Document

... 2002 through December 31, 2002 Expenditures (Uses) Consumption (spending on goods and services) ...

... 2002 through December 31, 2002 Expenditures (Uses) Consumption (spending on goods and services) ...

Chapter 2

... 4. Final goods and services a. Don’t count intermediate goods and services b. Capital goods (goods used to produce other goods) are final goods since they aren’t used up in the same period that they are produced c. Inventory investment (the amount that inventories of unsold finished goods, goo ...

... 4. Final goods and services a. Don’t count intermediate goods and services b. Capital goods (goods used to produce other goods) are final goods since they aren’t used up in the same period that they are produced c. Inventory investment (the amount that inventories of unsold finished goods, goo ...

This PDF is a selection from a published volume from... Bureau of Economic Research Volume Title: NBER International Seminar on Macroeconomics

... found in table 5, wherein the higher the debt / tax revenue and the higher the trade openness, the smaller the fiscal stimulus. A 1 percentage point increase in the debt / tax revenue induces a 0.004 percentage point reduction in the stimulus size (0.026 percentage point reduction if endogeneity is ...

... found in table 5, wherein the higher the debt / tax revenue and the higher the trade openness, the smaller the fiscal stimulus. A 1 percentage point increase in the debt / tax revenue induces a 0.004 percentage point reduction in the stimulus size (0.026 percentage point reduction if endogeneity is ...

The effects of a government expenditures shock

... RBC model by including imperfect competition, price-setting and wage-setting frictions, lumpsum taxation, investment adjustment costs and also non-Ricardian rule-of-thumb consumers, which are consumers that consume all their available disposable income in each period, to obtain the result that unde ...

... RBC model by including imperfect competition, price-setting and wage-setting frictions, lumpsum taxation, investment adjustment costs and also non-Ricardian rule-of-thumb consumers, which are consumers that consume all their available disposable income in each period, to obtain the result that unde ...

PDF - Urban Institute

... Next year, our debt will exceed 60 percent of our total economic output, or gross domestic product (GDP). We would not meet the standards Poland and Estonia needed to qualify for admission into the European Union. In 2023, our debt will exceed 100 percent of GDP — the highest level since World War I ...

... Next year, our debt will exceed 60 percent of our total economic output, or gross domestic product (GDP). We would not meet the standards Poland and Estonia needed to qualify for admission into the European Union. In 2023, our debt will exceed 100 percent of GDP — the highest level since World War I ...

Lesson 9 - Fiscal Policy

... b) Administration Lag: The administration lag at the Federal level is the time it takes for Congress to debate and approve a fiscal policy bill, and to get the President to sign the bill. Once the economic condition is recognized, then Congress and the President have to approve discretionary fiscal ...

... b) Administration Lag: The administration lag at the Federal level is the time it takes for Congress to debate and approve a fiscal policy bill, and to get the President to sign the bill. Once the economic condition is recognized, then Congress and the President have to approve discretionary fiscal ...

Chart

... Public Debt (Percent of GDP unless noted otherwise) Fiscal deficits and public debt are very high in many advanced economies. Although policy became much less stimulatory in 2010, real GDP growth picked up, suggesting a handoff from public to private demand. For 2011, fiscal consolidation is expecte ...

... Public Debt (Percent of GDP unless noted otherwise) Fiscal deficits and public debt are very high in many advanced economies. Although policy became much less stimulatory in 2010, real GDP growth picked up, suggesting a handoff from public to private demand. For 2011, fiscal consolidation is expecte ...

Exam 3

... a. the economy will return quickly to full employment in most cases b. if output is below its potential, the economy will soon return to full employment c. production can be stuck below its full-employment level for extended periods of time d. the Great Depression proved that classical economics doe ...

... a. the economy will return quickly to full employment in most cases b. if output is below its potential, the economy will soon return to full employment c. production can be stuck below its full-employment level for extended periods of time d. the Great Depression proved that classical economics doe ...

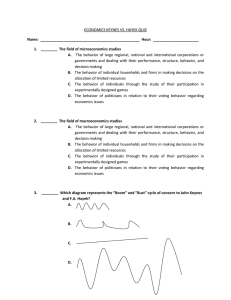

ECONOMICS KEYNES VS. HAYEK QUIZ

... A. The total supply of products available to all Americans in the United States B. The total demand for all products and services in the United States C. The total demand for a single product or service by individuals in specific regions of the United States D. The total supply of specific products ...

... A. The total supply of products available to all Americans in the United States B. The total demand for all products and services in the United States C. The total demand for a single product or service by individuals in specific regions of the United States D. The total supply of specific products ...

The Economics of Private Legal and Defense Services

... industrial leaders a new sense of their responsibilities…Never before have they been called upon to act together.” ...

... industrial leaders a new sense of their responsibilities…Never before have they been called upon to act together.” ...

Fiscal Policy and Macroeconomic Performance: an Overview

... not have a direct impact on aggregate demand but rather only work through their impact on disposable income and consumption (which will rise less than transfers if part of the latter is saved). Since this framework does not account for supply constraints, spending multipliers can be quite large, ren ...

... not have a direct impact on aggregate demand but rather only work through their impact on disposable income and consumption (which will rise less than transfers if part of the latter is saved). Since this framework does not account for supply constraints, spending multipliers can be quite large, ren ...

Answers 2008 Exam

... or by measuring changes in net social welfare. Real gross domestic production (Real GDP) could also be used to measure the growth of an economy. ...

... or by measuring changes in net social welfare. Real gross domestic production (Real GDP) could also be used to measure the growth of an economy. ...

PowerPoint-Presentation

... which investigates which policies can avoid an unstable deflationary spiral, which arises in a standard New Keynesian model with active monetary policy and passive fiscal policy, a zero lower bound on interest rates and adaptive learning by the private agents. ...

... which investigates which policies can avoid an unstable deflationary spiral, which arises in a standard New Keynesian model with active monetary policy and passive fiscal policy, a zero lower bound on interest rates and adaptive learning by the private agents. ...

Fiscal IQ Quiz - Deficit Ranger

... voluntary programs Parts B & D. Under reasonable assumptions, on average, people do not contribute enough over their lifetimes to account for the amount of benefits they receive from both Social Security and Medicare combined. However, the difference is much more significant for Medicare than Social ...

... voluntary programs Parts B & D. Under reasonable assumptions, on average, people do not contribute enough over their lifetimes to account for the amount of benefits they receive from both Social Security and Medicare combined. However, the difference is much more significant for Medicare than Social ...

contract - frickman

... – The economy stops growing (reached the top) – GDP reaches maximum – Businesses can’t produce any more or hire more people – Cycle begins to contract ...

... – The economy stops growing (reached the top) – GDP reaches maximum – Businesses can’t produce any more or hire more people – Cycle begins to contract ...

Chpt 17 pp

... What is the crowding-out effect? When federal government borrowing increases interest rates, the result is lower consumption and investments ...

... What is the crowding-out effect? When federal government borrowing increases interest rates, the result is lower consumption and investments ...

File - Year 11 Economics NIS

... Inflation can be defined as an increase in the average levels of prices in an economy. Governments actually go to the shops and look at the prices of many products periodically. Over time, they can measure changes in average prices. The actual index for this average price measurement is called the C ...

... Inflation can be defined as an increase in the average levels of prices in an economy. Governments actually go to the shops and look at the prices of many products periodically. Over time, they can measure changes in average prices. The actual index for this average price measurement is called the C ...

Document

... Equilibrium GDP is the output level at which the aggregate expenditure line intersects the 45 degree line. If firms produce this output level, their inventories will not change, and they will be content to continue producing the same level of output in the future. © 2001 South-Western, a division of ...

... Equilibrium GDP is the output level at which the aggregate expenditure line intersects the 45 degree line. If firms produce this output level, their inventories will not change, and they will be content to continue producing the same level of output in the future. © 2001 South-Western, a division of ...

Previous Exam - Napa Valley College

... Event: The drought and extreme heat waves ruin crops of corn, alfalfa and other feed corps. Graph---include all 9 labels. Explanation: NO POINTS without an explanation. Which curve shifts and why? ...

... Event: The drought and extreme heat waves ruin crops of corn, alfalfa and other feed corps. Graph---include all 9 labels. Explanation: NO POINTS without an explanation. Which curve shifts and why? ...

syllabus

... main concepts and principles of macroeconomic theory and policy. The course deals with the problems of aggregate product and national income determination, measurement and problems of unemployment and inflation and their trade-off, commodity market equilibrium, money supply, economic growth and econ ...

... main concepts and principles of macroeconomic theory and policy. The course deals with the problems of aggregate product and national income determination, measurement and problems of unemployment and inflation and their trade-off, commodity market equilibrium, money supply, economic growth and econ ...

Press summary (PDF, 131 KB)

... Eurozone gradually stabilises over the forecasting period and that confidence, especially on the part of investors, is restored. Should the situation in the Eurozone continue to deteriorate, this will also impact the German economy. Over the forecasting period as a whole the downside risks prevail a ...

... Eurozone gradually stabilises over the forecasting period and that confidence, especially on the part of investors, is restored. Should the situation in the Eurozone continue to deteriorate, this will also impact the German economy. Over the forecasting period as a whole the downside risks prevail a ...

A budget to promote employment, welfare, and security

... effectiveness of low interest rates and put pressure on the exchange rate. We also cannot replace jobs in the petroleum sector with a massive increase in public sector employment. To succeed with the necessary economic rebalancing we need to prioritize measures that sustain long-term growth and stre ...

... effectiveness of low interest rates and put pressure on the exchange rate. We also cannot replace jobs in the petroleum sector with a massive increase in public sector employment. To succeed with the necessary economic rebalancing we need to prioritize measures that sustain long-term growth and stre ...