackling the deficit is essential as it will: o reduce the UK’s vulnerability to further shocks or a loss of market confidence, which could force a much sharper correction; o underpin private sector confidence, supporting growth and job creation over the me ...

... growth and economic stability in the UK. • Tackling the deficit is essential as it will: o reduce the UK’s vulnerability to further shocks or a loss of market confidence, which could force a much sharper correction; o underpin private sector confidence, supporting growth and job creation over the me ...

Euro area recovery still lacks momentum

... by declining interest rate payments and the economic recovery rather than consolidation efforts. Over the forecast horizon, fiscal policy is expected to be mildly expansionary on average. Targeting the Euro area fiscal stance by fiscal coordination could destabilize the Euro area on the country le ...

... by declining interest rate payments and the economic recovery rather than consolidation efforts. Over the forecast horizon, fiscal policy is expected to be mildly expansionary on average. Targeting the Euro area fiscal stance by fiscal coordination could destabilize the Euro area on the country le ...

Higher Interest Rates and the National Debt

... The continued tightening of monetary policy should be viewed as a positive sign of economic strength. The economy has strengthened considerably since the depths of the recession, and the Federal Reserve’s actions reflect these improvements. Going forward, there will be a number of consequences of a ...

... The continued tightening of monetary policy should be viewed as a positive sign of economic strength. The economy has strengthened considerably since the depths of the recession, and the Federal Reserve’s actions reflect these improvements. Going forward, there will be a number of consequences of a ...

Economic Forecast for 2014 & Beyond

... What to make of all this? • Growth in the last part of 2013 will likely be at most around 3%, maybe lower. – Not enough to make major progress in terms of reducing unemployment; no surprise if rate remains above 7% over the rest of the year – Combined with growth of about 1.5% in the first half, ov ...

... What to make of all this? • Growth in the last part of 2013 will likely be at most around 3%, maybe lower. – Not enough to make major progress in terms of reducing unemployment; no surprise if rate remains above 7% over the rest of the year – Combined with growth of about 1.5% in the first half, ov ...

A Simple Route to Major Deficit Reduction

... for universities, religious and cultural institutions, and hospitals. The 2% overall cap on tax expenditures should be politically more acceptable than changes in the treatment of mortgage interest or other specific deductions because it treats all tax expenditures equally. It would also reduce afte ...

... for universities, religious and cultural institutions, and hospitals. The 2% overall cap on tax expenditures should be politically more acceptable than changes in the treatment of mortgage interest or other specific deductions because it treats all tax expenditures equally. It would also reduce afte ...

Warren Harding and the Forgotten Depression of 1920

... services, for instance—are now released for use in more remote stages of the structure of production. Likewise for labor, steel, and other nonspecific inputs. When the market’s freely established structure of interest rates is tampered with, this coordinating function is disrupted. Increased investm ...

... services, for instance—are now released for use in more remote stages of the structure of production. Likewise for labor, steel, and other nonspecific inputs. When the market’s freely established structure of interest rates is tampered with, this coordinating function is disrupted. Increased investm ...

Download

... may have played a role. As stimulus in one country increases demand in another, one country may want to free ride on the others’ fiscal expansion. When coordination fails the level of fiscal stimulus may get too small. This failure may help to explain why the scale of fiscal expansion in Europe is s ...

... may have played a role. As stimulus in one country increases demand in another, one country may want to free ride on the others’ fiscal expansion. When coordination fails the level of fiscal stimulus may get too small. This failure may help to explain why the scale of fiscal expansion in Europe is s ...

幻灯片 1

... covering the period Q4 2008 to year-end 2010. □ The statement names a whole series of areas that would receive the money including roads, health, rural infrastructure, railways, low-cost housing, food subsides, Western development, and rural subsides, among others. □ Certainly this kind of announcem ...

... covering the period Q4 2008 to year-end 2010. □ The statement names a whole series of areas that would receive the money including roads, health, rural infrastructure, railways, low-cost housing, food subsides, Western development, and rural subsides, among others. □ Certainly this kind of announcem ...

PDF - The Heritage Foundation

... of forming a business is burdensome. Labor regulations are outmoded, and a large proportion of the labor force is dependent on the informal sector. The government is continuing to overhaul the struggling state-owned ENEE electricity utility but maintains price controls for basic food items along wit ...

... of forming a business is burdensome. Labor regulations are outmoded, and a large proportion of the labor force is dependent on the informal sector. The government is continuing to overhaul the struggling state-owned ENEE electricity utility but maintains price controls for basic food items along wit ...

Economics for Today 2005

... economy is inherently unstable and may require government intervention to control aggregate expenditures and restore full employment. ...

... economy is inherently unstable and may require government intervention to control aggregate expenditures and restore full employment. ...

Living standards - Institute for Fiscal Studies

... – Substantial changes to taxes and benefits during this period which affect different people differently – e.g. Increases to income tax personal allowance, increases in NICs, cuts to benefits and tax credits ...

... – Substantial changes to taxes and benefits during this period which affect different people differently – e.g. Increases to income tax personal allowance, increases in NICs, cuts to benefits and tax credits ...

CHAPTER 15: FISCAL POLICY Section 1: Understanding Fiscal

... What is the main premise of classical economics? What major event challenged this economic “school of thought”? 2. *Explain the deadlock that was occurring between producers and consumers in a depressed economy. 3. Who was John Maynard Keynes? 4. What is demand-side economics? How is it different fr ...

... What is the main premise of classical economics? What major event challenged this economic “school of thought”? 2. *Explain the deadlock that was occurring between producers and consumers in a depressed economy. 3. Who was John Maynard Keynes? 4. What is demand-side economics? How is it different fr ...

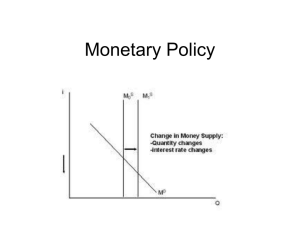

Monetary Policy

... • Decreases AD (investment and consumption) • Higher interest rates lead to capital inflow, so dollar appreciates, and exports decrease (lower AD) • Asset prices decrease ...

... • Decreases AD (investment and consumption) • Higher interest rates lead to capital inflow, so dollar appreciates, and exports decrease (lower AD) • Asset prices decrease ...

Answers to Questions: Chapter 6

... people or the construction industry, hurt by the downturns in housing and commercial real estate, in the from of infrastructure spending or cash-strapped state governments. The tax cuts that had the largest multipliers, ranging from 1.30 down to 1.01, would either provide help for employers to hire ...

... people or the construction industry, hurt by the downturns in housing and commercial real estate, in the from of infrastructure spending or cash-strapped state governments. The tax cuts that had the largest multipliers, ranging from 1.30 down to 1.01, would either provide help for employers to hire ...

Second Prelim for Spring 2008

... show that labor supply increases from a decrease in taxes. When transfers are increased (decreased), there is a pure income effect since wages do not change, and workers consumer more of everything, including leisure. Therefore, increases (decreases) in transfers result in decreases (increases) in l ...

... show that labor supply increases from a decrease in taxes. When transfers are increased (decreased), there is a pure income effect since wages do not change, and workers consumer more of everything, including leisure. Therefore, increases (decreases) in transfers result in decreases (increases) in l ...

Business Management

... available for everyone in the world to consume as much as he or she would like Opportunity cost = when you take one action/make one purchase, then this is the best opportunity that is passed up/lost ...

... available for everyone in the world to consume as much as he or she would like Opportunity cost = when you take one action/make one purchase, then this is the best opportunity that is passed up/lost ...

Keynesian Circular

... equilibrium when Y = C + I. Note that income itself (rather than prices, wages, or the interest rate) is the equilibrating variable. ...

... equilibrium when Y = C + I. Note that income itself (rather than prices, wages, or the interest rate) is the equilibrating variable. ...

www.plan.be

... Challenges for ensuring the conduct of sound fiscal policies in the EU: • Continue progress in the analysis of government finances • Promote institutional settings at national level that encourage governments to pursue sound policies • Improve consistency and interactions between the national framew ...

... Challenges for ensuring the conduct of sound fiscal policies in the EU: • Continue progress in the analysis of government finances • Promote institutional settings at national level that encourage governments to pursue sound policies • Improve consistency and interactions between the national framew ...

Unit 3 Macroeconomics-pp_UPDATED 2013

... measure changes in prices over time, or more simply, it is a ratio of 2 prices. Base Year: a year that serves as the basis of comparison for all other years. Market Basket: a representative selection of commonly purchased goods and services by urban consumers. ...

... measure changes in prices over time, or more simply, it is a ratio of 2 prices. Base Year: a year that serves as the basis of comparison for all other years. Market Basket: a representative selection of commonly purchased goods and services by urban consumers. ...

Study Questions for Final File

... the aggregate demand curve shifts to the right causing an increase in real GDP and the price level. d. the aggregate demand curve shifts to the right causing a decrease in real GDP and the price level. A real depreciation of a country’s currency generally causes: a. an increase in the production of ...

... the aggregate demand curve shifts to the right causing an increase in real GDP and the price level. d. the aggregate demand curve shifts to the right causing a decrease in real GDP and the price level. A real depreciation of a country’s currency generally causes: a. an increase in the production of ...

Government Spending — Running on Empty

... government involvement in the U.S. economy, and how to prevent America from going down the path of a sovereign debt crisis. The questions stem not just from the rapid rise in federal government spending in recent years but also from worries about projected increases in future spending on mandatory g ...

... government involvement in the U.S. economy, and how to prevent America from going down the path of a sovereign debt crisis. The questions stem not just from the rapid rise in federal government spending in recent years but also from worries about projected increases in future spending on mandatory g ...