Annexure – 1

... The broker shall enter into a specific agreement with the clients for whom they permit DMA facility. This agreement will include the following safeguards: ...

... The broker shall enter into a specific agreement with the clients for whom they permit DMA facility. This agreement will include the following safeguards: ...

Does Supply Curve Inelasticity Explain Abnormal Long

... firms’ trades. We find that firms buy on ‘dips.’ They pay lower prices than outside investors but similar to the prices paid by other asymmetrically informed insiders. We measure the returns earned by a strategy of mimicking repurchasing firms’ trades and find no abnormal performance after adjusting ...

... firms’ trades. We find that firms buy on ‘dips.’ They pay lower prices than outside investors but similar to the prices paid by other asymmetrically informed insiders. We measure the returns earned by a strategy of mimicking repurchasing firms’ trades and find no abnormal performance after adjusting ...

Orders and Positions

... • Account: This panel on the left of the window displays a hierarchical view of your accounts by date, symbol, or trade system. • Filter: This panel on the top of the window provides a way for you to filter orders and positions data. • Orders: This set of tabbed windows provides order status, order ...

... • Account: This panel on the left of the window displays a hierarchical view of your accounts by date, symbol, or trade system. • Filter: This panel on the top of the window provides a way for you to filter orders and positions data. • Orders: This set of tabbed windows provides order status, order ...

View COLL 6.3 as PDF

... bid prices of those same investments. The prospectus should explain how investments will be valued for which a single price is quoted for both buying and selling. ...

... bid prices of those same investments. The prospectus should explain how investments will be valued for which a single price is quoted for both buying and selling. ...

Chapter 2 Securities Markets and Transactions

... Secondary markets • The secondary markets or the aftermarket, is the market in which securities are traded after they have been issued. Unlike the primary market, secondary market transactions don’t involve the corporation that issued the securities • The secondary market permits an investor to sel ...

... Secondary markets • The secondary markets or the aftermarket, is the market in which securities are traded after they have been issued. Unlike the primary market, secondary market transactions don’t involve the corporation that issued the securities • The secondary market permits an investor to sel ...

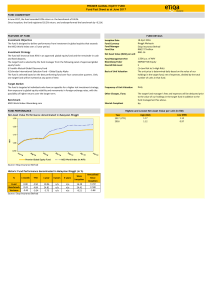

Etiqa Insurance Berhad Overall Risk Level Basis of Unit Valuation

... • In exceptional circumstances, we reserve the right to suspend the creation or cancellation of units. In such an event, a notice for suspension will be published on our website, and would be communicated to the policyholders upon any request for top-up, switching, or withdrawal to or from the fund. ...

... • In exceptional circumstances, we reserve the right to suspend the creation or cancellation of units. In such an event, a notice for suspension will be published on our website, and would be communicated to the policyholders upon any request for top-up, switching, or withdrawal to or from the fund. ...

press release

... toezicht), Sweco has notified the Netherlands Authority for the Financial Markets (Stichting Autoriteit Financiële Markten) that it has acquired a substantial holding of 8.98% in the shares in Grontmij. Sweco might purchase additional ordinary shares in Grontmij. Sweco will announce such additional ...

... toezicht), Sweco has notified the Netherlands Authority for the Financial Markets (Stichting Autoriteit Financiële Markten) that it has acquired a substantial holding of 8.98% in the shares in Grontmij. Sweco might purchase additional ordinary shares in Grontmij. Sweco will announce such additional ...

Multimarket Trading and Market Liquidity Author(s): Bhagwan

... fourth markets" in some stocks. Also, there often exist active markets in derivative securities, such as futures and options. An investor with private information about a stock could trade, for example, on one or more exchanges on which the stock is listed, while simultaneously trading in off-the-ex ...

... fourth markets" in some stocks. Also, there often exist active markets in derivative securities, such as futures and options. An investor with private information about a stock could trade, for example, on one or more exchanges on which the stock is listed, while simultaneously trading in off-the-ex ...

High-Frequency Trading in the US Treasury Market

... Menkveld, 2011; and Menkveld, 2013), but they are in line with others recording that HF market orders negatively impact liquidity when information uncertainty is high (Brogaard, Hendershott and Riordan, 2014). We also find, consistent with the predictions of the theoretical literature, that HF tradi ...

... Menkveld, 2011; and Menkveld, 2013), but they are in line with others recording that HF market orders negatively impact liquidity when information uncertainty is high (Brogaard, Hendershott and Riordan, 2014). We also find, consistent with the predictions of the theoretical literature, that HF tradi ...

The Causal Effects of Short-Selling Bans

... discontinuities in short-selling activity are up to 20% (40%) of the mean (median) shortselling activity for all short-eligible firms in Hong Kong. Despite this, we find that these short-selling bans have no effect on stock prices or market quality. Stock returns, volatility, bid-ask spreads, and c ...

... discontinuities in short-selling activity are up to 20% (40%) of the mean (median) shortselling activity for all short-eligible firms in Hong Kong. Despite this, we find that these short-selling bans have no effect on stock prices or market quality. Stock returns, volatility, bid-ask spreads, and c ...

Xinfu Chen Mathematical Finance II - Pitt Mathematics

... increased from time bought to time sold. By return rate it means return per unit time. A portfolio is a collection of shares of assets. The proportions in value of assets in a portfolio are called the weights. A portfolio’s return is the percentage of value increased from time bought to time sold. I ...

... increased from time bought to time sold. By return rate it means return per unit time. A portfolio is a collection of shares of assets. The proportions in value of assets in a portfolio are called the weights. A portfolio’s return is the percentage of value increased from time bought to time sold. I ...

The Objective in Corporate Finance

... In theory: Financial markets are efficient. Managers convey information honestly and truthfully to financial markets, and financial markets make reasoned judgments of 'true value'. As a consequence• A company that invests in good long term projects will be rewarded. • Short term accounting gimmicks ...

... In theory: Financial markets are efficient. Managers convey information honestly and truthfully to financial markets, and financial markets make reasoned judgments of 'true value'. As a consequence• A company that invests in good long term projects will be rewarded. • Short term accounting gimmicks ...

Welfare effects of downstream mergers and upstream market

... supply of the input. And it is precisely the combination of these two ingredients which allows us to get the interesting and unexpected result that a downstream merger can be welfare enhancing. For example, with no alternative supply in our setting, it is well-known that the upstream monopolist coul ...

... supply of the input. And it is precisely the combination of these two ingredients which allows us to get the interesting and unexpected result that a downstream merger can be welfare enhancing. For example, with no alternative supply in our setting, it is well-known that the upstream monopolist coul ...

World Financial Markets, 1900-1925

... I present a new dataset that describes the financial markets of the early twentieth century. Historical data have proven useful to better understand how financial markets operate. Estimation of the equity-premium (e.g. Goetzmann and Ibbotson (2006)), the efficiency of derivatives markets (Moore and J ...

... I present a new dataset that describes the financial markets of the early twentieth century. Historical data have proven useful to better understand how financial markets operate. Estimation of the equity-premium (e.g. Goetzmann and Ibbotson (2006)), the efficiency of derivatives markets (Moore and J ...

Tick Size Constraints, Market Structure, and Liquidity First Draft

... depth following a split is simply a mechanical effect: measuring the same dollar distance before and after a split from the best price implies measuring a greater percentage away from the best price after the split since the nominal price decreases. Finally, the effective spread (the actual transact ...

... depth following a split is simply a mechanical effect: measuring the same dollar distance before and after a split from the best price implies measuring a greater percentage away from the best price after the split since the nominal price decreases. Finally, the effective spread (the actual transact ...

Market Turmoil and Destabilizing Speculation Supplementary Material

... variation a¤ects risk-taking di¤erentially in the pre and post periods. For example, funds may di¤er in their reactions to changes in uncertainty or in their propensity to take on risk when uncertainty arises. My method of accounting for this possibility is twofold. First, I include a set of control ...

... variation a¤ects risk-taking di¤erentially in the pre and post periods. For example, funds may di¤er in their reactions to changes in uncertainty or in their propensity to take on risk when uncertainty arises. My method of accounting for this possibility is twofold. First, I include a set of control ...

Article 81(1)

... • Previous BERs conferred high degree of intra-brand protection to safeguard dealer investments in sales/servicing ...

... • Previous BERs conferred high degree of intra-brand protection to safeguard dealer investments in sales/servicing ...

Securities Processing: The Effects of a T+3 System on Security Prices

... and that delay payment by more than six business days. In addition, his study explores whether payment delays explain the day of the week effect, but when the payment delay is controlled for, the effect still exists. By comparison, I use data from the T+3 settlement regime in this study. During this ...

... and that delay payment by more than six business days. In addition, his study explores whether payment delays explain the day of the week effect, but when the payment delay is controlled for, the effect still exists. By comparison, I use data from the T+3 settlement regime in this study. During this ...