Two View ofthe Effects of Governemnt Budget Deficits in the 1980s

... income, increasing both private consumption expenditures and pnvate saving. Since par’t of the tax cut or transfer payment is spent for consumption, the nse in private saving is less than the deficit increase. Thus, national saving declines, Such a decline also indicates that desired aggregate deman ...

... income, increasing both private consumption expenditures and pnvate saving. Since par’t of the tax cut or transfer payment is spent for consumption, the nse in private saving is less than the deficit increase. Thus, national saving declines, Such a decline also indicates that desired aggregate deman ...

Mankiw 5/e Chapter 15: Government Debt

... policymakers do not worry about the true costs of their spending, since the burden falls on future taxpayers future taxpayers cannot participate in the decision process, and their interests may not be taken into account This is another reason for the proposals for a balanced budget amendment, di ...

... policymakers do not worry about the true costs of their spending, since the burden falls on future taxpayers future taxpayers cannot participate in the decision process, and their interests may not be taken into account This is another reason for the proposals for a balanced budget amendment, di ...

Principles of Macroeconomics

... Know the different forms of money in today’s world and consider the advantages and disadvantages of each form. Understand what is meant by inflation; Be able to describe the causes and effects of inflation; Be able to identify the tools to control inflation. Understand the distinction between flows ...

... Know the different forms of money in today’s world and consider the advantages and disadvantages of each form. Understand what is meant by inflation; Be able to describe the causes and effects of inflation; Be able to identify the tools to control inflation. Understand the distinction between flows ...

Clearing Up the Fiscal Multiplier Morass Eric M. Leeper Nora Traum

... The bulk of our results, like most of the existing literature, conditions on a policy regime in which monetary policy is actively targeting inflation and fiscal policy is passively adjusting surpluses to stabilize government debt. Active monetary policy reacts to a persistent fiscal expansion and the a ...

... The bulk of our results, like most of the existing literature, conditions on a policy regime in which monetary policy is actively targeting inflation and fiscal policy is passively adjusting surpluses to stabilize government debt. Active monetary policy reacts to a persistent fiscal expansion and the a ...

Revision Guide

... The minimum wage is the minimum rate a worker can legally be paid (usually per hour) as opposed to wages that are determined by the forces of supply and demand in a free market. Each country sets its own minimum wage laws and regulations, and many countries have no minimum wage. Advantages and Disad ...

... The minimum wage is the minimum rate a worker can legally be paid (usually per hour) as opposed to wages that are determined by the forces of supply and demand in a free market. Each country sets its own minimum wage laws and regulations, and many countries have no minimum wage. Advantages and Disad ...

r - Control and Cybernetics

... to be obtained since the usual way for an increase in the rate of interest to be produced is a decrease in the stock exchange vah:ie of the bonds: the negative effect on wealth may then offset the positive effects on the future income obtained from the future savirigs. In our model we have not consi ...

... to be obtained since the usual way for an increase in the rate of interest to be produced is a decrease in the stock exchange vah:ie of the bonds: the negative effect on wealth may then offset the positive effects on the future income obtained from the future savirigs. In our model we have not consi ...

ECN 111 Chapter 14 Lecture Notes

... The quantity of real GDP demanded is the total amount of final goods and services produced in the United States that people, businesses, governments, and foreigners plan to buy: Y = C + I + G + X M. B. Aggregate Demand and the AD Curve The quantity of real GDP demanded decreases when the price lev ...

... The quantity of real GDP demanded is the total amount of final goods and services produced in the United States that people, businesses, governments, and foreigners plan to buy: Y = C + I + G + X M. B. Aggregate Demand and the AD Curve The quantity of real GDP demanded decreases when the price lev ...

Federal Debt: Who Ran up the Bill? Who`ll Pay It?

... Bush 2 was also a proponent: “President Bush said … that there was a benefit to the government's fast-dwindling surplus, declaring that it will create ‘a fiscal straitjacket for Congress.’ He said that was ‘incredibly positive news’ because it would halt the growth of the federal government.” 21 If ...

... Bush 2 was also a proponent: “President Bush said … that there was a benefit to the government's fast-dwindling surplus, declaring that it will create ‘a fiscal straitjacket for Congress.’ He said that was ‘incredibly positive news’ because it would halt the growth of the federal government.” 21 If ...

Central bank deficit financing in a constrained fiscal space

... as a conditionality for a bail out. Given internal lassitude, the former seem unlikely making the IMF ECF one possible avenue for bringing the public finances to a sounder footing. However, the requirements of zero BoG financing for 2016 and 2017, although necessary appear too draconian. The forgoin ...

... as a conditionality for a bail out. Given internal lassitude, the former seem unlikely making the IMF ECF one possible avenue for bringing the public finances to a sounder footing. However, the requirements of zero BoG financing for 2016 and 2017, although necessary appear too draconian. The forgoin ...

Chapter 14

... Fed buys bonds, lowers reserve ratio, lowers the discount rate, or increases reserve auctions Excess reserves increase Federal funds rate falls Money supply rises Interest rate falls Investment spending increases Aggregate demand increases Real GDP rises LO4 ...

... Fed buys bonds, lowers reserve ratio, lowers the discount rate, or increases reserve auctions Excess reserves increase Federal funds rate falls Money supply rises Interest rate falls Investment spending increases Aggregate demand increases Real GDP rises LO4 ...

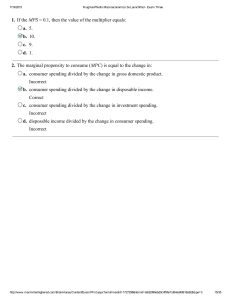

2007 Economics Subject Test

... 20. The short-run aggregate supply curve is upward sloping because A) a lower price level creates a wealth effect. B) lower taxes motivate people to work more. C) money wages do not immediately change when the price level changes. D) most business firms operate with long-term contracts for output b ...

... 20. The short-run aggregate supply curve is upward sloping because A) a lower price level creates a wealth effect. B) lower taxes motivate people to work more. C) money wages do not immediately change when the price level changes. D) most business firms operate with long-term contracts for output b ...

Macro-Fiscal Forecasting - Homepage

... 2. Macroforecasting is a key building block in various types of fiscal analysis 3. Consistency between macroforecasts and fiscal policy requires coordination and iteration. 4. Positive forecasting bias is well documented, and can be addressed through transparency and independent input 5. Deficiencie ...

... 2. Macroforecasting is a key building block in various types of fiscal analysis 3. Consistency between macroforecasts and fiscal policy requires coordination and iteration. 4. Positive forecasting bias is well documented, and can be addressed through transparency and independent input 5. Deficiencie ...

Krugman`s Chapter 31 PPT

... increasing the money supply. This increases investment spending and consumer spending, which in turn increases aggregate demand and real GDP in the short run. Contractionary monetary policy raises the interest rate by reducing the money supply. This reduces investment spending and consumer spending, ...

... increasing the money supply. This increases investment spending and consumer spending, which in turn increases aggregate demand and real GDP in the short run. Contractionary monetary policy raises the interest rate by reducing the money supply. This reduces investment spending and consumer spending, ...

Diapositiva 1 - University of Verona

... • Investment = additions to the physical stock of capital (i.e. building machinery, construction of factories, additions to firms inventories) • In the national income accounts, investment associated with business sector’s adding to the physical stock of capital, including inventories – Household’s ...

... • Investment = additions to the physical stock of capital (i.e. building machinery, construction of factories, additions to firms inventories) • In the national income accounts, investment associated with business sector’s adding to the physical stock of capital, including inventories – Household’s ...

PAGE ONE ECONOMICS NEWSLETTER

... not to spend that $100, I deny the wait staff at my favorite restaurants some work hours and tips (i.e., some portion of their income). As a result, these workers also have to reduce their consumption because they are earning less. If society (as opposed to an individual as in our example) follows t ...

... not to spend that $100, I deny the wait staff at my favorite restaurants some work hours and tips (i.e., some portion of their income). As a result, these workers also have to reduce their consumption because they are earning less. If society (as opposed to an individual as in our example) follows t ...

The Aggregate Demand -- Aggregate Supply Model

... (Demand Policy) Encourage long-term, non-indexed nominal wage contracts. Keep inflation expectations down. -- seek gradual policy changes (“soft landing”) -- verbal reassurances on inflation Watch closely for unusual increases in nominal wage rates. ...

... (Demand Policy) Encourage long-term, non-indexed nominal wage contracts. Keep inflation expectations down. -- seek gradual policy changes (“soft landing”) -- verbal reassurances on inflation Watch closely for unusual increases in nominal wage rates. ...

Program Quality Assurance Review (PQAR) Improving the

... Wikipedia Definition of Incentives: 1. A thing that motivates or encourages one to do something: "incentive to conserve". 2. A payment or concession to stimulate greater output or investment: "tax incentives for investing". 3. Inducement or supplement reward that serves as a motivational devise for ...

... Wikipedia Definition of Incentives: 1. A thing that motivates or encourages one to do something: "incentive to conserve". 2. A payment or concession to stimulate greater output or investment: "tax incentives for investing". 3. Inducement or supplement reward that serves as a motivational devise for ...

EOCT Review Unit One - Mr. Zittle`s Classroom

... What is a mutual fund? Compare and contrast this to purchasing stock. Who benefits, and who loses from inflation? Define progressive, regressive and proportional taxes. How does a sales tax affect different income groups? What factors affect a person’s credit? What is the difference between simple a ...

... What is a mutual fund? Compare and contrast this to purchasing stock. Who benefits, and who loses from inflation? Define progressive, regressive and proportional taxes. How does a sales tax affect different income groups? What factors affect a person’s credit? What is the difference between simple a ...

The question of income inequality in developed nations

... What is a developed nation? A developed nation is defined as a state with a more developed economy than that of developing nations. Economic development is usually assessed in terms of “gross domestic product (GDP), with most developed nations having a higher GDP than less economically developed nat ...

... What is a developed nation? A developed nation is defined as a state with a more developed economy than that of developing nations. Economic development is usually assessed in terms of “gross domestic product (GDP), with most developed nations having a higher GDP than less economically developed nat ...