Annual Equity-Based Insurance Guarantees Conference

... retirement savings industry. Milliman’s work helps the clients of life insurance companies, banks, financial advisory platforms and mutual fund firms create strategies for success in retirement. In particular, the Milliman Managed Risk Strategy provides retail investors with institutional quality ma ...

... retirement savings industry. Milliman’s work helps the clients of life insurance companies, banks, financial advisory platforms and mutual fund firms create strategies for success in retirement. In particular, the Milliman Managed Risk Strategy provides retail investors with institutional quality ma ...

Why is long-horizon equity less risky? A duration-based

... for prices and risk premia. Motivated by these expressions, Brennan et al. empirically evaluate whether expected returns on a cross-section of assets can be explained by betas with respect to discount rates. Here we make use of similar analytical methods to address a different goal, namely, endogeno ...

... for prices and risk premia. Motivated by these expressions, Brennan et al. empirically evaluate whether expected returns on a cross-section of assets can be explained by betas with respect to discount rates. Here we make use of similar analytical methods to address a different goal, namely, endogeno ...

Analysis and comparison of methods of risk

... For the valuation of Cost of Equity of the enterprise, it is recommended to use the rate of return on 10-year Slovak T. Bonds (NBS 2016). Mařík et al. (2011) also considers it necessary to determine return on government bonds with longer maturity – 10 years or more. If there is a number of governmen ...

... For the valuation of Cost of Equity of the enterprise, it is recommended to use the rate of return on 10-year Slovak T. Bonds (NBS 2016). Mařík et al. (2011) also considers it necessary to determine return on government bonds with longer maturity – 10 years or more. If there is a number of governmen ...

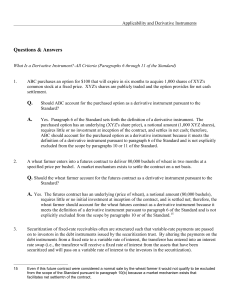

Chapter 6

... According to the Security Market Line (SML) equation, an increase in beta will increase a company’s expected return by an amount equal to the market risk premium times the change in beta. For example, assume that the risk-free rate is 6 percent, and the market risk premium is 5 percent. If the compa ...

... According to the Security Market Line (SML) equation, an increase in beta will increase a company’s expected return by an amount equal to the market risk premium times the change in beta. For example, assume that the risk-free rate is 6 percent, and the market risk premium is 5 percent. If the compa ...

Do Corporate Managers Time Stock Repurchases Effectively?

... cash to shareholders. Corporate managers are charged with acting in the best interest of shareholders, which may include repurchasing company shares when they are considered to be undervalued, and issuing shares when values are deemed to be high. Managers who make timing mistakes risk repurchasing s ...

... cash to shareholders. Corporate managers are charged with acting in the best interest of shareholders, which may include repurchasing company shares when they are considered to be undervalued, and issuing shares when values are deemed to be high. Managers who make timing mistakes risk repurchasing s ...

testing intraday volatility spillovers in turkish capital markets

... after the stock index futures were introduced, the cash market was found to play a more dominant role in the price discovery process. Turkish Derivatives Exchange (TURKDEX) is a new established futures market and hence there is a limited number of studies analyzing the relationship between the futur ...

... after the stock index futures were introduced, the cash market was found to play a more dominant role in the price discovery process. Turkish Derivatives Exchange (TURKDEX) is a new established futures market and hence there is a limited number of studies analyzing the relationship between the futur ...

Caps, Floors and Collars

... Major advantages of caps are that the buyer limits his potential loss to the premium paid, but retains the right to benefit from favorable rate movements. The borrower buying a cap limits exposure to rising interest rates, while retaining the potential to benefit from falling rates. An upper limit i ...

... Major advantages of caps are that the buyer limits his potential loss to the premium paid, but retains the right to benefit from favorable rate movements. The borrower buying a cap limits exposure to rising interest rates, while retaining the potential to benefit from falling rates. An upper limit i ...

Accounting Quality and Catastrophic Market Events.

... associated with a reduction by 10% of the average drop (this is approximately equivalent to 450 billions dollars). I also find that the effect of accounting quality is stronger during the worst crashes. To further ensure that accounting quality is not simply a proxy for a greater sensitivity to mark ...

... associated with a reduction by 10% of the average drop (this is approximately equivalent to 450 billions dollars). I also find that the effect of accounting quality is stronger during the worst crashes. To further ensure that accounting quality is not simply a proxy for a greater sensitivity to mark ...

have Higher Stock Returns? - IC

... respectively. Edmans (2012) points out several difficulties in identifying the relationship between job satisfaction and firm value variables. According to him, most publications may not show the true impact of job satisfaction. On the one hand, studies are cross-sectional and positive correlation c ...

... respectively. Edmans (2012) points out several difficulties in identifying the relationship between job satisfaction and firm value variables. According to him, most publications may not show the true impact of job satisfaction. On the one hand, studies are cross-sectional and positive correlation c ...

Long-Term Analysis Conquers Wrong Turn Paralysis

... have since found that there are at least five factors that influence performance (size, value, market risk, profitability, investment, and possibly a sixth as Cliff Asness - Fama’s student - wants the momentum effect included), we can’t explain all the performance by any one factor. Equally, as inve ...

... have since found that there are at least five factors that influence performance (size, value, market risk, profitability, investment, and possibly a sixth as Cliff Asness - Fama’s student - wants the momentum effect included), we can’t explain all the performance by any one factor. Equally, as inve ...

An Empirical Assessment of Models of the Value Premium*

... variables. The way we identify our conditional variables is motivated by the limits-toarbitrage literature, which has shown that the value premium is much more pronounced among firms with high limits to arbitrage. We therefore choose six commonly used proxies for limits to arbitrage as our moderator ...

... variables. The way we identify our conditional variables is motivated by the limits-toarbitrage literature, which has shown that the value premium is much more pronounced among firms with high limits to arbitrage. We therefore choose six commonly used proxies for limits to arbitrage as our moderator ...

Communicating Asset Risk: How Name

... stronger home bias for risk judgments than for volatility judgments in our study. For the same reason, we also expected a smaller home bias effect on judgments of expected returns. The second irrational bias potentially used in asset choice as the result of providing investors with asset names is us ...

... stronger home bias for risk judgments than for volatility judgments in our study. For the same reason, we also expected a smaller home bias effect on judgments of expected returns. The second irrational bias potentially used in asset choice as the result of providing investors with asset names is us ...

Fama EF and French KR (1996) Multifactor explanations of asset

... comparing two or more factors to analyze relationships between variables and the security’s resulting performance. A multi-factor model is a modeling tool that is used to identify the underlying reasons for shifts in pricing and other market events. A capital asset pricing model of this type can be ...

... comparing two or more factors to analyze relationships between variables and the security’s resulting performance. A multi-factor model is a modeling tool that is used to identify the underlying reasons for shifts in pricing and other market events. A capital asset pricing model of this type can be ...

Version: March 14, 1999 - Duke University`s Fuqua School of Business

... method to study the time-series behavior of equity risk premia implicit in the asset allocation recommendations of investment advisors. A second approach uses fundamental data to deduce risk premia. Gebhardt, Lee and Swaminathan (2000) use firm level cash flow forecasts to derive an internal rate of ...

... method to study the time-series behavior of equity risk premia implicit in the asset allocation recommendations of investment advisors. A second approach uses fundamental data to deduce risk premia. Gebhardt, Lee and Swaminathan (2000) use firm level cash flow forecasts to derive an internal rate of ...

Repos - LexisNexis UK

... would have received had the repo been in respect of less volatile securities. Apart from the commercial effect that this has on the cost of funding, the seller should consider other effects of an increase in the haircut. For example, since a repo is a title transfer arrangement, the seller is an unsec ...

... would have received had the repo been in respect of less volatile securities. Apart from the commercial effect that this has on the cost of funding, the seller should consider other effects of an increase in the haircut. For example, since a repo is a title transfer arrangement, the seller is an unsec ...

Equilibrium Cross-Section of Returns

... about productivity and costs guarantee then that individual investment decisions can be aggregated into a linear stochastic growth model with adjustment costs. In addition to its obvious computational appeal that will allow us to address the behavior of the cross-section of returns, this feature is ...

... about productivity and costs guarantee then that individual investment decisions can be aggregated into a linear stochastic growth model with adjustment costs. In addition to its obvious computational appeal that will allow us to address the behavior of the cross-section of returns, this feature is ...

What is Arbitrage? - Palladium Capital Advisors

... Option Arbitrage commonly refers to an equity trading strategy utilizing options, such as calls, puts, and warrants. The value of an option and the way it is priced in the market is based on sophisticated pricing models involving a number of variables including volatility, share price, exercise pric ...

... Option Arbitrage commonly refers to an equity trading strategy utilizing options, such as calls, puts, and warrants. The value of an option and the way it is priced in the market is based on sophisticated pricing models involving a number of variables including volatility, share price, exercise pric ...