Macroeconomics Unit 1(1)

... people and businesses make regarding the allocation of resources and prices of goods and services. Macroeconomics, on the other hand, is the field of economics that studies the behavior of the economy as a whole and not just on specific companies, but entire industries and economies. ...

... people and businesses make regarding the allocation of resources and prices of goods and services. Macroeconomics, on the other hand, is the field of economics that studies the behavior of the economy as a whole and not just on specific companies, but entire industries and economies. ...

Hungary`s Fiscal Policy Council

... Initially, the Council consisted of three members, assisted by a secretariat of about 30 officials. The members were nominated by the President, the Central Bank Governor and the National Auditor and were chosen by the Parliament for a non-renewable nine-year term of office. One eligibility requirem ...

... Initially, the Council consisted of three members, assisted by a secretariat of about 30 officials. The members were nominated by the President, the Central Bank Governor and the National Auditor and were chosen by the Parliament for a non-renewable nine-year term of office. One eligibility requirem ...

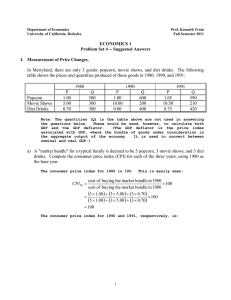

mid term exam solutions

... every month. Roughly, the survey concerns household members 16 and older and asks them whether they work 1 hour or more as a paid employee, 15 hours or more without pay in a family enterprise or whether they have a job from which they are temporarily absent. If they do, they are considered to be emp ...

... every month. Roughly, the survey concerns household members 16 and older and asks them whether they work 1 hour or more as a paid employee, 15 hours or more without pay in a family enterprise or whether they have a job from which they are temporarily absent. If they do, they are considered to be emp ...

slashed

... Due to the efficient management of the company, we INCREASED sales by 25% this year. Unemployment JUMPED from 200,000 to 600,000 in 3 months due to the closure of several factories in the country. The higher income that resulted from the suddenly increased sales SLASHED the company's deficit by half ...

... Due to the efficient management of the company, we INCREASED sales by 25% this year. Unemployment JUMPED from 200,000 to 600,000 in 3 months due to the closure of several factories in the country. The higher income that resulted from the suddenly increased sales SLASHED the company's deficit by half ...

Answers

... a. higher taxes then lower consumption then less aggregate demand. b. higher income the higher consumption then more aggregate demand. c. higher consumption then higher income then more aggregate demand. d. higher interest rates then less consumption then less aggregate demand. e. higher consumption ...

... a. higher taxes then lower consumption then less aggregate demand. b. higher income the higher consumption then more aggregate demand. c. higher consumption then higher income then more aggregate demand. d. higher interest rates then less consumption then less aggregate demand. e. higher consumption ...

16.1 the budget and fiscal policy

... 16.1 THE BUDGET AND FISCAL POLICY Taxes decrease the supply of labor and saving. A decrease in the supply of labor increases the equilibrium real wage rate and decreases the equilibrium quantity of labor employed. Similarly, a decrease in the supply of saving increases the equilibrium real interest ...

... 16.1 THE BUDGET AND FISCAL POLICY Taxes decrease the supply of labor and saving. A decrease in the supply of labor increases the equilibrium real wage rate and decreases the equilibrium quantity of labor employed. Similarly, a decrease in the supply of saving increases the equilibrium real interest ...

21.1 the budget and fiscal policy

... 21.1 THE BUDGET AND FISCAL POLICY Taxes decrease the supply of labor and saving. A decrease in the supply of labor increases the equilibrium real wage rate and decreases the equilibrium quantity of labor employed. Similarly, a decrease in the supply of saving increases the equilibrium real interest ...

... 21.1 THE BUDGET AND FISCAL POLICY Taxes decrease the supply of labor and saving. A decrease in the supply of labor increases the equilibrium real wage rate and decreases the equilibrium quantity of labor employed. Similarly, a decrease in the supply of saving increases the equilibrium real interest ...

... On the spending front, private consumption grew by 4.1%, sustained by credit growth and high levels of employment, while public consumption increased by 6.4%. Gross private fixed capital investment decreased by 1.6% in 2014, due to delays in the implementation of ongoing and planned mining projects. ...

what do we mean by economic development

... economic growth is not sufficient for improving living standards because of problems related to how income in spent and distributed: 1. governments may promote economic growth to attain other goals other than improving its citizens well-being 2. resources may be heavily invested in further growth w ...

... economic growth is not sufficient for improving living standards because of problems related to how income in spent and distributed: 1. governments may promote economic growth to attain other goals other than improving its citizens well-being 2. resources may be heavily invested in further growth w ...

January,1998 - Ministère des Finances Canada

... Low interest rates, rising profits and strong equity markets have improved businesses’ ability to invest at the same time as an increased rate of capacity utilization had created a need for new investment. The rate of capacity utilization in non-farm sectors rose to 86.2% in the third quarter, its h ...

... Low interest rates, rising profits and strong equity markets have improved businesses’ ability to invest at the same time as an increased rate of capacity utilization had created a need for new investment. The rate of capacity utilization in non-farm sectors rose to 86.2% in the third quarter, its h ...

November 21, 2012

... We’re heading for economic dictatorship The whole of the West is falling into the economic black hole of permanent no-growth by Janet Daley Forget about that dead parrot of a question – should we join the eurozone? The eurozone has officially joined us in a newly emerging international organisation: ...

... We’re heading for economic dictatorship The whole of the West is falling into the economic black hole of permanent no-growth by Janet Daley Forget about that dead parrot of a question – should we join the eurozone? The eurozone has officially joined us in a newly emerging international organisation: ...

Some Basic Facts About Government in Canada

... Revenues and Expenditures in Canada • Since we’re studying the role of government in this course it is worth considering some measures of government activity – How big is government? – What does government spend money on? – How does it collect taxes? – At what level of government do different activ ...

... Revenues and Expenditures in Canada • Since we’re studying the role of government in this course it is worth considering some measures of government activity – How big is government? – What does government spend money on? – How does it collect taxes? – At what level of government do different activ ...

Syllabus203

... 1. to think critically and be able to apply economic reasoning in making personal &business decisions and in analyzing economic conditions & policies. 2. to identify and discuss economic issues facing the country & the world. 3. to explain the causes and effects of inflation ,unemployment. 4. to exp ...

... 1. to think critically and be able to apply economic reasoning in making personal &business decisions and in analyzing economic conditions & policies. 2. to identify and discuss economic issues facing the country & the world. 3. to explain the causes and effects of inflation ,unemployment. 4. to exp ...

EPS Session4 2011

... If actual output > potential output, restrictive monetary policy will reduce dangers of inflation ...

... If actual output > potential output, restrictive monetary policy will reduce dangers of inflation ...

AS) curve shows the relationship between the A

... D) equilibrium real GDP and desired consumption. E) price level and the total output that firms wish to produce and sell, as technology and input prices vary. 2) Real GDP is equivalent to A) the money value of all goods and services produced in an economy per year plus imports. B) the nominal value ...

... D) equilibrium real GDP and desired consumption. E) price level and the total output that firms wish to produce and sell, as technology and input prices vary. 2) Real GDP is equivalent to A) the money value of all goods and services produced in an economy per year plus imports. B) the nominal value ...

RETHINKING MACROECONOMIC POLICIES FOR

... much fiscal flexibility in either revenue or expenditure. Tax revenues are based less on direct taxes and more on indirect taxes. The base for taxation is not broad enough. Tax compliance is low (attributable to tax avoidance and tax evasion). Thus, governments find it very difficult to increase the ...

... much fiscal flexibility in either revenue or expenditure. Tax revenues are based less on direct taxes and more on indirect taxes. The base for taxation is not broad enough. Tax compliance is low (attributable to tax avoidance and tax evasion). Thus, governments find it very difficult to increase the ...

IMF Regional Economic Outlook for SSA

... appropriate policy measures Jump in non-mining growth based on investment in new electricity generating capacity, plus beneficial impact of reforms ...

... appropriate policy measures Jump in non-mining growth based on investment in new electricity generating capacity, plus beneficial impact of reforms ...

Document

... • ratings reflect risk of default, not risk of bonds performing poorly Qualitative factors can be key, and are hard to quantify • political calculation about potential international support • understand cross-country exposures, especially banking • understand social contract and government constrain ...

... • ratings reflect risk of default, not risk of bonds performing poorly Qualitative factors can be key, and are hard to quantify • political calculation about potential international support • understand cross-country exposures, especially banking • understand social contract and government constrain ...

National Income Accounts

... The expenditures line shifts down. C falls as Y declines, and I falls as a result of higher interest rates. Since P falls, real wages increase and employment falls to nlower. Results: If the economy can be stabilized at Ymoderate, Pmoderate, and nlower, then we can have a successful softlanding. Bec ...

... The expenditures line shifts down. C falls as Y declines, and I falls as a result of higher interest rates. Since P falls, real wages increase and employment falls to nlower. Results: If the economy can be stabilized at Ymoderate, Pmoderate, and nlower, then we can have a successful softlanding. Bec ...

Economics Scholarship Exam 2007 These are my Economics

... (i) Calculate the change in the level of real wages for the year to December 2006 and explain why wage earners would be more interested in this figure than in the change in nominal wages. The growth in real wages in the year to December 2006 is 4.9% - 2.6% = 2.3% increase. Wage earners are more inte ...

... (i) Calculate the change in the level of real wages for the year to December 2006 and explain why wage earners would be more interested in this figure than in the change in nominal wages. The growth in real wages in the year to December 2006 is 4.9% - 2.6% = 2.3% increase. Wage earners are more inte ...