SAST - SA JPMorgan MFS Core Bond Portfolio Summary

... not bank deposits and are not guaranteed or insured by any bank, government entity or the Federal Deposit Insurance Corporation. As with any mutual fund, there is no guarantee that the Portfolio will be able to achieve its investment goal. If the value of the assets of the Portfolio goes down, you c ...

... not bank deposits and are not guaranteed or insured by any bank, government entity or the Federal Deposit Insurance Corporation. As with any mutual fund, there is no guarantee that the Portfolio will be able to achieve its investment goal. If the value of the assets of the Portfolio goes down, you c ...

Opportunistic Deep-Value Investing: A Multi-Asset Class

... We broadly define potential deep-value investments as those with the following attributes: 1. The potential investment is significantly cheap with respect to long-term (five to 10 years or more) historical valuation levels when compared to itself, peer asset classes, or the broader market. 2. The po ...

... We broadly define potential deep-value investments as those with the following attributes: 1. The potential investment is significantly cheap with respect to long-term (five to 10 years or more) historical valuation levels when compared to itself, peer asset classes, or the broader market. 2. The po ...

CHAPTER SIXTEEN

... produces. In the program, investment produces sales for two years (as in the tables in the text), so investment turnover for two years has to be specified. As the only expense is the depreciation on the investment, this turnover is the element that determines the “real” profitability. The examples i ...

... produces. In the program, investment produces sales for two years (as in the tables in the text), so investment turnover for two years has to be specified. As the only expense is the depreciation on the investment, this turnover is the element that determines the “real” profitability. The examples i ...

Subjective Measures of Risk Aversion, Fixed Costs, and

... Suppose your medical doctor advises you to move house because of an allergy. You follow his advice and it turns out you have to choose between two jobs. Both jobs are comparable in terms of working hours, but one job is more secure than the other. In the first job there is a guarantee that you will ...

... Suppose your medical doctor advises you to move house because of an allergy. You follow his advice and it turns out you have to choose between two jobs. Both jobs are comparable in terms of working hours, but one job is more secure than the other. In the first job there is a guarantee that you will ...

Chapters 11&12

... Diversification of a Portfolio Correlation: →the behavioral relationship between two or more variables (stocks in a portfolio) →a measure of the degree to which returns share common risk. →it is calculated as the covariance of returns divided by the standard deviation of each return Various conditi ...

... Diversification of a Portfolio Correlation: →the behavioral relationship between two or more variables (stocks in a portfolio) →a measure of the degree to which returns share common risk. →it is calculated as the covariance of returns divided by the standard deviation of each return Various conditi ...

Testing Volatility Restrictions on Intertemporal Marginal Rates of

... the study of international equity returns data, and Backus, Gregory, and Telmer (1993) use these methods in an attempt to understand foreign currency returns.' Thus far, researchers have primarily applied this analysis by comparing point estimates of the volatility bound with point estimates of the ...

... the study of international equity returns data, and Backus, Gregory, and Telmer (1993) use these methods in an attempt to understand foreign currency returns.' Thus far, researchers have primarily applied this analysis by comparing point estimates of the volatility bound with point estimates of the ...

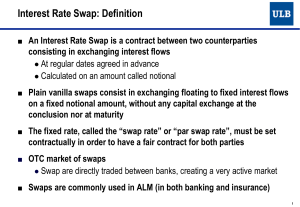

Interest Rate Swap

... ■ More complex contracts can be concluded in the OTC market, where e.g. ● The notional vary with time ● The contract is not spot but forward ● One or both legs are function of more than one reference rates (structured swaps) ...

... ■ More complex contracts can be concluded in the OTC market, where e.g. ● The notional vary with time ● The contract is not spot but forward ● One or both legs are function of more than one reference rates (structured swaps) ...

The impact of short-selling constraints on financial market

... The practice of short-selling – borrowing a financial instrument from another investor to sell it immediately and close the position in the future by buying and returning the instrument – is widespread in financial markets. In fact, short-selling is the mirror image of a “long position”, where an in ...

... The practice of short-selling – borrowing a financial instrument from another investor to sell it immediately and close the position in the future by buying and returning the instrument – is widespread in financial markets. In fact, short-selling is the mirror image of a “long position”, where an in ...

Tactical Asset Allocation with Macroeconomic Factors

... quarterly, reducing transaction costs incurred by investors. In terms of similarity between ...

... quarterly, reducing transaction costs incurred by investors. In terms of similarity between ...

The long term equilibrium interest rate and risk premiums under

... host of new questions, well beyond the scope of the present presentation. 4 In Section 2 we discuss time variations in the interest rate. In Section 3 we calibrate the uncertainty about the future, inherent in the Stern Review, to the standard pure exchange equilibrium model of Lucas (1978). Here we ...

... host of new questions, well beyond the scope of the present presentation. 4 In Section 2 we discuss time variations in the interest rate. In Section 3 we calibrate the uncertainty about the future, inherent in the Stern Review, to the standard pure exchange equilibrium model of Lucas (1978). Here we ...

Financial Accounting: Assets Question 1 (30 marks) Multiple choice

... not to control those decisions. That influence can be achieved, under certain circumstances, with any level of ownership. f. 2) Cost is normally defined as the fair value of the consideration given up to acquire the asset. g. 4) Under the equity method of accounting for investments in associates, d ...

... not to control those decisions. That influence can be achieved, under certain circumstances, with any level of ownership. f. 2) Cost is normally defined as the fair value of the consideration given up to acquire the asset. g. 4) Under the equity method of accounting for investments in associates, d ...

Guidance Note on the Calculation of Capital Requirement for Market

... products and mature within seven days of each other; in the case of swaps and FRAs, the reference rates (for floating rate positions) are identical and the coupons are closely matched (i.e. within15 basis points); and in the case of swaps, FRAs and forwards, the next interest fixing date or for fixe ...

... products and mature within seven days of each other; in the case of swaps and FRAs, the reference rates (for floating rate positions) are identical and the coupons are closely matched (i.e. within15 basis points); and in the case of swaps, FRAs and forwards, the next interest fixing date or for fixe ...

A Model-Based Approach to Constructing Corporate Bond Portfolios

... which employs a similar setup for portfolio construction. However, our previous paper, while related, had a different focus. It concentrated on understanding how to vary the portfolio weights in the ML indices using quantitative tools to achieve outperformance. The number of bonds used in those port ...

... which employs a similar setup for portfolio construction. However, our previous paper, while related, had a different focus. It concentrated on understanding how to vary the portfolio weights in the ML indices using quantitative tools to achieve outperformance. The number of bonds used in those port ...

Low Risk- Hight Propabilities Trading Strategies 1

... Breakeven: Where is the breakeven point in this setup? These options are just out of the money and are being bought for $1.08. At that strike price that would make this traders upside breakeven $40.08, or about 4.6% higher than the stock’s price at the time of the trade. This is only a 4.6% move to ...

... Breakeven: Where is the breakeven point in this setup? These options are just out of the money and are being bought for $1.08. At that strike price that would make this traders upside breakeven $40.08, or about 4.6% higher than the stock’s price at the time of the trade. This is only a 4.6% move to ...

Ch7 Portf theory sols 12ed

... With some arranging, the similarities between the CML and SML are obvious. When in this form, both have the same market price of risk, or slope, (rM - rRF)/σM. The measure of risk in the CML is σp. Since the CML applies only to efficient portfolios, σp not only represents the portfolio's total risk, ...

... With some arranging, the similarities between the CML and SML are obvious. When in this form, both have the same market price of risk, or slope, (rM - rRF)/σM. The measure of risk in the CML is σp. Since the CML applies only to efficient portfolios, σp not only represents the portfolio's total risk, ...

Managing a Matching Adjustment Portfolio

... As stated previously, a natural starting point for an MA asset strategy is to construct a buy and maintain portfolio of corporate bonds. However, a more flexible investment approach could be followed if interest rate swaps were to be added to the MA investment universe. If this approach was undertak ...

... As stated previously, a natural starting point for an MA asset strategy is to construct a buy and maintain portfolio of corporate bonds. However, a more flexible investment approach could be followed if interest rate swaps were to be added to the MA investment universe. If this approach was undertak ...