* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download CHAPTER 15: FISCAL POLICY Section 1: Understanding Fiscal

Survey

Document related concepts

Transcript

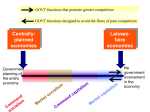

CHAPTER 15: FISCAL POLICY Section 1: Understanding Fiscal Policy 1. 2. 3. 4. 5. 6. 7. The government spends an average of how much money on a daily basis? See Figure 15.1 on page 392. Explain how the government goes about creating the federal budget. What is considered the fiscal year in regards to managing the federal budget? View the visual glossary on page 393. What is fiscal policy? What is an appropriations bill? What two things can happen if Congress cannot finalize a budget before the end of the fiscal year? Define: a. Expansionary Policy b. Contractionary Policy c. Go back to the visual glossary on page 393. Which tools are expansionary and which are contractionary? 8. See Figure 15.2 on page 395. Explain the effects of expansionary policy. 9. See Figure 15.3 on page 396. Explain the effects of contractionary policy. 10. What are the limits of fiscal policy? List AND Explain. (5) Section 2: Fiscal Policy Options 1. What is the main premise of classical economics? What major event challenged this economic “school of thought”? 2. *Explain the deadlock that was occurring between producers and consumers in a depressed economy. 3. Who was John Maynard Keynes? 4. What is demand-side economics? How is it different from classical economics? 5. Define productive capacity. 6. See Figure 15.4 on page 400. How did Keynes propose assisting a down economy in reaching productive capacity? 7. What two problems did Keynes argue that Fiscal Policy could be used to combat? How would the government know when to intervene? 8. How is Keynesian theory reflected in the two political parties today? 9. How does the “multiplier effect” work? 10. What is supply-side economics? What mode of fiscal policy does supply-side theory focus on? 11. See Figure 15.6 on page 404. How does the Laffer Curve justify the theory behind those who support supply-side economics? 12. See Figure 15.7 on page 407. Detail how the Marginal Tax Rate has changed in the country from decade to decade (1925 – 2007). *Note: it may help to define Marginal Tax Rate! Section 3: Budget Deficits and the National Debt 1. 2. 3. 4. 5. 6. 7. 8. What is the difference between a budget surplus and a budget deficit? In what two ways can the government respond to a budget deficit? What is the difference between deficit and debt? See Figure 15.10 on page 411. Explain the crowding-out effect. How do governments attract business investment in times of need? What is “servicing the debt”? What consequences might foreign ownership of the national debt have on the United States? What was PAYGO? *Analyze: What are potential pros and cons of a balanced budget amendment? CHAPTER 16: THE FEDERAL RESERVE AND MONETARY POLICY Section 1: The Federal Reserve System 1. 2. 3. View the visual glossary on page 420. What is monetary policy? What are reserve requirements? See Figure 16.1 on page 422. Explain the structure of the Federal Reserve System, including the following: a. Board of Governors b. Federal Reserve Banks c. Member Banks d. Federal Open Market Committee (FOMC) Section 2: Federal Reserve Functions 1. Define the roles that the Federal Reserve serves for the following institutions: a. US Government (2) b. Member Banks (3) c. Regulating the Banking System (2) d. Regulating the Money Supply (2) Section 3: Monetary Policy Tools 1. 2. 3. 4. 5. 6. 7. What is money creation? See Figure 16.4 on page 430. Explain the process of money creation. What is the required reserve ratio? What is the money multiplier formula? What are excess reserves? See Figure 16.5 on page 431. How does changing the reserve requirements affect the money supply? What is the discount rate? See Figure 16.6 on page 433. How do Open Market Operations work? Section 4: Monetary Policy and Macroeconomic Stabilization 1. 2. 3. 4. 5. 6. 7. 8. Define monetarism. How does the money supply affect interest rates? How do interest rates affect spending? Explain the differences between an easy money policy and a tight money policy. When does “The Fed” utilize each of these? See Figure 16.7 on page 437. What role does timing play in the use of monetary policy? Define both inside lag and outside lag. a. Why do lags occur? (2) b. Which is more severe for monetary policy – inside or outside? Which has the longer overall “lag” period – Fiscal or Monetary policies? Which types of policy are used more by our government – Fiscal or Monetary policies?