Income Distribution, Household Debt, and Aggregate

... as well as cars, and college degrees, which resemble assets in economic terms even if they are not normally counted as such. Second, consumption involves not just expenditure for the consuming unit, but creates income for other units. So the relationship between consumption and balance-sheet positio ...

... as well as cars, and college degrees, which resemble assets in economic terms even if they are not normally counted as such. Second, consumption involves not just expenditure for the consuming unit, but creates income for other units. So the relationship between consumption and balance-sheet positio ...

Power Point - The University of Chicago Booth School of Business

... LM Curve: (drawn in (Y-r) space) - represents the relationship of Y and r through the money market (specifically - Y’s affect on money demand). The LM Curve relates real interest rates to real changes in output in the money market. As Y increases - Md shifts upwards - causing real interest rates to ...

... LM Curve: (drawn in (Y-r) space) - represents the relationship of Y and r through the money market (specifically - Y’s affect on money demand). The LM Curve relates real interest rates to real changes in output in the money market. As Y increases - Md shifts upwards - causing real interest rates to ...

One money, but many fiscal policies in Europe

... Recent advances in the literature have yielded new isnights into the solution to this problem. Schmitt-Grohe and Uribe (2001) study optimal fiscal and monetary policy under Calvo sticky product prices in a stochastic production economy without capital. Government expenditures are assumed to be exoge ...

... Recent advances in the literature have yielded new isnights into the solution to this problem. Schmitt-Grohe and Uribe (2001) study optimal fiscal and monetary policy under Calvo sticky product prices in a stochastic production economy without capital. Government expenditures are assumed to be exoge ...

Document

... Thomson Learning™ is a trademark used herein under license. ALL RIGHTS RESERVED. Instructors of classes adopting EXPLORING ECONOMICS, 3rd Edition by Robert L. Sexton as an assigned textbook may reproduce material from this publication for classroom use or in a secure electronic network environment t ...

... Thomson Learning™ is a trademark used herein under license. ALL RIGHTS RESERVED. Instructors of classes adopting EXPLORING ECONOMICS, 3rd Edition by Robert L. Sexton as an assigned textbook may reproduce material from this publication for classroom use or in a secure electronic network environment t ...

" For a closed economy, the national income identity is written as Y

... for money decreases according to the condition: M=P = L(r + e; Y ) Therefore P has to rise to satisfy the equation. Hence, P increases faster than M. LM curve shifts to the left of its initial position At that point, prices and money supply increase at the same rate Even though the real interest rat ...

... for money decreases according to the condition: M=P = L(r + e; Y ) Therefore P has to rise to satisfy the equation. Hence, P increases faster than M. LM curve shifts to the left of its initial position At that point, prices and money supply increase at the same rate Even though the real interest rat ...

A : Abstract

... to be targeted at generating employment (through training or by reducing labour market rigidities that prevent firms from hiring or by reducing search costs) rather than providing unemployment insurance, the government could not only generate a higher level of economic growth, compared to the unempl ...

... to be targeted at generating employment (through training or by reducing labour market rigidities that prevent firms from hiring or by reducing search costs) rather than providing unemployment insurance, the government could not only generate a higher level of economic growth, compared to the unempl ...

Helicopter money – next year`s Christmas - Nordea e

... carrying out large public-sector infrastructure improvements over a short period are limited and may be ineffective. Therefore, a direct transfer to households may very well be a more efficient use of resources. So maybe we have not yet reached the end of the road in terms of fiscal and monetary pol ...

... carrying out large public-sector infrastructure improvements over a short period are limited and may be ineffective. Therefore, a direct transfer to households may very well be a more efficient use of resources. So maybe we have not yet reached the end of the road in terms of fiscal and monetary pol ...

here.

... deficit in the UK public finances worth over 8% of GDP. It is planned to reduce this deficit by a period of sustained fiscal tightening (tax increases, spending cuts or a combination of both). While the Fiscal Responsibility Act has established the broad parameters to govern the path to restoring ne ...

... deficit in the UK public finances worth over 8% of GDP. It is planned to reduce this deficit by a period of sustained fiscal tightening (tax increases, spending cuts or a combination of both). While the Fiscal Responsibility Act has established the broad parameters to govern the path to restoring ne ...

India`s Macroeconomic Performance and Policies since 2000

... A glance at the composition of GDP growth from the expenditure side is also instructive (Table 3). The increase in aggregate investment expenditure between 1991/92 and 1996/97 accounted for nearly 30 percent of GDP growth achieved during these years and reflected a significant rise in the share of i ...

... A glance at the composition of GDP growth from the expenditure side is also instructive (Table 3). The increase in aggregate investment expenditure between 1991/92 and 1996/97 accounted for nearly 30 percent of GDP growth achieved during these years and reflected a significant rise in the share of i ...

8 Grade Personal Finance Project

... Insurance Rating Group (based on the value of your car). Choose one. ...

... Insurance Rating Group (based on the value of your car). Choose one. ...

Income Inequality: United States vs. Romania

... of income would be equal among the quintiles of households, where each group would account for twenty percent of personal gross income. In fact, the United States, just like many other nations in the world, has suffered from a disproportionate allocation of income for many generations. Occasionally ...

... of income would be equal among the quintiles of households, where each group would account for twenty percent of personal gross income. In fact, the United States, just like many other nations in the world, has suffered from a disproportionate allocation of income for many generations. Occasionally ...

Working Paper Series Is fiscal consolidation self-defeating? A panel-VAR analysis for the euro

... of fiscal consolidations, Blanchard and Perotti (2002) apply a structural VAR to a dataset for the US in the postwar period. They find consistent evidence that positive government spending shocks have a positive effect on output, whereas positive tax shocks have a negative effect. They find that fi ...

... of fiscal consolidations, Blanchard and Perotti (2002) apply a structural VAR to a dataset for the US in the postwar period. They find consistent evidence that positive government spending shocks have a positive effect on output, whereas positive tax shocks have a negative effect. They find that fi ...

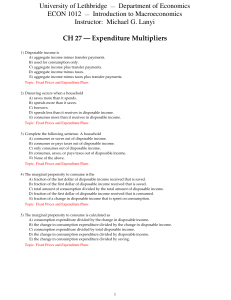

26 Expenditure Multipliers.tst

... 49) The marginal propensity to import is equal to ________. A) the change in net imports divided by the change in disposable income, other things remaining the same B) 1 - MPC C) the change in imports divided by the change in real GDP that brought it about, other things remaining the same D) dispos ...

... 49) The marginal propensity to import is equal to ________. A) the change in net imports divided by the change in disposable income, other things remaining the same B) 1 - MPC C) the change in imports divided by the change in real GDP that brought it about, other things remaining the same D) dispos ...

AP 宏觀經濟學講義

... Scarcity, Choice, and Opportunity Cost .................................................................................. 11 Production Possibilities Curve ................................................................................................ 13 Comparative/Absolute Advantage, Specia ...

... Scarcity, Choice, and Opportunity Cost .................................................................................. 11 Production Possibilities Curve ................................................................................................ 13 Comparative/Absolute Advantage, Specia ...

PDF Download

... Over the summer China was able to return to nearly pre-crisis growth levels. GDP grew by an annualised 7.9 and 8.9 percent in the second and third quarter of last year, respectively. A comparison of the first three quarters with those of 2008 reveals an impressive growth rate of 7.7 percent. Therefo ...

... Over the summer China was able to return to nearly pre-crisis growth levels. GDP grew by an annualised 7.9 and 8.9 percent in the second and third quarter of last year, respectively. A comparison of the first three quarters with those of 2008 reveals an impressive growth rate of 7.7 percent. Therefo ...

lesson 6

... implications for monetary policy, and the shortrun and long-run effects of monetary policy on real output and the price level. The students need to understand the relationship between real and nominal interest rates because the real interest rate determines the level of investment, whereas the nomin ...

... implications for monetary policy, and the shortrun and long-run effects of monetary policy on real output and the price level. The students need to understand the relationship between real and nominal interest rates because the real interest rate determines the level of investment, whereas the nomin ...

National Fiscal Policy and Local Government during the Economic

... efforts to increase demand for goods and services through some combination of increased public spending financed through borrowing and tax reductions that leave consumers with more effective buying power. Why does this matter? If a national government does not pursue a counter-cyclical economic poli ...

... efforts to increase demand for goods and services through some combination of increased public spending financed through borrowing and tax reductions that leave consumers with more effective buying power. Why does this matter? If a national government does not pursue a counter-cyclical economic poli ...

Criticisms of Aggregate Demand and Aggregate Supply

... Even more importantly, even if prices were to fall, this “deflation” would not increase AD and would not provide an unproblematic return to full employment output, but would instead be a disaster, especially for a heavily indebted economy, such as the U.S. economy. Falling prices would increase the ...

... Even more importantly, even if prices were to fall, this “deflation” would not increase AD and would not provide an unproblematic return to full employment output, but would instead be a disaster, especially for a heavily indebted economy, such as the U.S. economy. Falling prices would increase the ...

December 2016 test mark scheme

... Number of people claiming unemployment benefit/jobseekers allowance ...

... Number of people claiming unemployment benefit/jobseekers allowance ...

1 Inequality and Taxation in Brazil: A Proposal to Reduce

... Some authors believe inequality is positively related to growth: “Some economists, perhaps influenced by Keynes’s General Theory, believe that individual saving rates rise with the level of income. If true, then a redistribution of resources from rich to poor tends to lower the aggregate rate of sav ...

... Some authors believe inequality is positively related to growth: “Some economists, perhaps influenced by Keynes’s General Theory, believe that individual saving rates rise with the level of income. If true, then a redistribution of resources from rich to poor tends to lower the aggregate rate of sav ...

ch_7

... bottom half of the circular flow. Specifically, GDP is equal to the sum of the four categories of expenditures. ...

... bottom half of the circular flow. Specifically, GDP is equal to the sum of the four categories of expenditures. ...

Funding Ghana`s `Free` Senior High School with Oil Revenue: Sober

... critical: the selection of areas and sectors to benefit from this revenue remains at the discretion of the finance minister. An investment by the new government in developing a consensus based plan would perhaps facilitate a more inclusive approach in selecting these priority spending areas. The “Fr ...

... critical: the selection of areas and sectors to benefit from this revenue remains at the discretion of the finance minister. An investment by the new government in developing a consensus based plan would perhaps facilitate a more inclusive approach in selecting these priority spending areas. The “Fr ...

Objectives for Chapter 23: The Basic Theory of Monetarism Chapter

... The more people will spend on daily transactions, the greater is the demand for money and vice versa. The demand for money = k times P times Q. In addition to the transactions demand for money, there is also an asset demand for money. There are two aspects of this asset demand for money. The first a ...

... The more people will spend on daily transactions, the greater is the demand for money and vice versa. The demand for money = k times P times Q. In addition to the transactions demand for money, there is also an asset demand for money. There are two aspects of this asset demand for money. The first a ...

Document

... 10 percent. As a result, gross domestic income increases. What happens to Gross Domestic Product? A. Gross Domestic Product also increases since consumption expenditures would increase. B. Gross Domestic Product decreases as people pay more taxes on their higher incomes. C. Gross Domestic Product wo ...

... 10 percent. As a result, gross domestic income increases. What happens to Gross Domestic Product? A. Gross Domestic Product also increases since consumption expenditures would increase. B. Gross Domestic Product decreases as people pay more taxes on their higher incomes. C. Gross Domestic Product wo ...